How to Fill Out (and File) Schedule C for Form 1040

If you’ve ever downloaded a tax form from the IRS website, you’ll notice most of them aren’t any longer than a few pages. Then why do we associate business tax returns with mounds of paper? Schedules.

Overview: What is Schedule C?

Schedule C, whose full name is Form 1040 Schedule C - Profit or Loss from Business, is where most small business owners report their business net profit or loss.

Net profit or loss as reported on Schedule C determines how much you pay in self-employment and federal income taxes.

Who should file a Schedule C form?

Schedule C is a sole proprietor tax form. That means sole proprietorships, including freelancers and most single-member LLCs, must file their business taxes with Schedule C.

By default, LLCs with one owner are taxed as sole proprietorships. Since LLCs may elect a different tax treatment, check your taxation status before filing your LLC taxes with Schedule C.

You file a Schedule C for every small business you own. Those who own multiple businesses must file just as many Schedules C.

How to complete and file Schedule C for your small business

You’re only 9 steps away from filing Schedule C.

1. Prepare your financial statements

The easiest way to fill out Schedule C is by having your accounting software open. You should trust self-employment tax software to walk you through the small business tax filing process.

Before you get started, have the following financial statements and documents ready:

- Income statement for the year ended December 31

- Balance sheet as of December 31

- List of business tax credits you plan to take

- List of your meal expenses

- Miles driven on your vehicle for business purposes

- Your fixed asset depreciation schedules

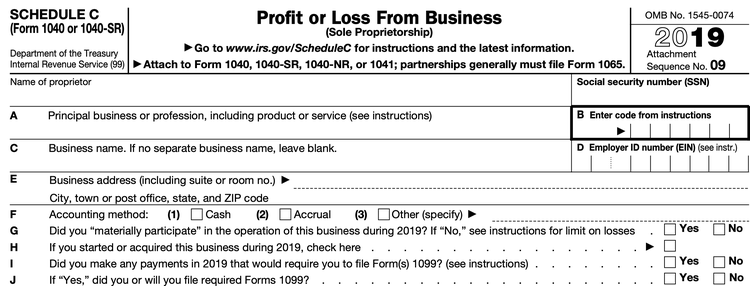

2. File Forms 1099 for all contractors

The first section on Schedule C asks whether you made any payments subject to filing a Form 1099. You must file a 1099 form for every contract employee to whom you paid $600 or more during the year.

Before 2020, you’d file Form 1099-MISC. Starting in 2020, you file Form 1099-NEC for each independent contractor to whom you paid $600 or more.

Make sure that you’ve filed Forms 1099 for all independent contractors. Image source: Author

3. Report cost of goods sold

After you fill out the top section with your general business information -- business name, accounting method, employer ID number (EIN) -- you should go straight to the second page. Start by breaking down your cost-of-goods-sold calculation since you’ll need to include the result on the first page.

Your accounting software contains all the information you need to fill in Schedule C’s Part 3, cost of goods sold. To find beginning and ending inventory, look at your balance sheets from the past two years. Purchases, labor costs, materials, and other costs should be on last year’s income statement.

Calculate cost of goods sold before filling out any other section of Schedule C. Image source: Author

4. Report income

Let’s move back up to the first page. Part 1 asks you to report your business’s gross income. You should be able to get all of this information from your accounting software.

Gross income is your gross sales minus returns, allowances, and cost of goods sold. Make sure line one, gross receipts or sales, includes the sale of merchandise that was either returned or discounted. Line two asks you to enter that information separately so that you can calculate net sales on line three.

Make sure the amount you enter for the cost of goods sold matches your calculation on page two.

The income section includes your cost of goods sold. Image source: Author

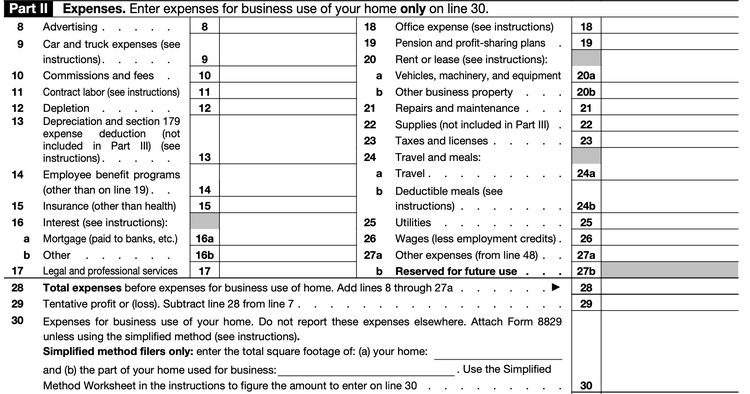

5. Report business expenses

The most laborious section of Schedule C comes in Part 2, where you enter your small business tax deductions. Most of the amounts you enter will mirror the account balances in your accounting software, but there are a few differences. You know there’s going to be a difference between your book and tax expenses when the words “see instructions” appear on any line of Schedule C.

Some notable differences:

- Car and truck expenses: For tax purposes, you can deduct business vehicle costs by multiplying the number of business miles driven by the IRS mileage rate, which is 57.5 cents per mile in 2020.

- Travel and meals: The IRS allows you to deduct only one-half of meal expenses. Travel expenses are only deductible when they meet IRS conditions outlined in Topic No. 511.

- Entertainment: The IRS doesn’t allow you to deduct most entertainment expenses, so you don’t see that category on Schedule C.

- Fines and penalties: Similar to entertainment, you can’t deduct the payment of fines and penalties.

- Depreciation and section 179 expense deduction: Depreciation works differently for financial reporting and tax purposes.

- Business use of your home: As a business owner, you might qualify for a home office deduction.

- Other expenses: You may have some expenses in your books that don’t fit into the IRS expense categories. You have to list each expense separately on page two.

Deduct your business expenses in part two of Schedule C. Image source: Author

Fill out as much of this section as you can. You will probably need to come back to fill in amounts for your depreciation (line 13) and other expenses (line 27).

6. Report the business use of your vehicle

In general, you can deduct either the actual costs of the business use of your vehicle or the IRS mileage rate. Only miles driven for work count for the deduction.

You don’t have to have a company car to take a car or truck expense deduction. Say you’re an architect who frequently uses a personal car to visit client sites. Any miles driven for that purpose are deductible. You can use the same car to drop your kids off at school, but that won’t be deductible. It’s essential to keep track of your business mileage during the year.

Not everyone who uses their personal vehicle for work needs to fill out this section on Schedule C. Depending on what fixed assets your business has and how they’re expended, you may need to fill out Form 4562 instead.

Deducting fixed asset costs on your taxes is complicated. Consult a tax professional or software to help you through this part.

7. Add other expenses

Your expenses might not fit neatly into the IRS business expense categories. Expenses that fall outside need to be reported separately on page two of Schedule C.

Part 5 of the Schedule C instructions explains what might be considered “other.” One of the most common other expenses is bad debts.

Your total other expenses get reported on line 27a.

8. Calculate net profit or loss and report on schedules 1 and SE

You should have all of your numbers filled in on page one of Schedule C. Now it’s time to calculate your net profit or loss by subtracting your gross income from total expenses.

If your business had a loss, you might qualify for a net operating loss deduction.

You must report your business’s net profit or loss on two other schedules: Schedule 1, additional income and adjustments to income, and Schedule SE, self-employment tax.

Your business net profit or loss gets reported on the front page of personal tax Form 1040, line 8a.

9. Attach to and file Form 1040

Once you finish filling out the other sole proprietor tax forms, it’s time to file.

Tax software can e-file your return with the IRS, but you can also send it through the mail if that’s more your style. The mailing address depends on your state or territory, so check out the IRS website.

FAQs

-

You don’t report payments you made to yourself out of your business earnings.

Money transferred from your sole proprietorship bank account to your personal one doesn’t count as wages. If that were the case, everyone would pay themselves to the point where they owed no tax.

Businesses that file Schedule C are pass-through entities, meaning they pay tax using their owners’ Form 1040. As a sole proprietor, money isn’t taxed differently whether in your business or personal account.

-

Schedule C, attached to your personal tax return Form 1040, is due on April 15.

-

Your tax net profit or loss likely won’t exactly match the pretax income in your accounting software. There are temporary and permanent differences that cause discrepancies in book and tax income.

| Tax | Book |

|---|---|

| You can deduct only 50% of meal expenses. | You report all meal expenses. |

| You cannot deduct fines, penalties, and most entertainment expenses. | You report all fines, penalties, and entertainment expenses. |

| You must follow the IRS modified accelerated cost recovery system (MACRS) depreciation system. | You can use one of four depreciation methods. |

| You can deduct car or truck expenses as a rate of business miles driven. | You report car or truck expenses at their actual cost. |

Schedule time for Schedule C

Don’t leave tax preparation until the last minute. It’s just one of many forms you’re required to file as part of your small business taxes.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles