Have an idea that could make your corner of the world a better place? If you have a passion for social change and a team of enthusiastic supporters, it might be time to make your vision a reality and form a nonprofit.

But where do you begin? This article walks you through the eleven essential steps to forming a nonprofit organization.

The 11 steps to start a nonprofit organization:

- Create a strategic plan

- Register your name

- Appoint a board of directors

- Draft bylaws

- Write a conflict of interest policy

- Incorporate

- Appoint a registered agent

- Get an Employer Identification Number (EIN)

- Apply for tax-exempt status

- Register for charitable solicitation

- Maintain compliance

What is a nonprofit organization?

A nonprofit organization exists to serve the public good. More than 90% of nonprofits are formed as corporations.

Contrary to popular belief, nonprofits may generate income and profits. What differentiates them from other corporations is that their earnings must be reinvested in their nonprofit missions and operations, not distributed to shareholders or other individuals.

While nonprofits do not have to be tax exempt, most apply for exemption under Section 501(c) of the Internal Revenue Code (IRC).

The IRC divides tax-exempt organizations into more than two dozen classes, including everything from alumni associations and chambers of commerce to soccer leagues and credit unions.

By far the most common type of nonprofit, though, is the 501(c)(3), which includes organizations formed for charitable, religious, educational, scientific, literary, public safety testing, amateur sports, or cruelty prevention purposes.

These 501(c)(3) organizations may be publicly supported charities or private foundations that support these purposes. Foundations are nonprofits that get most of their funds from one source, usually a family or company, and distribute them to other nonprofits through grants and other awards.

Examples include the Bill and Melinda Gates Foundation and the Coca-Cola Foundation.

Most likely, the nonprofit you want to form will be a 501(c)(3) charity.

So how do you legally form your nonprofit?

Step 1: Create a strategic plan

While a nonprofit is founded on passion for a mission, it's also a corporation. That has two critical implications for you, the founder.

No. 1: It's no longer your baby: A corporation, unlike, say, a limited liability company, doesn't belong to the owner. A for-profit corporation belongs to shareholders. A nonprofit corporation, though, doesn't have shareholders. Basically, it belongs to the public.

Like other corporations, a nonprofit is governed by an independent board of directors and managed by an executive director (ED), often the founder. The ED reports to the board.

Once you legally form your nonprofit, it's no longer simply yours to control.

No. 2: It has to be able to hang with the big kids: A nonprofit cannot run on love and hope. It needs to be built to weather many of the same pressures as other corporations. Board conflicts. Market forces. Budget shortfalls. Labor shortages. Outreach and engagement. If anything, these challenges tend to hit nonprofits harder than their for-profit relatives.

That's why it's important to do the same sort of market research you would do with any business startup. Consider these key questions:

- What is your nonprofit's mission? What niche will you fill that is currently underserved in your community?

- What constituencies will your nonprofit serve? What geographic area will you cover?

- Are there nonprofits in your area that already provide the services you want to deliver?

- Can your mission be accomplished by teaming up with existing providers?

- How will you finance your operations? With grants, donations, or fundraising events? How much will you need to cover expenses?

- How will you recruit volunteers?

- Will you have paid employees? Who will manage the nonprofit?

- What is your vision for the organization? Where do you want to be in one year? Five years?

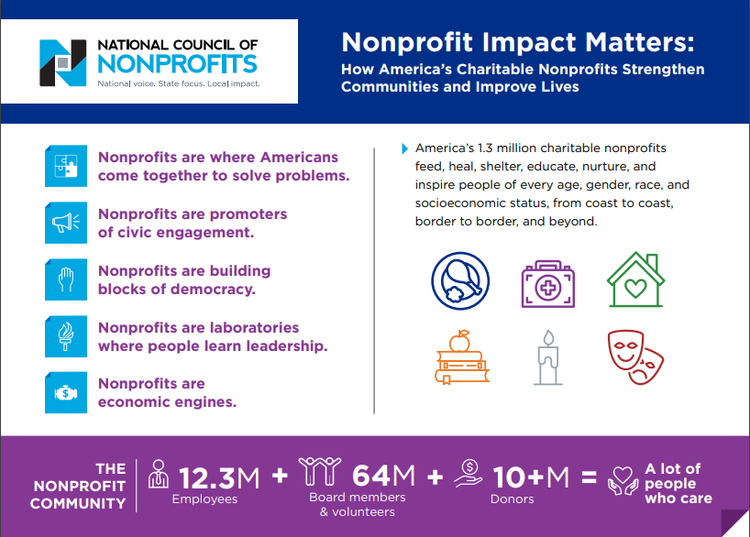

Nonprofit Impact Matters, a report from the National Council of Nonprofits (NCN), provides a wealth of data and insights to inform your planning.

If your research shows that forming your nonprofit is the best way to fill an unmet need, create a plan that lays out your mission and goals and how you plan to accomplish them.

The National Council of Nonprofits provides a wealth of resources for nonprofits. Image source: Author

Step 2: Register your name

If your research leads to a solid plan, you're ready to move on to the work of forming your legal entity. This begins with choosing a name for your business, known as a “doing business as” (DBA) or fictitious name, that is available and permissible in your home state.

Each state has unique rules for naming businesses, usually available on your secretary of state’s website. First, make sure your name doesn't include any restricted words. In Michigan, for example, you cannot use the word academy in your name without prior approval from the education department.

Second, you'll need to ensure your name isn't already being used by another organization in your state. You can generally determine this with a quick name availability search through the secretary of state’s website.

Once you have a viable name, you must file a fictitious name registration with the secretary of state. You can usually submit this online along with a small processing fee.

Step 3: Appoint a board of directors

Most states require nonprofits to have a minimum of one to three board members, often serving in specific positions. In Pennsylvania, for example, nonprofits must have a president, a secretary, and a treasurer, although you don't have to use those exact titles.

To be independent and avoid conflicts of interest, your board should not include family members or business partners. Check the website of your state charities office to ensure that you meet all requirements.

It takes much more than passion to put together a board that can carry you through good times and bad. A strong board includes members who:

- Bring diverse skills and expertise to your nonprofit, including financial and legal savvy

- Are able and willing to attend board meetings and meet other obligations

- Agree on the nonprofit's vision, mission, and strategic plan

- Understand their roles and legal duties as nonprofit board members

- Can strike a balance between holding the ED accountable and providing support

Step 4: Draft bylaws

Your bylaws are basically your nonprofit's constitution, spelling out the roles and duties of board members and executives, how decisions will be made, and how the organization will manage changes such as leadership transitions.

States have specific laws guiding nonprofit governance. You can usually find your state's specifications through the website of your attorney general or secretary of state.

You can find samples and templates of bylaws online to guide your work. It's important for your founding board and ED to discuss each aspect of the document to ensure consensus. Your bylaws should cover these key items:

- Number of board members, their positions, and their powers and responsibilities

- How board members are chosen and elected

- Meeting dates and frequency

- How and when votes will be taken

- How many votes create a quorum, the number needed to validate a decision

- Terms for board members, including how and when they'll retire

- How disputes will be resolved

This IRS guide to nonprofit governance is an excellent resource for assembling a successful board and drafting effective bylaws.

Step 5: Write a conflict of interest policy

Next to your bylaws, your conflict of interest policy is one of the most important corporate documents your nonprofit will create. A conflict of interest occurs when a person's private interests conflict with their official duties to the organization.

For example, if a board member owns a hotel and your nonprofit is looking for an event venue, the board member could benefit personally if the nonprofit chose that hotel over another.

Your policy should require board members to disclose any conflicts of interest and to withdraw from voting on any matters in which they have a conflict. It should also cover how and when conflicts must be disclosed and what measures you will use to enforce the policy, among other matters.

The IRS often reviews conflict of interest policies as part of its oversight of your nonprofit, and some states require them. A few, such as New York, require specific language to be included. Be sure to check your state's requirements before drafting your policy.

Your state chapter of NCN is a great resource for your conflict of interest policy and other aspects of founding your nonprofit.

Step 6: Incorporate

Now that you've done all of the preparation, it's time to file articles of incorporation with the state to form your nonprofit corporation.

The application is usually available on your secretary of state's website. In most cases, you can submit the form directly online along with a filing fee and any required supporting documents.

Most states will also require you to announce your new corporation in newspapers or trade magazines. Make sure to complete this step and keep the published notices in your permanent corporate records.

Step 7: Appoint a registered agent

In most states, you must provide a physical office location where someone is available during regular business hours to receive notices of lawsuits (service of process) and other important business documents. This is your registered agent address, also called registered office or agent for service of process in some states.

While you can use any office address that meets the requirements, it's generally best to hire a professional service that can reliably and securely handle legal documents for you.

Step 8: Get an Employer Identification Number (EIN)

Your nonprofit will need an EIN for tax documents and other official correspondence. You can complete your EIN registration in minutes for free through the official IRS EIN portal.

Step 9: Apply for tax-exempt status

Once you've formed your legal entity, you can apply for tax exemption online using IRS Form 1023 or the short form, 1023-EZ. As of January 2020, the IRS no longer accepts paper applications. You can sign Form 1023 without use of electronic signature software.

It can take months for the IRS to review and approve your 501(c)(3) application, so plan ahead. Once your application is approved, the IRS will send a determination letter certifying you as an official 501(c)(3) tax-exempt organization.

This allows donors to claim tax deductions for donations to your nonprofit. People will also be able to find you in the IRS nonprofit search tool.

Once you achieve federal tax-exempt status, you can apply for other tax exemptions at the state and local levels where available. Many taxes, such as payroll taxes, are not subject to exemption.

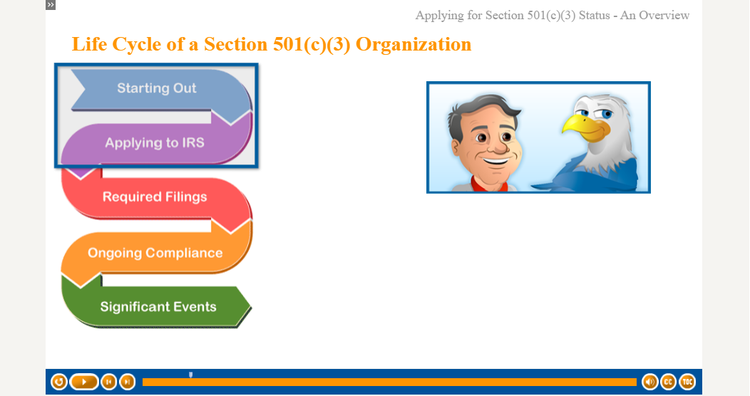

The IRS provides free on-demand courses on applying for tax-exempt status and other critical tasks for nonprofits. Watching them with your team is a great way to learn what you need to know.

Be sure to check out the IRS's free, on-demand courses on nonprofit operations. Image source: Author

Step 10: Register for charitable solicitation

Most states require charities to register before soliciting donations from their residents. In some cases, you must register only if donations reach a certain threshold.

If you fundraise online, you're potentially soliciting in all 50 states, so you may need to register widely to comply with the laws. This is especially true if you receive substantial donations from other states. This state guide provides a helpful summary of the laws.

In 25 states, nonprofits must also include specific charitable disclosure language on all solicitations to their residents.

In addition to the IRS 501(c)(3) lookup tool, states have databases where the public can search for information about your nonprofit, including whether you're registered for fundraising.

You can find complete requirements and application instructions for your state through these helpful IRS state links for charities.

Step 11: Maintain compliance

Once registered, your nonprofit is a legal entity with ongoing compliance duties such as:

- Filing Form 990 annually with the IRS

- Submitting annual or periodic reports to keep the secretary of state up to date on your growing organization

- Renewing state tax exemptions

- Renewing fundraising registrations

Appoint a board member or employee to maintain company documents and ensure compliance. Document management software can make this task much easier. You may also want to consult a legal advisor periodically to ensure that you're meeting your legal obligations.

Passion and planning

Setting up a nonprofit is a process of taking charge, but also letting go. It's a passion project that also requires diligent administration and financial expertise.

By creating a careful framework for your organization and assembling a robust board, you're equipping your nonprofit to weather every challenge on the road ahead.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.