Investing activities refer to any transactions that directly affect long-term assets. This can include the purchase of a building, the sale of equipment, or investing in stocks. Once completed, these activities are then reported on a company’s cash flow statement. Anytime that the purchase of a long-term asset occurs, it reduces company cash flow from assets, while the sale of a long-term asset increases cash flow.

All cash flow statements contain the following sections:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

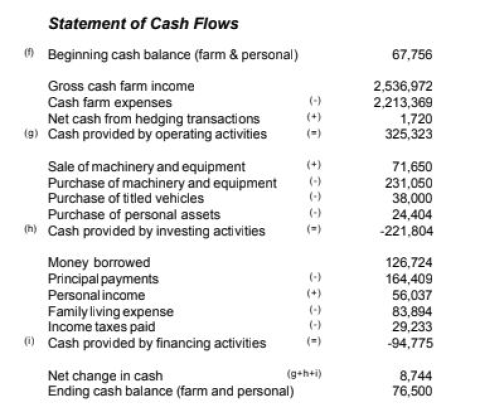

A cash flow statement displays operating, investing, and financing activities in three separate sections, reporting the cumulative total at the end. Image source: Author

Unlike other financial statements, the cash flow statement is only concerned with cash going into and out of a business. The statement is most frequently used by both business owners and investors to measure how well cash is being managed from day-to-day operations, from any investing activities, as well as financing activities.

While a cash flow statement measures and reports on cash flow across a company, it can also pinpoint the specific area(s) where cash flow may be an issue.

For example, if you look at the cash flow statement above, you’ll see that cash from operations is a substantial number, while both the investing cash flow and financial activities cash flow are negative.

If this business were to combine all three sections, it would be difficult to determine how well the core operations were performing or if operating cash flow was positive or negative. This format helps determine how each part of the company is doing, allowing business owners and managers to directly address any cash flow issues.

Cash flow from investing activities deals with the acquisition or disposal of any long-term assets. Because these activities directly affect cash flow, they are always included in the cash flow from investing activities section of your company’s cash flow statement.

Along with being part of your cash flow statement, your adjusted asset totals are also reported on the non-current part of a balance sheet. In addition, the total income reported on your company’s income statement will also impact your cash flow statement.

Overview: What are investing activities?

Investing activities are the acquisition or disposal of long-term assets. This can include the purchase of a company vehicle, the sale of a building, or the purchase of marketable securities. Because these items involve the long-term use of cash, they are reported in the investing section of the cash flow statement.

How to calculate the cash flow from investing activities

Calculating cash flow from investing activities is completed automatically if you’re using accounting software to manage and record your financial activities. If you’re not, you’ll need to add up the proceeds from the sales of long-term assets or the money received from the sale of stocks, bonds, or other marketable securities.

Then you’ll subtract the cost of purchasing any long-term assets such as equipment or securities. These totals would then be reported on your company cash flow statement.

Examples of investing activities

Investing activities involve transactions that use cash in the long term. Because the cash purchase is used long term, standard accounting practice allows businesses to consider the purchase of assets as an investment.

For example, David owns a small factory that manufactures key components used in airplanes. Because orders have increased so much, David decides to sell the current plant and purchase a much larger one. All of these transactions take place in 2020 and will be reflected in the company’s cash flow statement for the period.

1. Purchase of a plant

David was lucky enough to quickly locate a plant to purchase that will adequately house his business. He purchased the building in March 2020 at a cost of $1.2 million.

2. Sale of equipment

Much of David’s current equipment has been in use since he started the business 10 years ago. Rather than move the old equipment, David decides to sell some of it and purchase new, updated equipment. Over a two-month period, David sold power presses, laser cutters, welding machines, industrial cutters, and a rivet machine, receiving a total of $50,000 from the sale in April.

3. Purchase of equipment

Now that David has moved into his new manufacturing plant, he needs to purchase new equipment to replace much of what he sold. The total cost of the new equipment is $145,000.

4. Sale of building

In May, David sold his existing building for $750,000, which is considerably more than he expected to receive.

5. Purchase of marketable securities

Because David received an influx of cash from the sale of the old plant that he didn’t expect, he decides to invest some of that money by purchasing stock, which can be easily liquidated if necessary. After some research, David purchased some tech stocks in September for $40,000.

6. Investment in a second business

David’s brother decides to open a hardware store and asks David to be his partner. While David declines a full partnership role in his brother’s business, he agreed to a 25% partnership, writing his brother a check in October for $75,000 to cover his investment.

When David runs his cash flow statement at the end of the year, the following items will be displayed in the investing activities section of the statement.

| Investing Activities for 2020 | |

|---|---|

| Purchased plant | ($1,200,000) |

| Sale of equipment | 50,000 |

| Purchase of equipment | (145,000) |

| Sale of building | 750,000 |

| Purchase of stocks | (40,000) |

| Investment in a second business | (75,000) |

| Net Cash in investing activities | (660,000) |

While a negative cash flow number might send up red flags if it was in the operating section of the cash flow statement, a negative cash flow number in investing activities shows that David is investing in his company. And by keeping cash flow investment activities separate, investors will also be able to see that the core business operations represented in the operating activities section are fine.

Items not to include when calculating cash flow from investing activities

When calculating cash flow from investing, it’s just as important to understand what shouldn’t be included in your calculations.

- Regular income and expense transactions

- Interest payments

- Dividends

- Depreciation of capital assets

- Debt or equity financing

Because these transactions impact other areas of the cash flow statement, including them in the investing activities section will result in an understatement or overstatement of cash flow.

Final thoughts on cash flow from investing activities

Whether you’re doing accounting for a small business or an international enterprise, cash flow from investing activities is important for a variety of reasons. For example, if you spend a lot of money on purchasing long-term assets such as David’s company did in the example above, these purchases could hurt your total cash flow if they were not separated from operating and financing activities.

While a negative cash flow in operating activities may be cause for alarm, in most cases negative cash flow in investing activities may temporarily reduce cash flow. However, it is almost always seen as a worthy investment in your business in the short term while helping to grow your business over the long term.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.