A Small Business Guide to MACRS

Learning to ice skate, making macarons, and calculating depreciation: What do they have in common? They all sound easier to execute in my head than in reality.

Allow me to walk you down the winding road of calculating the depreciation deduction for your business tax return.

Overview: What is the modified accelerated cost recovery system (MACRS)?

You might be familiar with depreciation, the concept where you expense large asset purchases over their useful lives rather than at the time of purchase. Assets like cars, furniture, machinery, and buildings are subject to depreciation. Depreciation lowers your net income and taxable income.

You have a slew of depreciation options for financial reporting purposes, from the simplistic straight-line method to the more complex sum-of-the-years’-digits method. Each depreciation method determines your depreciation expense for the period, which appears on your income statement.

But for tax purposes, you have just one option: the modified accelerated cost recovery system (MACRS, pronounced “makers”). It’s the IRS’s proprietary depreciation method that dictates your annual tax depreciation deduction.

The asset's characteristics determine how long you depreciate the asset, called its “recovery period” or “useful life.” MACRS generally mimics the straight-line and double-declining balance depreciation methods.

It’s helpful to know how MACRS works, because while tax depreciation is mostly predetermined, you do have some choices to make. The calculation isn’t for the faint of heart, so you should always have a tax professional take the lead on calculating your depreciation tax deduction.

To avoid calculating MACRS depreciation, you might qualify for the section 179 or bonus depreciation deductions, allowing you to expense the entire cost in the year the asset was placed in service.

How the modified accelerated cost recovery system (MACRS) works

In broad strokes, here’s how to calculate depreciation using MACRS. IRS Publication 946 can give you more details about specific types of assets and other unique situations.

1. Find your property class and recovery period

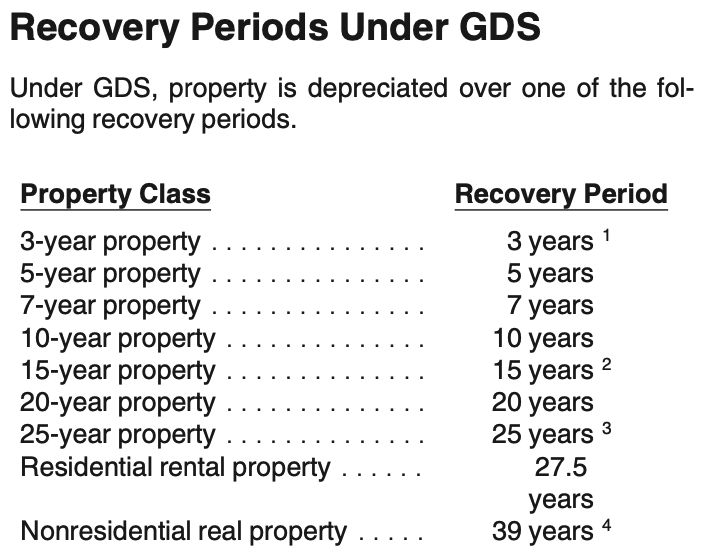

Every depreciable asset belongs to one of nine IRS property classes. The property class determines how long you depreciate the asset, called a recovery period. Recovery periods range from three to 39 years.

The IRS has nine property classes. Image source: Author

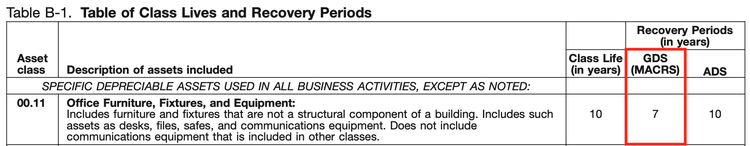

Use IRS Publication 946 Chapter Four to find the property class for each of your assets.

If Chapter Four doesn’t specifically list the asset you’re looking for, Appendix B probably does. Make sure you’re looking in the column labeled “MACRS” when using Appendix B.

Refer to IRS Publication 946 Appendix B when you’re unsure what property class to which your asset belongs. Image source: Author

2. Determine the asset basis

An asset’s basis, known in some circles as depreciable value, generally consists of the asset's purchase price, sales tax, shipping, and installation.

If you personally owned the asset before transferring it into your partnership, your basis might look different. Talk to a tax professional if this scenario speaks to your situation.

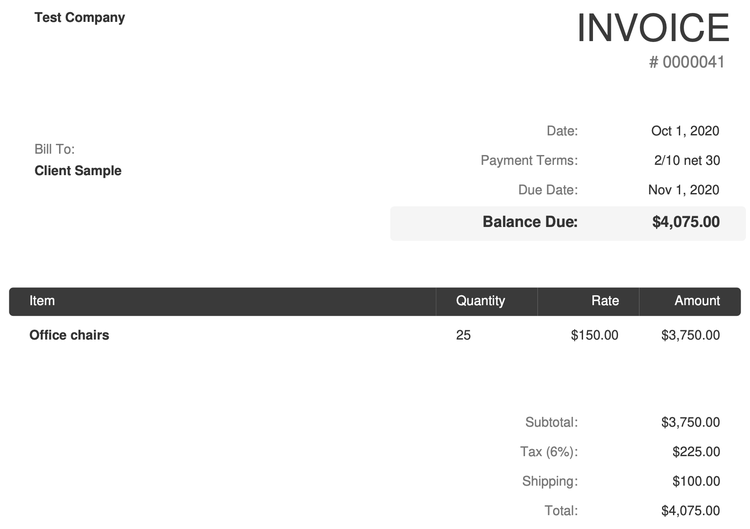

Consider the invoice below, which is a purchase of 25 office chairs at $150 each.

Include the cost of shipping, sales tax, and installation in your asset basis calculation. Image source: Author

The office chairs' asset basis is $4,075, inclusive of $100 in shipping and $225 in sales tax.

3. Identify the depreciation method and convention

You might have a couple of options when it comes to how and when your asset is depreciated.

Depreciation method

Let’s start with the depreciation method, which tells you how to calculate annual depreciation. MACRS has two branches: General Depreciation System (GDS) and the Alternative Depreciation System (ADS). For most assets, you’ll be using GDS, which will be our focus.

Small business owners will use ADS for listed property, assets like cars and computers used for personal and business purposes.

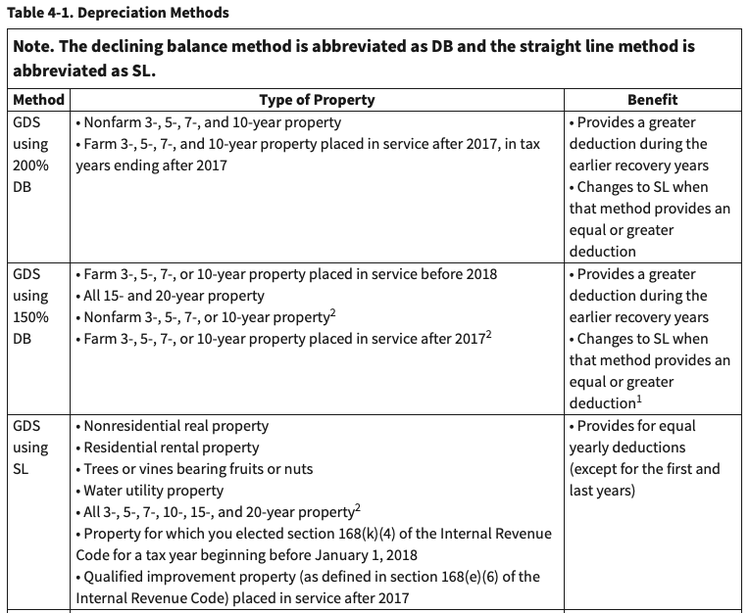

Under the GDS umbrella, there are three potential ways to depreciate your asset: 200% double declining, 150% double declining, or straight line.

From the IRS chart, you can see that you have your choice for most property classes, but there are tons of exceptions. For instance, businesses usually use MACRS straight-line depreciation for intangible assets.

How you decide on a depreciation method depends on your goals. You’d want the 200% double-declining method for larger deductions at the beginning of the asset’s recovery period, but go for the straight-line method if you’re looking for a consistent cost-recovery deduction.

The IRS offers three depreciation methods for most depreciable assets. Image source: Author

Depreciation convention

Your depreciation convention decides when the recovery period starts and ends. There are three conventions: mid-month, mid-quarter, and half-year. Your tax software or a tax professional can help you determine which convention applies to your asset. The type of asset and the date it was placed in service determine the convention.

The convention makes an assumption about when you placed your asset in service and disposed of it.

The mid-month convention presumes that you placed an asset in service in the middle of a month. For example, the recovery period for a building you bought and placed in service on August 1 would start on August 15.

Under the mid-quarter method, an asset starts depreciating in the middle of the quarter it was put in service. Say a new office chair arrived on March 5; the recovery period would begin in the middle of February, the midpoint of the first quarter of the calendar year, even though you didn’t own the office chair yet.

As you might have guessed, the half-year convention assumes that a new asset was placed into service in the middle of the year. You can deduct 6 months’ worth of depreciation.

4. Calculate MACRS depreciation deduction

I don’t advise calculating MACRS depreciation by yourself. You should entrust a tax professional or your accounting software with this step. Even if you’re familiar with depreciation for book purposes, similar methods look different for MACRS.

For example, the straight-line method for financial reporting purposes has you depreciate an asset based on its depreciable value: purchase price minus salvage value. Salvage value is an asset’s estimated worth at the end of its useful life. Salvage value doesn’t exist under MACRS, so the calculation is different.

Calculating MACRS depreciation by hand requires the MACRS tables in Publication 946 Appendix A. The tables list the rates by which you multiply the asset base determined in step 2. There are 20 tables and a lot of room to make mistakes, so again, please don’t try this at home.

5. Create a MACRS depreciation schedule

The last step in determining MACRS depreciation is creating a road map for the asset. A MACRS depreciation schedule outlines the annual deduction you’ll take for the asset over its useful life.

An example of modified accelerated cost recovery system (MACRS)

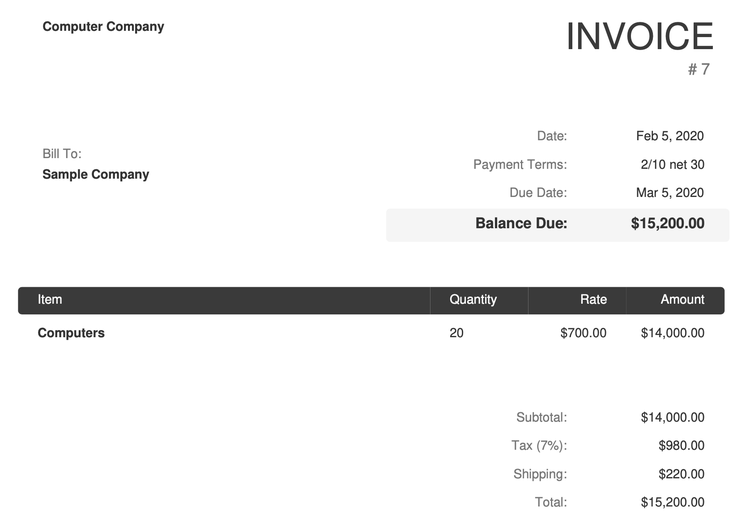

Say your business bought 20 computers for its employees for a total of $15,200. The invoice is below.

All assets belong to one of the IRS’s nine property classes. Image source: Author

1. Find your property class and recovery period

According to the IRS, computers are part of the five-year property class, subject to a five-year recovery period.

2. Determine the asset basis

An asset’s basis includes shipping and tax, so the computers’ basis is the full amount of the invoice, $15,200.

3. Identify the depreciation method and convention

Five-year assets can be depreciated using any of the three MACRS depreciation methods. I’ll go with the straight-line recovery cost method, a common choice for small businesses.

The appropriate depreciation convention for the computer purchase is the half-year convention, meaning it’s implied that the computers were placed into service on July 1, even though they were purchased on February 5. The first-year depreciation deduction will be for just half of the year.

4. Calculate MACRS depreciation deduction

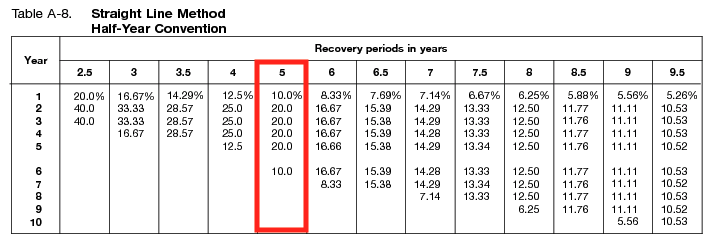

Do as I say, not as I do. I will calculate MACRS depreciation using the IRS tables, but you should have a tax professional or software complete this step.

Table A-8 tells me the first-year depreciation deduction is 10% of the asset basis.

IRS MACRS tables tell you the depreciation rate for each year of an asset’s recovery period. Image source: Author

First-year depreciation is $1,520 ($15,200 asset basis ✕ 10% MACRS rate).

5. Create a MACRS depreciation schedule

It’s best practice to store two depreciation schedules for every asset you depreciate: one for your financial statements and one for your taxes. The computers’ MACRS depreciation should include the following table.

| Year | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|

| Starting value | $15,200 | $13,680 | $10,640 | $7,600 | $4,560 | $1,520 |

| Depreciation | $1,520 | $3,040 | $3,040 | $3,040 | $3,040 | $1,520 |

| Accumulated depreciation | $1,520 | $4,560 | $7,600 | $10,640 | $13,680 | $15,200 |

| Ending value | $13,680 | $10,640 | $7,600 | $4,560 | $1,520 | $ 0 |

You can see the first and sixth years have half the depreciation seen in years two through five. That’s because of the half-year convention: It assumes you placed the computers into service on July 1, year 1 and disposed of them on July 1, year 6. While you’re depreciating the asset over five years, it falls into six calendar years.

Don’t deprecate MACRS depreciation

Depreciation is likely the most complicated part of doing your small business taxes, but it’s also a critical calculation for reducing your tax bill.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles