Margin vs. Markup: Why You Need to Calculate Both

Both margin and markup can be used by business owners to determine profit margin or to set or reexamine pricing strategies.

While both are useful tools, margin and markup provide you with different information and should not be used interchangeably, but instead, side-by-side to provide you with a more detailed view of your business. Before we discuss margin and markup, take a minute to familiarize yourself with the following accounting terms.

Both margin and markup are useful ratios to calculate for your small business. Image source: Author

- Gross profit: Gross profit is the revenue your business has remaining after deducting the cost of purchasing or producing the products you’re selling. To calculate gross profit, you subtract the cost of goods sold from your revenue.

- Cost of goods sold (COGS): Cost of goods sold is a culmination of all of the expenditures incurred from producing a product or service. Direct labor, direct materials, and factory overhead are all part of the cost of goods sold.

- Revenue: Revenue is the amount of money your business earns from selling products and services.

The most accurate way to calculate both margin and markup is to use accounting software, which makes it easier to track sales revenue and product costs. Of course, profit margin and markup can both be calculated even if you’re using a manual accounting system, though your results may be less accurate.

What is profit margin?

If you’ve done accounting for your business for any length of time, you’ve come to understand that many accounting terms sound similar, which can cause a lot of confusion. Margin and markup are prime examples. While both deal with profit, they are calculated for two different purposes.

Profit margin or gross profit margin is a ratio used by businesses to determine how much money is being made on a particular product or service. The profit margin ratio lets you see just how much of your product sales turn into profits. It is calculated by subtracting your cost of goods sold from your sales.

Usually calculated as a percentage, gross margin is the most common type of margin calculated, though businesses can also calculate net profit margin and operating profit margin.

How to calculate margin

Is your business profitable? That’s one of the most important questions that business owners want answered. One way to answer that question is to calculate the margin for your business.

The good news is that margin is one of the easier accounting ratios to calculate. The profit margin formula is:

Revenue - Cost of Goods Sold ÷ Revenue

For example, your business sells electric scooters for $1,000 each, purchasing each scooter for $450 from your current supplier. In June, you sold seven scooters for a total of $7,000, with your cost of goods sold totaling $3,150. To calculate your margin on the scooters, you would do the following calculation:

($7,000 - $3,150) ÷ $7,000 = 0.55

To then obtain your margin as a percentage, simply multiply by 100:

0.55 x 100 = 55%

The result indicates that your gross margin percentage for selling the electric scooters is 55%, meaning that your business is able to retain 55% of the revenue it earns from selling the scooters, with the other 45% used to pay for the scooters.

When determining management efficiency, gross profit margin is one of the more useful metrics a business owner can use.

The higher your margin, the more revenue your company can make on the products and services it sells, while a low margin indicates your business may be losing money on sales or needs to reevaluate product and supplier costs.

What is markup?

Instead of dealing with gross profit, markup is calculated to show you how much your product price is or needs to be marked up from its cost to earn the profit desired. Markup is a more complicated number than margin, which deals with absolutes.

Markup is one of the most important calculations you can do as a small business and is essential for calculating initial pricing levels on any product or service your business offers.

How to calculate markup

One of the most important things you’ll do is a business owner is set pricing for your products and services. But how do you know if the pricing you’re currently using is earning you a profit, losing money? You can find out by calculating your markup.

Using the electric scooter example from above, we’ll calculate markup using the markup formula:

$7,000 - $3,150 = $3,850 gross profit

Next, we’ll take the gross profit and divide it by the cost of the scooters:

$3,850 ÷ $3,150 = 1.22 markup

Finally, to determine the markup percentage, we’ll multiply the markup results by 100:

1.22 x 100 = 122%

This means that you marked up the price of the electric scooters 122% from their original cost. Like margin, the higher the result, the more profit your business is earning.

Margin vs. markup: What’s the difference?

While both are accounting ratios, margin looks at cost while markup looks at pricing.

Margins provide information on how much revenue is kept by your business after you deduct the cost of purchasing or producing the product, while markup looks at the cost of goods sold to determine how much above cost a product or service should be marked up.

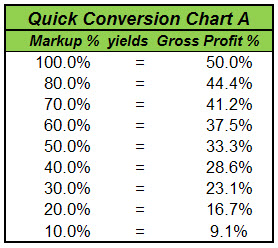

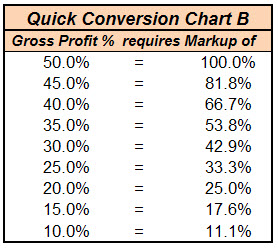

These charts convert margin to markup or markup to margin. Image source: Author

Let’s assume that your business sells leather-bound journals. Your company purchases the journals for $15 each and sells them for $30 each.

The margin for the journals would be:

($30 - $15) ÷ $30 = 0.5

You can then multiply the result by 100 to obtain the margin percentage:

0.5 x 100 = 50%

Currently, your margin on the journals is 50%, which means that 50% of the revenue received from the sale of a journal is retained by your company, while the other 50% is used to cover the cost of purchasing the journal from the supplier.

Next, we’ll calculate markup using the same information:

($30 - $15) ÷ 15 = 1 markup

Next, we’ll multiply the markup result by 100:

1 x 100 = 100% markup

This means that you sold the journals for 100% more than what it cost to purchase them. Markup is also a useful metric for determining how much you should sell a product for.

Both margin and markup provide useful information for your business, with each calculation offering a different perspective, which is why it’s useful to calculate both.

When should you use margin over markup?

If you’re interested in calculating business profits, it’s best to use margin over markup. Margin also provides a better overall view of the profitability of your products.

On the other hand, markup is extremely useful when looking to determine initial product pricing. Markup can also signal potential issues and allow you to reexamine the current markup to determine if pricing levels need to be addressed.

Use margin and markup for a more complete picture

You’re in business to earn a profit. Calculating both margin and markup are important metrics that business owners can use to measure the profitability of their business as well as determine if their pricing is adequate to cover all necessary expenses incurred by purchasing or producing that product.

By calculating margin, you’ll be able to see just how profitable your business is, while calculating markup does two things, it allows you to set appropriate pricing for any new product or service and allows you to revisit those pricing levels to determine if they need to be adjusted.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles