A master budget is a series of smaller budgets that are rolled up into one larger budget to provide a more comprehensive view of your business.

Combining an operating budget with a financial budget, a master budget is typically prepared for the upcoming year, and it can also be a useful tool when creating a strategic plan for your business.

Managing multiple budgets is a time-consuming process and is best undertaken with the help of a good accounting software application that can assist you with tracking your revenue and expenses properly.

This is not a task that should be delegated to your bookkeeping or accounting clerk, but instead should involve management and ownership.

Overview: What is a master budget?

A master budget is a comprehensive budget created from a series of smaller, specialized business budgets. The master budget process has two parts -- an operating budget and a financial budget -- that are themselves made up of a series of smaller budgets.

The operating budget consists of projected sales revenue, the cost of goods sold, and all the separate operating expense budgets you’ll be creating.

Once completed, these smaller budgets are rolled up into a budgeted income statement format, while the financial budget consists of a projected balance sheet and statement of cash flow.

Creating the smaller budgets using a standard budget format makes the creation of the master budget simpler and more accurate.

A master budget consists of an operational budget and a financial budget. Image source: Author

Source: differencebetween.com.

How to prepare a master budget for your business

Preparing a master budget will require you to first prepare all of the smaller budgets, starting with the sales budget, since the numbers in your sales budget will directly affect the others.

Before you begin preparing any budget, you’ll need to decide whether you’ll be preparing master budget components on a monthly or quarterly basis.

Step 1: Create your sales budget

Your sales budget serves as the foundation for the rest of the budgets you’ll need to create. These are just a few of the items that are directly affected by your sales budget:

- Production levels

- Materials costs

- Customer demand

- Staffing levels

- Overhead costs

- Revenue

Creating the sales budget first will reduce the amount of work needed for many of the other budgets.

Step 2: Create a production budget

Closely tied to the sales budget, the production budget drills down a bit more into production, covering details such as the number of items you plan to produce or sell.

For example, if you plan to produce 12,000 rocking chairs, how much will those materials cost? What about labor costs? If you’re not manufacturing items, you can skip the production budget and focus on the materials budget instead.

Step 3: Create a materials budget

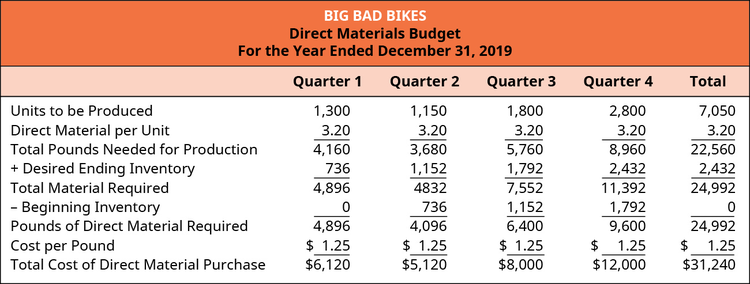

Whether you’re manufacturing products to sell or just buying them for resale, you’ll need to create a materials budget, which will directly tie to your sales budget. Because you’ve already estimated your sales totals for the upcoming year, it will be much easier to create your materials budget.

Sample materials budget by quarter. Image source: Author

Source: openstax.org.

Step 4: Create a direct labor budget

Creating a direct labor budget is a necessary step for businesses involved in production. If you purchase goods for resale, you can skip this step.

Step 5: Create an overhead budget

This step will help you account for both fixed and variable costs in production, while excluding direct materials and direct labor, since each of those has its own budget.

Step 6: Account for cost of goods sold

Using the information from the sales budget, materials budget, and production budget will simplify the creation of the cost of goods sold budget. You’ll also need to include budgeted beginning and ending inventory in the cost of goods sold budget.

Step 7: Create an administrative budget

Once the production steps have been completed, you can start on your administrative budget, which should include all non-manufacturing costs your business will incur, such as supplies, sales, and shipping or freight costs, as well as front office salaries.

Step 8: Create the financial budget

If you’ve been in business for a while, you can use totals from previous years to guide you through the financial projections needed to create the financial budget. If you’re just starting out, all the numbers in both your operational and financial budgets will be estimates.

The financial budget consists of a cash budget that displays cash inflow and outflow based on the operational budgets created earlier; a budgeted balance sheet, also based on operational totals; and a budget for any capital expenditures expected in the upcoming fiscal year.

Step 9: Create the master budget

The final step in the process is combining the details provided in the smaller budgets to create a master budget. Remember, your master budget will consist of two parts: the budgeted income statement, which is a result of your smaller budgets, and your financial budget, which was prepared in Step 8.

Master budgets usually reflect totals for the upcoming year, with budgeted amounts entered into a standard monthly or quarterly budget format.

Tips and best practices for making a master budget

Creating a budget is a learning process. New budget preparers frequently feel overwhelmed with the entire process, but familiarizing yourself with the components of budgeting is helpful, as are the following tips.

1. Start with sales

Your sales budget will directly affect all your other budgets.

When creating a sales budget, you’ll need to look at how much you expect to sell, how many items you need to purchase or manufacture to sell the amount projected, and how much money will be spent on materials to produce the items you’ll be selling.

Once you have sales projections down, many of the other budgets fall into place.

2. Get others involved

If you run a one- or two-person business, it’s likely you’ll be doing most of the prep work yourself. However, if you have sales or production managers, be sure to get them involved in the budget creation process as well.

No one knows the production line or sales department better than those managing it, and their participation will help provide a more accurate depiction of the upcoming year than you possibly could by creating the budgets on your own.

3. Be conservative

Always be conservative when preparing a budget. It’s great to be optimistic about your business, but an overly optimistic budget does no one any favors.

While there’s no reason to build catastrophic events into your budget, even a small blip such as a supplier going out of business or your rent doubling can have a serious impact on your budget. Always be conservative.

4. Expect inaccuracies

In a perfect world, your actual totals would match up nicely with your budgeted figures. Sometimes they do, more often they don't.

It’s important that you’re tracking your budget vs. actual totals with your accounting software, or by using a spreadsheet, to understand just how accurate (or wildly off-base) your projections are. If this is your first time creating a budget, cut yourself some slack, and learn from your mistakes.

A master budget may prove helpful for your business

Not every business needs a master budget. However, if you manufacture products and need to manage multiple areas, taking the time to prepare a master budget may be a good idea.

Keep in mind that preparing a master budget is not a job for your bookkeeper alone; it’s a joint effort by owners and management to produce a document that can serve as a financial blueprint for the upcoming year.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.