A Small Business Guide to Microloans

Many small business owners often don't need or qualify for traditional loans. It could be because they’re a startup or don't have much credit history, or they only need a little bit of funding. In fact, it's more common than you think. You might even be one of them.

Maybe you're a veteran who recently opened a food truck and only needs $25,000 to get it off the ground. Or, let’s say you own a salon and find the perfect spot to expand but need $10,000 for the deposit on a new lease.

In both these instances and many more like them, a microloan could be the funding option you need. These small loans help business owners who might otherwise struggle to find a loan for their small business.

If you think you might be a good candidate for a microloan, keep reading. You'll learn the basics of microloans for small businesses and some best practices if you decide to apply for funds from a lender.

Overview: What are microloans?

Typically, microloans are small loans, usually between $5,000 and $20,000, designed to help disadvantaged or underserved small business owners.

The U.S. Small Business Administration (SBA) has one of the more well-known microloan programs. The SBA works with intermediary lenders across the country, ranging from small community banks to nonprofit organizations and other governmental agencies, to administer loans for qualifying borrowers. According to the SBA Microloan Program, the average loan administered through the program is about $13,000.

The SBA administers funds to small business owners through lending partners. Image source: Author

However, if you're looking for microlenders, the government isn't the only place to turn. You can also find microlending opportunities through private citizens, venture capital (VC) firms, and microloan investing programs.

For small business owners who are new and underserved, there are various benefits to seeking a microloan. These include:

- Reasonable interest rates, ranging from 6% to 15%

- Favorable repayment terms, including extended payment plans

- Flexibility for business expenses compared to more traditional loans

- Potential to help improve your business credit

Since microloans target new and up-and-coming small business owners, many lenders also offer training and mentorship programs. The goal is to help give small business owners a leg up, grow their business, and eventually qualify for more traditional lending.

Microloans aren't for everyone. For some small business owners, the size of a microloan would be too small for their needs. Also, there's often a long documentation process that can include submitting a business plan, and you still might get disqualified based on poor credit. Some small business owners aren't interested in training programs, in which some lenders might require participation.

What types of business expenses are microloans used for?

In many instances, microloans offer more flexibility when it comes to how you're allowed to allocate your funds. Of course, this depends on the lender you use, so be sure you are fully aware of what's acceptable and what’s not before you agree to anything.

Working capital and fixed assets are the most common SBA-approved business expenses for small business loans. Image source: Author

1. Working capital

In many cases, funding from loans goes toward working capital. That’s the money used to cover short-term operating expenses -- essentially what you need to keep the lights on. It can also help cover your inventory and short-term debt.

2. Inventory

Sometimes you might need to make a larger purchase to restock your inventory. It's pretty common with seasonal businesses, for example. If you don't have the available cash flow to buy more inventory, a microloan can help cover these costs.

3. Furniture and fixtures

Let's say you've opened a new office for your startup. You've got your business cards and printer all ready to go, but you and your co-founder will need a place to sit. Funds from your microloan can go toward furnishings, like desks and chairs, for your business.

4. Leases

Remember that beauty salon owner? She can use her microloan to cover the first, last, and security deposit on that new commercial space she found. If you're considering applying for a microloan to help cover real estate expenses, keep in mind that many microloan lenders won't allow you to use these funds to purchase real estate.

5. Equipment

You can also buy equipment with the funds from a microloan. A small business owner might use the funds to upgrade from a used piece of machinery to a new one. Or, they might buy equipment to help them process orders more quickly.

6. Employees

While microloans typically don't provide enough to hire an employee full time, you can use the funds to bring on an administrative person to help you set up appointments a few times a week or to hire an extra cashier on busy Saturdays during the holiday season.

Who is eligible to receive a microloan?

Traditionally, microloans tend to focus on people and startups underrepresented through traditional lending. Many microlenders specifically target such people for assistance, so check to see if you qualify in these groups before you apply.

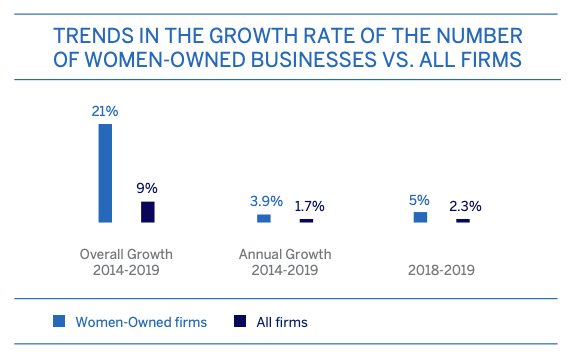

Women

According to a 2019 report from American Express on the State of Women-Owned Businesses, they represent 42% of all U.S. companies and generate nearly $2 trillion in revenue. However, these businesses are often underfunded compared to competitors.

Women-owned businesses are significant drivers of growth in the U.S. Image source: Author

Women of color

According to the same report, startups and small businesses owned by women of color are massive drivers of business growth in the country. Yet they also often struggle to get the funding they need. Many microlending programs specifically target women of color, especially those who live in underserved communities.

Veterans

Veterans are also often considered underrepresented in traditional funding, so many veterans starting small businesses turn to microlending opportunities. Some lenders specifically focus on veterans, helping them build a network and providing training on writing grant proposals for government funding.

Small startups

Not every startup is the next big tech company in Silicon Valley. However, that doesn't mean that your startup doesn't have the opportunity to get funding through microloans. If you live in an area that's home to many startups, you'll probably find a few private and nonprofit funds that offer to loan to local businesses.

4 best practices when applying for a microloan

The amount of funding available through a microloan may be much smaller compared to more traditional loan options, but that doesn't mean the application process is faster. Regardless of the lender, from connecting with a local credit union to securing a primary investor at a VC firm, you'll want to follow these four tips to help make the process a bit easier.

1. Read the requirements

Depending on the lender, microloans can have a very specific list of qualifications to meet. Just as you would with any loan, read through the qualifications and requirements first to make sure you have a handle on what sort of paperwork and information you might need to move your application along.

2. Have your business plan ready

As with bigger lenders, it's important to look at your business and have a plan in place before applying for any microloan. Since these loans are for small amounts, many lenders look for detailed descriptions of where the money is going. Create a business plan to show how your business operates and your plans for the future.

3. Know your numbers

Some small business owners turn to VC firms for microloans. When dealing with VCs, it's essential to know your numbers. Having a handle on your balance sheet helps these firms determine your company's valuation before any money is invested, as well as the value of your company after investment if the VC firm chooses to go ahead.

4. Prep for the interview

Many lenders offer microloans because they care about improving their local communities, so they often have business owners come in for a chat during the loan application process. This gives you a perfect chance to share your strengths and highlight your business' potential. It also lets you explain any issues with your resume or dings on your credit, so prepare to honestly discuss the good and the bad.

Microloans could give your business the boost it needs

For many small business owners who struggle to get a foot in the door with a traditional lender, microloans provide another option. As you explore the lending process, dig in and see if securing one of these small loans is something that can help you grow your business.

Before you decide on any business funding, though, make sure to explore all your options first and find the best option for your needs.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles