The Small Business Guide to Mobile Payments

When Apple Pay hit the market in 2014, critics were doubtful of the technology behind it. Was it a truly secure payment method, or just another marketing gimmick?

Fast forward to 2020, and mobile payments have become very popular among customers wanting faster transactions. For businesses, this has meant embracing a new and additional payment method.

eMarketer recently predicted that by 2021, the total transaction value of mobile payments will reach $161.41 billion, so it’s time for businesses to get savvy about mobile payment technology.

In this article, we’ll go through the different mobile payments available, their benefits, and how the mobile payment process works.

Overview: What are mobile payments?

There are various types of mobile payments, but overall, mobile payments refer to transactions performed via a mobile device. They allow businesses to take in-person digital payments rather than cash, card, and check transactions, usually via an app downloaded to a customer’s phone.

Mobile payments are not the same as virtual terminals, which are web-based applications that allow merchants to manually process payments when a credit or debit card, digital or otherwise, isn’t present.

The 3 types of mobile payments small businesses can accept

Mobile payments facilitate payment with most mobile devices which simplifies the transaction process for both the merchant and the customer. Though the mobile payment industry is booming, three main types of mobile payments are suitable for small merchants to accept.

1. Near-field communication (NFC) payments

NFC payments are mobile-based, contactless payments between a mobile and an NFC-enabled card reader. NFC payments use radio-frequency identification (RFID), and the devices’ NFC chips exchange encrypted data to make the transaction.

A common example of an NFC payment is when a customer stores their bank details in a “mobile wallet” (a virtual wallet that stores card information on a mobile device), opens that wallet on their phone, and ‘taps’ the card reader, like they would with a physical credit card.

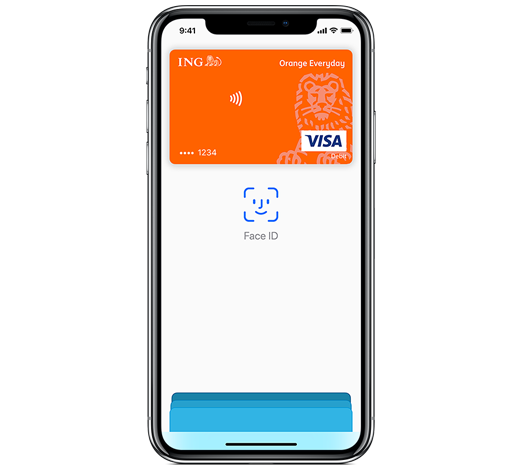

Generally, customers are prompted to unlock the app on their device via thumbprint or facial recognition, or screen lock codes to secure each NFC transaction.

Some customers’ mobile devices prompt them to use their device’s facial recognition functionality to enable the NFC transaction. (Image source: Author

2. Quick response (QR) codes

QR codes are two-dimensional, black and white square codes that are decoded once scanned with a customer’s phone camera, or with a QR code scanner. Generally, once the code has been scanned, a link in the phone’s browser may open asking for payment confirmation.

This type of mobile payment can be processed in two ways:

- The customer scans a merchant’s QR code with their phone, using an app that facilitates QR code payments. The customer then confirms the transaction and amount with their phone.

- The merchant scans a customer’s QR code, the customer opens an app that facilitates QR code payments, which then displays a QR code that contains the customer’s card details. To complete the transaction, the merchant scans this code with a QR scanner.

3. Magnetic Secure Transmission (MST) payments

MST payments use “magnetic” signals to generate a connection between a mobile device and a POS terminal. This mobile payment method emulates a physical card being swiped through a card reader.

When customers hold their phones against a POS terminal, the phone emits a signal that mimics the magnetic strip on a credit card.

MST technology works with most NFC-enabled hardware that accept contactless payments, which means that so merchants don’t need to update their point of sale systems. Currently, MST works exclusively with Samsung mobile devices.

Benefits of your small business accepting mobile payments

They’re here to stay, so preparing your business to accept mobile payments should top your list of priorities. Cash-only payment systems should be a relic of the past, but you need to meet your customers where they are -- and they’re on the side of mobile payments. Here are some benefits of accepting mobile payments.

1. Increase sales volume

When you don’t give potential customers the option of paying with their mobile, you’re likely losing sales. There’s been a large decline in cash payments overall, but research has shown that users of mobile payment methods spend twice as much as non-users.

2. Improves the customer experience

No one likes to wait in line to pay. With mobile payments, you’re eliminating time your customers spend waiting for other customers to find their credit cards or find the right change, and providing them with quick and easy customer service.

Customers need only tap their phone near the reader -- there’s no need to enter a PIN number, sign receipts, or dig for nickels in their pockets.

It also gives other staff the freedom to serve customers wherever they are in the store, as they don’t need to be connected to a POS terminal to process transactions.

3. Reduces hardware expenses

Some smaller businesses might not need all of the features that POS systems have to offer, so investing in systems and POS hardware just to accept payments may not make sense. Most mobile card systems come with free or low-priced card readers and transaction fees for mobile payments.

NFC-enabled card readers are inexpensive and lightweight for small business owners. Image source: Author

Square’s card reader comes in at under $50. (Source: Square)

How does the mobile payment process work?

Though it differs from method to method, most mobile payments are simple. When a customer pays using NFC technology they:

- Hold their mobile close to the merchant’s card reader, approximately 2 inches away.

- RFID frequency is used to make a connection, and exchange encrypted data to process the transaction.

- Customers are usually asked to press their thumb to their device or show their face to its screen to confirm and authenticate the transaction.

Mobile payment technology is constantly evolving, and accepting mobile payments couldn’t be easier for small businesses.

Save time and money with mobile payments

Mobile payments are an inexpensive way of making sure you clock as many sales as possible while giving your customers payment flexibility and quick customer service. To enable mobile payments, you’ll need to find a POS system with features and hardware that can manage mobile payments.

Because most mobile payment methods use tokenization (whenever a customer makes a mobile payment, the device creates a single-use credit card number it sends to the merchant), they also help serve peace of mind.

However, accepting mobile payments doesn’t eliminate the risk of chargebacks to retailers, so if they’re right for your business, it’s also worth looking at chargeback protection policies.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles