Net 30: Good or Bad for Your Business?

One of the most frequently used payment terms, net 30 is a credit term extended to your customers requesting that payment be made within 30 days of the invoice date. While net 30 can be used with a discount as an incentive for early payment, net 30 is also used without any discounts being offered.

Overview: What does net 30 mean?

Are you ready to start offering credit terms to your customers? Then you’ll probably want to learn more about net 30.

Net 30 is one of the most common credit terms used by bookkeepers and accountants and simply means that you’re extending credit to your customer, and expect them to pay the net, or full amount of the invoice, within 30 days of the invoice date.

While customers may get confused about when the net 30 period starts, it’s always based on the invoice date.

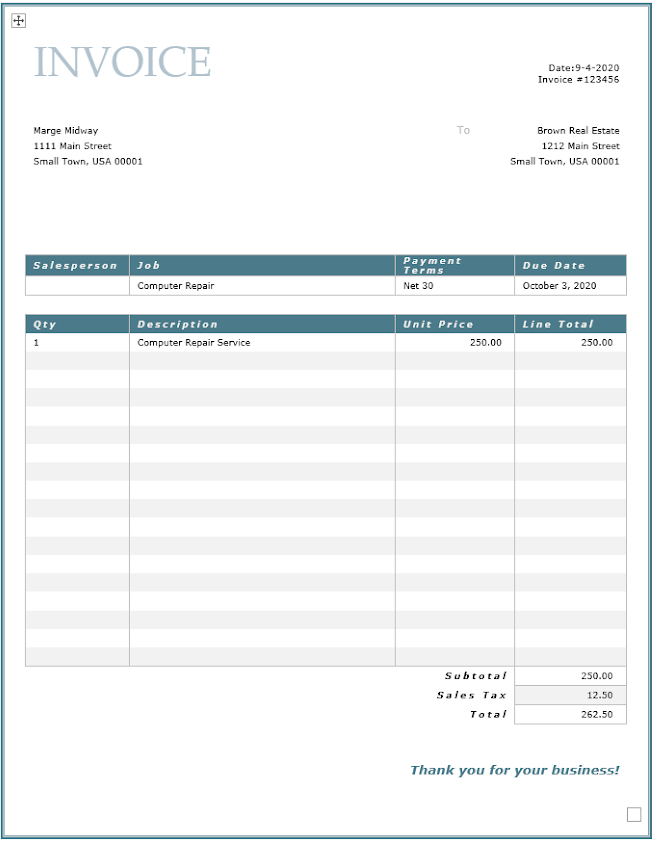

For example, if Marge sends you an invoice dated September 4, and that invoice has net 30 terms, that means that you’ll have to pay the net, or total amount due, by October 3.

If you’re using accounting software or invoicing software, you can enter the credit terms you wish to use when creating your invoice.

Net 30 vs. due in 30 days: What's the difference?

In most cases, there is no difference between “net 30” and “due in 30 days” as they appear on an invoice, since both indicate that your customer is responsible for paying the invoice within 30 days. The only time these two terms differ is if you’re offering a discount along with the net 30 terms.

5 benefits of using net 30 payment terms

If you’re still undecided about offering credit terms, learning about some of the advantages of using net 30 payment terms may help you make up your mind.

1. Expands your customer base

Offering net 30 terms can help to broaden your customer base tremendously, as many customers appreciate the 30-day payment option, particularly those that may be experiencing cash flow problems of their own.

2. Offers a strong incentive for your customers

If you frequently sell to larger businesses, you’ll understand that sometimes the act of getting payment up-front or at the time of service is next to impossible.

However, by offering credit terms such as net 30, it’s much simpler for your customers to put your invoice through their normal processes and still pay you within the 30-day time frame specified on the invoice.

3. Lets you add an early payment discount

One of the most effective ways to get your customers to pay early is to offer an early payment discount. If you’re currently offering your customers net 30 terms, but would like them to pay a little quicker, you can add a discount for early payment.

For example, if you want to offer a 2% discount to customers who pay early, you can change the billing term to 2/10 net 30.

If you pay an invoice within 10 days, you can take advantage of a 2% discount. Image source: Author

This means that if your customer pays within 10 days of the invoice date, they can take a 2% discount. If they choose not to pay early, the invoice is due at the net amount within 30 days of the invoice date.

4. Helps your business remain competitive

It’s tough to compete with other businesses in your industry if they’re extending net 30 terms to their customers and you’re still insisting on payment up-front. While not every business is in a position to offer credit terms to all of its customers, doing so can help your business remain competitive.

5. Builds customer loyalty

Offering credit terms to your customers can help establish both trust and loyalty, and perhaps even reward you with a customer for life.

5 disadvantages of using net 30 payment terms

While offering net 30 terms to your customers has some distinct advantages, before making a decision, be sure you’re aware of the drawbacks as well.

1. Can create cash flow problems

If you have limited cash flow, you may want to reconsider offering net 30 terms to your customers. Small businesses with a limited cash flow margin may be hard-pressed to wait 30 days for payments from their customers.

If you feel you must offer credit terms to remain competitive, consider net 10, which will bring in payment much faster.

2. Discounts create thinner profit margins

If you attach a discount to net 30 terms, your profit margin will become even thinner. Again, if you’re in a position to reduce your profit margin a bit in order to be paid more quickly, then go for it. But, if you’re already operating on a razor-thin margin, discounting invoices may not be a good idea for your business right now.

3. Can create additional work

Yes, it does take more work to invoice a customer, post a discount (if offered) and record a customer payment. You may also be tasked with following up with late-paying customers and even handling collections.

If you have the staff and the time to do this, great, but if not, it may be better to continue using your current payment arrangements.

4. Terms are unclear

Net 30 terms can confuse customers, who ask the following questions:

- Does the 30 days start when the invoice is received?

- Is payment due 30 days from today or 30 days from the invoice date?

- Does the 30 days start when the product or service is received?

- If a discount isn’t offered, why are billing terms net 30?

You can easily include both credit terms and a specific due date to reduce customer confusion. Image source: Author

These are all very good questions, and one of the easiest ways to get around them is to use a due date instead of net 30.

Revisiting Marge above, on the invoice she mailed dated September 4, if she wanted payment by October 3, she could just use Due by October 3 on her customer’s invoice rather than net 30, which eliminates all of the questions above.

5. Delinquent accounts become a reality

No matter how diligently you do your research, in reality, you’re going to have delinquent accounts. Late payers create a lot of extra work (see #3) and even with all of that extra work, they still may never pay. And as a business owner, you have to be prepared for that.

FAQs

-

No, you don’t. But you may find that doing so increases your customer base, and helps your business grow. It also helps you remain competitive in the marketplace, particularly if your direct competitors offer credit terms to their customers.

-

That depends on a lot of things, such as your current cash flow and if offering a discount will impact that cash flow negatively. If you don’t want to offer a discount, but would like your customers to pay earlier, you can try offering net 10 or net 15 terms, or even due upon receipt, if you want to get paid even quicker.

-

If you’re not offering your customers a discount, there’s no reason why you can’t use a specific due date rather than net 30. This can also help avoid customer confusion for those unsure about when the 30 days actually begins.

Are net 30 terms right for your business?

Some small business owners may find that the benefits of offering net 30 terms far outweigh the drawbacks.

However, if you’re uncomfortable waiting 30 days for payment, you can use net 10 or net 15, but keep in mind that any time you offer credit to your customers, there’s a chance that you won’t receive payment on time, or at all.

On the other hand, offering credit terms to your customers can help grow your business and your customer base. If you screen your customers carefully and are selective with who you offer credit terms to, chances are that offering net 30 payment terms can be a wise decision for your business.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles