As a business owner, one of your primary goals is to make money. There are many things you can do to help your business accomplish this, from creating a business budget to using various accounting ratios.

But how do you determine how successful your business is? By calculating your net income or net profit -- the single best indicator for determining just how successful your business really is.

What is net income?

In order to understand what net income is, you also have to understand these accounting terms:

- Accounting Cycle: Understanding the accounting cycle helps ensure that your financial statements are accurate. Whether you’re calculating earnings vs revenue or reconciling your bank statement, everything is part of the accounting cycle.

- Revenue: Revenue is the money received from providing services or selling products to customers. Though many people use revenue and income interchangeably, they are two very different things. When tracking revenue, be sure to use the revenue recognition principle, which explains exactly how and when revenues should be recognized.

- Expenses: Expenses are things that are paid by your business. Expenses include employee payroll, rent, and the day-to-day expenses your business incurs such as printing, postage, utilities, and office supplies.

- Cost of goods sold: Cost of goods sold are all of the related costs of creating a product or service. If you’re providing consulting services, your cost of goods sold would include any related labor costs, payroll taxes, and benefits paid to employees providing that service. If you sell products, your cost of goods sold includes the cost of the product that you are selling. For instance, if you buy 100 leather wallets for $5 each from the manufacturer, and sell them for $15 each, your cost of goods sold is $500.

- Depreciation expense: Depreciation expense is used to properly allocate the cost of an asset over its useful life, indicating the portion of the asset that has been used or consumed in that period.

- Taxes: Businesses need to pay taxes just like the rest of us. Some of the taxes that a business may need to pay include income tax, sales tax, property tax, self-employment tax, and payroll tax. All of the taxes paid by your business will need to be included with your total expenses when calculating net income.

Net income is calculated much like pretax income is, except that you’re also including your taxes in the calculation. Here is the formula for calculating net income:

Net income = Total revenues – Total expenses

Net income vs net profit: Is there a difference?

Is there any difference between net income and net profit? What about net earnings vs net income? No, there isn’t a difference. Most accountants and CPAs use the three terms interchangeably, as all three mean the same thing, which is the total money left over after subtracting all business expenses, which includes taxes, depreciation, and interest expense from total revenues received.

What does net income mean for your business?

“Just give me the bottom line.” We’ve all heard that said by bank representatives, investors, and even CEOs. That’s what net income is -- the bottom line on a company’s income statement. But what does that number mean for you and your business? Here are a few things that net income does:

It provides a good indicator of how successful the business is

Net income indicates that a company is making money. If expenses and taxes outweighed revenues, the company would experience a net loss. Net income, unlike gross income, shows you just how much money you have left over after all of your expenses have been paid; providing you with useful information on the health of your business.

In order to track net income for your business, it’s important that you’re able to track both revenues and expenses properly.

It is a basis for comparing performance over years

Net income comparisons from year to year can provide you and your accountant with a way to track business growth and financial health over a period of time.

For instance, if your net income remains stagnant or decreases over a period of three to five years, you may need to find ways to cut expenses or increase revenue, while a steep incline shows that your business is growing in a healthy manner from year to year.

It provides investors with the financial data they need

Net income is one of the first things that investors and financial institutions will look at. Good net income indicates that a company is financially stable, with enough money left over to pay their bills. It also provides good insight into whether a company is likely to remain successful.

Best accounting software to calculate net income and net profit

While most accounting software applications provide you with net income and/or net profit totals, the more comprehensive your reporting options are within a software application, the better.

Here are three small business accounting software applications that offer excellent reporting capabilities, including comprehensive financial statement reporting.

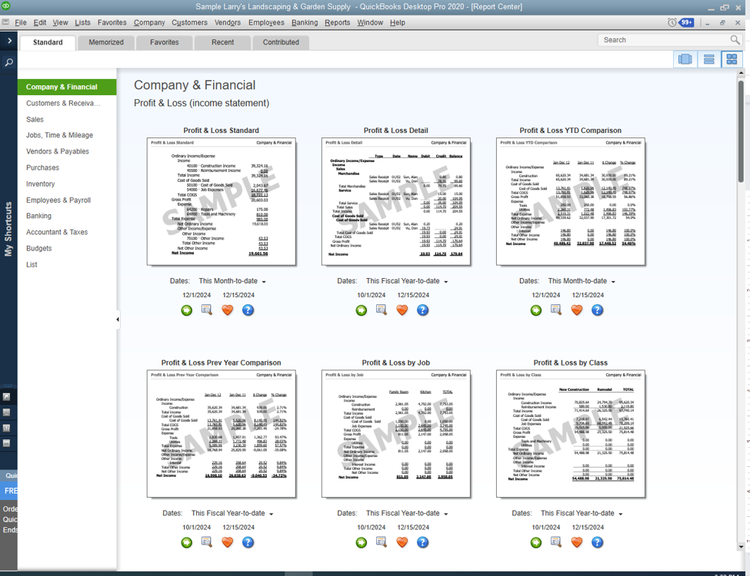

1. QuickBooks Desktop

QuickBooks Desktop is an on-premise application that includes top-notch reporting options for small and growing businesses.

QuickBooks Desktop offers excellent reporting options, including a Profit & Loss Statement. Image source: Author

QuickBooks Desktop Pro offers more than 100 standard reports, while the Premium and Enterprise plans include more than 150 industry-specific reporting options. All QuickBooks Desktop reports can be completely customized or exported to Microsoft Excel for further customization.

QuickBooks Desktop starts at $299.95 for the Pro plan, which supports up to three users, with the Premier plan running $449.95 per year, for up to five users. For growing businesses, the Enterprise supports up to 30 users and is $849.10 annually.

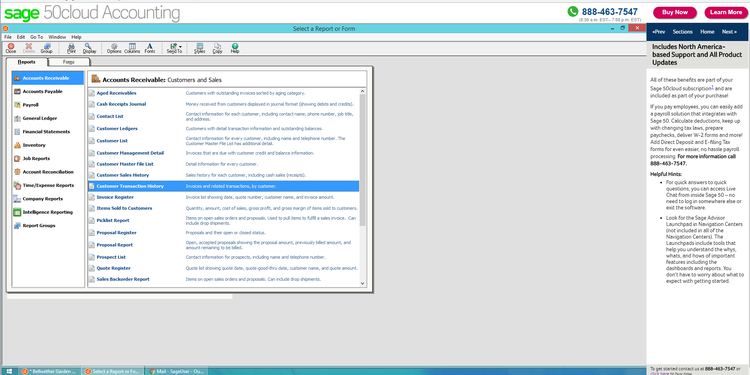

2. Sage 50cloud Accounting

Sage 50Cloud Accounting is a hybrid application, designed to be installed on-premise, but offering online access via Microsoft 365. Sage 50cloud Accounting offers solid reporting options for small- to mid-sized businesses.

Sage 50cloud Accounting offers an excellent selection of standard reports. Image source: Author

Sage 50cloud Accounting reporting options include complete financial statements, as well as company reports. Optional intelligence reports are available as well. All reports are fully customizable, and can be exported to Excel for further customization if desired.

Sage 50cloud Accounting starts at $278.98 annually for a single user system, while Premium is $431.95 per year for five users. For growing businesses that need a more robust system, Sage Quantum Accounting supports up to 40 users, with prices available upon request.

3. AccountEdge Pro

AccountEdge Pro is an on-premise application that offers excellent reporting options for small and growing businesses. Online access options are offered with AccountEdge Pro as well.

AccountEdge Pro’s Accounts List provides a list of all of your accounts. Image source: Author

AccountEdge Pro.

Along with a good accounts reports, AccountEdge Pro also offers complete transaction journals, and financial statements, including a trial balance and profit-and-loss statement. All AccoundEdge Pro reports can be customized or exported to Excel for further customization.

AccountEdge Pro has a one-time fee of $149 for the Basic Plan, while the Pro plan carries a one-time fee of $399. If you want 24/7 online access, AccountEdge offers Priority Zoom, with a monthly subscription running $50 per month.

Knowing your net income is essential

Knowing your net income is one of the most important markers for business success. While other numbers such as gross income and gross profit are also important for different reasons, net income is the bottom-line number that investors and banks want to see.

The easiest way to calculate your net income is by using accounting software. While the number can be calculated manually, using accounting software helps track revenue and expenses accurately, providing you with a net income figure that you can trust.

If you’re still in the market for accounting software, check out the products above, or take a look at The Ascent’s accounting software reviews.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.