The overhead rate, sometimes called the standard overhead rate, is the cost a business allocates to production to get a more complete picture of product and service costs. The overhead rate is calculated by adding indirect costs and then dividing those costs by a specific measurement.

While this is a necessity for larger manufacturing businesses, even small businesses can benefit from calculating their overhead rate.

Overview: What is the overhead rate?

Overhead rates are calculated by adding the indirect or overhead costs incurred by your business and allocating those costs based on a specific measure. Indirect costs are part of doing business, but they are not directly associated with production and do not generate revenue.

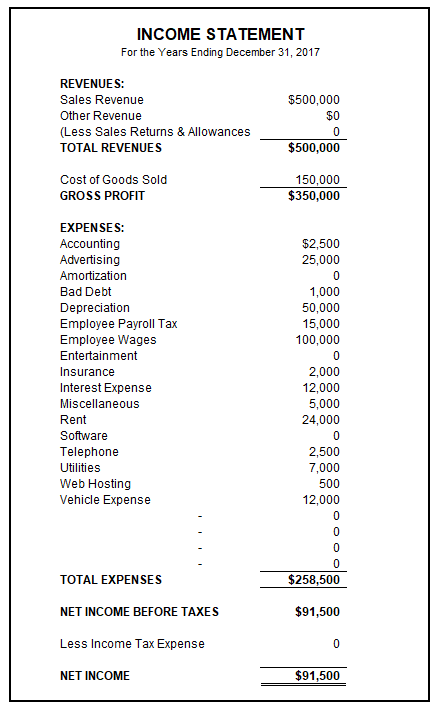

Overhead costs or the overhead rate is never directly associated with revenue generation. Image source: Author

The measures used to calculate overhead rate include machine hours or labor costs, with these costs used to determine how much indirect overhead is spent to produce products or services.

To properly calculate your overhead rate, you first need to add up all of your indirect business expenses. Indirect expenses are overhead expenses that are not directly involved in the production or services process. Some examples of indirect costs include:

- Rent

- Utilities

- Maintenance

- Equipment

- Insurance

- Advertising and marketing

- Taxes

If you’re using accounting software for your business, you can obtain this information directly from your financial statements or other system reports. If not, you’ll have to manually add your indirect expenses to calculate your overhead rate.

To fully understand the overhead rate, you should first be comfortable with the following accounting terms.

- Direct costs: Any cost that can be directly associated with producing a product or service is considered a direct cost. The majority of direct expenses impacting your business include direct labor, direct materials, and manufacturing supplies.

- Indirect costs: Indirect costs are costs incurred by your business that are required for normal business operations but cannot be directly associated with the cost of producing a product or service. Indirect costs are the costs that are used to calculate your overhead rate.

- Fixed costs: Fixed costs are costs that do not change based on production levels. For example, rent is a fixed cost since the rent amount paid each month will be the same whether production levels increase or decrease.

- Variable costs: Unlike fixed costs, variable costs will increase or decrease with production. For instance, both direct materials and direct labor are considered variable costs and will increase when production increases and decrease when production decreases.

Overhead rate vs. direct costs: What's the difference?

While both the overhead rate and direct costs can impact final product cost, along with your balance sheet and income statement, they are two different things.

The overhead rate is calculated by adding your indirect costs and then dividing them by a specific measurement such as machine hours, sales totals, or labor costs. Direct costs are the costs that directly impact production such as direct labor, direct materials, and manufacturing supplies.

Examples of overhead rate measures

Before calculating the overhead rate, you first need to identify which allocation measure to use. An allocation measure is something that you use to measure your total overall costs.

1. Direct labor

Direct labor costs are the wages and salaries of your production employees. Direct labor is a variable cost and is always part of your cost of goods sold. If you want to measure your indirect costs against direct labor, you would take your indirect cost total and divide it by your direct labor cost.

For example, if Joe’s manufacturing plant had indirect costs of $175,000 and direct labor costs of $145,000 in August, the overhead rate would be calculated as follows:

$175,000 ÷ $145,000 = $1.21

This means that for every dollar of direct labor, Joe’s manufacturing company incurs $1.21 in overhead costs.

2. Machine hours

Machine hours are the amount of time that production machines run for the period the overhead rate is being calculated for. Let’s say that Joe’s machines ran a total of 10,000 hours in August. To calculate the overhead rate using machine hours, do the following calculation:

$175,000 ÷ 10,000 = $17.50

This means that Joe’s overhead rate using machine hours is $17.50, so for every hour that the machines are operating, $17.50 in indirect costs are incurred.

3. Sales

Joe decides to measure his indirect costs against total sales. This measurement can be particularly helpful when creating a budget since he’ll be able to estimate sales for the budget period and then calculate indirect expenses based on the overhead rate.

If Joe’s sales for the month were $325,000, he would calculate his overhead rate as follows:

$175,000 ÷ $325,000 = $0.54

This result indicates that for every dollar that Joe’s manufacturing company earns, he’s spending $0.54 in overhead.

To obtain the percentage of any of these overhead rates, simply multiply the results by 100. For example, if Joe wanted a percentage for his sales calculation, he would simply complete the following calculation:

($175,000 ÷ $325,000) x 100 = 53.84%

This means that 53.84% of Joe’s sales dollars are spent on overhead.

How to calculate the overhead rate

Once you’ve decided which activity driver -- such as direct labor, sales, or cost per hour -- you wish to use, you can go ahead and calculate your overhead rate. The standard overhead cost formula is:

Indirect Cost ÷ Activity Driver = Overhead Rate

Let’s say your business had $850,000 in overhead costs for 2019, with direct labor costs totaling $225,000. To calculate your overhead rate, you’ll do the following:

$850,000 ÷ $225,000 = $3.78 = Overhead Rate

Overhead rates are always calculated in dollar amounts, although if you wish to calculate overhead as a percentage, you can change the formula slightly:

Indirect Cost ÷ Activity Driver x 100 = Overhead Rate Percentage

FAQs

-

Overhead expenses directly impact your financial performance and your profit margin. Knowing your overhead rate can help you estimate budgeted overhead, price products or services accurately to ensure profit, and be aware of just how much it’s costing your business to keep its doors open every day.

-

It depends on the questions you want answered. If you’re looking to measure machine efficiency, using machine hours to calculate your overhead rate might be best.

If you’re looking at how to effectively price your products, using total sales or even labor costs may be a better allocation measure to use for your business.

-

Many small businesses find that calculating their overhead rate yearly is sufficient. However, businesses with an active manufacturing component may find it helpful to calculate their overhead rate quarterly to make more timely adjustments if needed.

-

There are a lot of things you can do to lower your overhead rate, starting with a thorough examination of your monthly expenses.

While you won’t be able to change fixed costs such as rent and insurance, you can certainly look at expenses such as administrative salaries, maintenance costs, and office equipment.

You may even want to reevaluate your current office/warehouse space to see if it’s still a good fit for your business. Evaluating utility costs may also be a good first step to reducing overhead.

You can use your income statement to view indirect cost totals for the period. Image source: Author

Calculating overhead rate is important for your business

Calculating the overhead rate is important for any business. Even small business owners will benefit from knowing what their indirect costs are and how they impact the business.

One simple calculation is all it takes to determine your overhead rate. But this simple calculation can benefit many facets of your business from initial product pricing to bottom-line profitability.

Taking a few minutes to calculate the overhead rate will help your business identify strengths and weaknesses and provide you with the information you need to remain profitable.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.