A Beginner’s Guide to Payment Processing

From a top-level view, setting up a payment processing system seems like a straightforward process.

For the most part, you’ll have to create a merchant account and get approved. When customers make card-based payments, you submit the transaction details to the payment processor, the issuing bank authorizes the payment, and the money is deposited in your merchant account. That’s it!

In reality, the entire process is much more complicated than that. You’ll need to consider many factors, including which payment methods are ideal for your customers, plus payment system hardware and software compatibilities, security, fees, and more.

In this guide, you’ll learn the basics of payment processing so you can set up smooth and secure transactions for both you and your customers.

Overview: What is payment processing?

Essentially, payment processing is the process of automating transactions between customers and merchants. On secure internet connections, third-party services often handle processing, verification, and accepting (or declining) the transaction on behalf of the merchant.

Payment processing generally includes the following key players:

- The consumer: With card-based transactions, the buyer supplies the cardholder details when paying online or, if you also own a brick-and-mortar store, through your Point of Sale (POS) hardware.

- The merchant: As the provider of products and services, the merchant has the authority to accept payments from customers.

- The acquiring bank: The financial institution holding the merchant’s bank account manages and receives deposits from card transactions on behalf of the merchant.

- The credit card network: American Express, MasterCard, Visa, and other credit and debit card networks facilitate the transactions between card issuers and merchants.

- The credit card issuer: This is the company, financial institution, or bank issuing cards to holders and buyers.

- The payment processor: Processors handle routing payment details via the card networks and to the customer’s issuing bank. They also return payment approvals to the merchant, consumer, and acquiring bank.

How does payment processing work?

While the online payment process can vary depending on the customer’s payment method, it generally includes two main stages -- the authorization, or when the sale is approved, and the settlement, or when the money is in your account.

Here’s an example of how money usually moves from your customers to your business.

- A consumer buys your product on your website using a credit or debit card.

- The transaction information, or POS data, goes through a payment gateway that encrypts your data to secure it and then sends it to the gateway processor.

- The processor sends a request to the consumer’s issuing bank to check for sufficient credit to pay for the item.

- The issuing bank approves (or declines) the transaction and notifies the processor.

- The processor sends you back the transaction approval and informs your merchant bank to credit your account.

All of this happens in seconds, and, in the settlement stage, the issuing bank sends the money to your merchant bank, which then deposits the payment to your account.

5 methods of payment processing

Learn about these several payment processing methods to determine which options your business should offer to give your customers a convenient buying experience.

1. Debit card payment processing

Debit card transactions are easy to process since the issuing bank doesn’t need to decide whether to issue credit to the customer to cover the purchase cost. As long as your customer’s bank account has sufficient funds, the issuing bank usually approves the transaction immediately.

Also, since there isn’t any need to issue a credit, the risks associated with debit card transactions are significantly lower compared to credit cards. This means the interchange rates, or the debit and credit card fees you need to pay with every card transaction, are also lower.

2. Credit card payment processing

Generally, credit card payment processing starts with a customer purchase. The cardholder data is sent to the processing network and then the processor contacts the issuing bank to check if there are sufficient funds in the consumer’s account to cover the cost of the purchase.

Once sufficient funds are confirmed, the network processes the transaction and divides out the different interchange fees, keeping the processing charge’s remainder. The funds are then released to your merchant account.

The Shopify POS system, for example, lets you unify your in-store and online sales and payment processing, including credit cards.

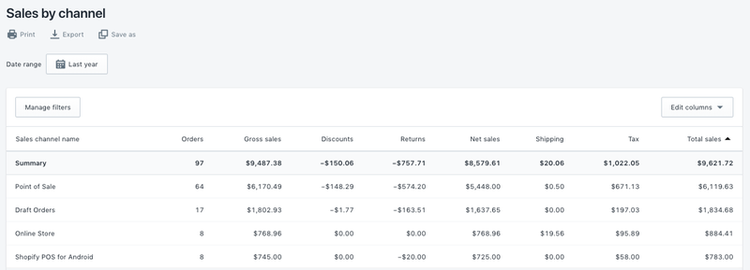

Get a breakdown of your sales, whether they come from in-store, online, or other locations. Image source: Author

It offers all the essential features for collecting online and in-person payments, including powerful tools to help you manage your inventory, customers, employees, and sales and financial analytics.

If you plan on accepting credit card payments, which you absolutely should, it pays to have a good understanding of how the procedure works, including choosing the right credit card terminal and POS systems, processing rates, and more.

3. ACH payment processing

Automated Clearing House, or ACH, payment processing is a network that coordinates automated money transfers and electronic payments between banks without using cash, wire transfers, credit cards, or checks.

Commonly used for recurring transactions, the steps in ACH payment processing include:

- Customer authorization: Customers authorize a direct payment from their bank account on your e-commerce website.

- Transaction initiation: Your business submits the payment information to your bank or ACH provider, the Originating Depository Financial Institution (ODFI).

- Payment request: The ODFI’s request for payment is sent to your customer’s bank, referred to as the Receiving Depository Financial Institution (RDFI).

- Payment processing: The RDFI checks your customer’s account for sufficient funds to make the payment and processes the payment once it confirms there is an adequate amount to cover the payment cost.

4. Digital wallet payment processing

Digital wallets integrate smart technology, such as smartphones, smartwatches, tablets, and other mobile payments, to accept and process purchases.

Digital wallets store payment information in these smart devices so buyers won’t need to provide all the details or whip out their credit or debit cards to pay for their purchase.

This payment processing method works by passing a signal from your customer’s smart device to your POS terminal using radio waves, allowing for contactless and cashless mobile payments.

Digital wallets can either use Near-Field Communication (NFC), Quick Response (QR) codes, or Magnetic Secure Transmission (MTS) technology.

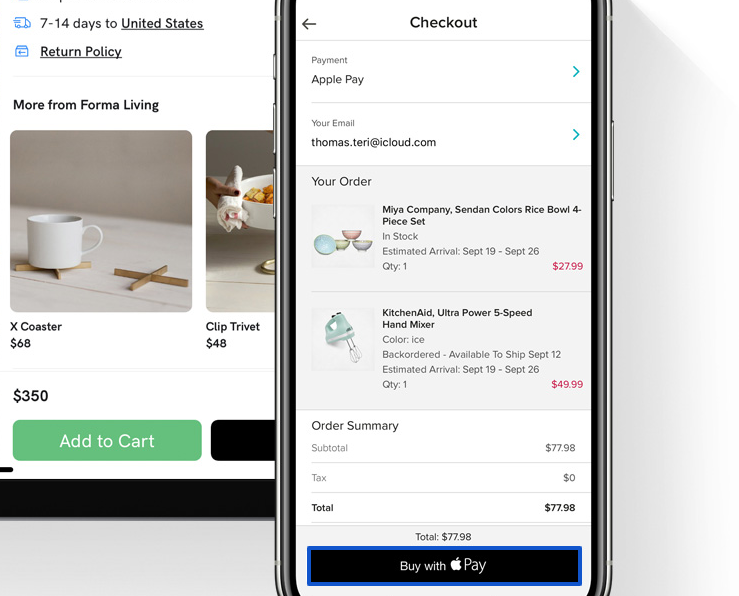

Integrating Apple Pay to your payment system, for instance, allows your customers to purchase products from your online store using their Apple Pay digital wallet.

Give your customers the option to make contactless secure purchases, whether in-store, in-app, or on your e-commerce website. Image source: Author

The backend of the digital wallet payment process is usually similar to processing debit or credit card transactions since most of the devices for digital wallets are linked to customers’ cards.

5. Payment gateway

Payment gateways are merchant services or third-party companies that process credit card payments for brick-and-mortar stores and e-commerce websites.

Popular payment gateways, such as Stripe, Square, and PayPal, provide increased speed, security through encryption, and efficiency in processing payments.

Various payment gateways offer different monthly, transaction, and cross-border fees, so do a bit of research and check on which third-party services provide the options best suited to your business’ specific needs.

Find the best payment processing method

Integrate payment processing methods that fit your business dynamics. Whether you’re optimizing your penetration pricing strategies or you’re streamlining your process for collecting sales tax, your payment processing systems must supplement your initiatives.

Giving your customers more ways to pay makes purchasing your products more convenient for them. It also improves their shopping experience, which ultimately helps increase your sales.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles