FICA Taxes: What You Should Know

There are so many acronyms in the tax world. I didn’t know that I was signing up to learn a new language when I decided to study accounting.

FICA (pronounced like “ficus” but without the “s”) is one of the first acronyms I learned, and it’s one of the most important for business owners to know and understand.

Overview: What is FICA?

The Federal Insurance Contributions Act (FICA) comprises Social Security and Medicare payroll taxes, which fund retirement benefits for U.S. citizens and eligible residents.

Social Security taxes pay for old-age, survivor, and disability insurance benefits. The Social Security program, enacted through the Social Security Act (SSA) of 1935, covers retirees and those with disabilities, including their dependents and survivors.

Medicare taxes fund federally administered hospital and medical insurance programs for U.S. citizens and eligible residents who are age 65 and older. Founded in 1965, Medicare also benefits those with disabilities and people with end-stage renal disease.

You can learn more about Medicare beneficiaries on the SSA website.

Both programs rely on FICA payroll taxes collected now to fund current beneficiaries of each program. Trustees of the Social Security and Medicare trust funds said in their 2020 report that both programs “face long-term financing shortfalls.”

For years, legislators have brought up raising FICA tax rates for some or all U.S. workers to address the solvency of Social Security and Medicare. However, there are no formal plans to change FICA rates.

How much do employers withhold for FICA taxes?

As with all payroll taxes, employers must withhold a portion of their employees’ pay for FICA taxes.

You don’t withhold FICA taxes -- or any other payroll taxes -- from independent contractors. In general, you need to withhold FICA taxes from anyone who receives a W-2 form every January.

Both employers and employees pay FICA taxes. Together, you contribute 15.3% of employee gross wages toward FICA taxes: 12.4% to Social Security and 2.9% to Medicare.

What about self-employed people?

FICA taxes for self-employed people go by a different name: Self-Employment Contributions Act (SECA) taxes. The self-employed pay 15.3% of gross wages in SECA taxes, equal to both halves of FICA taxes. You can deduct one-half of SECA on your business tax return.

FICA taxes are different from other payroll taxes, like federal and state income taxes, which are calculated based on taxable wages. Federal and state income taxes are reduced when employees contribute their pre-tax dollars to health insurance premiums and some retirement plans.

You calculated FICA taxes using gross wages, which aren’t affected by pre-tax payroll deductions. The 15.3% in total FICA taxes get split evenly between your employee’s paycheck and your business bank account.

How Social Security and Medicare taxes are calculated

In 2020, Social Security taxes only apply to the first $137,700 an employee earns. Once an employee reaches the Social Security maximum for the year, both the employer and employee stop paying the tax until the following year. The maximum contribution amount changes annually.

Medicare tax contributions have no such cap, but some high earners have to pay the Additional Medicare Tax.

As an employer, you’re required to withhold an additional 0.9% of an employee’s gross wages after he or she earns $200,000 for the year, regardless of their filing status. Employers don’t pay the Additional Medicare Tax; you keep paying your 1.45% of gross wages toward regular Medicare taxes.

Married taxpayers might be able to get a portion of their Additional Medicare Tax back when they file their personal tax return. When filing jointly, married taxpayers start owing Additional Medicare Tax after they earn $250,000 for the year, compared to $200,000 for unmarried taxpayers.

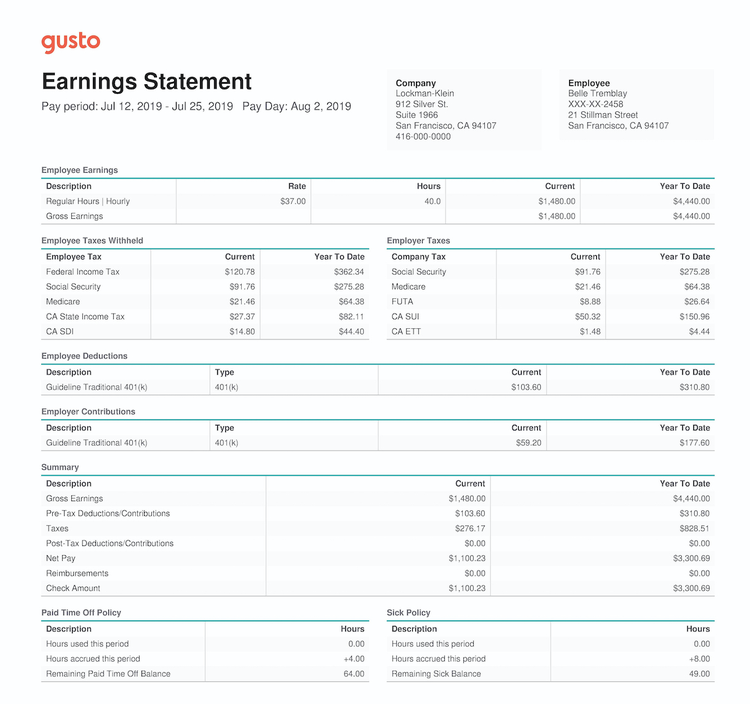

Let’s look at employee Belle’s pay stub, which lists employee tax withholding and employer-paid taxes.

FICA taxes are calculated on gross wages, unlike federal and state income taxes. Image source: Author

The paystub tells us that Belle’s gross wages, or gross earnings, are $1,480 for the pay period. You can see in the “Employee Taxes Withheld” section that her employer withholds 6.2% for Social Security and 1.45% for Medicare.

The “Employer Taxes” section shows Belle’s employer contributing an equal amount for FICA taxes, along with other employer-paid taxes such as federal unemployment (FUTA) and state unemployment (SUTA).

If Belle’s year-to-date gross earnings, or total earnings since January, exceeded $137,700, you would see $0 for Social Security in both the employer and employee payroll tax sections.

Which payments are not subject to FICA taxes?

Nearly all payments made to employees are subject to FICA taxes. Exempt or non-exempt, earning the state minimum wage or seven figures, their gross earnings are subject to FICA taxes.

However, there are a few exceptions where payments to your employees do not qualify.

Employer-paid contributions to health insurance and qualified retirement plans are exempt from payroll taxes, including FICA. Any contributions your employees make to the same plans are FICA taxable, though.

FICA taxes don’t apply to the wages of children younger than age 18 who work at a parent’s sole proprietorship or partnership, provided the partners are the children’s parents. Put simply, if you and your spouse own a business together, your children’s earnings are FICA-free.

Mileage reimbursements that don’t exceed the IRS mileage rate -- $0.575 per mile in 2020 -- are not subject to any payroll taxes, including FICA taxes. Some other employee business expense reimbursements are also nontaxable.

Check IRS Publication 15 for other exceptions. If you know anything about the IRS, it’s that they’re all about their rules and exceptions.

FAQs

-

Under President Trump’s August 2020 executive order, employers can defer the withholding and payment of the employee’s share of Social Security taxes from Sept. 1 to Dec. 31, 2020.

The executive order doesn’t affect the employer side of FICA or the employee share of Medicare taxes.

The implications of the executive order remain murky. Treasury Secretary Steven Mnuchin said in an Aug. 12, 2020, Fox News interview that “you can't force people to participate” in the employee Social Security tax deferral, indicating it may not be mandatory. That sounds too noncommittal for me.

If you defer Social Security withholding, there’s a possibility your business will be on the hook to pay it after the deferral period. If you don’t withhold it, you may be depriving your employees of money they could use right now.

So, sit tight and check The Ascent for updates on the employee Social Security tax deferral. For now, I don’t have enough answers to make a recommendation. Consult a trusted tax professional before adjusting your employees’ payroll tax withholding.

-

If you have payroll software, you don’t have to worry about how and where to send FICA tax payments because it’s done for you, like magic.

Those processing payroll by hand fill out IRS Form 941 every quarter. Follow our guide to Form 941.

However you manage your payroll, complete a payroll reconciliation where you match amounts listed in your payroll register to Form 941.

-

In 2020, Social Security taxes are limited to the first $137,700 of an employee’s gross wages. Once an employee earns that amount, both the employer and employee stop paying Social Security taxes on his or her wages until the following year.

Say that one of your employees, Melissa, has earned $135,000 so far this year. Her next paycheck is for $6,250, which will bring her over the Social Security tax maximum.

Only $2,700 of her next paycheck is subject to Social Security tax ($137,700 annual maximum - $135,000 = $2,700). Make sure to apply the 6.2% tax only to the eligible portion of her earnings.

Melissa’s earnings for the rest of the year will no longer have Social Security tax taken out. As her employer, you also don’t pay Social Security tax on her earnings, although Medicare taxes continue. Melissa and your business will start paying Social Security taxes on her wages again in the new year.

-

Yes. With few exceptions, such as IRS mileage reimbursement, you must pay FICA taxes on any cash you put in employees’ wallets.

Don’t FICA up your withholding

Though FICA taxes are one of the most straightforward taxes to calculate, don’t get too cocky. Business owners who do payroll manually should always check their calculations before sending out paychecks. Incorrectly withholding FICA taxes can stick your business with making up the error when the payment comes due.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles