How Many Pay Periods Are in a Year?

As we enter 2021, it is important to note that some employers will have 27 pay periods this year due to the extra Friday that falls on the payroll calendar. This is in contrast to the normal biweekly 26 pay periods we see during a typical year.

Pay practices, like all aspects of the employee experience, are an important part of your offer as an employer. How often you pay employees is much more than an administrative decision as it affects your ability to attract and retain great performers.

So, what's the ideal payroll schedule for small businesses, and how does that translate into pay periods? Let's break it down and look at some numbers to benchmark your pay practices.

Overview: What are pay periods?

Pay periods are recurring time periods for which employee wages are calculated and paid. The Fair Labor Standards Act (FLSA) requires businesses to pay employees on their "regular payday," but it doesn't specify how often those paydays must come.

Instead, states have set their own standards through payday frequency laws.

The most common pay periods are weekly, biweekly, semi-monthly, and monthly. No states allow bimonthly pay schedules. In most states, paying at least semi-monthly is acceptable, but some states have more stringent requirements.

In Connecticut, for example, businesses must pay weekly unless they get approval from the labor commission for longer pay periods. Be sure to verify your state's laws when setting up payroll.

How often you pay employees is an important decision not only because of its effect on recruiting and retention, but because you need to be able to deliver paychecks consistently based on the schedule you create.

Missing your regular payday, even by as little as a day or two, opens you up to FLSA complaints. The cost of a wage violation can be steep, including double back wages and other penalties.

There are also strategic considerations when setting pay frequency. Employees value shorter pay periods, yet each payroll run costs your business in administrative hours or vendor expense. You'll need to balance the administrative costs with your talent management goals to find the right frequency for your business.

How many pay periods are in a year?

With 52 work weeks in a year, pay periods generally add up as follows:

- Weekly: 52 pay periods per year

- Biweekly: 26 pay periods per year

- Semi-monthly: 24 pay periods per year

- Monthly: 12 pay periods per year

For weekly and biweekly pay, though, it's not quite that simple, because our 365-day year doesn't divide evenly into 7-day weeks. If you multiply 7 days times the 52 weeks in a year, you get 364 days. That means that each year, one day of the week occurs 53 times instead of 52.

If your payday falls on one of these "extra" days in the calendar year, you could have 53 weekly pay periods instead of 52, or 27 biweekly pay periods instead of 26. In addition to pay, this throws a wrench in things like payroll deductions for benefits.

In a leap year, you have two extra days to deal with. If you pay weekly or biweekly on one of those days, you’ll have an extra pay period that year.

You can tell where the extra days in a year will fall because they're the first (and last) days of the year. For example, 2019 started with a Tuesday, so there were 53 Tuesdays that year. 2016 began on a Friday, and since it was a leap year, there were 53 Fridays and Saturdays that year.

Payroll software can manage these quirks of the payroll process for you. The right software may put a wider range of payroll options and capabilities within reach, allowing you to align your pay practices more closely with your employees' desires.

4 types of pay periods

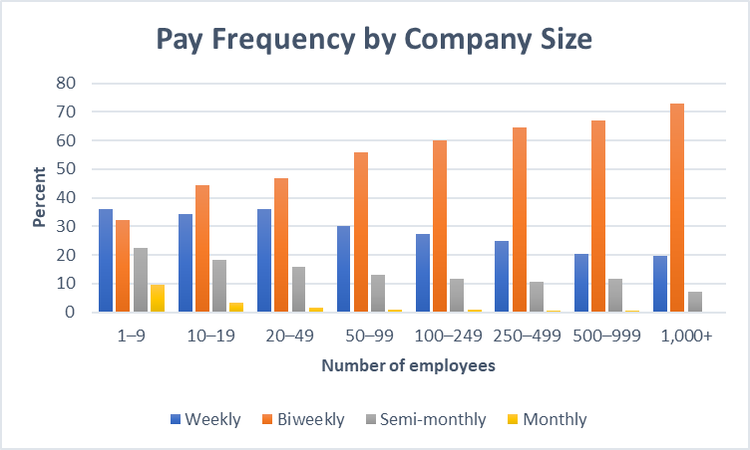

The four types of pay periods are weekly, biweekly, semi-monthly, and monthly. According to the U.S. Bureau of Labor Statistics (BLS), biweekly pay periods are most common among all employers, with 42% of employers paying on that schedule, followed by 34% paying weekly, 19% semi-monthly, and 5% monthly.

There are a few considerations when choosing your payroll schedule.

Type 1: Weekly

BLS reports that 36% of businesses with fewer than 10 employees pay on a weekly basis. Weekly pay periods are very common in the construction, manufacturing, mining, and transportation industries.

Weekly pay periods are particularly important to lower-wage employees who may lack a financial safety net for unexpected expenses. This frequency is the most costly and time-intensive payroll schedule, though.

Depending on the makeup of your workforce, your recruiting goals, and your bookkeeping practices, weekly pay periods may be worth the expense.

Type 2: Biweekly

Biweekly pay periods run a close second among small businesses at 32%. As business size increases, biweekly pay becomes the clear favorite, with 73% of very large companies paying on this schedule. Biweekly pay is also favored across the board in the education and health service industries.

Weekly pay, shown in blue, is the most common pay period for small businesses. Data from BLS. Image source: Author

Type 3: Semi-monthly

Semi-monthly pay periods run from the 1st of the month through the 15th, and from the 16th through the end of the month. This can be challenging to administer because your pay periods no longer coincide with the work week.

What do you do when a payday falls on a weekend? How can you calculate overtime based on a 40-hour work week?

Semi-monthly pay does, however, free you from the occasional extra paycheck dilemma.

Roughly 23% of small businesses pay semi-monthly, with its popularity declining as company size increases. Among those, salaried professions such as finance, information, and professional services are most likely to pay semi-monthly.

Type 4: Monthly

Roughly 10% of small businesses use a monthly pay period, the least common across all business groups. Monthly pay periods are the easiest and least expensive to administer, but they are also less popular with employees because they require careful planning and budgeting.

Once again, you'll have to weigh your talent management goals against your administrative capabilities to find the ideal schedule for your payroll processing.

FAQs

-

You may choose any day of the week as your payday. The only requirement is that your payday follows the pay period promptly.

-

You're not required to pay salaried employees more than their annual salary in years when you have extra pay periods. Some employers choose to reduce pay across all paychecks for the year to adjust for the extra payday.

This can be hard to explain to employees, though. Other employers simply absorb the expense of the extra paychecks.

-

Once you choose a pay schedule, you may change it, but not frequently and not in a way that reduces your employees' pay. For example, adjusting a pay period to avoid paying overtime to someone would violate the FLSA.

Changing your company's pay schedule after several years for a legitimate business reason would be permissible, though.

The bottom line

The most important thing to remember when setting up your payroll process is that a payday, as far as the federal government is concerned, is a promise. It's also a bit of a high point in your employees’ work week. Making payday something your employees can bank on is a great way to say thanks for a job well done.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles