Payroll is likely one of the biggest expenses your business has, which is why it’s important to get it right. The easiest way to do that is by performing a payroll reconciliation each pay period.

A payroll reconciliation should be completed whether or not you’re currently using payroll software or a payroll service. When it comes time to remit payroll taxes, you’ll be happy you spent a few extra minutes reconciling your payroll.

Overview: What is payroll reconciliation?

A payroll reconciliation ensures the payroll you’re currently preparing balances with the payroll recorded in your general ledger. Even if you’re using payroll software or payroll services, the payroll reconciliation process still needs to be completed regularly.

Doing so reduces or even eliminates payroll errors before they occur, ensuring that your employees are paid accurately.

What to consider when reconciling payroll

Whether you’re using a payroll service that integrates with your accounting software or you need to record journal entries manually, there are a few things you need to look out for when reconciling your payroll.

1. Does my general ledger match my payroll expenses?

Your total payroll expenses must match what you’ve posted in your general ledger. Always. The payroll expenses you need to account for in your general ledger include salary and wages, employee withholding (for taxes, insurance, or other payables), and employer liabilities.

Be careful not to include employer liabilities with your wages payable journal entries, but instead, record them separately. You’ll understand how important this is when it’s time to reconcile your payroll taxes for reporting and remittance purposes.

2. Are there major differences between payroll runs?

You know your business and your payroll better than anyone, so if your last payroll run was $5,100, and it’s $10,000 this pay period, there’s a good possibility something is wrong.

A discrepancy this large can be easily explained if you recently hired several new employees, or you paid out vacation time to a terminated employee. However, if your employee count is the same, and no one received a very nice raise, you need to discover where the problem is.

The best place to look is your employee hours worked. It’s easy enough to enter employee hours wrong. Finding this error and fixing it before funds are withdrawn from your bank is paramount, which is why you always want to do your payroll reconciliation before you run payroll, not after.

3. Payroll taxes

It’s easy to forget to record the payroll taxes you’re responsible for, such as the employer portion of FICA as well as FUTA and SUTA.

When you’re preparing your general ledger, be sure you record these expenses, or when it comes time to remit your payroll taxes, your reports will be inaccurate, and you don’t want to send an inaccurate report to the IRS.

How to do a payroll reconciliation

You’ll need to take many steps to reconcile payroll properly. These steps should be completed before you finish processing payroll and need to be completed even if your payroll software integrates with your accounting software. If that’s the case, just skip Step 5.

Step 1: Review your payroll register for accuracy

Whether it’s a Microsoft Excel spreadsheet or a register provided by your payroll service provider, your payroll register displays the information you’ve entered for the payroll period.

If you’re familiar with your regular payroll totals, you’ll be able to look at the register and see if the payroll total is too high or too low.

If it looks different from other payroll runs, determine if there have been any changes to your payroll, such as adding a new employee, or an employee leaving.

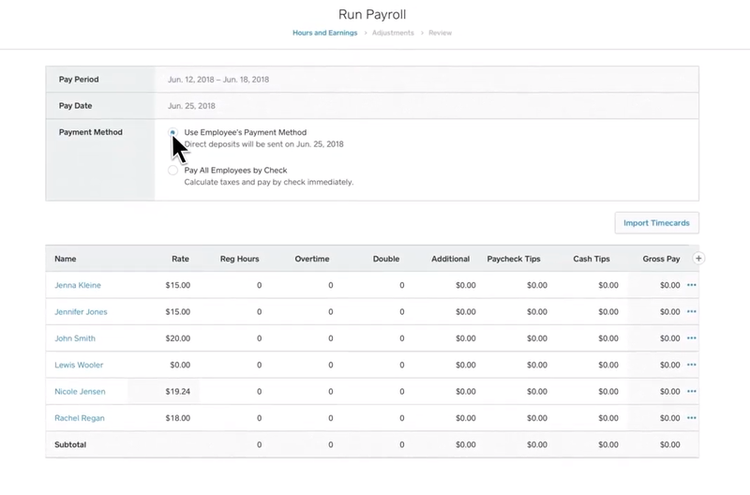

Square Payroll’s Run Payroll screen lets you review employee hours and pay rates. Image source: Author

Bonuses and commissions can also throw off your regular payroll totals. Before you assume something has been entered wrong, check for employee changes first.

Step 2: Check pay rates & salaries

If you only have a few employees, this process should go fairly fast. However, if you have upwards of 50 employees, concentrate on new employees or employees who have had a raise or a bonus to ensure that the information has been entered properly.

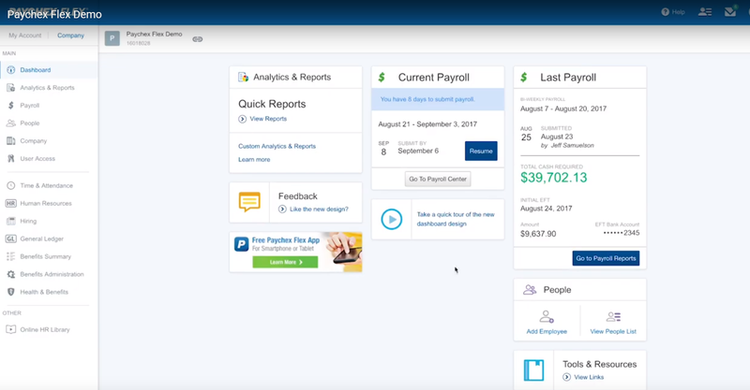

Paychex Flex’s Payroll Analytics and Reports page displays current and prior payroll totals. Image source: Author

The fastest way to do that is, when entering payroll data, to keep new employee information and salary changes separate from the rest of the payroll. This way you can refer to the additions and changes to make sure they were entered correctly. If there’s no change to an employee’s salary, it should be fine.

Step 3: Double-check hours entered

Here’s where you may need to spend some quality time. If you’re using an automated time and attendance system, employee hours are likely entered automatically into payroll, though that’s not always the case.

If you’re doing payroll for multiple departments, your department managers should be double-checking and approving hours worked for their employees, but if you have fewer than 25 employees, it’s likely this job may fall onto your shoulders.

Be sure to have the completed and approved timecards or time sheets handy to check that all hours, including overtime, have been entered properly. Employees are not happy when their paychecks are incorrect.

Step 4: Make sure deductions are correct

Again, if you have upwards of 50 employees, you may not have time to check payroll deductions for each one. However, it’s important that you do check any new employees and those whose deductions have changed.

For instance, if your receptionist becomes eligible for healthcare this pay period, you need to be sure to include that new deduction. Likewise, if one of your employees changes their W-4 withholding information, double check that the new withholding information has been entered.

Step 5: Complete general ledger entries

If your payroll software or service integrates with your accounting software, this step will be completed for you. However, you’ll often need to prepare and record a payroll journal entry to reconcile expenses properly. The entry should resemble the following:

| Date | Account | Debit | Credit |

|---|---|---|---|

| 5-31-2020 | Wages & Salaries Expense | $16,000 | |

| 5-31-2020 | Federal Income Tax Withheld | $ 1,800 | |

| 5-31-2020 | State Income Tax Withheld | $ 900 | |

| 5-31-2020 | FICA - Social Security | $ 992 | |

| 5-31-2020 | FICA - Medicare | $ 232 | |

| 5-31-2020 | Employee Health Insurance Payable | $ 1,100 | |

| 5-31-2020 | Salaries Payable | $10,976 |

You’ll also have to prepare your taxes and other employer expenses separately, since these are solely your responsibility.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 5-31-2020 | Payroll Tax Expense | $2,984 | |

| 5-31-2020 | FICA - Social Security | $ 992 | |

| 5-31-2020 | FICA - Medicare | $ 232 | |

| 5-31-2020 | FUTA Tax Payable | $ 960 | |

| 5-31-2020 | SUTA Tax Payable | $ 800 |

It’s particularly important you don’t skip this step, since you’ll need this information when you file Form 940 at year end.

Step 6: Run a payroll tax report and remit taxes due

You’ll use the information in the journal entries you create each payroll to file your quarterly Form 941, which reports the amount withheld from your employee’s paychecks.

You’ll also have to remit the withholding, either semiweekly or monthly, depending on the amount. For more information, check out the IRS website for more information on filing Form 941.

Don’t skip the reconciliation step

When you have a thousand other things to do, it’s tempting to assume payroll is correct. However, not reconciling payroll can lead to a lot of incorrect paychecks, which leads to a lot of unhappy employees. Take a few extra minutes and reconcile your payroll. You and your employees will be glad you did.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.