The only person who doesn’t love bonuses is the person running payroll for it.

Overview: What is supplemental payroll?

Supplemental payroll refers to irregular payments made to employees. It’s a broad term that encompasses all sorts of variable pay, from bonuses to sales commissions.

Businesses award supplemental pay to incentivize employees to reach company objectives and work overtime. Employers also send former employees out the door with severance pay and the dollar value of their unused vacation days. No matter what the reason, though, supplemental payments are all subject to payroll taxes.

Examples of supplemental pay include:

- Bonuses

- Sales commissions

- Severance pay

- Overtime pay

- Accumulated paid time off at the end of a worker’s employment

- Retroactive pay

- Tips

- Nondeductible moving expenses

Withholding income taxes for supplemental payments can be done in several ways. Employers have two options for withholding income taxes for supplemental pay, although they’re both imperfect.

One method often causes employers to withhold more than is necessary, while the other leads them to withhold too little. If you’ve ever received a bonus, then you probably know the Goldilocks problem employers have with variable pay and taxes. If you’re lucky -- and I’m convinced that’s the only way this happens -- the withholding will be just right.

At any rate, it all gets corrected when you file your individual income taxes by April 15. Let’s dive into your options for paying supplemental wages and how to withhold tax from them, whether you manage payroll by hand or you’re using software.

How supplemental payroll works

The following example sets up the options we’ll explore in the next section.

Frank owns Frankly Frames, an art framing store. I’m one of his highest-performing employees, if I do say so myself.

Frank wants to start paying me sales commissions to encourage me to keep up my prolific selling record. In the first half of February, I sold enough to earn a $1,000 commission. However, Frank isn’t sure how variable payments are taxed and needs some guidance.

Some more information about me: I’m paid $1,600 in salary semi-monthly. My 2021 federal income tax withholding Form W-4 says I’m single, have one job, claim no dependents, and request no additional withholding.

Let’s work through Frank’s options for getting me that extra pay.

2 ways to handle supplemental payroll income tax withholding

The method you choose for withholding income taxes from supplemental wages does not change this fact: Supplemental wages are subject to all the same taxes as regular wages.

We’re going to go over the hard part -- federal income tax withholding -- but other payroll taxes, like Federal Insurance Contributions Act (FICA) taxes, federal unemployment tax (FUTA), and state unemployment tax (SUTA), still apply.

Don’t forget about state income tax withholding. States with income taxes often allow the same or similar methods for withholding from supplemental payments.

1. Flat-rate method

The flat-rate method is the most straightforward way to withhold federal income taxes from supplemental payments. I’d recommend going this route if you do payroll manually and get a twitch in your right eye whenever you think about IRS tax withholding tables.

Under the flat-rate method, you withhold a specific rate set by the IRS. In 2021, the IRS supplemental tax rate is 22% for all payments of $1 million or less and 37% for payments that exceed $1 million for the year.

In our example, the supplement income tax withholding comes out to $220 with the flat-rate method ($1,000 sales commission x 22% IRS flat rate). Frank will withhold federal income taxes from my next regular paycheck as if I hadn’t received a supplemental payment.

There are some rules about using the flat-rate method:

- You can only use the flat-rate method when you’ve withheld federal income taxes from the employee’s regular pay at least once in the current or previous year.

- You must separately state the employee’s regular and supplemental wages to use the flat-rate method.

- The flat-rate method is required for payments that exceed $1 million for the year.

The drawback to the flat-rate method is that it doesn’t accurately withhold federal income taxes from most employees. Unless the employee’s effective federal tax rate is around 22%, it will either be withholding too much (for low-income taxpayers) or too little (for high-income taxpayers).

2. Aggregate method

Those who use payroll software might opt for the aggregate method. While more challenging to calculate, it’s more likely than the flat-rate method to withhold enough in federal income taxes to cover the supplemental payment.

When supplemental and regular payments are in one paycheck

When your supplemental and regular payments are part of the same paycheck, withhold federal income taxes as if the entire payment were regular wages.

This is the only method you can use if you don’t separately state on your pay stub what portion of the payment is for regular and supplemental wages. Simplistic payroll systems will default to this method.

1. Add the supplemental and regular payments.

Since we’re treating the supplemental and regular payments as one, combine them.

My pay stub from Frankly Frames says I earned $2,600 in gross pay ($1,600 semi-monthly salary, plus $1,000 in sales commissions).

2. Calculate federal income tax withholding based on the total in step 1.

Next, calculate how much you have to withhold based on information on your employee’s Form W-4.

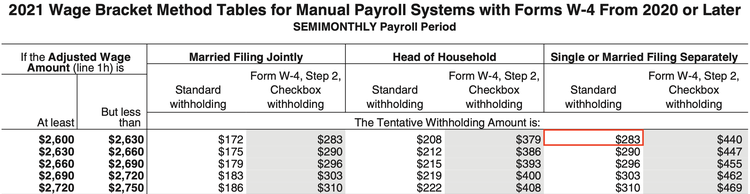

Frank does payroll manually. To calculate federal withholding, he uses the IRS Publication 15-T Wage Bracket Method Tables. The standard withholding for a $2,600 semi-monthly payment to a single person is $283.

Treat supplemental wages combined with regular wages as one regular payment. Image source: Author

When supplemental and regular payments are in separate paychecks

Let’s say Frank prefers to send two separate checks -- one with my regular $1,600 salary and another with the $1,000 in commissions. He’ll have to withhold federal income taxes from both payments.

1. Add the supplemental and regular payments.

If you’re feeling déjà vu, that’s because it’s essentially the same first step as the other aggregate method. Add together supplemental wages and regular wages paid for the most recent pay period.

Just like last time, our number is $2,600 ($1,600 semi-monthly salary, plus $1,000 in sales commissions).

2. Calculate federal income tax withholding based on the total in step 1.

Based on a $2,600 semi-monthly payment, my federal income tax withholding is $283.

3. Find federal income tax withholding based on regular wages.

Using the same federal income tax withholding table, find the withholding for only regular taxable wages. A $1,600 semi-monthly payment comes to $122 for our example, according to the tables.

4. Subtract step 3 from step 2.

To find supplemental wage withholding, subtract total withholding from regular wages withholding.

Frank should withhold $161 in federal income taxes from the commission paycheck ($283 total withholding - $122 regular wages withholding).

Not sure which method to choose? Ask an expert

It’s rare that you’ll be given a choice about how to withhold taxes from your employees. Before setting the supplemental wage withholding policy at your company, talk to an enrolled agent or a Certified Public Accountant (CPA).

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.