Completing W-2s at the end of the year is one of the main components of the small business tax cycle. The W-2 is what each employee uses to complete their personal return.

The W-3, which is the summation of all W-2s generated by a company, can be used as a check against your financial statements.

The W-4, on the other hand, is completed by the employee and usually just entered into a computer program and forgotten about by the employer.

In this article, we’ll talk about how to complete W-2s and the best way to fill out W-4s to maximize income.

What is a W-2 tax form?

The W-2 tax form is a form that you must complete and submit to all employees annually. The form shows the employee’s taxable wages, identification information, fica taxes, and other tax data for the year.

What is a W-4 tax form?

The IRS W-4 form is completed by employees when they join your company. Employees fill out their identification information and indicate how much they want withheld from each paycheck. Enter the W-4 information into your payroll software to calculate each pay period’s withholding and then print the W-2s at the end of the year.

W-4 vs. W-2: How to fill out each form

Let’s take a look at how each of the two forms should be completed.

Filling out the W-2 tax form

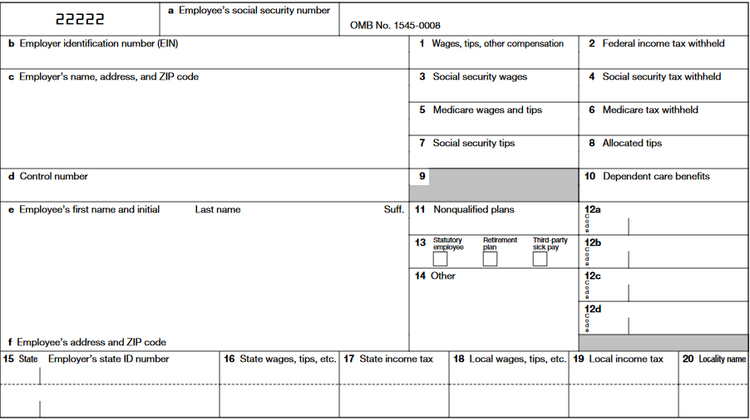

You’ve probably seen plenty of W-2s over your career and may be familiar, at least, with the basics. I will include a graphic of the form and then we’ll go through it line by line.

When you order W-2 forms, you will find six versions of the form below. One must be filled out and submitted to the Social Security Administration; one must be submitted to local tax authorities; and you send three to the employee; the last one, you keep in your files. Make sure to order forms directly from the IRS or from an official provider.

The identification information should match what the employee enters into their W-4. Image source: Author

Boxes a through f, excluding d, can all be found on the W-4 form that the employee completed when they were hired. Box d is for internal purposes. Any type of employee code that is assigned to each employee should be entered into this box. For example, at my company, we create a code that is the first three letters of the employee’s last name and however many employees have those three letters. My code is PRI001.

The wages and tax withholding boxes (1-6) should be completed with reports from your payroll software. Wages in box 1 is net of any pre-tax deductions (e.g. 401 (k) contributions). Social security wages is the gross amount up to $132,900 with no deductions, and Medicare is the gross amount with no ceiling. For most employees, the Social Security and Medicare amounts will be the same.

For the tax withholding boxes, you can save yourself a lot of time by keeping good Form 941 records. Form 941 is submitted to the IRS each quarter and includes records for all Social Security, Medicare, and income tax withholding.

Tips in box 7 is any amount that the employee reports to you, if their job includes tips. In box 8, calculate how much the employee would’ve earned in tips if they had been paid 8% on all the tables they served, if working in a restaurant for example, and report the difference between that amount and the amount in box 7. If you do not run a restaurant, skip box 8.

Leave box 9 blank. Boxes 10 through 14 are typically not completed as well. See the IRS instructions for when these need to be completed.

Finally, the last row of boxes is completed for employees who work in local jurisdictions that tax income. Research your localities to see if this pertains to you.

Filling our the W-4 tax form

The first step for new W-4 employees should be filling out a W-4. You cannot correctly pay employees until the form is complete, and the information is entered into your payroll software or submitted to your payroll provider.

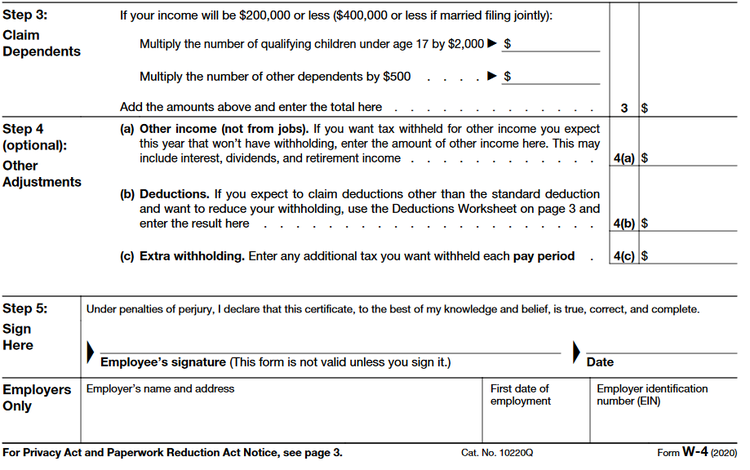

The IRS changed the form last year so you may not be familiar with the current instructions. Let’s take a look at the second half of the W-4 form after the identification information.

If your payroll software updates often, you should be able to simply enter the information directly without any manually calculating. Image source: Author

Step 3 is straightforward and cannot be manipulated. If the employee does not want to decrease withholding based on their dependents they should enter 0 for each. Otherwise, just follow the directions.

Step 4 is where you can get a little creative. If the employee has a side hustle where they are paid as a contractor or if they run a business selling collector edition cat magazines online, they can increase their withholding from the job with you on line a.

On the other hand, if they expect to deduct more than normal on their return this year, they can reduce withholding on line b. This would’ve worked out well for me when I wrote off four figures worth of air conditioner unit purchases for investment properties last year.

You may not want to advise employees to change their withholding. But keep in mind for your personal W-4, any amount that you withhold above what you end up owing in taxes is effectively an interest free loan to the government. If you get a huge tax return it just means you overpaid months ago and haven’t had a chance to plow that money back into your business or use it for important personal expenses.

FAQs

-

The W-4 form does not have an annual deadline. It should be completed by the employee when they are hired before their first paycheck.

The W-2 form is due by January 31 each year. Fines of $50/return start immediately after that date and the fine will eventually increase to $280/return.

My strategy is to wait until the last week of January to complete the form. The software we use makes the process quick and easy and there are inevitably five or six employees who forget until the last minute to let us know that their address has changed. That week is also around when I am finally getting around to preparing all my other business tax reports as well.

-

The W-3 form is used to report the sum of all of the numbers on each individual W-2 form. Use the W-3 form to verify the expense line items in your business tax return.

-

A W-2 employee is one who works for you full-time and is paid to work for you. Contractors, or 1099 employees, are typically paid by project and work for several different companies at once. These employees are paid differently and their income is reported with the 1099 form.

It’s all about the Ws

The government loves its arcane form names. The W-2, W-3, and W-4 are no different -- whatever happened to the W-1? That doesn’t mean the forms themselves are arcane or hard to complete.

Set up a procedure to get W-4s completed as soon as you hire a new employee. Find a good payroll software that lets you print out all W-2s at once. And check all that output with what you’ve learned here, and you’ll be good to go.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.