Is Penetration Pricing the Right Pricing Strategy for Your Business?

Remember Goldilocks and her three bowls of porridge? Through careful testing, she discovered the best bowl of porridge was not too hot, not too cold, but just right.

When setting prices, business owners need to put themselves in a Goldilocks frame of mind. Set prices too high, and you risk pricing customers out of the market. Set them too low, and you’ll struggle to turn a profit. A Goldilocks price, however, satisfies both you and the customer.

Ultimately, you need to hit that sweet spot when it comes to pricing your products. However, landing on the right pricing strategy for your products and business model consists of many factors -- price shouldn’t be the only element you consider.

In this guide, we go through penetration pricing, a pricing strategy to attract customers to a new product or service. We’ll explore its pros and cons, and what scenarios best fit this strategy, to help you decide whether it’s the right choice for your business.

Overview: What is penetration pricing?

Penetration pricing is a market penetration strategy designed to quickly capture a share of the market by entering the market with low prices to increase customer demand. It’s considered the opposite of price skimming, a strategy that involves charging high prices for a new product or service, and then lowering the price over time as the product becomes less relevant or popular.

Penetration pricing is commonly used by companies who launch new products or services into the market. Once customer demand is high, companies then usually raise prices.

This pricing strategy is intended to draw attention and customers away from competitors with higher prices.

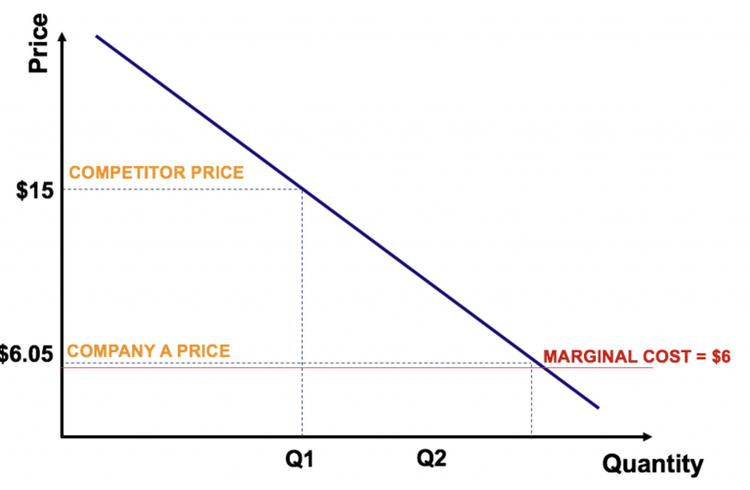

Penetration pricing lowers prices significantly below competitors to capture a share of the market. Image source: Author

An example of penetration pricing

Internet and cable television providers are great examples of companies who use penetration pricing to tempt customers away from their current providers by offering often the same services at much lower prices. They often add ‘extras’ such as free upgrades or heavily discounted bundles to sweeten the deal even more.

For example, Company A, a long-standing internet provider, charges $55 per month for a basic home internet connection.

Company B, a new company, charges $25 per month for a basic home internet connection, plus six months free on a TV bundle package of your choice. Company B’s goal is to draw droves of customers away from Company A, and will likely raise its prices once it’s succeeded.

What are the advantages of penetration pricing?

There’s a reason penetration pricing is so popular with companies introducing new products or services. Below are some of the biggest benefits of penetration pricing.

Fuels customer acquisition

Penetration pricing is a customer acquisition strategy. When a company enters the market with prices far lower than its competitors, customers often flock en masse. This makes it easy to build a large customer base quickly (keeping that customer base is another thing -- we’ll go through that later).

Can build brand loyalty

Customers love a good deal, especially if you deliver above and beyond with the product or service you’re offering. Once you’ve acquired customers, it’s up to you to build great customer experiences to keep those customers on board and loyal to your brand.

Reduces competition

Penetration pricing is often described as an aggressive pricing strategy because competitors cannot compete with such low prices. However, as discussed, price isn’t everything. Once you’ve hooked customers, you need to work out how to keep them loyal, even after you’ve raised your prices.

What are the disadvantages of penetration pricing?

Every pricing strategy has its downsides. Let’s explore some of the main drawbacks of a penetration pricing strategy.

Risk of losing customers

When you use penetration pricing strategies, you risk losing the customers you gained when you raise prices. Customers often expect low prices to be a permanent fixture, and they become disillusioned when they lose out on what they thought was a good deal. If your business model depends heavily on customer retention, penetration pricing is likely not the best fit.

Lack of customer loyalty

Similar to customer retention, penetration pricing becomes risky if building customer loyalty is your goal. Penetration pricing often appeals to savvy, bargain-hunting customers who don’t mind switching companies every so often to take advantage of a good deal.

Unstable long-term strategy

Penetration pricing is not a viable long-term strategy. To succeed, you will eventually need to switch up your pricing structure to one with more market longevity. Though other pricing strategies might not help you accrue customers as fast as penetration pricing might, they’ll likely contribute to a far more sustainable strategy overall.

Should you use penetration pricing for your business?

Sometimes it’s not clear if a certain pricing strategy makes sense for your business, so let’s take a look at the scenarios where penetration pricing makes sense, and when it’s time to consider a different strategy.

When penetration pricing makes sense

Here are a few scenarios where it’s logical to use penetration pricing:

- There are few variations of the product: Penetration pricing can be ideal in markets where there aren’t many significant differentiations in product or service. Think of cell phone providers, grocery stores, and cable and internet services. As the products are more or less the same, price becomes a huge competitive advantage.

- You are running a ‘bait and hook’ business model: Bait and hook refers to companies that sell products dependent on each other for use, thus maximizing profits.

- Example: a coffee machine manufacturer who sells quality coffee machines at low prices and makes most of its profits through highly-priced coffee capsules

- Your business model is subscription-based: Subscription services are a great example of where penetration pricing works well. Businesses capture the majority of their customer base quickly. When raising prices after a given amount of time, they're able to retain customers because they've delivered a great customer experience.

When other pricing strategies are a better option

Let’s consider when other pricing strategies might be a better fit for your business model:

- You have very few direct competitors: This pricing strategy is built on luring customers away from similar businesses. If your product is unique, a different pricing strategy will be more suitable.

- You don’t have sufficient reserve funds: Penetration pricing is often a gamble, where you swap out short-term profits for long-term investments. Low prices are a hook, but you’ll need more than great prices to retain customers, or you’ll be left empty-handed.

- You have a large customer base already: Slashing introductory prices down to the bone while your existing customers are paying double for the same product or service can have the opposite effect and push your existing customers to other companies. Why should they pay over the odds after being a loyal customer?

The price is right...or is it?

Penetration pricing can be a great strategy for launching a new product or service into a saturated market and capturing the lion's share of your competitors’ customer base.

Beyond that, you’ll need to tread carefully. If you’re set on using penetration pricing, make sure you have plans B and C ready to help your business move to the next level once the boom is over. Think of penetration pricing as the first, but not the only, pricing strategy you’ll need to succeed.

There are many other pricing strategies you should consider before deciding which pricing structure suits your business model best, such as economy pricing, keystone pricing, and value pricing -- but definitely not price gouging.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles