How to Qualify and Apply for PPP Forgiveness

If you’re reading this, congratulations: You’ve made it to the point where you need to start thinking about how to get your Paycheck Protection Program (PPP) loan forgiven.

After the tumult that 2020 brought to small businesses, you’d think there’d be a Candyland-like path to getting the government-provided loan off your books. Unfortunately, it’s more like San Francisco’s Lombard Street (think steep hills and sharp turns).

Recent legislation, however, made it easier to apply for forgiveness on PPP loans of $150,000 or less. Here’s the latest.

Overview: What is PPP forgiveness?

When the global economy halted in early 2020 due to the COVID-19 pandemic, the U.S. government stood up the PPP so small businesses could keep the lights on and employees on the payroll.

The Small Business Administration (SBA) deployed PPP loans equal to 2.5 times a company’s allowable monthly payroll costs, up to $10 million. When your business uses PPP funds to cover qualifying expenses, you can apply for forgiveness to essentially turn the PPP loan into a nontaxable grant.

In December, Congress passed another stimulus package that re-ups the PPP, making a few changes in the process. PPP2 loans are limited to $2 million, and some businesses qualify for an additional forgivable loan, called a second draw.

Businesses must meet several criteria for 100% PPP forgiveness. When you use PPP funds on anything except specific allowable business expenses, you’re responsible for repaying some or all of the loan at a 1% interest rate. Check with your lender for more specific PPP repayment terms.

It’s best to talk to a tax professional when applying for SBA PPP loans and forgiveness. The rules are tricky and transient, and you don’t want to be surprised with a bill you didn’t realize you had accepted.

PPP forgiveness requirements

You’re poised for PPP forgiveness when your small business meets the following requirements.

You spent PPP funds in 8 or 24 weeks

You need to account for where and when you spent each dollar in the forgiveness application. The December COVID-19 relief package allows PPP borrowers to choose to have their loan period cover eight or 24 weeks.

PPP recipients are asking themselves: Which is better? Since you don’t have to decide until you apply for forgiveness, run the forgiveness calculation using both periods. Choose whichever results in the higher forgiveness amount.

You met the 60% rule

PPP allows for full forgiveness when at least 60% of the PPP funds go toward eligible payroll costs (it had previously been 75%).

For full forgiveness, the remaining 40% must go toward:

- Additional payroll costs

- Mortgage interest

- Rent

- Utilities

- Personal protective equipment and facility modification to help you comply with COVID-19 federal health and safety guidelines

- Operating expenses for software, cloud computing services, and accounting

- Essential payments to suppliers for your business’s operations

You might not recognize the last three items on the list above; the December stimulus package added them to the list of non-payroll-covered expenses.

Say your business received a $200,000 PPP loan; at least $120,000 must have gone toward eligible payroll costs. Simple enough, right? Wrong. The word “eligible” creates some mess.

If you’re a pass-through business owner, PPP loans are calculated based on your business’s 2019 net profits -- to account for owner compensation -- and average monthly employee payroll costs. The catch is earnings above $100,000 on an annualized basis were reduced to $100,000 for the calculation.

Say that one of your employees earns $125,000 annually. You could only count 80% of her wages toward the 60% payroll cost requirement ($100,000 limit ÷ $125,000 salary = 80% of total wages eligible for forgiveness).

Businesses that don’t pass the 60% rule can still apply for partial forgiveness. If you spend just $100,000 on payroll costs using the $200,000 PPP loan, the maximum forgiveness becomes $166,667 ($200,000 total loan ✕ [$100,000 used on payroll ÷ $120,000 allocated for payroll]).

You kept employees on the payroll

Legislators implemented the PPP to keep people employed during the pandemic. You need to bring your employee headcount back to pre-pandemic levels to receive full loan forgiveness.

The SBA calculates employee headcount using full-time equivalents (FTE), where a person who works 40 or more hours per week counts as one FTE. Someone who works 10 hours per week is 0.25 FTE (10 hours worked ÷ 40-hour workweek). Or you can opt for the SBA’s simplified FTE method by counting any part-time employee, regardless of hours worked, at 0.5 FTE.

Compare your FTE during the loan period to the average FTE during one of the following periods. If your FTE is the same as or higher than one of the periods below, you qualify for full payroll forgiveness:

- Feb. 15, 2019, to June 30, 2019

- Jan. 1, 2020, to Feb. 29, 2020

Your loan forgiveness drops when you don’t bring your FTE back to its pre-pandemic levels. For example, if you only rehire three of your four employees, your maximum forgiveness becomes 75% of the total loan amount.

You might qualify for full forgiveness if:

- Safety requirements prevent you from returning to pre-pandemic operating levels.

- Your headcount declines because of employees who are justifiably fired or voluntarily resign.

The SBA also cuts slack on rehiring employees:

- You have until Dec. 31 to rehire employees laid off between Feb. 15 and April 26 due to the pandemic.

- Employees who formally reject your written re-employment offer at the same pay and hours don’t count as staff reductions.

- Your headcount isn’t affected by employees who ask for and are granted a reduction in working hours.

You didn’t reduce salaries and wages by more than 25%

For full forgiveness, employee salary and wages can’t fall below 75% of what they were when applying for the PPP. Any further reduction lowers the forgiveness amount. The wage reduction rule applies to employees whose annualized salaries are less than $100,000.

Say you were paying an employee $5,000 per month when you applied for the PPP loan. Financial circumstances led you to reduce his pay to $3,500 per month, a 30% decrease. The maximum wage reduction without penalty is 25%, which would’ve left him with $3,750 monthly.

Your forgiveness amount is reduced by $250 multiplied by your PPP loan period. If your PPP period is 24 weeks, the forgiveness amount is reduced by $1,500 ($250 additional monthly reduction ✕ 6-month PPP period).

How PPP forgiveness guidelines work

Here’s what you have to look forward to once you’re ready to apply for forgiveness.

1. Gather accounting records

For loans above $150,000, the PPP forgiveness application will ask for the following documents:

- Payroll reports for the loan period

- Quarterly federal tax return Form 941

- Utility, rent, and mortgage proof of payment (bank statements or receipts)

- Photo identification (passport or ID)

- Form 1040 Schedule C for sole proprietors

You’ll also need the following information:

- SBA loan number, listed on your loan promissory note

- Employer identification number (EIN)

Thanks to a simplified forgiveness application for smaller loans, those with loans of $150,000 or less won’t submit all these documents. However, you’re still required to retain employment records for four years and other related documents for three years.

Having updated accounting records is crucial to a smooth PPP forgiveness process. Should the SBA or your lender inquire about the use of PPP funds, you’ll want your records in order.

2. Submit a forgiveness application to your lender

Apply for forgiveness through your loan provider. Wherever you got the PPP loan -- either a traditional bank, payroll provider, or online service like PayPal -- you need to return there to apply for forgiveness. If you still have a balance on your PPP loan, you’ll start making payments starting 10 months after the loan period.

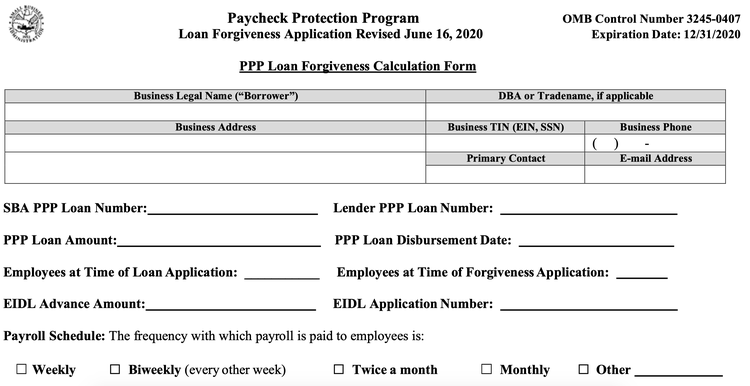

The December stimulus package created a simplified path for forgiveness for PPP loans of $150,000 or less. Image source: Author

The late December stimulus package, signed by President Donald Trump, streamlines the forgiveness process for loans of $150,000 or less. Rather than filling out a pages-long application with dozens of attached records, you’ll fill out a one-page form certifying your loan amount, employee headcount retention, and estimated amount spent on payroll costs.

Borrowers with smaller loans should still consider filling out the longer forgiveness application to ensure they qualify for full forgiveness. Though the one-page application is simpler, you’re still required to meet the forgiveness rules.

You have 10 months from the end of the loan period to apply for forgiveness. If you wait too long, loan payments will start coming due at a 1% interest rate.

3. Wait for your lender’s decision

Within 60 days, your lender will decide on the forgiveness amount. You might get full, partial, or no forgiveness. Whatever the decision, it goes directly to the SBA, requiring no action on your part.

You’ll be notified of the loan forgiveness amount as your case moves to the SBA. If you don’t like the answer -- maybe you only got partial forgiveness when you expected 100% -- you have 30 days from receiving your lender’s decision to request the SBA review your case again.

The SBA will render its own final decision within 90 days. They might reach out and ask for additional information.

The SBA’s final decision is, well, final. If you want to appeal your lender’s PPP forgiveness decision, talk to a CPA for guidance.

4. Begin repaying your loan

If there’s a balance left, PPP loan repayment starts 10 months after the loan period. You were done in the last step if your lender and the SBA decided to forgive the entire loan.

Best practices when applying for PPP loan forgiveness

PPP forgiveness rules have changed a few times in the past nine months, so my best advice is to wait for lenders and the SBA to catch up with the newest legislation before applying for forgiveness.

For smaller loans, wait to apply for forgiveness

A shorter forgiveness application is on the way for most PPP loans. If you received a PPP loan for $150,000 or less, wait until your lender and the SBA are ready to accept your application.

The December stimulus package also repealed a deduction to reduce a company’s PPP loan forgiveness amount by the amount of its EIDL Advance grant, which provided struggling businesses up to $10,000 in grant funding. The SBA has yet to update its applications, so you’ll need to wait until the application reflects that change.

Those applying for other small business loans might not have the luxury of time. If you need to clear the PPP debt from your books, go ahead and apply for forgiveness. You could be waiting weeks before lenders update loan forgiveness procedures.

Consult a professional

If there’s any year to hire a tax professional, it’s this year.

The PPP is a loan program, meaning you promised to repay a given amount unless you meet specific conditions. Making a small mistake on your forgiveness application can lead to owing thousands back to the government.

Though you can patch up any small error you let slip through, it’s best to get your application done correctly the first time. For that, you’ll at least want a tax professional to look over your application before submitting it.

Stay informed

The PPP rules have changed a few times since the program launched in March. It’s important to keep up with the latest PPP loan guidance to ensure you’re maximizing your forgiveness amount and small business tax deductions.

For example, the December COVID-19 stimulus package added new forgivable expenses to its list of non-payroll costs, potentially increasing your forgiveness amount.

The relief bill further clarified Congress’s stance on deducting expenses covered by PPP funds. Directly refuting the IRS’s and Treasury Department's guidance, legislators say you may fully deduct any business expense you paid with a PPP loan. In other words, deductions are business as usual for the 2020 tax year.

Forgive the chaos

Tax experts, tax software companies, and small business owners might be feeling whiplash with all of the PPP rule changes. Stay up to date on all the PPP forgiveness news here at The Ascent.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles