In accounting, pro forma refers to financial reports based on assumptions and hypothetical situations, not reality. Businesses use pro forma financial documents internally to aid in decision-making and externally to showcase the effect of business decisions.

Before acquiring another business, investing in new equipment, or taking on new debt, businesses draft forward-looking pro forma financial statements to understand the effect. Unlike traditional financial statements that explain the past, pro forma documents usually look forward and rely on financial modeling and speculation.

Pro forma statements take on a slightly new meaning with public companies. After a major acquisition, a public company must prepare a secondary balance sheet and income statement as if the purchase occurred at the beginning of the year. We put the “pro forma” label on these financial documents because there’s a lot of “what if” involved in their making.

“What if” doesn’t jibe with Generally Accepted Accounting Principles (GAAP). Straying even further from GAAP, pro forma financials exclude unusual one-time expenses, such as restructuring costs. Critics say pro forma financial statements are ploys to excite investors about the benefits of a business combination, what finance nerds call “synergies.”

The Securities and Exchange Commission (SEC) consistently updates its stringent rules on preparing pro forma statements for the public. Still, pro forma financials are not regulated to the same extent as historical financial statements.

3 types of pro forma statements

Small business owners can use pro forma statements to draft forecasted financial statements, budgets, and quotes.

1. Forecasted financial statements

Small business owners draft pro forma financial statements to quantify the impact of potential business decisions, such as taking out a loan to grow your business. Pro forma financial statements give you and your team something to consider before signing on the dotted line.

The most common pro forma financial statements are projected balance sheets, income statements, and cash flow statements. Together, the documents help you assess whether your business’s financial health improves, declines, or remains the same following the decision.

Say you’re a business owner contemplating a loan to invest in more efficient equipment. Your current equipment still works, but the cutting edge technology in newer machines can speed up production by 20%. You’re not sure what to do.

Guide your decision-making by creating two sets of forecasted financial statements: the first to project next year’s net income if you take out the loan, the second if you don’t.

If you take out the loan, you might share the pro forma financial statements with the lender to demonstrate your ability to repay the loan. Businesses also use pro forma financial statements to prod investors to provide capital.

Since we can’t predict the future, don’t rely solely on pro forma financial statements. Your assumptions could wind up wrong, throwing off your financial projections.

2. Budgets

Businesses create annual budgets that fall in line with a company’s profitability and production goals.

Budgets and projected financials are similar in that they both factor in assumptions and scenarios that remain to be seen. Where they differ: Budgets are managerial accounting documents, meaning they’re meant to guide business decisions and aren’t to be shared publicly. Budgets provide more detail than you’d care to share with a lender, and they’re more nearsighted, usually focusing one year ahead.

3. Pro forma invoices

The best way to package a quote for your goods and services is by using a pro forma invoice, also called a draft invoice.

Before delivering an actual invoice, send a client a pro forma invoice that lists the cost of the goods and services you’re planning to provide. A pro forma invoice isn’t binding; it’s a way to make sure you and the client are on the same page before agreeing to the transaction. The transparency could score you points for customer satisfaction.

Your accounting software can make pro forma invoices.

An example of pro forma

Russell operates a life coaching business. Word has gotten around that Russell is the absolute best, and he has more prospective clients lined up than he has time to take on. Russell is considering hiring an assistant to lighten his administrative workload, but he’s unsure whether he can afford to pay someone full time. His options are:

- Not hiring an assistant

- Hiring a part-time assistant

- Hiring a full-time assistant

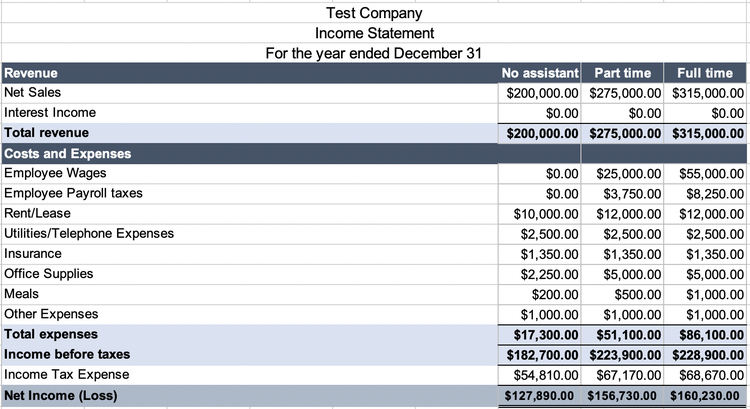

Russell creates a pro forma income statement for next year to inform his decision. He dedicates a column for each scenario he’s considering. Russell follows The Ascent’s guide to forecasted financial statements to generate the document.

Create multiple pro forma documents to play out different scenarios. Image source: Author

According to Russell’s projections, he reaches the highest earnings when he hires a full-time administrative assistant. More significantly, the pro forma income statement reveals that hiring a part-time assistant is nearly as lucrative as bringing someone on full-time.

I’d advise Russel to hire a part-time assistant to reduce the risk of sinking nearly $60,000 into a new position when he’s not sure he’ll see the increased revenue he’s expecting. He can always offer the person a full-time job after his projection actualizes.

FAQs

-

Not all pro forma documents are made equal. Pro forma financials have their place, but some public companies have taken advantage of loose rules to mislead potential investors.

For small, private companies, pro forma financials can help you see the long-term impact of decisions you’re considering today. Nobody is dissing the use of pro forma reports here.

The dot-com bubble, where tech companies enjoyed bloated market valuations before losing it all, proved the harm of pro forma financials. In the early 2000s, Yahoo caught heat after years of releasing pro forma financial statements that downplayed hefty one-time costs from business acquisitions.

Public companies release pro forma financials under the guise of clarifying their financial position after a business acquisition. They take out one-time or unusual costs to offer a fuller picture of the business’s operating profit. To some, pro forma financials feel like companies are creating their own financial accounting rules to engineer appealing financial results.

Since the dot-com bubble burst, the SEC has cracked down on using pro forma financials to protect the public from being misled.

-

Before extending capital or credit, investors and lenders might ask for pro forma statements to understand your outlook on company performance. For new businesses with no historical financial statements, lenders look at pro forma statements for a realistic vision of your company’s future.

-

After you create pro forma financial statements to inform a business decision, run a pro forma analysis to assess your company’s profitability.

Say you own a small restaurant, and you’re considering extending your business hours and hiring a new waiter. You drafted a balance sheet, income statement, and cash flow statement for next year, assuming increased utility, wages, and food expenses.

Analyze the results using profitability metrics. If the measures point to increased profitability, you might have hit on a winning opportunity for your restaurant.

It’s not called “amateur forma” for a reason

Building accurate pro forma financials requires an in-depth financial analysis of your present business. When creating pro forma financial statements, ask an accountant to provide additional guidance.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.