Every business knows the importance of recurring revenue, but what about the importance of recurring payments?

Though the concept of recurring payments is straightforward, small businesses often don’t think of them as a viable payment method, often because of concerns about how to implement them and how their customers might respond to them.

Recurring payments aren’t suitable for every business, but if you’re already using a POS system to accept credit card payments and are thinking about ways to diversify revenue streams, then recurring payments may be a powerful strategy for your business.

Read on to learn about the benefits of recurring payments and how to manage them for your small business.

Overview: What are recurring payments?

Recurring payments, also known as recurring billing, enable merchants to charge a customer’s credit card on a predetermined and periodic basis. Instead of manually charging a customer for goods or services each time, automated payments are made on an agreed schedule.

Monthly recurring payments are amongst the most common, but recurring payments schedules can be created according to the needs of both the customer and the business.

Recurring payments are offered as fixed payments or variable payments. Fixed recurring payments are suitable for subscription billing, such as gym memberships or digital subscriptions like Netflix, and the customer is charged a set amount each time.

Variable recurring payments enable the merchant to charge a different amount from payment to payment, and they're commonly associated with usage-based services, such as utilities.

To enable recurring credit or debit card payments, businesses must obtain permission from the customer or cardholder to collect recurring funds. Your payment service provider will charge a fee for the setup and processing of recurring payments.

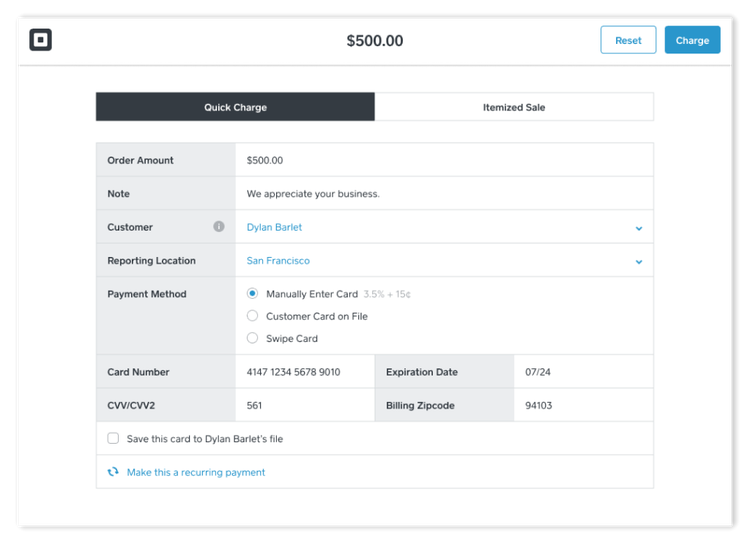

Square allows you to choose recurring payment amounts, payment intervals, and when the recurring payment series should expire. Image source: Author

Recurring payments don’t suit every business. Those offering subscription services (such as food boxes, magazines, and software) and membership services (such as gyms, clubs, and associations) are most likely to benefit from implementing recurring payments.

Benefits small businesses get by setting recurring payments

There’s a reason recurring payments have become so popular among businesses that manage subscriptions: They offer a host of benefits for both customers and businesses. Here are the three biggest benefits of recurring payments.

1. Improved cash flow

Recurring payments are automated (usually via an ACH provider) and approved by the customer, meaning you’ll have a steady source of cash coming into the business each month, week, or year, depending on your set payment intervals.

You’ll also be able to plan better, as you can accurately predict baseline revenue within a specific time frame based on the recurring payments you’re due to receive.

2. Reduced billing admin

Instead of reconciling the books each month, automatic payments free up time that merchants usually spend creating invoices and processing payments to focus on other areas of the business.

Once you’ve set up the payment amount and frequency and entered the customer’s card details, you’ll only need to check on recurring payments if you need to make a change to any of these details.

Recurring payments also reduce the need to chase late or non-payments, saving merchants valuable time in following up with customers.

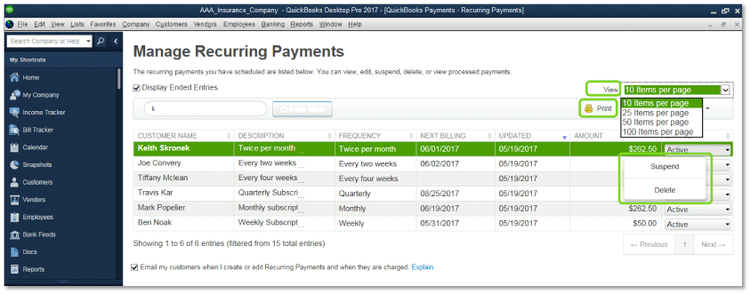

QuickBooks allows you to quickly modify recurring payment information within one page. Image source: Author

3. Enhanced customer experience

The “set it and forget it” approach means customers don’t need to ensure that they’ve paid their bills on time.

As customers only need to provide their payment details once, while the business handles setting up the payment schedule, customers can relax knowing they don’t need to set reminders to pay outstanding bills, or provide their payment details over and over again.

How to manage recurring payments within your small business

To take advantage of the benefits of recurring payments, you’ll first need to decide whether they’re right for your business, and then get your business ready to accept them. Consider these items to make the process of managing recurring payments easier:

Consider other kinds of payments you want to process

Depending on your business, you’ll need to consider whether you want to only process recurring payments or one-time payments, too.

For example, if your business is based on selling subscription boxes (think Dollar Shave Club), you might think you only need to process recurring payments. However, even if your business is based on a subscription model selling subscription boxes, you may also want to offer customers the chance to buy one-off boxes.

When thinking about what system you want to invest in to manage recurring payments, make sure you’re considering each type of payment method you’ll need to process.

Consider recurring payment processing fees

Each payment provider will charge a fee to process recurring payments, which are usually a percentage of the value of each transaction, while others set a flat credit card processing fee and add on monthly fees.

For example, Square charges 3.15% plus $0.15 per recurring payment charge, while PaySimple charges $59.95 in monthly fees for recurring payments, but offers lower fees starting at 2.49% per recurring transaction.

You’ll need to decide which pricing structure suits your business model.

Consider how to optimize your billing processes

Recurring payments are great for automation, but some systems don’t offer features that notify you when customer cards have been cancelled or have expired.

This results in a disappointing customer experience when customers don’t receive their goods or services, and it could even lead to customer churn. When searching for a system that can process recurring payments, make sure this feature and any others you deem important are included.

Consider allowing customers choose their own payment schedules

Often, merchants set payment schedules that work best for them. However, allowing customers to choose when they’re charged can encourage customer loyalty. If a monthly plan doesn’t work for a potential customer, and you can’t be flexible, you’re likely to lose them to a competitor.

Recurring payments can be a game changer

Automated, recurring payments are convenient for customers and businesses alike. Not only do they ensure a reliable revenue for merchants, but they free up time spent issuing invoices and manually settling outstanding bills.

The majority of retail-only based businesses won’t need recurring payments, while those relying on a subscription model will likely need a recurring payments service in order to survive.

If you’re set on introducing recurring payments into your business, make sure you’re aware of what monthly fee you can expect to pay and that it includes all the features you need to manage your business.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.