Part of the accounting cycle, bookkeeping is the act of tracking, managing, and recording all financial transactions for your business.

If the thought of bookkeeping is frightening, rest assured, there are a variety of small business accounting software applications on the market today that make the process easy, even if you’ve never recorded a financial transaction before.

Overview: What is bookkeeping?

Bookkeeping is the proper recording of all financial transactions for your business. Bookkeeping involves a lot of attention to detail; everything from properly identifying and coding invoices, purchase orders, and vendor bills, to ensuring that bills are paid promptly.

While many small businesses use accounting software to handle the accounting basics, others continue to rely on spreadsheets to track their income and expenses.

What is a bookkeeper responsible for?

Bookkeepers are responsible for accurately recording all financial transactions for a business.

While the specific duties of a bookkeeper can vary widely depending on the specific needs of the business, they can include the following:

- Categorize financial transactions

- Enter and pay vendor bills in a timely fashion

- Write invoices for clients/customers for goods or services provided

- Record client/customer payments to the appropriate account

- Review employee expense reports

- Maintain a petty cash fund

- Enter journal entries as needed

- Reconcile all bank accounts monthly

- Make any month-end adjusting entries

- Prepare financial projections

- Assist with preparing a business budget

- Prepare financial statements

Why your small business needs bookkeeping

It’s next to impossible to manage your business properly without bookkeeping.

Imagine trying to run your business without knowing how much you’re spending on expenses each month, or not knowing how much money your customers owe you. Imagine not accounting for those expenses properly and then trying to prepare your tax return the following year.

Finally, imagine approaching your financial institution for a loan or a credit line without having the proper documentation that shows exactly how your business is performing.

You need to know how much money you have

Once you start a business, you become responsible for a lot of things.

As a business owner, you need to know how much money your customers owe you and how much has been received. You also need to know how much money you need to spend in order to keep your business running smoothly.

Unexpected customer payments can severely deplete your expected cash flow, while a late payment may jeopardize your credit standing with a vendor.

Accurate and timely tax payments

We all have to pay taxes, and to avoid penalties, interest, and other collection activities by the IRS and other tax agencies, you’ll want to pay them on time, and you’ll want to pay them accurately.

Having a solid bookkeeping process in place will allow you to do just that, while also tracking all of your business expense deductions, a necessity in case your business is ever audited.

Potential business growth

If your plans are to grow your business, you need a good bookkeeping system in place.

Not only does bookkeeping help you manage your transactions properly, it also provides the information needed to obtain additional financing for your business.

Banks, investors, and even your brother-in-law will want to see how your business has performed in the last year before they agree to lend you money. If you can’t provide this information, it will be difficult, if not impossible, to obtain any outside funding.

Accurate budgeting

Creating a budget is one of the most important things a small business owner can do. But in order to create a budget that is accurate, you’ll need to be able to access the information such as accounts receivable totals, vendor payments, and cash flow.

How will you know you need to reduce expenses if you don’t know what those expenses are? Bookkeeping provides you with that information.

How to bookkeep for your small business

If you’re a sole proprietor or freelancer, chances are you get by with a manual journal or spreadsheet software to record your financial activity. But even a freelancer could benefit from using accounting software to record their financial transactions.

If you’re ready to get started, there are a few things you’ll need to do.

1. Decide between Single entry vs. double-entry accounting

You're likely wondering whether single or double-entry accounting is better for your business?

Single entry accounting is much like it sounds. You record a single entry in a journal or spreadsheet in the same manner used to record a check-in your checkbook. This is what a single entry would look like in your journal.

| Date | Paid to | Amount |

|---|---|---|

| 1-15-2020 | Nevada Power - Utilities | 175.00 |

Double-entry accounting uses a debit and a credit when making an entry. The same payment to Nevada Power would look like this using double-entry accounting.

| Date | Account | Debit | Credit |

|---|---|---|---|

| 1-15-2020 | Utilities | 175.00 | |

| Cash | 175.00 |

Using double-entry accounting helps you better track your business income and expenses, which is important for tax purposes, as well as for preparing budgets and financial statements.

Keep in mind that the IRS frowns on mid-year changes, so when you make your decision, be prepared to stick with it for at least a year.

Pro tip: Before you commit to single-entry accounting, try out some small business accounting software and see for yourself how easy double-entry accounting can be.

2. Decide between cash or accrual accounting

Like single vs. double-entry accounting, you must decide whether you want to use cash or accrual accounting prior to beginning the bookkeeping process.

Cash accounting records a transaction when money is exchanged. In other words, the expense for the electric bill is recorded when the bill is paid; not when it’s received.

Accrual accounting would record the expense upon receiving the bill. Again, very small businesses may be able to use cash accounting, but accrual accounting allows you to account for expenses in the proper month, rather than when they’re received or paid.

Pro tip: If you already have an employee or plan to hire employees in the future, you will need to use accrual accounting.

3. Learn about the basic accounts

There are three basic accounts that you will use for all of your bookkeeping transactions.

- Assets: Assets are anything of value that you own, such as your cash accounts, your accounts receivable, your building, your intangible assets, or your inventory.

- Liabilities: Liabilities are what you owe, such as your accounts payable, loans, and mortgages.

- Equity: Equity is the ownership of the business, whether that is only you as the business owner or any investors or partners you may have.

Pro tip: If you’re using accounting software, consider using the default chart of accounts included with the application, which includes asset, liability, and equity accounts.

4. Start entering your transactions correctly

Instead of tossing that receipt on your desk for later, it’s time to start accounting for it properly.

Just finished a job for someone? Write an invoice and send it to your customer. Just received an electric bill?

Instead of putting it aside to pay later, enter it into your accounts payable to be paid by the due date. Any financial transaction, no matter how small, should be recorded in the proper fashion.

Pro tip: Review and approve financial transactions when received, and post them accordingly. Many small business owners choose a day of the week when they will process their accounts payable or record customer payments.

5. Reconcile your bank accounts

If you have your bank accounts linked to your accounting software, reconciliation is a quick and easy process.

If not, you likely can still import your bank statement into your accounting software to simplify the reconciliation process. Otherwise, you’ll need to wait until you receive your bank statement in order to reconcile.

Either way, it needs to be done on a regular basis in order to ensure that your ending bank statement matches your general ledger cash balance.

Pro tip: If you’re using accounting software, consider linking it to your bank accounts. The process is just as secure as online banking and allows you to easily record income and expenses promptly. Additionally, it does much of the month-end reconciliation process for you.

6. Run your financial statements

Granted, this process will not be easy if you’re not using accounting software, but in order to know how your business is performing, you must have an accurate depiction of that performance. Financial statements do just that.

The three main financial statements that should be run at month’s end include:

- Balance sheet: A balance sheet shows the assets, liabilities, and equity of your business on a particular date.

- Income statement: Of particular importance if you’re trying to obtain outside financials or investors, an income statement displays the net income of your business over a specified period of time.

- Cash-flow statement: Cash flow statements are designed to provide you with details regarding your business cash flow, displaying both incoming and outgoing cash totals for a specific period of time.

Pro tip: For more accurate financial statements, accounting software is the way to go.

The best bookkeeping software for small businesses

If you’re still not sure how to track business expenses using a spreadsheet application, accounting software may be the answer. Accounting software is designed to make it easy for small businesses to handle bookkeeping and accounting tasks.

Be sure to check out our accounting software reviews to determine which application may be right for your business, but here are a few options to get you started.

Wave Accounting

Perfect for sole proprietors and freelancers, Wave Accounting offers a variety of bookkeeping features, such as sales, purchases, banking, and reporting options.

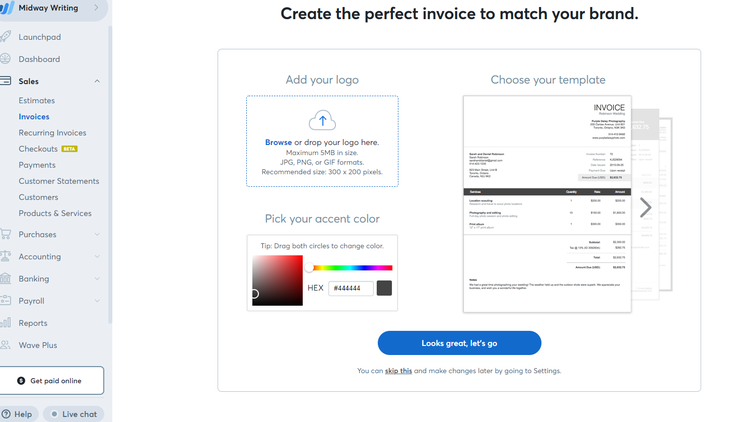

Wave Accounting offers invoice customization capability. Image source: Author

The Sales feature makes it easy to prepare a custom invoice for your clients, with the ability to accept online payments.

You can also track vendor bills and payments in Wave, as well as track business expenses by simply snapping a photo of a receipt with your smartphone.

For easy bank reconciliation, link your financial institutes with Wave for good expense tracking and month-end reconciliation.

Kashoo

Designed for small businesses, Kashoo features an all-inclusive pricing structure, and you can add additional users to Kashoo at no additional cost.

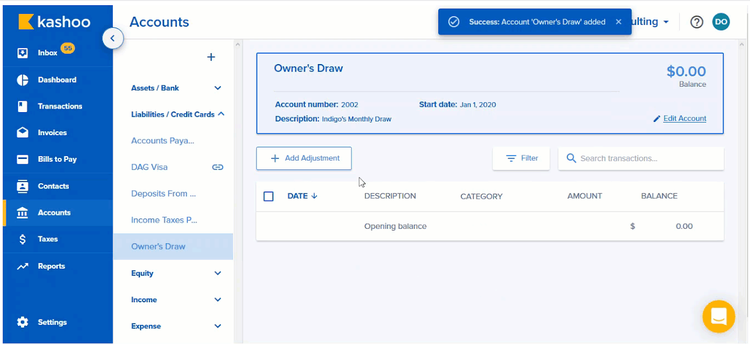

Kashoo’s updated Accounts feature lets you add new accounts at any time. Image source: Author

Just released in the spring of 2020, Kashoo 2.0 includes a completely updated user interface that looks sparkling new. Although different in appearance, Kashoo 2.0 still includes the same features but with some new ones added, including bill payment, contacts, accounts, and taxes.

A new addition to Kashoo 2.0 is the Inbox, which serves as a central repository for viewing current bank transactions that have been imported from your connected bank accounts, providing you with a quick view of all transactions. If you don’t connect any bank accounts, the Inbox will remain empty.

Sage Business Cloud Accounting

A good option for sole proprietors, freelancers, and consultants, Sage Business Cloud Accounting includes some great bookkeeping features, such as sales, expenses, contacts, and banking.

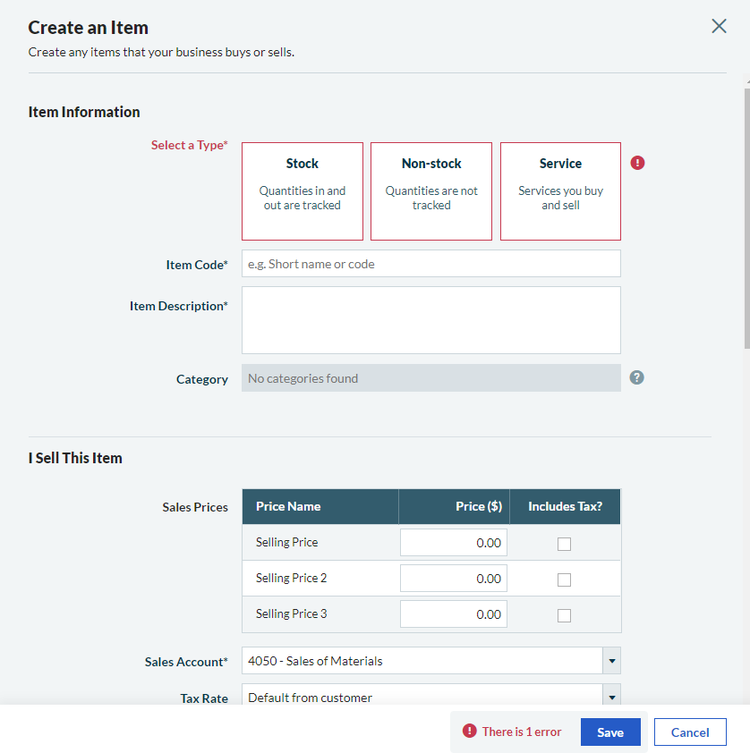

The application also includes a decent inventory management system, making it a good option for those who sell products, particularly online sellers.

The Create an Item option lets you manage your inventory and services properly. Image source: Author

Along with invoicing, Sage Business Cloud Accounting allows you to create quotes and estimates, add credit notes to any customer account, and even post a batch of quick entries.

You can connect the application with your bank accounts, and Sage Business Cloud Accounting also offers vendor bill management and good financial reporting.

Bookkeeping doesn’t have to be difficult

Bookkeeping for beginners can be confusing. However, most online accounting software applications have made it easy to handle all of the bookkeeping basics your business will need.

If you’re still unsure about how to do bookkeeping, you can choose to outsource your bookkeeping to a bookkeeping service.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.