Tax Forms for Sole Proprietors

As a sole proprietor, you have to wear a lot of hats. When you’re not marketing for new customers, you’re counting inventory or cleaning the shop floor. It doesn’t leave a lot of time to keep track of all the information you need for taxes and where that information goes.

There are at least 10 different IRS forms you'll need to fill out at some point during the year. Even if you’ve filed each one for the last 10 years, it can be hard to remember which one has to be filled out when and where to find the most recent version from the IRS.

Read this article, and save it, to know exactly what you need to do for sole proprietor taxation.

Overview: What is sole proprietorship taxation?

A sole proprietor is an entrepreneur who owns a business personally and has not incorporated the business. Typically, startups and side businesses are sole proprietorships.

Once your business reaches a certain size, it should be converted to an S corporation or C corporation. These business entity types allow for shares to be sold to outside owners and can reduce business taxes as the corporate tax rate is likely lower than what your personal marginal rate would be at that point.

A sole proprietor does not file a business tax return; instead taxes are reported on the personal income return of the owner.

How are sole proprietorships taxed?

Sole proprietorship taxes come in a variety of forms. Income is reported on Schedule C, which is part of the individual tax return Form 1040. This is where you will input a traditional income statement.

During the year, sole proprietors are required to report estimated taxes to the IRS each quarter. Estimated taxes are due on any income that is not subject to withholding. A sole proprietorship business must also pay self-employment taxes, which are Social Security and Medicare.

Finally, sole proprietors are also required to report any other business taxes, such as sales tax, FICA, FUTA, and SUTA.

Sole proprietorship taxes for LLCs

A limited liability company (LLC) is a structure used to limit the liability of owners. With an LLC, an owner (usually referred to as a member on legal documents) is not personally liable for the liabilities of the business.

The member can still separately guarantee loans or other liabilities, and many financial institutions will require them to do so.

When you register an LLC for your business, it will automatically be either a sole proprietorship if you're the sole owner, or a general partnership if there are multiple owners.

General partnerships file a business tax return, and the income passes through to the owners’ tax returns. LLCs in the form of a sole proprietorship file on the owner’s personal tax return.

LLCs with one member are called single-member LLCs and are treated as disregarded entities because the LLC does not file its own tax return.

What tax forms to use as a sole proprietorship?

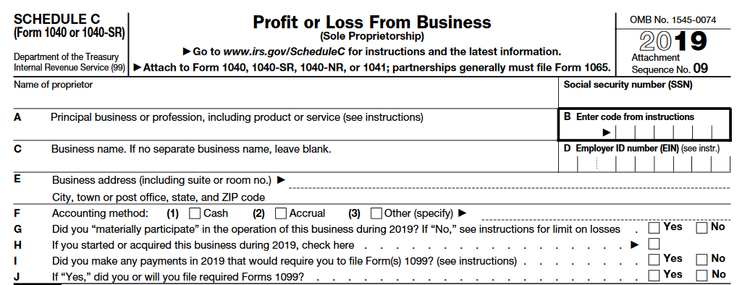

The main form is Schedule C, on IRS Form 1040. You can find Form 1040 instructions here and the instructions for Schedule C here. Let’s work through the main parts of Schedule C.

IRS Schedule C is reported as part of Form 1040. Image source: Author

Start by filling in the name of the proprietor, or owner, and the business name. Next are the North American Industry Classification System (NAICS) code, which you can find here, and the business’s employer ID number (EIN). If you do not have any employees or contractors you may not need an EIN.

On line F, check Cash if you report income when it’s paid, and Accrual if you report income when it's earned.

Line G differentiates passive and active owners; if you actively run the business and are not an investor, check Yes (if you’re not sure, you can find the test for line G in the instructions linked above).

Check Yes on line I if you have employed independent contractors during the tax year who will be paid with Form 1099.

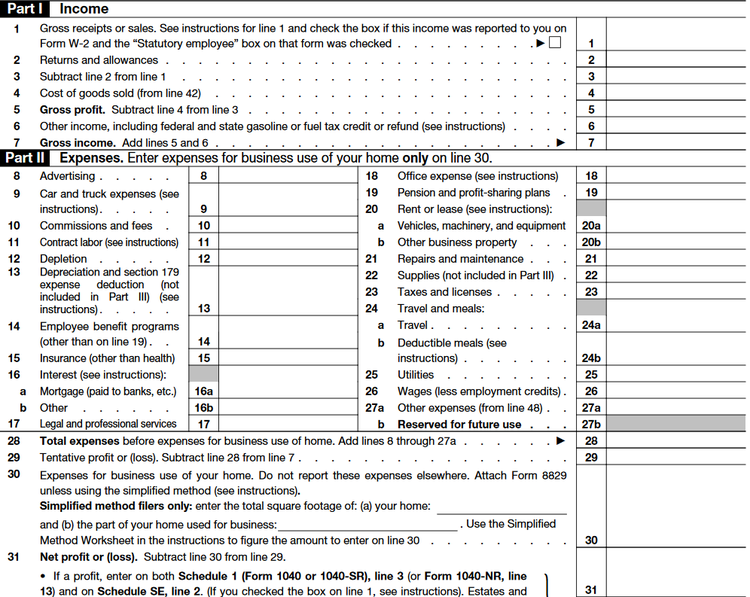

Business income and expenses is entered in this section of the IRS Schedule C. Image source: Author

This is the meat of the form, where you will enter Schedule C income and any small business tax deductions. Your tax software should make this section easier than it looks.

As long as you keep your income statement up to date and calculate tax shields like depreciation at the end of the year, you should be able to simply import your deductions into the form directly.

Be careful with the section on business use of your home. Use Form 8829 to calculate the deduction. You can only use an area that is set aside for business use and nothing else, and the IRS loves to audit this section.

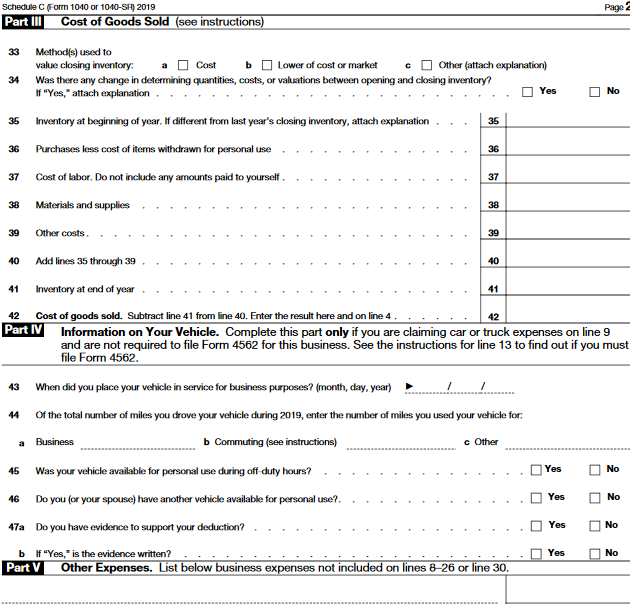

The second page of Schedule C is where you will break out how expenses are calculated. Image source: Author

The second page starts with the cost of goods sold calculation. Most small businesses use the FIFO method; if you change your method, attach an explanation. The number on line 42 reports up to line 4 on the first page.

Like the business use of your home section, be careful with reporting vehicle expenses. If possible, set aside a vehicle for business purposes only. If there isn’t a budget for that, keep close track of the miles used for the business; taking pictures of the odometer is the best way to do this.

The final section is where you will break down all expenses that don’t fit into one of the expense categories on page 1.

Here are the other forms to bookmark:

- Schedule SE for self-employment tax. This tax is your personal Social Security and Medicare contributions. The rate is a combined 15.3% for the first $132,900 of earnings and 2.9% for Medicare only after that.

- 1040-ES for estimated tax. Each quarter, calculate your expected earnings for the year, and pay tax on a quarter of that number. When it is time to file annual taxes, you will either owe more or get a refund. If you do not pay estimated taxes quarterly, the IRS may fine you and charge interest.

- Form 941 for employer’s quarterly filing of FICA and withholding taxes, or Form 944 to file yearly if your annual liability is $1,000 or less. This is the employee and employer portion of Medicare and Social Security.

- Form 940 for annual federal unemployment taxes (FUTA). There will also be a state form for state unemployment taxes (SUTA); look on your state’s secretary of state website for the form.

- Form W-3 to report the sum of all W-2’s. Form W-3 is not required if you submit W-2s online.

- Form 1099 for contract employees and subcontractors. One copy goes to the IRS and one to the contractor.

- Various excise taxes may also apply.

Get started on your sole proprietorship taxes

It can seem impossible to keep track of all the government forms you need to file small business taxes. Staying organized is the best way to minimize DTSD (Doing Taxes Stress Disorder). Make it easy on yourself and bookmark this page for future reference.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles