TaxAct Self-Employed Online is designed for small business owners, freelancers, sole proprietors, and consultants. TaxAct Self-Employed Online guarantees the maximum tax benefit for its users and also offers audit protection.

While TaxAct Self-Employed can be used by those doing their own tax return for the first time, the product is better suited to those that are familiar with the online tax-filing process.

TaxAct Self-Employed includes step-by-step guidance throughout the process, with an option to jump directly to the forms you need to access. Find out if it's right for you with our full TaxAct Self-Employed Online review.

TaxAct Self-Employed

Best for: Competitive pricing

TaxAct Self-Employed is designed for sole proprietors, self-employed, freelancers, and independent contractors. Along with filing your tax return, TaxAct Self-Employed Online also offers year-round tax support and planning resources. TaxAct offers an All-Inclusive Bundle Value deal, which is a collection of select products and services that can be over 50% off the price of each individually.

- Easy-to-use interface

- Affordably priced and offers bundled package

- Includes excellent help and support

- Data entry screens can be loaded down with text

- No full-service option

Alternatives to consider

- If wanting the support of a branch network: H&R Block Self-Employed

- If wanting one of the most competitively-priced options: TaxSlayer Self-Employed

Federal: Starts at $115 | State: Starts at $49

Federal: $64.95 | State: $39.95

TaxAct Self-Employed Online's features

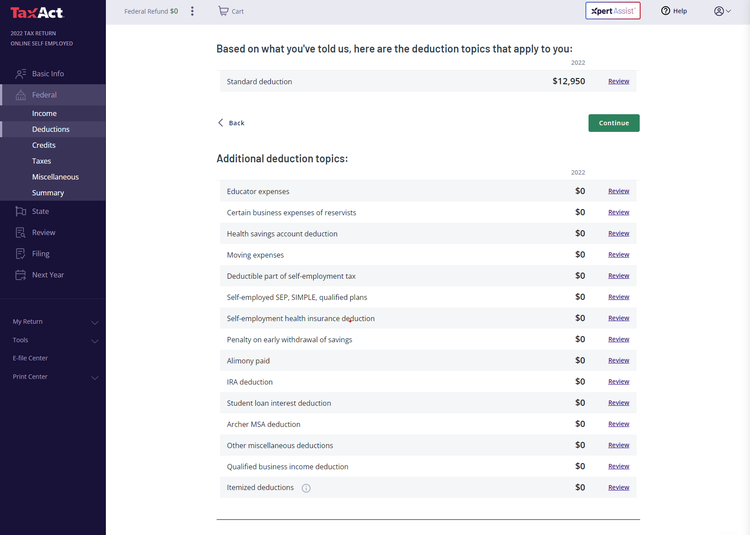

TaxAct Self-Employed offers a long list of features, including a maximum refund guarantee, as well as a deduction maximizer to ensure that you're taking advantage of all available deductions. TaxAct Self-Employed lets you enter all relevant freelance income along with any other business or farm income. You can also calculate depreciation totals using the application.

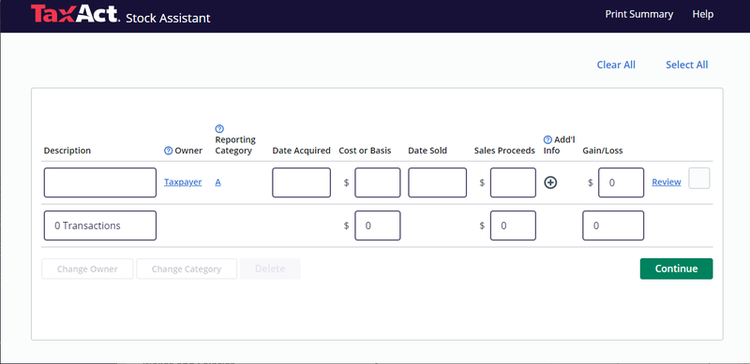

If you make a lot of charitable contributions, you'll want to use the Donation Assistant, and you can also calculate and report any stock gains or losses using the stock assistant.

One of the most important things that small business owners can do is plan for future taxes. TaxAct Self-Employed provides you with the tools to do so, including a "what-if" option, where you can plan out multiple scenarios to find the most beneficial one for your business.

TaxAct Self-Employed also includes a mobile app for both iOS and Android devices.

Deduction Maximizer

TaxAct Self-Employed's Deduction Maximizer offers a step-by-step process to uncover common deductions that are specific to your particular field of business.

For example, if you're a writer, you'll be able to view deductions related to your business such as business use of your home, writing supplies and expenses, and business-related travel.

For photographers, the deduction choices may include items such as photography equipment, advertising expenses, and website hosting.

Deductions for other fields include computers and other related business equipment, membership dues, software licenses, and studio or storefront rental costs.

Estimate taxes for future years

While we complete our tax returns once a year, true tax planning takes place throughout the year, particularly for business owners. TaxAct Self-Employed allows you to calculate tax liability for future years by estimating your future earnings and expenses using various "what-if" scenarios.

While this is only an estimate, using this feature can help prepare you for future tax liability, and plan your business around it accordingly.

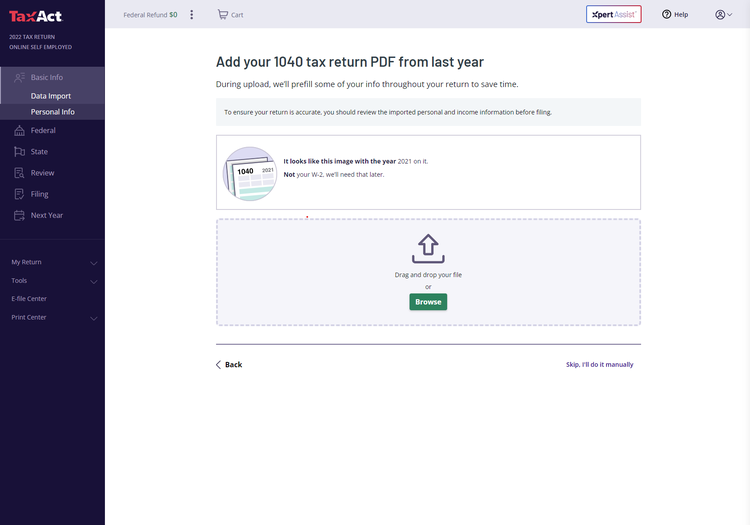

Data import

TaxAct Self-Employed will allow you to import last year's tax return from other tax preparation applications, such as TurboTax and H&R Block.

The import option is displayed in TaxAct Self-Employed immediately upon sign-in.

Importing this information can save you a lot of time, while also helping to reduce the amount of data entry you need to complete in order to process your return.

In addition to importing your tax return, you can also import charitable contribution receipts and W-2s. It's important to note that importing your tax documents may not be an option, since the process is dependent on the payroll service that produced the document.

There is no option to snap a photo of any document to import into TaxAct Self-Employed at this time.

Tools

The Tools feature in TaxAct Self-Employed offers a variety of Assistants, which can be incredibly useful, depending on your circumstances. The following Assistants are available:

- Donation Assistant: The Donation Assistant allows you to create a donation event, which is used if you have donated multiple items to the same charity. Once you create the event, you can add details for all donated items.

- Stock Assistant: The Stock Assistant helps you easily calculate your gains or losses on any stock transactions.

- Forms Assistant: The Forms Assistant provides you with a list of all available tax forms, with links that will take you directly to any forms you wish to access.

- Topics Assistant: The Topics Assistant lets you search for any tax topic. Simply choose the topic you're interested in and click the View Topic button.

- Calculators: TaxAct offers a tax calculator to help you plan your future taxes, plus a loan calculator and a savings calculator.

The Stock Assistant helps you figure gains and losses on stock transactions.

TaxAct Self-Employed also includes a variety of calculators including a Tax Calculator, Loan Calculator, and Savings Calculator.

TaxAct Self-Employed Online's ease of use

TaxAct Self-Employed Online offers easy navigation with step-by-step guidance available for new users. A navigation bar to the left of the screen allows you to jump to the appropriate section when desired, and a help option to the right of the screen allows you to search the Help Center or browse suggested topics.

TaxAct Self-Employed screens can feel somewhat crowded at times, as they tend to use a lot of text on each screen.

While it is nice to combine several questions on one page, rather than having to continually scroll through multiple pages, the amount of text to be read on each page can be overwhelming at times.

TaxAct Self-Employed Online's pricing

TaxAct Self-Employed fees are reasonable, with four plans available. This includes the Self-Employed plan, which is designed for freelancers, small businesses, and consultants.

TaxAct offers four plans, including the Self-Employed for small business owners.

The Free plan is suitable for those with simple returns, while the Deluxe plan, which runs $50.95, and the Premier plan, which is $74.95, include other features such as itemized deductions, stock sales and purchases, and rental property income.

The Self-Employed version, the most expensive at $99.95, offers complete freelance income management, along with personalized business deductions and year-round small business tax planning resources.

TaxAct's All-Inclusive Bundle includes Refund Transfer, audit protection, federal forms, one state return, and E-File Concierge. It also includes TaxAct Xpert Assist for free, which is $39.95 when purchased on its own.

TaxAct Self-Employed's cost is competitive with the market, but not the cheapest. There are also separate pricing plans available for Partnerships, C Corporations, and S Corporations.

Keep in mind that TaxAct Self-Employed prices can change frequently, so be sure to check out the website for the latest pricing.

TaxAct Self-Employed Online's support

TaxAct Self-Employed includes excellent support options, with the Deluxe, Premier, and Self-Employed plans all offering both telephone and email support.

All plans have access to the Answer Center, and a search function is available in the application.

The Help Center, to the right of the entry screens, offers easy access to the Answer Center.

All plan users can also access the TaxAct Self-Employed Support page, where you can easily view the most popular topics, as well as access topics in a variety of categories, including Getting Started, Electronic Filing and Printing, Download options, and News and Reference.

If you want even more help, you can add TaxAct Xpert Assist, which offers tax filers unlimited help from its live tax experts. When talking to an expert, you can share your screen to help you get your questions answered. They'll give helpful tax advice as needed, and they can quickly review your taxes before you file.

The cost of adding Xpert Assist is $39.95 for the free version, $90.90 for Deluxe, $114.90 for Premier, and $139.90 for Self-Employed. There is no limit to the number of times you can speak with tax experts during your filing.

For the quick review, when you're close to filing, you may request a call from a tax expert to help answer your final questions and walk you through the e-filing process. Upon request, a tax expert can briefly go over sections you're dealing with for the first time or that you find confusing.

Benefits of TaxAct Self-Employed Online

The benefits of using TaxAct Self-Employed are numerous, starting with the ability to save some money upfront, since TaxAct Self-Employed costs less than many of its competitors. Another benefit is the ability to import your tax documents, including W-2s, though not all forms can be imported.

TaxAct Self-Employed offers good help options for paid plan users, including a screen sharing feature that allows tax professionals to view your current screen.

Finally, you can access the various Assistants in TaxAct Self-Employed to easily calculate donation totals, stock gains and losses, as well as access a variety of forms. One drawback to TaxAct Self-Employed is that state filing is priced higher than the competition, at $39.95.

Is TaxAct Self-Employed right for you?

If you're a small business owner, freelancer, or sole proprietor and you're looking for great tax software, you owe it to yourself to check out TaxAct Self-Employed.

Like its competitors, TaxAct Self-Employed offers easy navigation, an interview process helpful to new filers, and good support options for all of its paid plans, all with a cost lower than much of the competition.

How TaxAct Self-Employed Compares

| Tax Prep Provider | MOBILE APP | LIVE SUPPORT | IMPORTS TAX DOCUMENT IMAGES | MAXIMIZES DEDUCTIONS |

|---|---|---|---|---|

| TaxAct Self-Employed | Yes | Yes | No | Yes |

| eSmart Tax | No | Yes | Yes | Yes |

| TaxSlayer Self-Employed | Yes | Yes | No | Yes |

| H&R Block Self-Employed | Yes | Yes | Yes | Yes |

| TurboTax Premium | Yes | Yes | No | Yes |

FAQs

-

Yes. It offers a mobile app for both iOS and Android devices that can be used along with the online application to complete your tax return.

-

Maybe. TaxAct Self-Employed does offer the option to import W-2s, but it depends on what payroll service prepared the W-2.

-

If you add TaxAct's Xpert Assist, you can request a call from a tax expert to help answer your final questions and walk you through the e-filing process. You may ask the expert to briefly go over sections you're dealing with for the first time or that you find confusing.

Our Taxes Experts

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.