Recruiting and retaining highly skilled employees is a challenge for businesses of all sizes. A recent McKinsey & Company survey found that 87% of executives struggled with skills gaps in the workforce, and the upheaval from the COVID-19 pandemic has only made matters worse.

Intriguingly, the study also found that small businesses were more successful at upskilling and reskilling employees due to their agility and their willingness to try new tactics.

One way to attract and develop a workforce of lifelong learners is through tuition reimbursement programs. Find out what they require and how they can affect your bottom line.

Overview: What is tuition reimbursement?

Tuition reimbursement is a benefit that reimburses employees for tuition and other education expenses. According to the Society for Human Resource Management, more than half of employers offer tuition assistance to their workers.

Most tuition assistance programs are set up to provide tax deductions following the Internal Revenue Service (IRS) requirements outlined below.

How does tuition reimbursement work?

Businesses have many options when setting up an employer tuition reimbursement program. Some of these choices may affect your ability to claim tax deductions. Be sure to check with a tax advisor before creating a program of your own.

- Payment schedule: Generally, employees pay for their classes up front and submit tuition reimbursement forms to their employers after successfully completing them, but some employers pay for classes at registration.

- Types of courses: Many employers pay only for courses that relate to the employee's existing career or to other positions within the business. Other companies offer benefits for any qualified education expense.

- Tiered payment levels: Some programs reimburse employees for a percentage of costs based on their grades. For example, an "A" might qualify for 100% reimbursement, a "B" would get 85%, a "C" might garner 75%, and so on. Or the employer might pay 100% only for classes with a passing grade.

- Direct payments: Some employers pay the institutions directly, while others reimburse employees.

- Expenses: Some plans cover tuition only, while others pay for additional education expenses such as books, technology, fees, and internet service.

- Institutions: Many programs cover any accredited institutions, but a growing trend is for employers to enter exclusive partnerships with education providers.

- Service requirements: Some plans specify a vesting period before qualifying for benefits. Some require employees to stay with the company for a certain period after completing the course in order to keep the funds.

Benefits of an employer tuition reimbursement program

If you're struggling with a skills gap now, hang on to your seat.

In a report on the future of work, experts at Dell Technologies and the Institute for the Future predict that 85% of the jobs that will exist in 2030 haven't been invented yet. Developing a culture of lifelong learning is key to thriving through those changes, and education reimbursement can play a central role in that effort.

Here are some of the benefits of providing tuition assistance as part of your benefits package.

Benefit 1: Recruitment

Education assistance is a highly prized benefit that can help you recruit top performers.

In a recent study by EdAssist, 84% of employees cited tuition assistance as an important factor in their decision to join their companies. In fact, 71% of participants rated tuition assistance among the best benefits offered by their employers after healthcare.

By offering help with college tuition, you're directly investing in your employee's development. That sends a strong message to prospective hires about your company's culture and values.

Benefit 2: Employee retention

More than 27% of employees quit their jobs each year, according to the Work Institute's 2019 Retention Report, and the No. 1 reason is lack of career development.

Tuition assistance helps keep lifelong learners engaged and committed to their jobs because it broadens their learning and development opportunities. More than 80% of participating employees in the EdAssist survey said the program made them happier in their jobs and more inclined to stay.

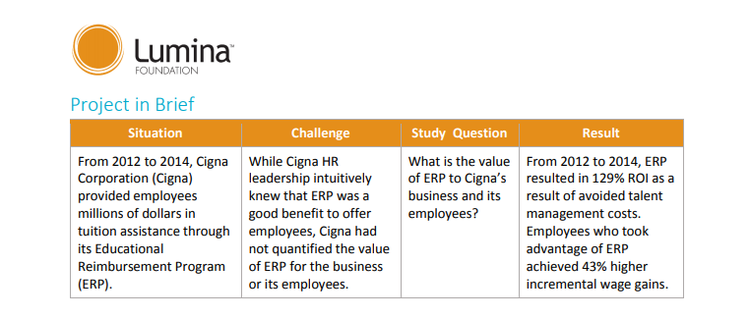

In fact, a study by the Lumina Foundation found that a tuition reimbursement program at Cigna yielded a 129% return on investment due in part to reduced employee turnover. The program paid off for employees, too, because participants saw 43% higher pay gains.

Cigna achieved a 129% ROI on a tuition reimbursement program. Image source: Author

Benefit 3: Tax savings

Another major benefit of education assistance is that it can provide tax savings for the employer and participating employees.

Under Internal Revenue Code Section 127, employers can deduct up to $5,250 per employee for tuition reimbursements made through qualified education assistance programs (EAPs).

EAP benefits are also tax-free for employees, making them even more attractive as part of your benefits package. Reimbursements up to $5,250 are excluded from the employee's income on Form W-2.

Qualified EAP expenses include tuition, books, supplies, and equipment necessary for class. The benefits may cover graduate or undergraduate coursework, and they do not have to be job-related.

An EAP must meet these IRS criteria:

- The employer must provide a written plan.

- The plan can't offer other benefits besides education.

- The employee can't receive more than $5,250 per year from all employers combined.

- The plan must not favor highly compensated employees (for 2020, that means those earning more than $130,000 in total compensation).

If you're a sole proprietor, you can create an EAP to cover your own education expenses since you can't discriminate in a company of one. Just make sure you offer benefits equally to employees as the company grows.

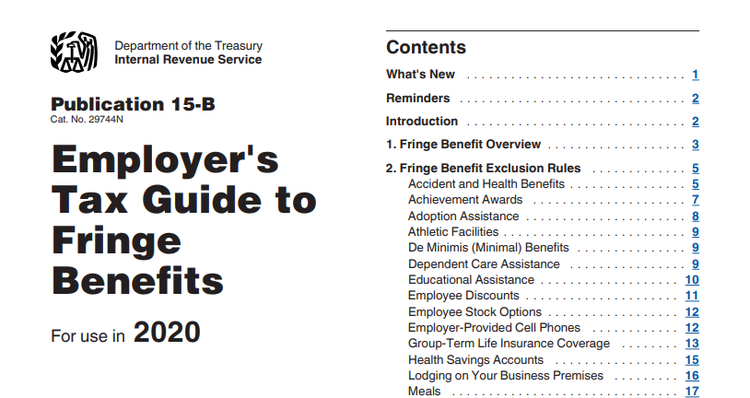

You can find further details in IRS Publication 15-B, Employer's Tax Guide to Fringe Benefits, Section 127.

Education expenses that don't qualify for tuition reimbursement tax breaks under Section 127 may qualify for exclusion from an employee's income as a working condition fringe benefit under IRC Section 132(d). These are benefits that would qualify as a business expense if the employee paid them out of pocket.

To qualify under Section 132(d), the education must improve or maintain skills that are needed or required for the employee's current job. They do not qualify if they're required to meet the minimum job requirements of that job, or if they qualify the employee for a new position, trade, or business.

Unlike Section 127 benefits, eligible reimbursements under Section 132(d):

- Are not subject to an annual cap.

- Do not require a written plan.

- Do not have to pass discrimination tests regarding highly paid employees.

- May include education-related travel.

You can find the full requirements in the IRS fringe benefit guide under Section 132(d).

The full details on education assistance are in the IRS guide to fringe benefits. Image source: Author

Benefit 4: Talent development

In addition to their recruiting power and tax savings, EAPs give you the benefit of a more skilled workforce. While on-site worker training is critical, EAPs allow your employees to build skills on their own time and in their own areas of interest and specialty.

Some employers worry that employees will use school reimbursement to prepare for a different job and leave. Yet 93% of participants in the EdAssist study said tuition assistance helped them develop skills they needed to grow in their current jobs.

Benefit 5: Employee engagement

One liability of hiring lifelong learners is that they tend to get easily bored. For those workers, tuition reimbursement programs are a standing invitation to fresh challenges at home and at work.

When you encourage employees to follow their passions, they're likely to have more passion for their jobs year after year. That's the sweet spot to be in for your workforce and for your business.

Should you offer tuition reimbursement for your employees?

So is tuition reimbursement a wise move for your business? It depends on your budget, your goals, and the positions you need to fill during the next few years.

Consider these key questions:

- Do you have the growth potential as a company to give employees development opportunities?

- What kinds of skills do you need to develop in your workforce, and how are you developing them? Are there gaps that an EAP might fill?

- Do you have trouble recruiting skilled employees?

- What is your retention rate? What is turnover costing you?

- Could you benefit from the tax write-offs? Could your employees?

- Would education benefits appeal to the kinds of workers you want to attract?

- How do your current employees feel about education benefits?

To answer those questions, you can conduct quick employee surveys, ask recruiters to gauge interest for you, or simply ask employees what they want.

You can also estimate your potential ROI based on human resources (HR) metrics such as turnover costs. HR software can make it much easier to gather the information you need. You can also ask your financial advisor to look into the tax impact.

Ultimately the decision is financial and cultural. Obviously you can't offer every benefit under the sun. Only you can decide whether an EAP is a good fit for your business.

Learning to grow

As McKinsey noted, small businesses are in a better position to try new things and learn from their mistakes than their larger counterparts.

Your employees may be looking for the same opportunity to learn and grow. In fact, that may be part of what drew them to your small business in the first place.

If so, tuition reimbursement might be just what you need to succeed in an economy of perpetual disruption and change.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.