Offering your customers a variety of payment methods is good for business. With the rise of e-commerce stores and business models that sell in several ways, merchants are offering new technologies that can help them enhance the digital customer experience.

A longtime standby, point-of-sale systems and associated software typically need POS hardware to run on, which can be expensive for small businesses, especially those who don’t process a huge amount of in-person transactions.

Virtual terminals are a good option for businesses who do a lot of business over the phone, or for those businesses that simply want to offer their customers more payment options.

We’ll go over what virtual terminals can help businesses achieve, which businesses they’re suitable for, and what to remember when considering investing in a virtual terminal.

Overview: What is a virtual terminal?

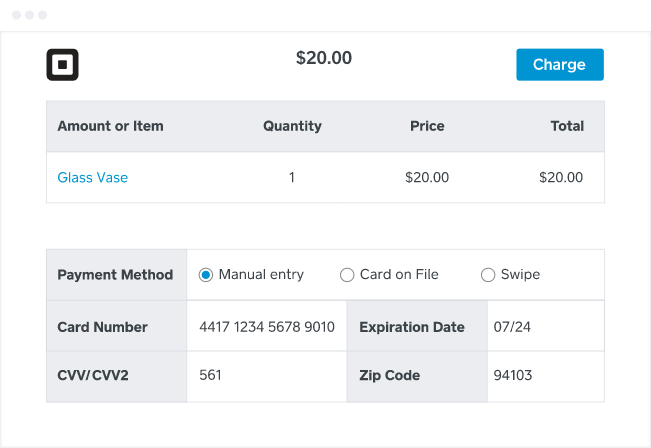

A virtual terminal is a web-based application that allows merchants to manually process card-not-present payments. You can take customers’ card details over the phone or in person, and process card payments with no physical hardware, such as a credit card terminal or reader.

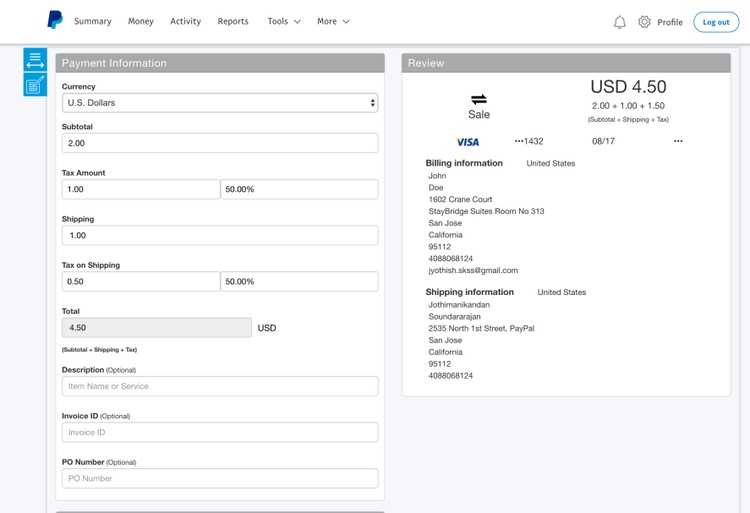

Virtual credit card terminals are considered the online version of common point-of-sale solutions. Users are charged a percentage of each transaction for using the service.

One advantage to virtual terminals in lieu of retail POS systems is that they require very few physical hardware components to accept credit card payments online.

As long as you have a computer or a mobile device, an internet connection, and a virtual terminal, you can accept and process card payments with no hardware.

Square's virtual Image source: Author

terminal allows you to enter in the customer’s card details via a computer to process payments

Virtual terminal credit card processing is managed in the same way as payments made via e-commerce stores -- except it’s the business who uses the terminal, rather than the customer. To accept and process virtual payments, you’ll need to have a payment gateway and a merchant account already set up.

PayPal offers a virtual terminal for merchants who want to offer card-no-present transactions Image source: Author

With a virtual terminal, you’ll add an extra payment option to your sales process, giving both your business and your customers more flexibility.

By offering a card-not-present payment option to customers that might not belong to your traditional clientele, virtual terminals can offer another avenue for customer acquisition.

How to use a virtual terminal for processing credit cards

Depending on your business’s product positioning and pricing strategy, virtual terminals could be a great way of offering your customers more payment flexibility.

Here are three steps you’ll need to follow before you can use virtual terminals as part of your operations.

Step 1: Weigh the pros and cons of using a virtual terminal

Virtual terminals are suitable for most businesses, but that doesn’t mean you need to use them. Depending on your business model, virtual terminals will suit some businesses more than others.

Offering your customers several payment options is a great marketing technique, but it’s important to consider the potential benefits and disadvantages of offering this type of payment.

What to consider before committing to a virtual terminal

Is a virtual terminal the right option for your business? Here are some points to consider before making an investment.

- Business type: Certain business types and industries can benefit more from using a virtual terminal, especially those that primarily operate their businesses over the phone or have recurring monthly subscription/membership costs. These include food delivery services, health and fitness services, freelancers and sole traders, doctors, etc.

- Frequency of card-not-present transactions: If you run a low volume of transactions over the phone, then the total costs for card-not-present transactions might be worth considering. However, if you run a physical store and are processing high volumes of payments each day, then it’s worth looking at a physical card reader to lower costs, as virtual terminal transactions are generally costlier than in-person payments.

- Associated risks: Because the customer is not present and you don’t capture the card’s electronic data, there is a risk of incurring chargebacks when using virtual terminals when customers call their credit card provider to deny the purchase.

Step 2: Choose a virtual terminal solution

While most businesses that provide a payment gateway will also provide a virtual terminal, their solution might not be suitable for your business.

As a small business owner, you need to choose a combination of the best sales techniques and technology to make sure that your business thrives. Before deciding on a solution, you need to consider several factors.

What to consider when choosing a virtual terminal solution

Here are a few virtual terminal features you should consider before settling on a solution.

- Pricing: How much does the provider charge for each transaction? Is there an initial setup cost associated with the terminal? Is there a monthly fee on top of the monthly costs?

- Ease of use: Virtual terminals are known for their ease of use, but are there any new workflows or staff training you’ll need to consider? How robust are their customer support options?

- Features: Does the solution comply with the highest security levels of PCI-DSS? Does the solution have experience in your industry or business type? Does it offer sales reporting features to help you with sales forecasting and sales management?

FAQs

-

No. There is no need to buy any additional physical point-of-sale hardware to use a virtual terminal. All you need is a device such as a computer or mobile phone.

-

This will differ from solution to solution, but the processing fees associated with virtual terminals are usually higher than card-present transactions.

For example:

- Square charges 2.6% + $0.10 per in-person card transaction, but 3.5% + $0.15 per typed-in transaction.

- Shopify charges between 2.4% to 2.9% per in-person transactions, but 2.9% + $0.30 per typed-in transaction.

- PayPal Payments Pro charges 2.7% per in-person transaction, but 3.1% + $0.30 per typed-in transaction.

-

Again, this varies from solution to solution, but generally virtual terminals do support automatic/recurring payments.

-

No, you don’t need a website to use a virtual terminal. Payments are processed through a webpage you access through your payment provider’s account.

Virtual terminals are a flexible option for merchants, but be mindful of fees

It’s tempting to offer your customers payment options, but remember that virtual terminals can add on extra fees to your overall monthly outgoings. Merchants need to weigh the benefits of offering flexible card-not-present transactions against the operational costs.

Our Small Business Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.