How to Prepare and File W-2s

The W-2 form is the first tax form most people receive in their working life. It shows the income you made over the last tax year and all of the taxes withheld from that income. If you're the one running the business, it’s your job to ensure all of your employees receive accurate and timely W-2 forms.

Read on to learn how to complete W-2s and when and where to submit them.

Overview: What is form W-2?

The IRS W2 form is one of several informational returns you have to file with the IRS as part of the small business tax cycle. The form is what you use to report all wages, withholdings, and employer payroll taxes for employees to the government. It’s due annually by January 31.

W-2 vs. 1099: What's the difference?

When you hire new people, first determine if they will be independent contractors or employees. Your choice determines if their tax information is reported with a W-2 or 1099 form.

Workers are typically considered contractors if they only work on specific projects and report their own taxes. They’re often working with more than one company.

Why is the W-2 form important for employers?

Completing the W-2 accurately and timely is important for the following reasons:

- Fines: If you fail to file by January 31, you are automatically fined $50 per return (up to a maximum of $197,500). After 30 days, that fine converts to $100/return (maximum of $565,000), and after August 1, it goes to $280 per return (maximum of $1,130,500).

- Record keeping: You need historical wage information for a variety of reasons, such as planning raises, verification of employment for mortgages, and insurance audits. It’s far easier to open a PDF and search for an employee name than to try to create a new report in your accounting software and find the same info. Additionally, the total W-2s should add up to the same number as the salaries and wages line item on your business tax return.

- Your employees need it: Employees not only need the info from their W-2 to fill out their return, they will also need to submit the form itself with their federal and possibly local tax returns.

How employers should prepare W-2 forms

Follow these steps to prepare and send out W-2 forms.

Step 1: Complete employee onboarding

Part of the payroll processing cycle is onboarding all new employees and getting all the government forms completed. The important onboarding form for our purposes in this article is the W-4.

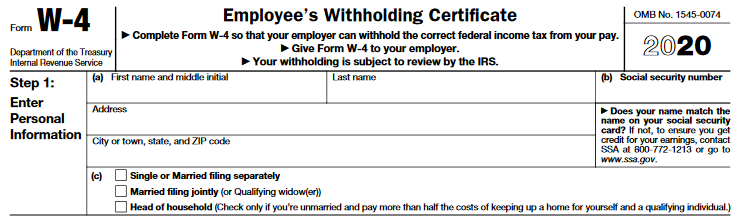

Employees will provide their personal and withholding information on the Form W-4 Image source: Author

During the onboarding process, enter the W-4 information into your payroll software to correctly withhold taxes during the year and produce W-2s at the end of the year.

Step 2: Order forms

You cannot complete the W2 online and print it out to send in. The forms must be ordered, either directly from the IRS or from your tax software company. The forms are printed with a specific color of ink for security purposes.

You can register with the Social Security Administration (SSA) and submit the government copies of the form online.

Step 3: Complete forms

You can find the official IRS instructions for all sorts of unusual scenarios here. We’ll go over the basics step-by-step.

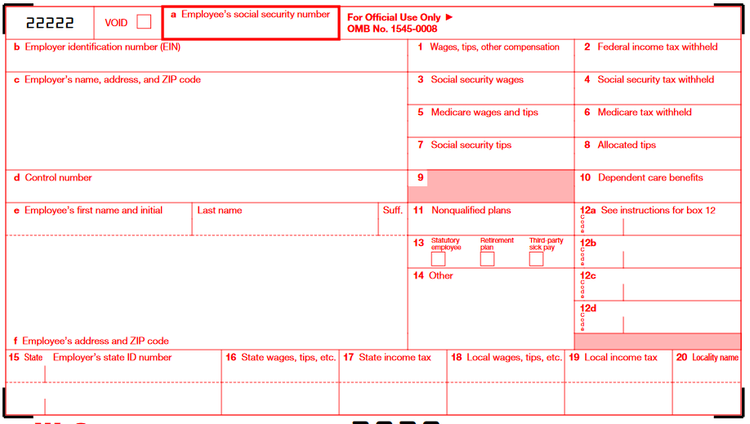

The information on the W-2 comes from both the employee’s W-4 and from business records. Image source: Author

Sections a, e, and f come from the employee’s W-4. Sections b, c, and 15 are your business’s information and are the same for each employee (except employees working in different states). Section d is for the company’s records -- whatever employee ID you use should go there.

Populate the remaining sections with information from your payroll or accounting software:

- Wages: Wages in box 1 is after any pre-tax deductions, such as 401(k) contributions and health savings plan contributions. Social Security wages do not include any deductions, but they have a ceiling of $132,900 (in 2020). Medicare wages have no ceiling and do not include deductions.

- Withholdings: Federal income tax withheld is based on the number of dependents and allowances an employee reports on their W-4. Social Security and Medicare withholdings are calculated each pay period as part of the payroll process.

- Tips: Box 7 contains the tips your employee received and reported to you. Box 8, allocated tips, is a calculated total -- if you run a food and beverage establishment, and any employee reports tips amounting to less than 8% of their share of food and drink sales, the difference between the 8% amount and their reported number is allocated tips.

- Box 9: This should always be blank. Tax laws have changed, and it's no longer applicable.

- Box 10: Any amount that was reimbursed to employees for child or dependent care.

- Box 11: Amount paid to the employee for a pension or deferred compensation plan that does not qualify under IRS Section 457.

- Box 12: There are over 30 reportable forms of deferred compensation. Visit the IRS instructions for the codes to use for each.

- Box 13: A statutory employee is one who does not get a normal paycheck. Their pay is totally incentive-based. Check "retirement plan" if the employee has opted into a 401(k) plan. Third-party sick pay is for payments from insurance companies and other third parties.

- Box 14: This is where the employer portion of health insurance or 401(k) contributions and any other compensation not reported in the other boxes goes.

- State and local: If the employee did all work at the same location, these boxes will mimic the federal boxes. If the employee does work in multiple localities and states, separate the information out into different lines.

Step 4: Send forms

You’ll have six versions of each form W-2 completed. Copy A and Form W-3 are submitted to the Social Security Administration, either online through the link above, or to the following addresses:

Via U. S. Postal Service:

Social Security Administration

Direct Operations Center

Wilkes-Barre, PA 18769-0001

(for Certified Mail, use ZIP code 18769-0002)

Via Private Delivery Service (FedEx, UPS, etc.):

Social Security Administration

Direct Operations Center

Attn: W-2 Process

1150 E. Mountain Drive

Wilkes-Barre, PA 18702-7997

Send Copy 1 to your city or state government. This may or may not be required. Check with the secretary of state staff for instructions and if you can use an online tax filing option.

Send Copies B, C, and 2 to the employee. The employee files Copy B with their income tax return and Copy 2 with their state return.

Copy D stays with the employer.

Step 5: File forms

Once all forms and the W-3 are completed, scan them together and save them in an electronic file. This is useful if the forms need to be resubmitted, if an employee loses their copies, or even if you need to complete a verification of employment form for an employee’s mortgage application.

Note that if an employee requests a copy of their transcripts, you can point them toward this link to get their IRS transcripts online. The transcripts show the entire personal tax return, not the W-2, and includes information the business would not have.

Don’t get the blues; do your W-2s

It’s bad enough worrying about your own small business taxes. Manually filling out each individual W-2 is probably not worth the hassle. Keep your software up to date, and let it do the heavy lifting. Now that you know how W-2s work, you can verify what the software prints out.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles