The Ascent Guide to the Weighted Average Cost Method

The Stormlight Archive and Atlas Shrugged are two of the longest books I’ve read. They come in at more than a thousand pages and over 55 hours listening time if you, like me, choose the audiobook route.

Sometimes it feels like reading about all the ways you can account for inventory would take just as long. Should you use FIFO or LIFO? Should you use periodic or perpetual?

Today we’re looking at another option: the weighted average cost method. Read on to learn how this method differs from the FIFO and LIFO methods as well as the advantages and disadvantages of using it in your business.

Overview: What is weighted average cost?

Most businesses using a periodic inventory system use the first-in, first-out (FIFO) or last-in, first-out (LIFO) methods to calculate inventory. These methods tie a price to every unit of inventory and then calculate cost of goods sold (COGS) based on which units were sold.

This approach isn’t feasible for everyone. If you sell homogeneous inventory that's constantly restocked, it can be impossible to track what unit was purchased for what price.

Weighted average inventory solves this problem. Instead of attempting to tie a price to each unit, the method uses a weighted cost that averages the price of all inventory that has been purchased. This simplifies things at period end, when inventory numbers are finalized.

Weighted average vs. FIFO vs. LIFO: What's the difference?

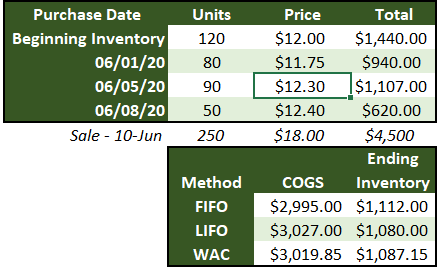

Let’s take a look at how cost of goods sold and ending inventory would be calculated using the three methods.

The resulting COGS from each method are around the same level. Image source: Author

In this example, there's a beginning inventory balance, three purchases of different unit amounts, and then a sale of 250 units. To calculate cost of goods sold, we need to either pick which 250 units were sold, or come up with an average price to apply to the sold units.

Using FIFO, the 120 units in beginning inventory, 80 purchased on June 1, and 50 of the units purchased on June 5 were included in the COGS calculation.

LIFO uses all of the units purchased in June and 30 of the units in beginning inventory.

The weighted average cost takes the average of each purchase, weighted by the number of units purchased, and applies that to the number of units sold. We will go over how to calculate the weighted average for this example in the next section.

There isn’t much difference in COGS between the three methods because of the small numbers used in the example. However, businesses that quickly turn inventory or have bigger price jumps than in this example can see that difference quickly add up to a more impactful change to the income statement.

The difference between LIFO and FIFO is which units are used to calculate cost of goods sold. Weighted average uses an average of all units in inventory.

How to calculate weighted average cost

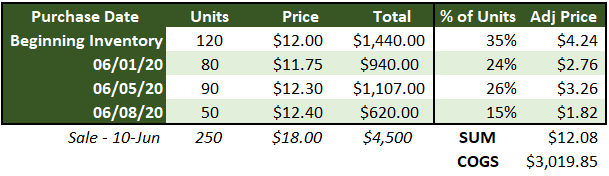

Here’s how we calculated the weighted average cost in the example above:

The average cost is calculated by weighting each transaction by the number of units purchased. Image source: Author

When the sale is made on June 10, there are 340 units of inventory. We start by finding what percent of total inventory each transaction accounts for by dividing the number of units in it by the total of 340.

Then, multiply that percentage by the price for each transaction to find the adjusted price. Finally, sum the adjusted prices to get the weighted average cost of $12.08, and multiply that by the number of units sold to find the cost of goods sold of $3,019.85.

The new beginning inventory is 90 units (340 total units - 250 units sold) with an average price of $12.08, totaling $1,087.15. You can also calculate this by subtracting the cost of goods sold from the total cost of inventory prior to the sale (340 units x $12.08 average price).

It's a good practice to count inventory at the end of each period and compare it with the calculated ending inventory in order to find any shrinkage. Shrinkage is the loss of inventory due to damage, loss, or theft.

Benefits and disadvantages of using the weighted average cost method within your small business

Is weighted average cost right for your business? Here are a few advantages and disadvantages of the system.

Advantages of the weighted average cost method

Here are a few advantages to using weighted cost:

- You don’t have to tie prices to units: The most time-consuming part of the LIFO and FIFO methods is tracking every batch that comes in along with its price to ensure items are sold in the correct order. With the weighted average cost method, when inventory comes in, you just record the purchase and update the current weighted average cost.

- You may be able to pay less for accounting software: While we certainly don’t recommend skimping on accounting software, if you’re just starting out and don’t even have a second employee, the weighted average cost method would make it easier to just track inventory on a spreadsheet -- or even by hand.

- You have a consistent price: With FIFO and LIFO, profits are based on either the oldest or most recent purchases. If there's been a significant price change, the calculated COGS and gross margin won't be accurate and could lead to bad decisions. If you have a running weighted average cost in mind when setting prices and making purchases, it will lead to better decisions.

Disadvantages of the weighted average cost method

Here are a few disadvantages:

- Your inventory may be too heterogeneous: Over time, products change. They evolve through added features and deleted bugs. With that evolution comes logical price changes. If your inventory turns slowly enough, you could have three or four iterations of the same product in one amorphous blob of "product x" in the inventory account. It’s fine to sell different versions of products, but be mindful of material changes to products, and if they occur, parcel out the new inventory when it's recorded.

- You may be including bad prices: While consistent pricing is an advantage of this method, if your business has a concentration in inventory at an older date, when prices were far lower, this will throw off your inventory cost. Reported profit will be correct, but the margin could lead to bad decisions if you assume it will stay that high forever. Unfortunately, this problem can’t be fixed by using a different method, such as FIFO, because the same inventory cost would be used. It's simply another situation to be mindful of -- you have to report cost of goods sold using outdated inventory, but that doesn’t mean you have to make decisions based on that profit number.

- You may naturally use FIFO to sell inventory: If your products are perishable or otherwise degrade over time, it is likely you follow a first-in, first-out policy when selling the items. The more quickly you sell old items, the less likely they are to go to waste. If you’re in this situation, go ahead and use FIFO so you can keep your accounts as close to actual business practice as possible.

Should you switch to weighted average cost?

Although it's smart to do thorough research before making important business decisions, it likely won't take 55 hours of reading to determine the best inventory accounting method for your company. It should be intuitive.

If you sell perishable items or a lot of different things, use FIFO. If you sell a lot of the same product over and over, use weighted average cost. If you enjoy having a migraine, use LIFO.

Alert: our top-rated cash back card now has 0% intro APR until 2025

This credit card is not just good – it’s so exceptional that our experts use it personally. It features a lengthy 0% intro APR period, a cash back rate of up to 5%, and all somehow for no annual fee! Click here to read our full review for free and apply in just 2 minutes.

Our Research Expert

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.

Related Articles

View All Articles