Image source: Getty Images.

Generally speaking, when Wall Street analysts speak, investors listen. Wall Street analysts are expected to have keen insights into the companies and industries they follow, making them the seeming gurus of stock investing.

Unfortunately, Wall Street and its analysts are fallible, so not every call they make will prove to be a gem. With this in mind, we asked three of our Foolish contributors to each name a Wall Street darling that you should seriously consider avoiding. Here's what they had to say.

Tyler Crowe

One company that has seen a lot of buying from Wall Street recently is oil services company Baker Hughes (BHI +0.00%). To be more specific, Baker Hughes is loved by one hedge fund, ValueAct Capital. According to its most recent disclosure, ValueAct has doubled its its position in Baker Hughes to $1.9 billion in the last couple months after Baker Hughes and fellow oil services firm Halliburton (HAL 0.81%) terminated their merger agreement. There is a justifiable reason that ValueAct is bullish on Baker Hughes, but I'm not so certain.

Since the two companies couldn't get a deal done -- thanks in large part to anti-trust concerns -- Halliburton paid Baker Hughes $3.5 billion in cash. Baker Hughes plans to use that cash infusion to pay down debt and buy back $1 billion in stock. Of course, that sounds great on paper and would likely result in a decent bump in share price in the short term. In the long term, though, there are some other things to keep in mind.

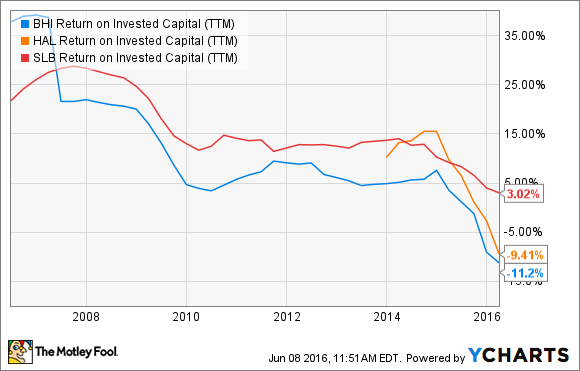

First and foremost, Baker Hughes is the third-largest player in a space where two companies -- Halliburton and Schlumberger (SLB 0.44%) -- are absolutely dominant, having carved out competitive advantages in certain parts of the industry already. Halliburton is the foremost oil services provider for shale drilling and the North American market, and Schlumberger is the big fish in offshore and international markets. There aren't many places where Baker Hughes' offerings stand out as superior to these two players.

The other concern is that this plan to pay down debt and buy back stock won't really change the fact that the company has underperformed in terms of generating long term returns for investors for quite some time.

So there may be a little bit of love for Baker Hughes stock today, but until the company proves it can generate superior returns for investors over the longer term, it's probably better to stay away.

Sean Williams

One stock that Wall Street fancies that I would strongly recommend avoiding is cannabinoid-based drug developer GW Pharmaceuticals (GWPH +0.00%). According to data provided by Thompson/First Call, two analysts currently rate the company a "strong buy," with four additional analysts considering it a "buy," with an overall average price target of $152.43. This implies 70% upside from where GW Pharmaceuticals' stock closed on June 10.

The thesis behind owning GW Pharmaceuticals lies with Epidiolex, the company's exciting late-stage liquid formulation that's designed to treat two forms of childhood-onset epilepsy known as Dravet syndrome and Lennox-Gastaut syndrome. In midstage studies, Epidiolex reduced seizure frequency by more than 50% in both indications, and in top-line data from its pivotal phase 3 trial released in mid-March, GW Pharmaceuticals observed that Epidiolex reduced seizure frequency in 39% of patients compared to just 13% for the placebo in Dravet syndrome patients.

While I'm willing to give credit where credit is due for GW's solid trial results, a valuation of $2 billion seems excessive for a variety of reasons.

Image source: GW Pharmaceuticals.

For starters, GW Pharmaceuticals has taken advantage of "marijuana mania," as I like to call it. Investors are flocking to marijuana's exceptional growth rate, and GW Pharmaceuticals has been a major beneficiary. But the issue is that the company's only approved drug is Sativex for spasticity associated with multiple sclerosis, and Sativex has not sold well. The result is losses, losses, and more losses expected for GW Pharmaceuticals throughout the remainder of the decade.

Given the forecast near-term losses, I would also be concerned about potential dilution. Keep in mind that without much in the way of revenue, GW Pharmaceuticals is expected to burn through its cash on hand. The good news for optimists is that GW Pharmaceuticals has $282 million in cash on hand ($266.5 million net cash), but with the possible marketing costs associated with Epidiolex (if approved) coming into play, along with ongoing research and development expenses, GW could burn through more than $100 million of this cash per year. The only way GW may be able to raise money is through dilutive share offerings.

With profitability still five or more years away, your best bet is to ignore Wall Street's optimism and wait for a substantial pullback before considering GW Pharmaceuticals.

Image source: Delta Air Lines.

Dan Caplinger

The airline industry has done exceptionally well, and Delta Air Lines (DAL +0.09%) in particular has benefited from the favorable tailwinds that have brought it an unprecedented period of profitability. Wall Street analysts love the stock, with all but one of the 15 analysts who follow the stock having issued it a rating of buy or strong buy. The single holdout still thinks Delta is worth holding. Bargain seekers can understand why Delta is so popular, because the stock trades at just seven times trailing earnings. Investors still expect further profit gains in 2016 and 2017, because industry consolidation has reduced competition, supporting pricing power for the remaining airline giants.

However, the danger that Delta and other airlines face is that favorable conditions could come to an end. Already, Delta expects passenger revenue per available seat mile to decline in the current quarter compared to year-ago levels. Analysts like the fact that several of Delta's peers are doing worse, but rising oil prices could also eat into some of the gains that Delta has made in recent years. Some believe the opportunity for Delta and other airlines to charge new fees has reached saturation, and that could threaten future growth. With the airline industry at what appears to be a cyclical high, Delta is riskier than many on Wall Street think.