Blue chip stocks are the stocks of well-known, high-quality companies that are industry leaders. These companies have stood the test of time and are respected by their customers and shareholders.

Blue chip companies have solid business models and impressive track records of returns for investors. These returns often include regular and growing dividend payments.

The blue chip stocks' attractive risk-reward profiles make them among the most popular for conservative investors. But even more risk-tolerant investors should consider buying blue chip stocks to diversify their portfolios and provide stability during turbulent stock market conditions.

What are they?

What is a blue chip stock?

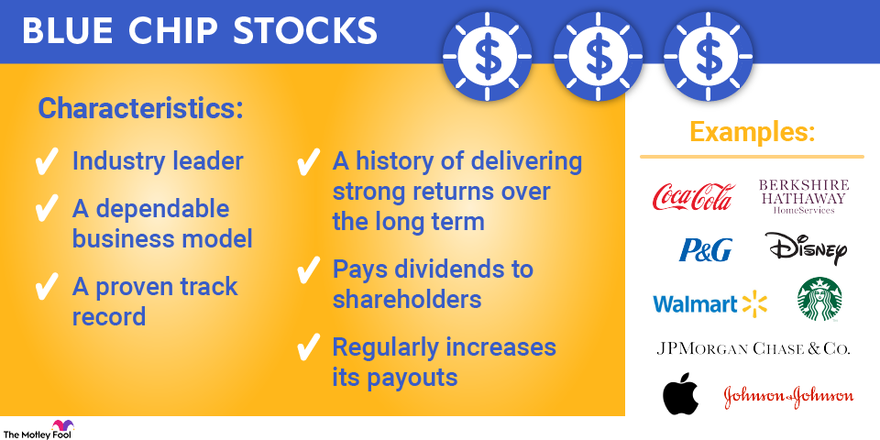

So, what are blue chip stocks? A blue chip stock is defined as a security that represents an equity position in a company possessing most of the following characteristics:

- An industry leader with a dependable business model.

- A proven track record and strong reputation with consumers and shareholders.

- A history of delivering strong returns over the long term.

- Dividends paid to shareholders and regular increases to its payouts.

Top five to buy now

Best blue chip stocks to buy right now

Even if you've never invested in the stock market, you'll recognize the names of many top blue chip stocks. These large-cap companies provide products and services that billions of people worldwide use daily. Here are some of the best blue chip companies on the market:

| Blue Chip Companies | Market Cap |

|---|---|

| 1. Apple (NASDAQ:AAPL) | $2.82 trillion |

| 2. Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) | $880.5 billion |

| 3. Coca-Cola (NYSE:KO) | $262.1 billion |

| 4. Johnson & Johnson (NYSE:JNJ) | $376.9 billion |

| 5. American Express (NYSE:AXP) | $154.9 billion |

1. Apple

Apple (AAPL -0.35%) is one of the world's most profitable companies. It has pioneered advancements in the technology sector throughout its history.

The company innovated with its Macintosh computers in the 1980s and made media portable with its iPods in the early 2000s. Its iPhones, iPads, and Apple Watches are ubiquitous today. In a world where consumers flock to the latest tech fads, Apple's products enjoy notable loyalty from its customer base.

Apple also earns recurring revenue through its services, which include its iTunes, App Store, and streaming television businesses. Apple's market capitalization climbed past the $1 trillion mark in 2018, up to an unprecedented $2 trillion in 2020, and has since had periods when its valuation topped the $3 trillion mark.

Revenue

While the company's valuation has sometimes fluctuated in conjunction with volatility for the broader market, the tech giant's stock has been an excellent performer for long-term investors. Even though Microsoft (NADSAQ:MSFT) has grown to become the world's most valuable business, Apple is still the second-largest public company -- and the business has plenty of room for growth over the long term.

2. Berkshire Hathaway

Berkshire Hathaway (BRK.A -0.76%)(BRK.B -0.69%) is a major player in the insurance industry, offering various lines of commercial and personal insurance through subsidiaries GEICO and Gen Re. But Berkshire owns a diverse set of businesses.

For instance, Berkshire owns restaurant chain Dairy Queen, railroad giant BNSF, and Berkshire Hathaway Energy, a utility company. It owns water companies, consumer apparel businesses, battery brands, and more.

Beyond its subsidiary businesses, the investment conglomerate also owns a large portfolio of publicly traded stocks. With such a broad range of businesses, the company has a reputation for safety, security, and consistent performance.

It's important to note that Berkshire Hathaway is the only blue chip stock on this list that doesn't pay a dividend. CEO Warren Buffett has one of the most impressive track records of market-beating returns in history and prefers investing the company's cash in lieu of paying dividends. That strategy has worked out great for shareholders so far.

3. Coca-Cola

Coca-Cola (KO 0.0%) has been a leader in the beverage industry for more than a century, with its namesake soft drink spawning a global empire. Yet Coca-Cola has also changed with the times and now provides a much broader array of products, including juices, sports drinks, and bottled water tailored for more health-conscious consumers.

Coca-Cola particularly stands out for increasing its dividend. Its streak of consecutive annual dividend payment increases dates back to the early 1960s, a track record placing it among the top 10 dividend stocks on the market.

4. Johnson & Johnson

Johnson & Johnson (JNJ -0.46%) is well known for its popular consumer products, including baby shampoo, Band-Aids, and Tylenol pain reliever. However, J&J separated its consumer health products business into a new company called Kenvue (KVUE -0.84%) through a stock spinoff that was completed in May 2023. The two companies are separate entities, but J&J still owned roughly 90% of Kenvue stock at the time of the spinoff, so it remains heavily invested in its major consumer products brands.

Even with the spinoff, J&J is a true healthcare giant and makes a wide array of medical devices to help doctors and other medical professionals perform lifesaving procedures. Johnson & Johnson also has a vast pharmaceutical business and produces drugs, such as the arthritis treatment Remicade, prostate cancer drug Zytiga, and psoriasis drug Stelara.

Spinning off Kenvue has also positioned J&J for better growth because the consumer health products business was generally considered the weaker of the company's segments. Johnson & Johnson has been restructured around its highly regarded pharmaceuticals and medical devices segments, and these businesses have promising long-term growth outlooks.

5. American Express

Financial giant American Express (AXP -0.62%) is another blue chip stalwart to consider. It's both a credit card company and a payments network. Its main revenue generators include credit card fees and transaction processing fees.

The company is poised to increase both revenue streams with new users and higher transaction volume. It's more than 170 years old, but it's apparently staying relevant: More than 60% of new card accounts in 2022 were millennials and Gen Z consumers -- an encouraging sign.

American Express' management believes it can expand profits at a double-digit pace in years to come, and it plans to pay out roughly a quarter of its profits as shareholder dividends. It announced a 15% increase in its dividend in March 2023. Ongoing earnings growth should lead to additional increases in future years.

Gen Z

A bigger list

A bigger list of blue chips

Investors have a sizable number of blue chip stocks to choose from. Here's a list of 20 additional top blue chip stocks:

- AbbVie (ABBV -4.58%)

- Nike (NKE 0.19%)

- Lockheed Martin (LMT -0.75%)

- Honeywell International (HON 0.22%)

- Procter & Gamble (PG -0.78%)

- Mastercard (MA 0.07%)

- JPMorgan Chase (JPM 0.06%)

- Walmart (WMT -0.08%)

- Microsoft (MSFT 1.82%)

- Caterpillar (CAT 1.59%)

- UnitedHealth Group (UNH 0.3%)

- Starbucks (SBUX 0.47%)

- Oracle (ORCL 2.02%)

- Northrop Grumman (NOC -1.56%)

- McDonald's (MCD -0.91%)

- Home Depot (HD 0.94%)

- Kroger (KR -0.75%)

- Merck (MRK 0.37%)

- Intel (INTC -9.2%)

- Goldman Sachs (GS 1.79%)

Why invest

Investing in blue chip companies

Blue chip stocks are smart choices for investors of all kinds. Beginning investors are likely familiar with the products and services of blue chip companies. Familiarity with a company makes stock-buying more comfortable, and it's exciting to become a partial owner of a business you know.

Meanwhile, long-time investors will have seen blue chip stocks rise to the top over the long haul, outlasting their weaker rivals and finding ways to stay relevant and continue growing, even as their industries change.

Investors of all experience levels can appreciate the stability and reliability blue chip businesses give to shareholders. Many of these companies pay great dividends and have payout growth streaks that have earned them a spot among the illustrious ranks of the Dividend Kings.

ETFs

Hands-off investing with blue chip funds

Investors may also want to consider exchange-traded funds (ETFs) and mutual funds. Blue chip-focused ETFs and mutual funds bundle numerous blue chip stocks into a single security, offering a simple way to diversify across many high-quality stocks and build exposure to industries ranging from technology and hardware to pharmaceuticals and electric utilities.

These investment vehicles also tend to be less volatile than individual stocks, particularly appealing to people who are retired or nearing retirement. Blue chip ETFs and mutual funds can also be a good fit for younger investors seeking the defensive advantages of diversification or who don't have the time to research individual stocks adequately.

Alternatively, blue chip ETFs can offer a narrower concentration of high-quality stocks than an S&P 500-tracking ETF or a Nasdaq-tracking ETF.

Related investing topics

Balancing your portfolio

Blue chips in a well-balanced portfolio

If you're looking for maximum growth in your stock investments, you'll also want to go beyond blue chip stocks to look at some up-and-coming small-cap stocks of innovative young companies seeking to disrupt their larger rivals. These high-growth upstarts aim to be the blue chip stocks of tomorrow.

However, just about every investor can benefit from having a portion of their portfolio invested in blue chip stocks. It doesn't have to be a set percentage; investors will have varying viewpoints about how much risk they want to assume.

But the more you want to preserve and protect the money you have invested in the stock market, the more attractive blue chip stocks will be as you try to meet your objectives and reach your long-term financial goals.

FAQ

Blue chip stocks FAQ

What are blue chip stocks?

Blue chip stocks are stocks of large, well-known, and widely respected companies. Most of these companies pay dividends and have many decades of profitable operation under their belts.

What are the blue chip stocks in the U.S.?

The U.S. plays host to more blue chip companies than any other country. Apple, Berkshire Hathaway, Coca-Cola, Johnson & Johnson, and American Express are all blue chip stocks with operations primarily based in the U.S.

Abbvie, Nike, Lockheed Martin, Honeywell, Northrop Grumman, and Procter & Gamble are additional examples of blue chip companies headquartered in the country. Many blue chips generate a substantial amount of their sales and earnings from other geographic markets, but most lists of blue chip stocks are primarily made up of U.S.-based companies.

Are blue chip stocks worth it?

Owning blue chip stocks is a smart move for most investors. Because they are backed by dependable, high-quality businesses, stocks in the category are often appealing as long-term investment candidates.

Blue chip companies typically have powerful competitive advantages and decades of profitable operations under their belts. While they may grow at slow rates compared to younger companies still in the earlier stages of addressing market opportunities, they tend to come with less risk and still offer investors the chance to achieve strong returns.

Is Apple a blue chip stock?

Apple is a blue chip stock. The company is a clear leader in its corner of the technology industry and has powerful competitive advantages. The tech giant has a fantastic history of delivering earnings growth, and it frequently ranks as the world's most profitable company. Apple stock also reliably pays a dividend.

Is Coke a blue chip stock?

Coca-Cola is a blue chip stock with a highly profitable business and nearly unparalleled history of returning cash to shareholders through dividends. The company owns one of the world's most powerful collection of brands. It also has one of the largest and most powerful infrastructure and distribution networks in the consumer goods sector. Thanks to its competitive advantages, Coke has been able to deliver consistent earnings growth and increase on an annual basis for over six decades.

What are the best blue chip stocks to buy right now?

Investing in a batch of blue chip stocks that includes Apple, Berkshire Hathaway, Johnson & Johnson, Coca-Cola, and American Express will give investors exposure to a diversified pool of high-quality companies. But it makes sense for investors to calibrate their stock purchases with their personal goals, industry expectations, and outlooks in mind.

For investors seeking blue chip tech stocks with opportunities in artificial intelligence, buying shares of Microsoft could be a smart move. For those seeking blue chip stocks in the aerospace and defense industry, Lockheed Martin has the makings of a good portfolio addition. Dividend-focused investors might want to buy shares of AbbVie.

In general, buying blue chip stocks is a good way for investors to build positions in top companies that offer reasonable risk-reward profiles. There's no perfect, one-size-fits-all prescription for which blue chip stocks will be the best portfolio fit, but the good news is that companies in the category are likely to be solid long-term investments.