Most people have heard the old saying, "Don't put all your eggs in one basket." The logic: If a farmer were to stumble while bringing the basket of eggs back from the henhouse, they could end up with a messy situation. Those words of wisdom go well beyond farming; they also perfectly encapsulate the idea of not risking all your money on a single investment.

One way investors can reduce their risk of a cracked nest egg is by diversifying their portfolio. Here's a look at what that means, as well as three tips to help you quickly diversify your investments.

What is portfolio diversification?

What is portfolio diversification? Why does it matter?

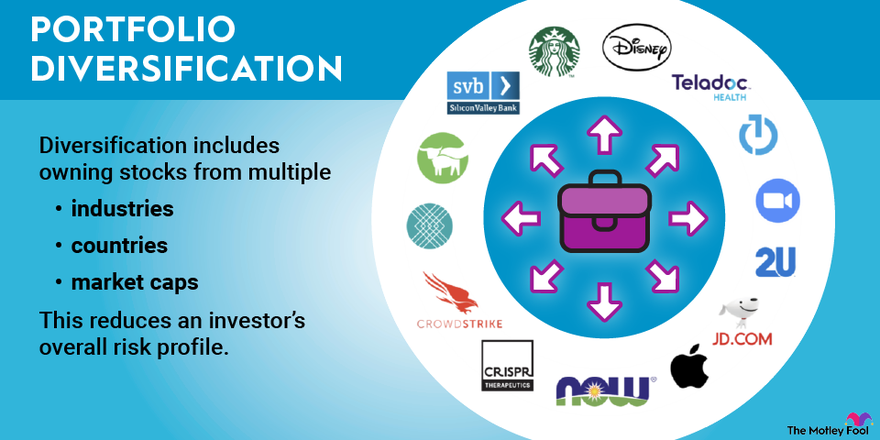

A diversified portfolio is a collection of different investments that combine to reduce an investor's overall risk profile. Diversification includes owning stocks from several different industries, countries, and risk profiles, as well as other investments such as bonds, commodities, and real estate. These various assets work together to reduce an investor's risk of a permanent loss of capital and their portfolio's overall volatility. In exchange, the returns from a diversified portfolio tend to be lower than what an investor might earn if they were able to pick a single winning stock.

Stock

How to build a diversified portfolio

How to build a diversified portfolio

A diversified portfolio should have a broad mix of investments. For years, many financial advisors recommended building a 60/40 portfolio, allocating 60% of capital to stocks and 40% to fixed-income investments such as bonds. Meanwhile, others have argued for more stock exposure, especially for younger investors.

One of the keys to a diversified portfolio is owning a wide variety of different stocks. That means holding a mix of tech stocks, energy stocks, and healthcare stocks, as well as some from other industries. An investor doesn't need exposure to every sector but should focus on holding a wide variety of high-quality companies. Further, investors should consider large-cap stocks, small-cap stocks, dividend stocks, growth stocks, and value stocks.

In addition to owning a diversified stock portfolio, investors should also consider holding some non-correlated investments (e.g., those whose prices don't ebb and flow with the daily gyrations of stock market indexes). Non-stock diversification options include bonds, bank certificates of deposit (CDs), gold, cryptocurrencies, and real estate.

Three tips for building a diversified portfolio

Three tips for building a diversified portfolio

Building a diversified portfolio can seem like a daunting task since there are so many investment options. Here are three tips to make it easy for beginners to diversify.

1. Buy at least 25 stocks across various industries (or buy an index fund)

One of the quickest ways to build a diversified portfolio is to invest in several stocks. A good rule of thumb is to own at least 25 different companies.

However, it's important that they also be from a variety of industries. Although it might be tempting to purchase shares of a dozen well-known tech giants and call it a day, that's not proper diversification. If tech spending takes a hit due to an economic slowdown or new government regulations, all those companies' shares could decline in unison. Investors should make sure they spread their investment dollars around several industries.

One quick way to do that for those who don't have the time to research stocks is to buy an index fund. For example, an S&P 500 index fund will aim to match the S&P 500's performance. The benefit of index funds is that they take a lot of guesswork out of investing while offering instant diversification. For example, with an S&P 500 index fund, you're buying shares of a single fund that gives you exposure to 500 of the largest public U.S. companies.

Another great thing about index funds is that their fees -- known as expense ratios -- are very low. That's because, with the best index funds, you're not paying for the expertise of a fund manager who's going to research and hand-pick investments for you.

2. Put a portion of your portfolio into fixed income

Another important step in diversifying a portfolio is to invest some capital in fixed-income assets like bonds. While this will reduce a portfolio's overall returns, it will also lessen the overall risk profile and volatility. Here's a look at some historical risk-return data on a variety of portfolio allocation models:

| Portfolio Mix | Average Annual Return | Best Year | Worst Year | Years with a Loss |

|---|---|---|---|---|

| 100% bonds | 6.3% | 45.5% | (8.1%) | 20 out of 96 |

| 80% bonds and 20% stocks | 7.5% | 40.7% | (10.1%) | 16 out of 96 |

| 40% bonds and 60% stocks | 9.9% | 36.7% | (26.6%) | 22 out of 96 |

| 20% bonds and 80% stocks | 11.1% | 45.4% | (34.9%) | 24 out of 96 |

| 100% stocks | 12.3% | 54.2% | (43.1%) | 25 out of 96 |

Although adding some bonds reduces a portfolio's average annual rate of return, it also tends to mute the loss in the worst year and cut down on the number of years with a loss.

While picking bonds can be even more daunting than selecting stocks, there are easy ways to get some fixed-income exposure. One of them is to buy a bond-focused exchange-traded fund (ETF).

3. Consider investing a portion in real estate

Investors who want to take their portfolio diversification to another level should consider adding real estate to the mix. Real estate has historically increased a portfolio's total return while reducing its overall volatility.

An easy way to do this is by investing in real estate investment trusts (REITs), which own income-producing commercial real estate. The sector has an excellent track record. In the 25-year period ending in 2021, REITs, as measured by the FTSE Nareit All Equity REIT Index, generated an average annual total return of 11.5%.

Several studies have found that an optimal portfolio will include a 5% to 15% allocation to REITs. For example, a portfolio with 55% stocks, 35% bonds, and 10% REITs has historically outperformed a 60% stock/40% bond portfolio with only slightly more volatility while matching the returns of an 80% stock/20% bond portfolio with less volatility.

Related investing topics

Diversification reduces the risk

Diversification reduces the risk of cracking your nest egg

Diversification is about tradeoffs. It reduces an investor's exposure to a single stock, industry, or investment option. While that can potentially cut into an investor's return potential, it also reduces volatility and, more importantly, the risk of a bad outcome. Investors should take diversification seriously. Otherwise, they're taking a big gamble that an outsized bet won't spoil their hopes of expanding their nest egg to support them in their golden years.

FAQs on portfolio diversification

What is a well-diversified portfolio?

A well-diversified portfolio invests in many different asset classes. It has a relatively low allocation to any single security. Because of that, if one security significantly underperforms, it won't have a meaningful impact on the portfolio's overall return. However, a well-diversified portfolio will typically deliver returns that roughly match those of the overall market.

What is considered a diversified portfolio?

A diversified portfolio contains a mix of asset types and investment vehicles. A diversified portfolio will typically hold several different stocks. An ideal diversified portfolio would include companies from various industries, those in different stages of their growth cycle (e.g., early stage and mature), some companies from foreign countries, and companies across a range of market capitalizations (small, mid, and large). In addition, it would hold bonds, cash, real estate, and commodities.