Do you have $20,000 to invest? Congratulations! Putting that money to work immediately is the best way to set yourself up for financial success. The key to achieving your financial goals is knowing that investing requires a long-term mindset -- thinking in terms of years and decades, not weeks and months.

Hopefully you've already established your emergency fund -- a savings account with enough money to cover your expenses for three to six months. With your additional $20,000, here are some ideas about how to invest those funds.

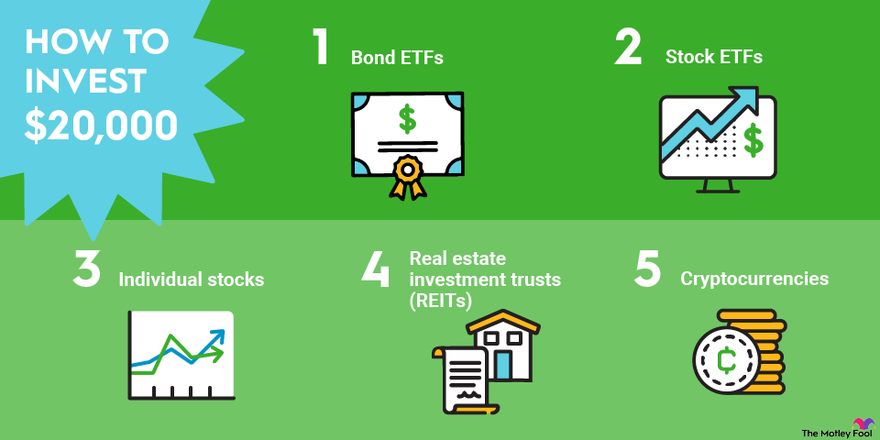

The best ways to invest $20,000

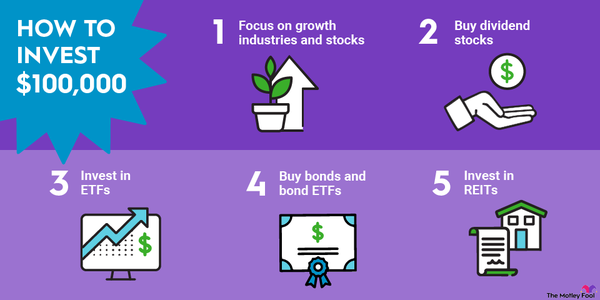

Here are five great investment options to consider:

Bond ETFs

1. Bond ETFs

Because bonds have a stated date when the borrower will pay back the face value of the bond, these are great investments if you need a certain amount of money at a known point in time. But bonds are usually sold in increments of $1,000 to $5,000, so buying shares in a bond-focused exchange-traded fund (ETF) might be an alternative if you have $20,000 to put to work.

Bonds

A bond ETF is a basket of debt spread across hundreds or thousands of organizations. Bond ETFs receive bond coupon payments and pay out the income to the fund's shareholders in the form of a dividend. A bond fund like the Vanguard Total Bond Market ETF (BND 0.23%) is a solid choice for long-term investors.

Stock ETFs

2. Stock ETFs

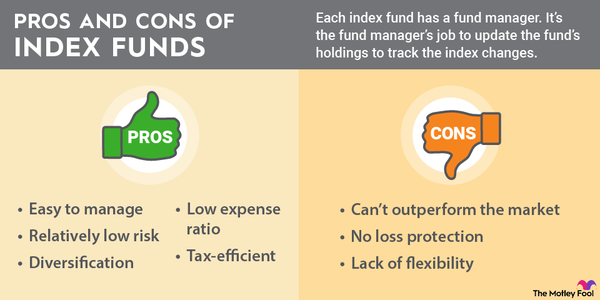

Investing in the stock market is one of the best ways to generate wealth over many years and decades, and buying shares in stock ETFs is a good place to start. Much like a bond ETF, a stock ETF owns a basket of stocks with the aim of tracking a particular market index such as the S&P 500 (SNPINDEX:^GSPC). One example of an ETF is the Vanguard Total Stock Market ETF (VTI 0.93%), which invests in all stocks trading on a U.S. stock exchange.

A key advantage of investing in ETFs is the "set-it-and-forget-it" nature of the investment. You don't need to choose individual stocks or make any buying or selling decisions; you can simply buy and hold an ETF investment.

Individual stocks

3. Individual stocks

It's easier than ever to purchase individual shares of a company. Owning individual stocks gives you control over exactly what's in your investment portfolio, which you may choose to align with both your values and goals, as well as your desired performance over time.

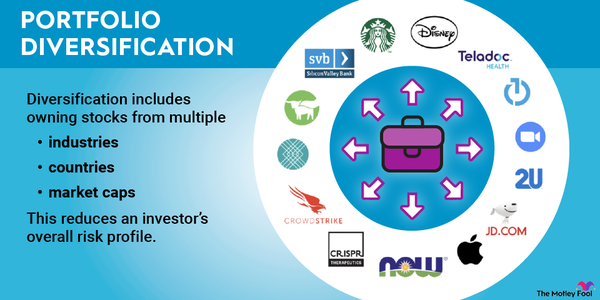

Since owning individual stocks increases your portfolio's exposure to the performances of individual companies, it's a good idea to diversify your stock holdings by investing in at least 10 to 15 stocks to start. With $20,000 to invest, that works out to about $1,500 to $2,000 per company.

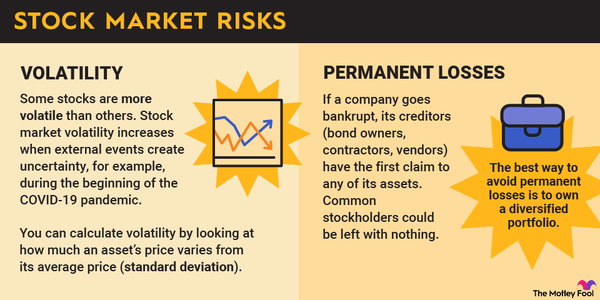

Like buying shares in stock ETFs, the key to investing in individual stocks is to buy and hold them for a long period of time. The prices of individual stocks can be volatile, so it's important to focus on the business fundamentals or other original reasons for your stock purchase regardless of how the price fluctuates.

Stock Market Volatility

REITs

4. Real estate investment trusts (REITs)

Buying shares in a real estate investment trust (REIT) is a convenient way to profit from the growth in real estate's value without being obligated to buy and maintain real estate. REITs generate income in the form of rent payments from portfolios of properties managed by real estate firms. The rental income is then distributed to the REIT's shareholders in the form of dividend payments.

Like individual stocks, the share prices of REITs can fluctuate in value, usually in tandem with real estate prices. But most REITs are generally safe investments that both diversify an investment portfolio and generate stable streams of income.

Cryptocurrency

5. Cryptocurrencies

Investors with a high tolerance for risk can consider investing in cryptocurrencies. Investor interest in cryptocurrencies is rising, with Bitcoin (BTC -2.44%) and Ethereum (ETH -0.98%) leading the way in terms of market value and adoption rate. Bitcoin, the original cryptocurrency, was valued a decade ago at just a few U.S. dollars and now trades for tens of thousands of dollars. Thousands of cryptocurrencies are in circulation today, making cryptocurrency a volatile investment.

If buying cryptocurrencies directly seems too risky, you can consider purchasing cryptocurrency or blockchain stocks. Block (SQ 2.32%), for example, has a large stake in Bitcoin and is making new digital payment applications available that accept cryptocurrencies.

Related investing topics

How to decide

Which type of investment is right for you?

Before you decide exactly how to invest your money, consider these important factors:

- Your financial objectives: What's your investment goal? You may choose to invest differently depending on whether you need to make a specific purchase such as a down payment on a home or want to use the money as income in retirement.

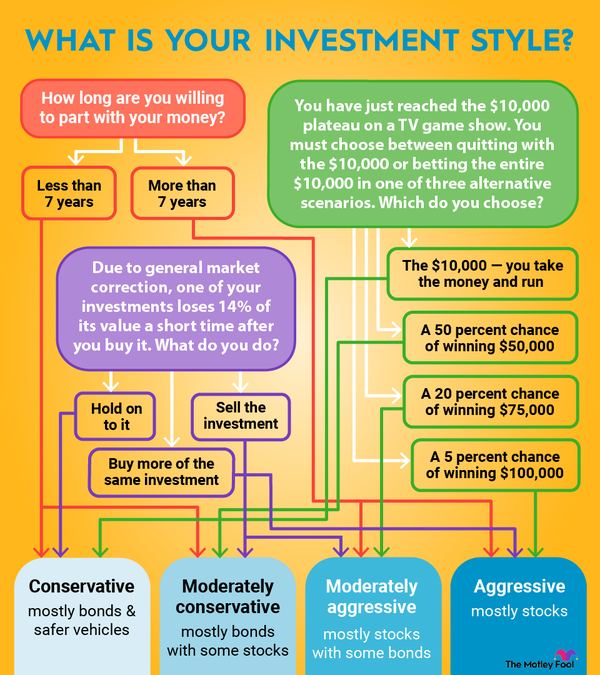

- Your investment timeline: When do you need the money? Whether you have a specific date in mind or are thinking in decades is relevant to the types of investments you choose.

- Your appetite for risk: How will you respond if your portfolio significantly drops in value? Investing always confers risk, but you can choose safe investments with relatively low return profiles or riskier investments that are more likely to generate high returns.

After pondering your priorities, it's time to start choosing some investments. No matter how you choose to allocate that $20,000, you can increase your wealth exponentially over time. The key is to maintain a well-diversified portfolio, focus on the long term, and consider making more deposits to your account over time to maximize your investment returns.

FAQs about how to invest $20K

What can I do with $20K to make more money?

Investing in assets like stocks, bonds, ETFs, real estate funds, and cryptocurrencies is a way to passively make more money. You can put your hard-earned savings to work for you, and after holding those investments for many years, your chances of turning a profit increase dramatically.

How can I turn $10K into $100K?

Investing in high-quality stocks -- which represents ownership of a real-life business -- has historically been the best way to grow your investment account. After buying and then holding for years in a retirement or brokerage account, stocks could eventually turn an initial $10,000 investment into $100,000.

Is $20,000 a good amount of savings?

It's a great start to saving for your future. Buying and holding quality investments for the long-term (many years) can dramatically compound an initial $20,000 into a much larger amount of savings. But for the best investment results, consider periodically adding to your savings whenever you can, perhaps making deposits monthly, quarterly, or at least once every year.