Creating resolutions is a time-honored tradition for a new year. And, for many Americans, resolutions involve finding ways to better manage money. According to a survey from The Ascent, 66% of Americans will make financial New Year's resolutions this year.

Unfortunately, far too many of those resolutions made in the financial new year will be abandoned by March. Yours don't have to be among them, though. If you think carefully about the goals that are most important to you and break big goals down into small ones, you can maximize your chances of success.

Not sure what types of financial resolutions could have the biggest impact on your life? Check out these eight goals that investment experts recommend and see if you can adopt any of them as your own:

- Review your long-term financial plan.

- Get started investing.

- Earn your employer match.

- Be smarter with your cash.

- Stay the course with your investments.

- Make tax-efficient investing a priority.

- Start a healthcare savings account.

- Put your estate plan in place.

1. Review your long-term financial plan.

1. Review your long-term financial plan.

With inflation surging this year, it's easy to get caught up in trying to cover day-to-day expenses and end up in credit card debt. If you're found yourself focused on the present, resolving to consider your long-term goals could be just the ticket to turn things around in 2024.

"I like my clients to begin the year reviewing their budgets and their financial plans to make sure they are on track to meet their long-term financial goals," advises Aviva Pinto, CDFA, CDS, and managing director at Wealthspire Advisors.

Pinto suggests starting with year-end statements provided by banks and credit card companies to see where your money is going and identify areas of overspending. After making sure you have a budget in place that prioritizes investing, she advises maximizing contributions to retirement plans such as a 401(k) or Roth IRA.

She also suggests making sure you're maintaining the right asset allocation, which means confirming you're exposed to an appropriate level of risk for your investing timeline.

2. Get started investing.

2. Get started investing.

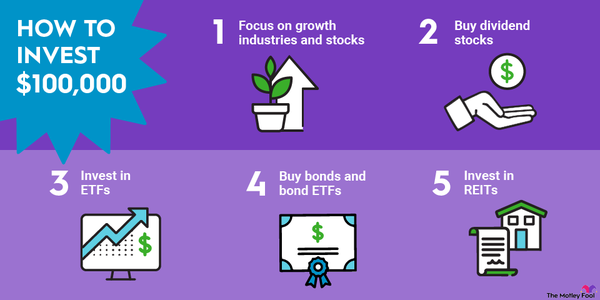

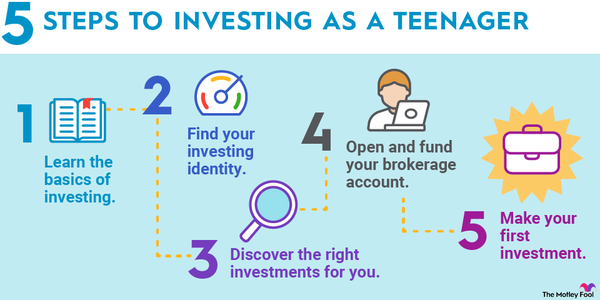

The current economic conditions may have you wary of investing right now -- especially if you're just getting started. But Melanie Hanson, editor-in-chief of EDI Refinance, recommends jumping into the market in 2024 with a focus on investing for the long term.

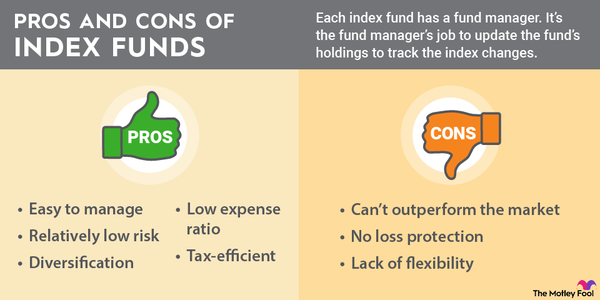

She urges investors to aim for a distant goal like retirement or paying for a child's college tuition, and to invest in diversified, proven assets like index mutual funds. The important thing is simply getting started. With compound interest, your money will grow faster and faster over time, even if economic conditions make your start a bit rocky.

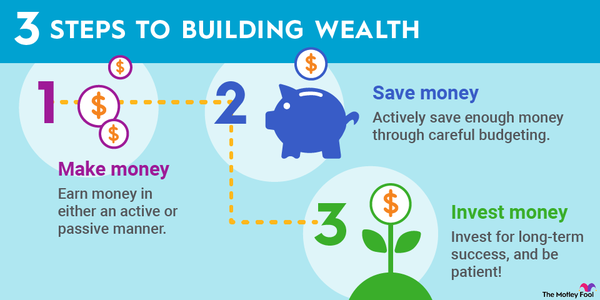

While Hanson warns you may not earn huge returns right now, investing in the stock market has proven to be the best way to build wealth over the long term. If you resolve to get started investing ASAP, your money can begin working for you, and the power of compound growth will accelerate your wealth-building efforts over time.

66% of Americans are planning on making a financial New Year's resolution for 2024.The Ascent

3. Earn your employer match.

3. Earn your employer match.

If you didn't take full advantage of your employer's retirement plan in 2023, you missed out -- and you may want to resolve not to make the same mistake in 2024.

Robyn Breshears, executive director for sales, service and support at Arvest Bank, calls company matching “essentially free money.” Breshears warns that many people cut back on retirement investing and hoard cash during times of economic uncertainty -- a mistake that can jeopardize your future financial security.

You have just one chance to max out your employer match each year. And the matching funds your employer provides when you contribute to your 401(k) can provide as much as a 100% return if your company matches your contributions on a dollar-for-dollar basis. If you make just one financial wellness resolution this year, plan to not leave retirement money on the table.

4. Be smarter with your cash.

4. Be smarter with your cash.

When focusing on personal finance issues and developing your investing strategy, it's easy to get caught up in looking at what you'll do with the money in your brokerage account or in different types of retirement accounts. As a result, the cash you're keeping in a savings account may go unnoticed.

If that sounds like you, this advice from Jamie Hopkins, managing partner of wealth solutions at Carson Wealth and author of Find Your Freedom, could help guide you toward a resolution to make better choices for your liquid assets in 2024.

"One thing I would push on everyone as we enter the new year from an investment and financial planning standpoint is to be smarter with cash," Hopkins says. Since money market funds and banks are paying extremely low interest, make sure you aren’t carrying more cash than you need right now. Also, look for alternatives such as certificates of deposit and ultra short-duration Treasury exchange-traded funds (ETFs). They may be a better place to store your cash heading into next year, generate more yield, and leave you better off overall.

Although you need to make sure your emergency fund is accessible in case of an unexpected expense, there's nothing wrong with optimizing your savings and trying to earn a little better return on investment to help with your wealth-building efforts.

Related resolution topics

5. Stay the course with your investments.

5. Stay the course with your investments.

For many investors, recent market volatility has been hard to handle. That's why it's so important to resolve to commit to your investment strategy and stick with it -- even over bumps in the road. That's what Jason Moser, a senior analyst and lead advisor at The Motley Fool, has done.

"One resolution I always like to set at the beginning of each year is to see if I can go the entire year without selling any shares," Moser says. "I find that when I approach each year with this mindset of avoiding selling, it also encourages me to think a little bit more about the stocks I want to buy, making sure that I'm confident in my analysis and commitment to owning shares for years as opposed to quarters."

Although Moser adds that he'd make an exception if he really needed the capital for expenses, his commitment to adding to his favorite holdings as opportunities arise is a resolution everyone should consider adopting. After all, a buy-and-hold strategy has historically proven to be the best way to build wealth.

6. Make tax-efficient investing a priority.

6. Make tax-efficient investing a priority.

With smart investing moves come profits -- and taxes on those profits. But you can resolve to make smart moves that minimize the cut the IRS takes.

Adam Nash, former Wealthfront CEO, co-founder/CEO of Daffy.org, and adjunct personal finance lecturer at Stanford University, offers suggestions for making smart year-end tax moves, including implementing a tax-loss harvesting strategy.

As Nash notes, tax-loss harvesting allows you to offset gains from earlier in the year by selling selected stocks at a loss to lower the amount of capital gains tax.

This is just one of many potential strategies you can use to reduce your tax bill. Nash also suggests estimating gains and taking the time to explore options to lower tax liabilities before the end of the year.

Although thinking about taxes may not be at the top of your list of fun things to do, resolving to make 2024 the year you focus on tax-reduction efforts could to help keep more of your gains in your pocket. If you aren't sure where to start when it comes to tax reduction, a financial advisor can help.

Paying off debt is the goal of 53% of Americans with financial resolutions.The Ascent

7. Start a healthcare savings account.

7. Start a healthcare savings account.

If the COVID-19 pandemic has taught us nothing else, it's that health risks can come out of nowhere. That's especially true for seniors who are at an increased risk of ailments and who may be on a fixed income that can't easily cover medical bills.

To make sure your retirement isn't derailed by unexpected medical expenses, it makes sense to follow the advice of Shobin Uralil, chief operating officer and co-founder of the benefits solution provider Lively. Uralil recommends resolving to start saving for healthcare in 2024.

"While 401(k)s and IRAs are more widely known for retirement savings, not as many are prepared for health expenses," Uralil says. "Saving for healthcare -- now and into retirement -- should be everyone’s New Year’s resolution."

Uralil recommends investing in a health savings account (HSA) since these portable accounts offer important tax advantages that aren't available with most types of retirement accounts. HSAs also do not mandate required minimum distributions, as 401(k) and IRA accounts do after age 72.

You need to have a qualifying high-deductible health plan to invest in an HSA, though. If you aren't eligible, you can still create a dedicated savings account earmarked for medical expenses.

8. Put your estate plan in place.

8. Put your estate plan in place.

Investing is about building wealth, but you'll also want to make sure you have plans in place to protect the assets you've worked so hard to acquire. If you don't already have an estate plan, you're falling down on the job and should resolve to make one this year.

Seventy percent of Americans don't have a will. Having an estate plan is critical for helping you leave behind a legacy to your loved ones, as well as to the causes you love, says Allison Lee, director of trusts and estate content at FreeWill.

Lee recommends completing your estate plan while you're in good health rather than being forced into a "rushed estate planning process when your health is already in its declining stages."

What goals should you set in the financial new year?

Each of these eight resolutions could help you to improve your financial wellness. But ultimately, you need to consider the state of your own finances when deciding what goals to set.

Whether it's paying off a personal loan or credit card debt, improving your financial literacy, boosting your credit score, or becoming a better investor, you should set a goal you believe in and then hold yourself accountable.

If you set SMART goals -- Specific, Measurable, Achievable, Relevant, and Time-bound -- you can maximize the chances that you'll actually stick to your financial New Year's resolutions all the way to 2025 and beyond. Get started now so you can ring in the next new year by celebrating the financial progress you made all year long.