If you've recently gotten a raise, tightened up your budget, or received a financial windfall, you might find yourself with more money available than before. People in this situation often ask themselves a common question: What should I do with extra money to improve my financial situation?

There are many great ways you can use your extra money to build wealth and a better future. You'll find the best options on the list below and can choose the ones that best fit your financial needs and goals.

Ten ways to invest extra cash

1-3

1. Pay off high-interest debt

The first thing to do is pay off high-interest debt, if you have any. Credit card debt is the most common example. The average credit card has an interest rate of more than 20%, making most credit cards an extremely expensive way to borrow money.

Look at it like this: you're not going to find an investment that guarantees a 20% return on your money. If you pay off a credit card charging you that much, you're effectively getting a 20% return on the money you spend.

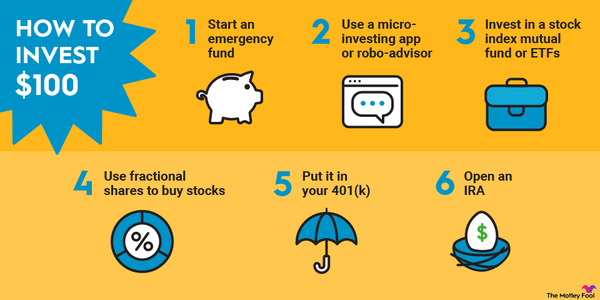

2. Boost your emergency fund

Your emergency fund should have enough money to cover your living expenses for at least three to six months. For example, if your essential bills cost $4,000 per month, it's a good idea to have $12,000 to $24,000 in emergency savings. If yours isn't there yet, then that's a smart place to put your extra cash.

An emergency fund isn't exactly an investment, but it does help protect your investments. Without it, you risk needing to dip into those investments when faced with emergency expenses.

3. Increase retirement plan contributions

It's recommended to save at least 15% of your income for retirement. Even if you're already doing that, it never hurts to add more to your nest egg.

Retirement plans vary depending on your job and employer. If your employer offers a 401(k) and matching contributions, then your first goal should be maxing out the amount your employer will match. Another option is an individual retirement account (IRA) that you open on your own.

4-6

4. Invest in an exchange-traded fund or mutual fund

Exchange-traded funds (ETFs) and mutual funds are great ways to build a diversified portfolio without picking individual stocks. They include a group of stocks and/or bonds based on the goal of the fund. For example, you could invest in a mutual fund or ETF that tracks the S&P 500.

Both types of funds are similar in how they work, but they have one main difference: ETFs are similar to stocks. You buy them in shares, and they have real-time pricing. Mutual funds are priced once per day at the end of the trading day, and you typically buy in dollars, not shares. ETFs also generally have lower expense ratios, because they're passively managed, but there are also low-cost mutual funds available.

5. Buy individual stocks

If you want to build your own investment portfolio, you can open a brokerage account and purchase individual stocks that you like.

Before you buy anything, take some time to learn how to pick a stock. Stock picking is challenging and time-consuming, so it's not something to rush into. But if it interests you and you're willing to work at it, you could do well picking your own investments.

6. Invest in real estate

Real estate investing has become much more accessible with the rise in real estate investment trusts (REITs). A REIT is a company that lets groups of investors pool their money and invest in real estate together.

These trusts are a more affordable way to add real estate to your portfolio. Since REITs need to pay at least 90% of taxable income to investors, they're also a fantastic choice if you're looking for dividend stocks that provide consistent passive income.

7-10

7. Buy bonds

If you're looking for a relatively safe place to put your money, you can invest in bonds. A bond is an asset offered by a government or corporation to raise money. In return, investors receive a fixed interest rate.

When you buy a bond, you typically receive interest payments twice a year. You also get your original investment back on the bond's maturity date. Alternatively, you can sell the bond early if the value has increased since you bought it.

8. Get a bank account bonus

Many banks offer bonuses as an incentive for new clients. Each offer includes an amount and requirements to earn the bonus. For example, a bank could offer a $300 bonus if you open an account and have at least $3,000 in direct deposits in the first three months.

Bank account bonuses are a safe moneymaking opportunity that many consumers don't know about. If you don't mind getting a new bank account and you can fulfill the terms of the deal, it's an easy way to add to your savings.

9. Try cryptocurrency investing

Cryptocurrencies are digital currencies that use cryptography for their transaction records. Bitcoin is the first and most well-known, but there are now thousands of cryptocurrencies you can buy.

If you want a high-risk, high-reward investment, cryptocurrencies fit the bill. They're extremely volatile, with some seeing gains or losses of more than 1,000% in a matter of months. Cryptocurrency shouldn't be a big part of your portfolio because of the risk involved, but it's an exciting option for investing extra cash.

Related investing topics

10. Spend on yourself

It's great to look for ways to build wealth with extra money, but it's also OK to spend on yourself. You could put more money into a hobby, save up for a vacation, or make that big purchase you've been putting off.

There's nothing wrong with rewarding yourself for your hard work. It's important to find that balance between being financially responsible and using your money to improve your quality of life.