If you have $100,000 to put to work, then you are well-positioned to achieve financial independence. But how should you go about investing that money? Your investment portfolio should be able to withstand unexpected crises (such as the COVID-19 pandemic) while still benefiting from booming sectors of the economy. With this much cash on hand, it's also important to invest in a way that minimizes fees and taxes.

Here are some tips for investing $100,000.

Before you start investing

Before you start investing

Although you may be eager to begin investing money in the stock market or another asset, two financial objectives should be satisfied first:

- Pay off high-interest debt. You should start by repaying high-interest debt such as credit cards. The interest on credit cards is compound interest, which is the most expensive interest for borrowers. Low-interest debts such home mortgages and auto loans do not need to be repaid before you start to invest.

- Start an emergency fund. Establish an emergency fund before investing in the stock market. Determine how much money you need for roughly six months' worth of basic expenses and deposit that amount into a savings account. Having cash available mitigates the need to withdraw money from your portfolio to pay for an unexpected expense.

Determining what kind of investor you are

Determining what kind of investor you are

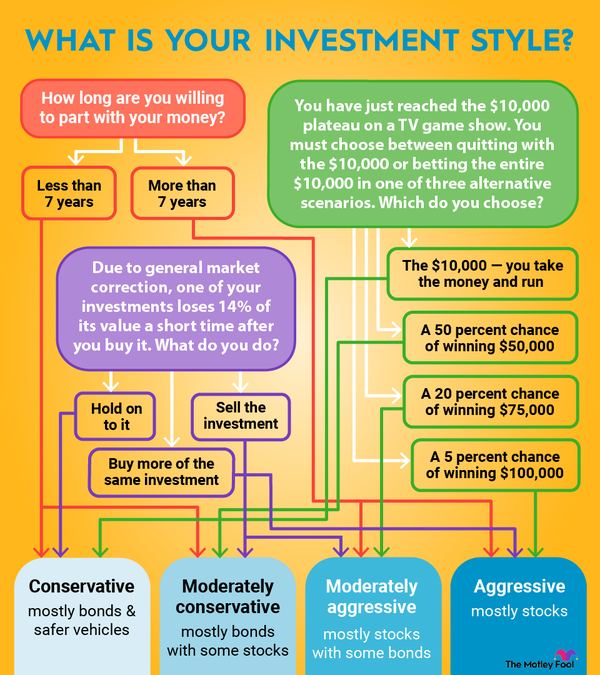

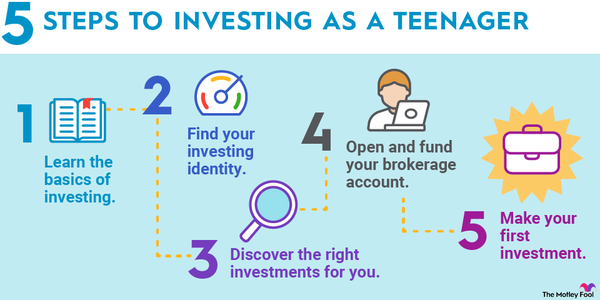

Before you invest any money, it's also important to think about your goals. Ask yourself these questions:

- What is my investing objective? You may be saving for a large expense such as a down payment on a house or for retirement. You might set up a different account for each objective such as one for retirement and another for a shorter-term savings goal.

- When do I need the money? Whether you need money in five or 30 years from now makes a major difference in how you should approach investing your cash.

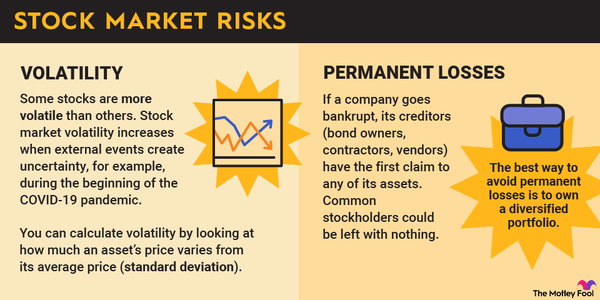

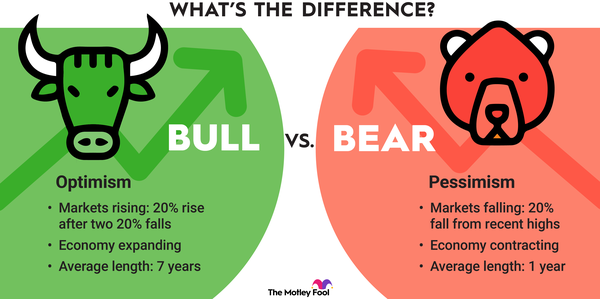

- What is my appetite or tolerance for risk? Investing involves risk, so you should consider how you are likely to react when an investment loses value, or whether enduring ups and downs in account value is something you are willing to accept.

- Do I want to be actively involved with my investments? If you don't want to choose your own investment options (more on that below), there are investment advisors out there who can help. If you prefer a low-cost online approach, robo advisors (automated investment management services) have become one way to get a diversified portfolio based on your risk tolerance and goals.

When it comes to investing, understanding your preferences and needs is important. Buy-and-hold investing, for most investors, is the easiest way to cope with the inevitable price volatility of the stock market. However, if you plan on needing the money at a predetermined time or aren't comfortable with the variables of being an investor, this should drastically alter the types of investment choices you make.

How to invest $100K

How to invest $100K: Five best ways

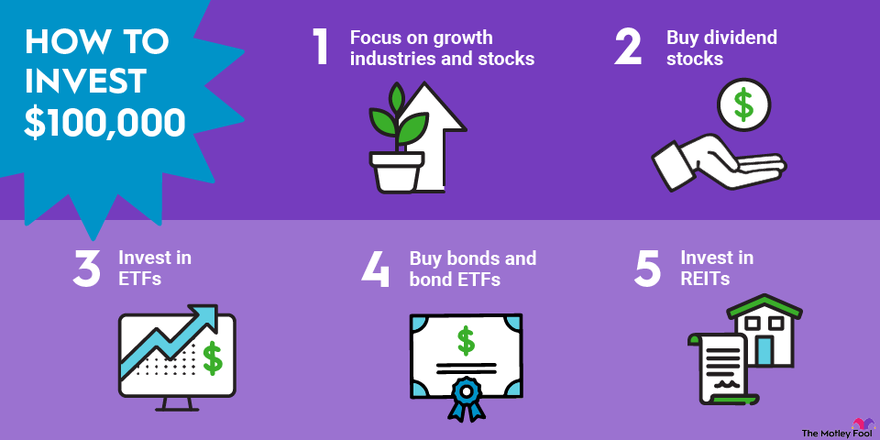

Here are some of the best ways to invest $100,000:

1. Focus on growth industries and stocks.

The world economy is changing at a rapid pace, with some industries expanding and others contracting. Some of the fastest-growing sectors include cloud computing, e-commerce, financial technology, and healthcare.

The technology sector in particular is attractive as a growth industry. Technology innovations drive progress in essentially every other industry, and tech's dominance has only been accelerated by the COVID-19 pandemic.

Investing in growth stocks can help your portfolio to outperform the broader stock market. Not only are fast-growing companies expanding faster than other enterprises, but owning the stocks of nimble businesses can help your portfolio to more quickly recover from recessions or other stock market shocks.

As for specific stock picks, Microsoft (MSFT -2.45%), Nike (NKE -0.74%), Visa (V 0.05%), and Warren Buffett's Berkshire Hathaway (BRK.A -0.3%)(BRK.B -0.26%) have been steadily growing for decades. The five tech giants -- Facebook (NASDAQ:FB), Apple (AAPL 0.52%), Amazon (AMZN -1.65%), Netflix (NFLX 1.74%), and Google's parent Alphabet (GOOGL -1.97%)(GOOG -1.96%) -- are solid options in the technology realm.

Stocks such as these may not be the "cheapest" stocks available, but they trade at premiums for good reason. Each of these companies is steadily increasing both revenue and profitability and plays a core role in the modern economy.

Since investing in high-growth businesses can greatly increase your portfolio's volatility, you should limit the portion of your portfolio devoted to growth stocks to a minority of your holdings. Exactly how much money you choose to invest in growth stocks depends on your risk appetite and investment time horizon.

2. Buy dividend stocks.

Investing in dividend-paying stocks is a great way to generate a stable source of passive income, which you can either reinvest or use to supplement your income. A dividend is a portion of profits that a company chooses to distribute, usually in cash, to its shareholders.

The best dividend-paying companies are those that steadily increase the dividends paid over time. A company that consistently raises its dividend is usually a growing company. To evaluate which companies are best positioned to raise their dividends, consider the free cash flow of the company in question.

A company with an increasing stock price and dividend can generate significant investment returns over long time horizons. The key is to use your dividends to buy more shares.

When selecting dividend stocks, don't simply invest in the stocks with the highest dividend yields. An above-average dividend is often a indicator that there's something wrong with the company.

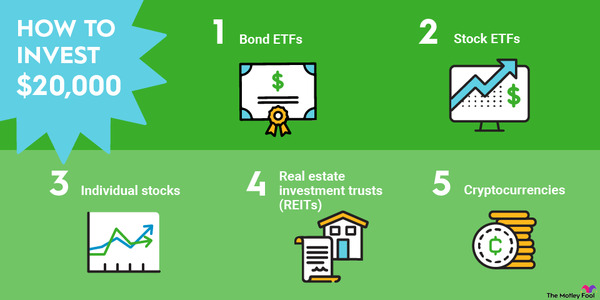

3. Invest in ETFs.

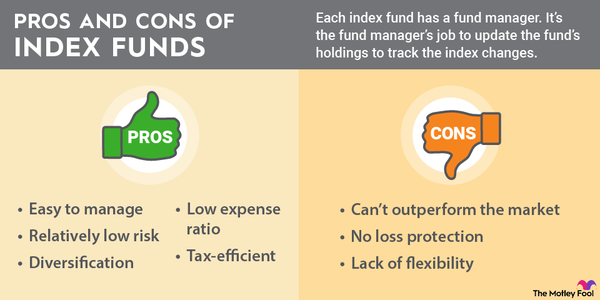

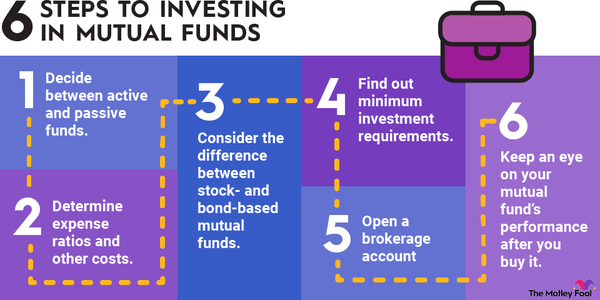

Buying shares in exchange-traded funds (ETFs) is a great option for investors who don't want to choose individual stocks. These passively managed funds track the performance of certain indexes, have low expense ratios, and can provide exposure to entire asset classes. ETFs, which confer instant portfolio diversification, are also well-suited for taxable investment accounts since their holdings change infrequently.

An ETF may be indexed to the S&P 500 (SNPINDEX:^GSPC), such as the iShares Core S&P 500 ETF (IVV -0.42%). Others, such as the Vanguard Total Bond Index (BND -0.28%), are correlated with the broad performance of bonds issued by U.S. companies.

Many ETFs are focused on specific industries, such as the Vanguard Information Technology ETF (VGT 0.04%), which invests in technology and software stocks. Funds with a narrower scope that focus on secular growth industries are more likely to outperform the broader stock market, but prices will also be more volatile than an ETF based on a broad-based market index.

4. Buy bonds and bond ETFs.

You can also add bonds to your investment portfolio. The values of bonds generally fluctuate less than the prices of stocks, making them well-suited for short-term investing and for investors who prefer certainty about investment rates of return.

Bonds

A bond is a loan to a business or organization. Bondholders are entitled to collect interest payments during the bond's term and receive the bond's face value in a lump-sum payment at the end of the period. Although bonds are generally less risky than stocks, they also generate lower returns over the long term. The bonds with the highest yields are known as junk bonds and are issued by companies that are less financially stable than their peers.

Another consideration when investing in bonds is that the interest payments from bonds can be taxed as income if you are using a taxable brokerage account. Exceptions include most municipal bonds, which are bonds issued by local governments.

Most bonds can only be purchased in $1,000 or $5,000 increments, which can make it difficult to diversify your bond holdings. For this reason, many investors instead opt to put their money in bond ETFs since they are more affordable and already diversified.

5. Invest in REITs.

While buying real estate is another great way to diversify your investment portfolio, owning property is not cheap. Even owning a few properties would not result in a diversified portfolio. For that reason, many investors may prefer to buy shares in real estate investment trusts (REITs).

REITs are professionally managed portfolios of properties. Most REITs are organized around a real estate theme such as shopping malls or data centers. Because REITs are required to disburse to shareholders at least 90% of their taxable income, which is generated by rent and interest payments, REITs often pay higher dividends than most stocks. Their share prices can also appreciate in value as the price of real estate rises.

Shares of REITs trade on stock exchanges just like shares of any public company. REITs can be especially appealing to income-focused investors, but it's important to realize that REIT payouts are typically taxed as ordinary income in taxable brokerage accounts.

Remember to diversify your portfolio

Remember to diversify your portfolio

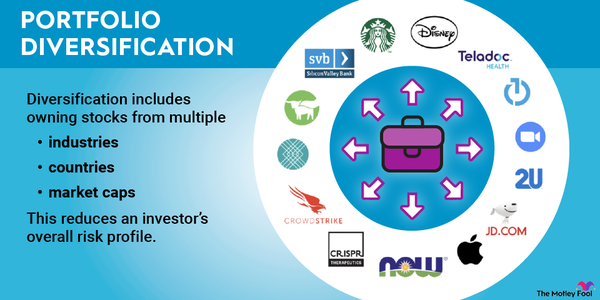

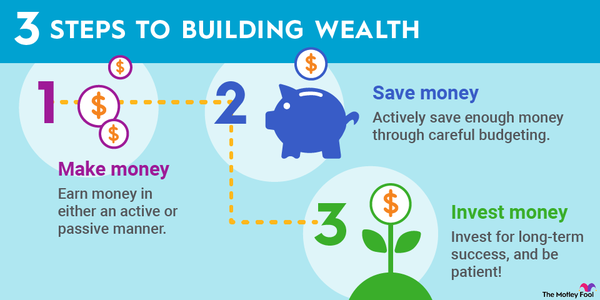

Regardless of how you choose to invest your $100,000, establishing a diversified portfolio is key to achieving your financial goals. No single company or investment should have an outsized place in your portfolio. Diversifying eliminates the risk of your portfolio's value changing dramatically if one company encounters misfortune. A diversified portfolio is also more likely to generate relatively consistent returns from year to year.

A good range for how many stocks to own is 15 to 20. You can keep adding to your holdings and also invest in other types of assets such as bonds, REITs, and ETFs. The key is to conduct the necessary research on each investment to make sure you know what you are buying and why.

Invest to minimize taxes and fees

Invest to minimize taxes and fees

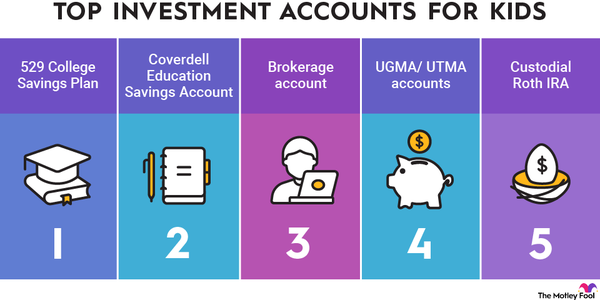

When putting your $100,000 to work, take care to minimize taxes and fees. Over long periods of time, expenses on your investments can significantly reduce your returns since every dollar subtracted from your portfolio is a dollar that is no longer earning compound interest.

Consider using a tax-advantaged retirement account. Individual retirement accounts (IRAs), including traditional IRAs and Roth IRAs, confer valuable tax savings. Contributions to traditional IRAs are often deductible from your tax bill, and withdrawals in retirement -- when you may be in a lower tax bracket -- are taxed as ordinary income. Contributions to Roth IRAs are made with after-tax dollars, and withdrawals in retirement are tax-free.

Other tax-advantaged options include 401(k) plans, if your employer offers one, and health savings accounts (HSAs). Every tax-advantaged retirement account has its own restrictions, but you are not limited to investing in just one type of account.

Regardless of the type of retirement account, the earnings accumulated in the account are tax-deferred. And, in a taxable investment account, you are not obligated to pay taxes on gains until you sell the security (except for dividends, which are usually taxed as ordinary income). Your tax burden is significantly reduced if you own the stock for more than a year because you pay the long-term capital gains tax rate.

All investments bear some sort of expense. Be on the lookout for hidden fees, especially if you invest in annuities offered by insurance companies or mutual funds. Fees can be assessed annually or on a per-trade basis and add up over time. If presented with two very similar investment options, consider the investment with lower fees.

Related investing topics

A recap

A recap on how to invest $100,000

- Pay off high-interest debt.

- Establish an emergency fund.

- Begin your investing journey.

Your specific investment goals and risk appetite predominantly determine how you should invest your money. Risk-averse investors or those nearing retirement may choose to invest more conservatively, while risk-seekers or younger investors may opt to buy mostly stocks.

Once you establish your portfolio, remember to stay focused on your investment goals and the reasons why you invested in each security. Market volatility is inevitable, but that matters little if your original investment thesis remains unchanged. Plan to continue adding to your best investments over time, sell chronically underperforming holdings, and look forward to enjoying the substantial wealth that you generate by investing $100,000.