Facebook is a ubiquitous social media platform. More than 2 billion people log into their Facebook accounts each day and more than 3 billion actively use the platform every month, making it the biggest social media site in the world. Even more people log into the company's family of social platforms each month.

A captive audience provides Facebook with a treasure trove of data that it can use to sell advertising. It generates billions of dollars in ad sales each year.

As a Facebook user, you might wonder how to invest in the company. Here's a step-by-step guide on investing in Facebook stock and some factors to consider before investing in the technology stock.

Is Facebook publicly traded?

Is Facebook publicly traded?

Facebook completed its initial public offering (IPO) in 2012. At the time, it traded on the Nasdaq stock exchange using the stock ticker FB.

However, the company has evolved over the past decade. In 2021, the company rebranded to showcase its move beyond social media. Among its biggest investments is in the metaverse, which led the company to change its name to Meta Platforms (META -0.4%) and its stock ticker to META.

In addition to its namesake social media platform and metaverse investments, Meta owns several other technology brands. The most notable ones are:

- The photo and video-sharing app Instagram.

- The text update and public conversation app Threads.

- Mobile messenger service WhatsApp.

- Virtual reality technology company Reality Labs and its Meta Quest VR headsets.

How to invest

How to invest in Facebook

While you can't invest specifically in Facebook's social media platform, you can invest in its parent company Meta Platforms. You can buy shares of Meta with any brokerage account. If you still need to open one, these are some of the best-rated brokers and trading platforms. Here's a step-by-step guide to buying Meta stock using the five-star-rated platform Fidelity.

Fidelity makes it easy to buy stocks. Its website offers a video tutorial and a step-by-step guide. Here's a screenshot of how to place a stock trade with Fidelity:

On this page, fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to spend on fractional shares.

- The ticker symbol (META for Meta Platforms).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price.

Once you complete the order page, click the "Place Order" button at the bottom and become a Meta Platforms shareholder.

ETF options

Alternative ways to invest in Meta Platforms

Instead of buying Meta Platforms shares directly, you can passively invest in the technology company through a fund holding its shares.

Meta Platforms is among the world's largest companies by market capitalization and is a widely held stock. Meta is in several stock market indexes, including the Nasdaq Composite and S&P 500 index. As a result, index funds and exchange-traded funds (ETFs) that benchmark their returns against those indexes hold Meta stock.

According to ETF.com, 410 ETFs held more than 200 million shares of Meta as of late 2023. The SPDR S&P 500 ETF Trust (SPY 1.13%) held the most shares at 25.3 million. Meta Platforms was the fund's sixth-largest holding at 1.9% of its assets.

Other ETFs have more exposure to Meta stock. The Communications Services Select Sector SPDR (XLC 2.53%) has the largest allocation to Meta stock at 25.6%, making it a potentially attractive way to invest passively in Meta stock.

Should I invest?

Should I invest in Meta Platforms?

Before investing in Facebook's parent company's stock, you need to determine whether Meta Platforms shares are a good investment. Here are some factors to consider before investing in Meta stock.

Profitability

Profitability

Meta Platforms is a profitable company. The social media giant reported $11.6 billion in net income in the third quarter of 2023. That was up 164% from the prior-year period as Meta focused on increasing revenue and cutting costs to improve profitability. Revenue rose 24%, while total costs were down 7% in the period.

The company behind Facebook is also free cash flow-positive. Meta generated $20.4 billion of cash provided by operating activities in the third quarter of 2023 and $13.7 billion in free cash flow after capital expenses. That enabled the technology giant to return cash to investors by repurchasing shares ($3.7 billion in the third quarter) while maintaining a cash-rich balance sheet ($60.1 billion in cash, equivalents, and marketable securities against $18.4 billion of long-term debt).

Meta unveiled a restructuring program in late 2022 to cut costs and improve its profitability. It consolidated facilities, laid off employees, and canceled several data center projects. Those actions paid big dividends in 2023, driving soaring profits in the third quarter.

Cash Flow

Revenue

Meta Platforms generated $34.1 billion in revenue in the third quarter of 2023, about 23% higher than the prior year period.

The company has three revenue sources:

- Family of Apps Advertising: $33.6 billion or 98.5% of the total.

- Family of Apps Other: $293 million or 0.8% of the total.

- Reality Labs (VR and metaverse): $210 million or 0.6% of the total.

Meta also launched its new Threads platform in mid-2023 to compete against X (formerly Twitter). While it's not currently a revenue driver for the company, analysts estimate it would produce $8 billion in revenue by 2025, assuming it reaches 200 million active users. That's not out of reach, considering the app quickly hit 100 million users shortly after its launch.

Meta Platforms' valuation

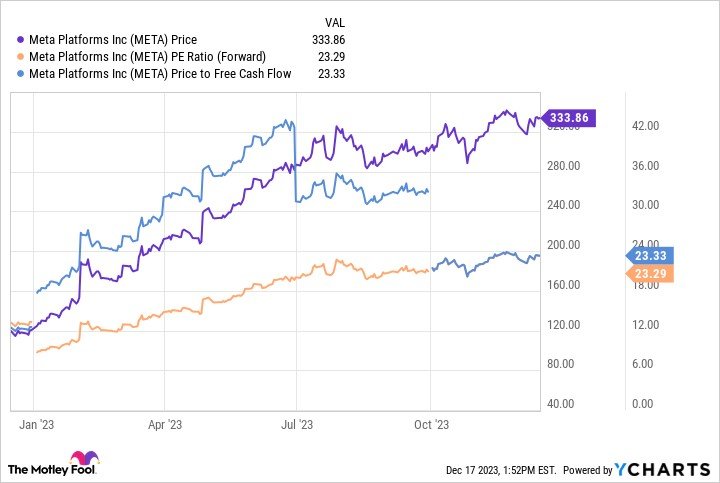

Here's a snapshot of Meta Platform's valuation:

As that chart shows, Meta traded at less than 25 times its forward price-to-earnings (P/E) ratio as of late 2023. For comparison, the S&P 500 traded at a forward P/E ratio of more than 21 times. Meanwhile, the Nasdaq Composite traded at 28.5 times its forward P/E. These valuation metrics suggest Meta Platforms stock trades at a premium to the broader market (S&P 500) and is a little cheaper than the tech-heavy Nasdaq.

Dividends

Does Meta Platforms pay a dividend?

As of late 2023, Facebook's parent Meta Platforms didn't pay dividends. Although the company is wildly profitable and generates significant free cash flow, it uses the money to invest in expanding its platforms and repurchasing shares.

Related investing topics

The bottom line on investing in Meta Platforms stock

Facebook is the most popular social media platform on the planet. Facebook's parent company, Meta, is cashing in on all those users by generating billions of dollars in advertising revenue each year, giving it money to invest in expanding into new areas, including the metaverse.

While those investments weighed on the company's profits in 2022, its actions have already re-accelerated its earnings growth rate. That makes Meta Platforms look like a potentially exciting stock to own for the long term.

FAQs

FAQs on investing in Meta Platforms (Facebook)

Can you invest in Facebook?

Yes. You can invest in Facebook through its parent company Meta Platforms.

Can you buy one share of Facebook?

Yes. You can buy a single share of Facebook's parent company Meta Platforms in a brokerage account. Some brokerage accounts also allow you to purchase fractional shares, meaning you could buy less than a full share of Meta.

What if you invested $1,000 in Facebook's IPO?

If you invested $1,000 into Facebook's stock at its IPO, that investment would have grown to more than $8,700 in value as of late 2023.

Does META pay a dividend?

No. As of late 2023, Meta Platforms did not pay a dividend.