AT&T (T 1.02%) is an iconic telecommunications company. It can trace its roots all the way back to 1876 when Alexander Graham Bell invented the telephone.

The company has evolved over the years through a series of transactions. Today, AT&T is one of North America's largest communications services providers. It provides mobile and wireline (broadband internet and voice) services to more than 100 million U.S. customers, wired services to almost 2.5 million businesses, and mobile services to consumers and businesses in Mexico.

AT&T is investing heavily to build next-generation 5G and fiber networks across the U.S. to support greater connectivity, faster data movement, and increased data usage. The investments should enable AT&T to increase its revenue and earnings in the future.

They should also help grow the telecom giant's already enormous cash flow, giving it more money for dividend payments, another key draw of AT&T stock. AT&T's lucrative income stream is another reason you might be interested in buying its stock.

How to buy

How to buy AT&T stock

People who want to invest in AT&T will need to take a few steps before becoming shareholders. Here's a step-by-step guide to adding the telecommunications company to your portfolio.

Step 1: Open a brokerage account

You'll want to open and fund a brokerage account before buying shares of any company. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one for you.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money.

The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years. You don't have to get there on the first day, though. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow from there.

Step 3: Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about how it makes money, its competitors, its balance sheet, and other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term. Continue reading to learn more about some crucial factors to consider before investing in AT&T stock.

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares

- The stock ticker (T for AT&T)

- Whether you want to place a limit order or a market order (The Motley Fool recommends using a market order since it guarantees you immediately buy shares at the market price.)

Once you complete the order page, click to submit your trade and become an AT&T shareholder.

Should I invest?

Should I invest in AT&T?

Taking the time to thoroughly research a company before buying shares is vital. You might realize the stock isn't right for you, or it might boost your confidence that shares are a good investment.

With that in mind, here are some reasons why you might want to buy shares of AT&T:

- You're at or nearing retirement and need dividend income.

- You're seeking stocks with a high dividend yield.

- Buying AT&T stock would help diversify your portfolio.

- You think AT&T's investments in 5G and fiber will reignite revenue growth and boost its profitability in the future.

- You believe AT&T can steadily reduce its leverage ratio without cutting its dividend again.

- You think shares of AT&T trade at an attractive valuation.

- You believe AT&T can produce a worthwhile total return.

On the other hand, here are some reasons you might decide not to buy shares of the telecom giant:

- You're years away from retirement and don't need income-generating investments.

- You're seeking dividend stocks that can steadily increase their payouts.

- You already own shares of another telecom stock.

- You think AT&T's leverage is too high, which could put its dividend at risk.

- You're not convinced AT&T's investments in fiber and 5G will reaccelerate its revenue and earnings growth rates.

- You're seeking a faster-growing company than AT&T.

- You're concerned that a recession could impact AT&T's earnings and cash flow.

- You don't think AT&T's total return can beat the S&P 500 over the next three to five years.

Profitability

Is AT&T profitable?

Dialing into a company's profitability is a vital part of investment research. Historically, profit growth is the biggest factor driving stock price performance over the long term. With that in mind, here's a closer look at AT&T's profitability.

AT&T is an incredibly profitable company. The telecom giant produced $4.8 billion, or $0.61 per share, of income from continuing operations during the second quarter of 2023 on $29.9 billion of revenue. Meanwhile, the company's cash flow from operations was even higher at $9.9 million. The telecom company used that money to cover capital expenses and dividend payments.

Revenue

While AT&T is very profitable, its earnings have stagnated. Revenue has risen only 0.9% over the past year, while income from continuing operations was roughly flat.

The company has been working to boost profitability. It has invested heavily in its infrastructure to grow its 5G and fiber businesses to increase its revenue and operating cash flow. Meanwhile, it's aiming to cut more than $2 billion in costs to improve profitability.

AT&T also seeks to use excess free cash flow after capital expenses and dividend payments to repay debt and reduce its interest expenses. These initiatives to increase profitability could help drive its stock price higher in the coming years.

Dividends

Does AT&T pay a dividend?

AT&T has a long history of paying dividends. The company made quarterly dividend payments of $0.2775 per share ($1.11 annualized) as of mid-2023. That gave the telecom giant a dividend yield of more than 7% on its share price at the time. That was much higher than average (the S&P 500's dividend yield was around 1.5%).

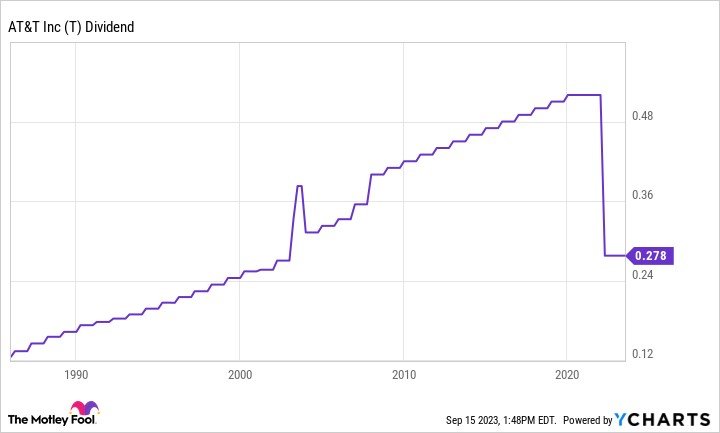

Despite the company's long history of paying dividends and its attractive yield, the company cut its payout in 2022, ending a long period of growth:

AT&T cut its dividend by almost 50% in 2022 to retain more cash to invest in its growth and to reduce debt following the spinoff and merger of its media business to create Warner Bros. Discovery (WBD -2.17%).

ETF options

ETFs with exposure to AT&T

People still determining whether they're ready to invest directly in a company like AT&T have alternative options to consider. They can passively invest by purchasing a fund that holds its stock. One of the most common passive investment vehicles is an exchange-traded fund (ETF).

Exchange-Traded Fund (ETF)

AT&T is a fairly widely held stock. According to ETF.com, 262 ETFs held 612.8 million shares of AT&T as of mid-2023. The SPDR S&P 500 ETF Trust (SPY 0.95%) was the biggest holder, with 78.9 million shares. However, the fund had only a 0.3% allocation to AT&T, so there are better options for those seeking passive exposure to the telecom giant.

The iShares U.S. Telecommunications ETF (IYZ 0.29%) and the Invesco S&P 500 Equal Weight Communications Services ETF (NYSEMKT:RSPC) had much higher weighting to AT&T stock, at more than 4% in mid-2023. That makes them better for gaining passive exposure to AT&T and other communications stocks.

Stock splits

Will AT&T stock split?

AT&T didn't have an upcoming stock split as of mid-2023. However, the company and its predecessor entities have completed several stock splits throughout their history. AT&T (along with the former SBC Communications Inc. and Southwestern Bell Corporation) has completed three splits:

| Split Year | Split Ratio |

|---|---|

| 1998 | 2-for-1 |

| 1993 | 2-for-1 |

| 1987 | 3-for-1 |

The company also completed a stock spinoff of its former media division in 2022. The transaction entitled investors to receive 0.241917 shares of Warner Bros. Discovery stock.

AT&T likely won't complete another stock split soon. Shares traded in the mid-teens in mid-2023, a very accessible level for most investors. Shares would have to gain significant value before AT&T would need to consider another stock split.

Related investing topics

The bottom line on AT&T

Iconic telecom giant AT&T believes its best days are still ahead. The company is investing heavily to build faster 5G and fiber networks, which it believes will increase its already copious cash flows. The increasing cash flows could enable it to increase value for its investors.

It should also strengthen its balance sheet and continue paying an attractive dividend (that it could eventually start growing again in the future). These factors could drive its share price higher over the longer term.

However, AT&T has taken on a lot of debt to fund its investments, which haven't always paid off. Its high-yielding dividend is at risk of another reduction if everything doesn't go according to plan, and that is a risk investors need to watch.

FAQs

Investing in AT&T FAQs

Can you buy AT&T Stock?

You can buy AT&T stock with any brokerage account. It trades under the stock ticker T. Here are some of the best online broker or stock trading accounts if you still need to open one.

Is AT&T a buy, sell, or hold?

AT&T's primary draw is its high-yielding dividend. It offers investors a bond-like fixed-income stream. While that might be attractive to some investors, there are better dividend stocks to buy for income, including chief rival Verizon (NYSE: VZ).

Verizon pays a higher-yielding dividend (as of mid-2023) that the telecom giant will likely continue increasing (it delivered its 17th straight year of dividend growth in 2023) since it already has a lower leverage ratio than AT&T.

AT&T is currently a "hold" at best for those who already own shares for the income. They may even consider selling the stock and swapping it for the more attractive Verizon.