It isn't surprising in the least that many individuals would be interested in how to invest in Costco Wholesale Corporation (COST 1.01%). After all, the company ranks among the biggest wholesale retailers in the world. The stock has also delivered massive gains since it began trading in 1985.

In this article, we'll explain how to buy Costco stock, the pros and cons of investing in the stock, and other key things you need to know about the giant retailer.

How to buy Costco stock

How to buy Costco stock

You can buy shares of Costco in the same manner as you invest in any stock. You'll first need to have a brokerage account.

If you don't already have one, you can check out some of the top stock brokers and trading platforms available. Below is a step-by-step guide on how to buy Costco shares using Charles Schwab (SCHW 0.13%), which ranks as one of the top online brokerages:

- Log in to your account.

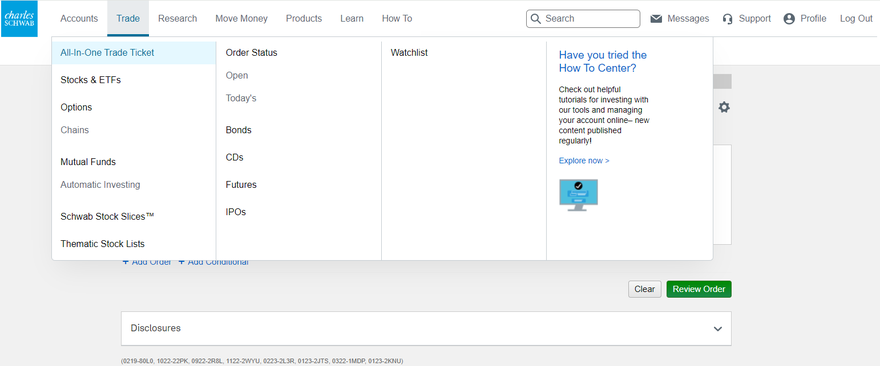

- Click the Trade option on the top menu, then select Stocks & ETFs.

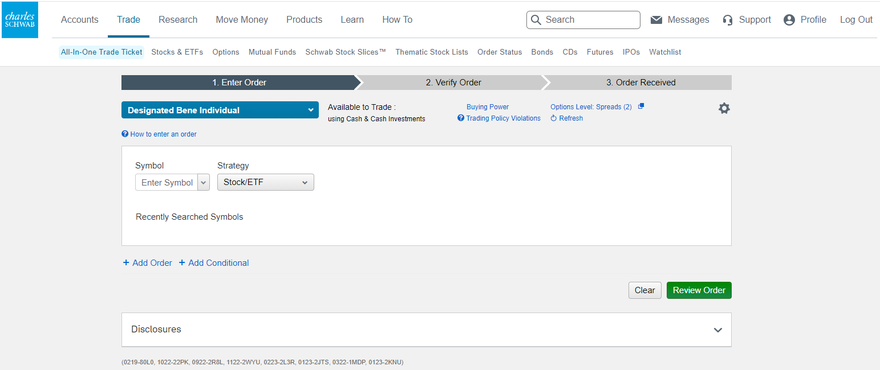

3. Type the ticker symbol (in this case, COST) into the Symbol textbox, then press the tab or enter key.

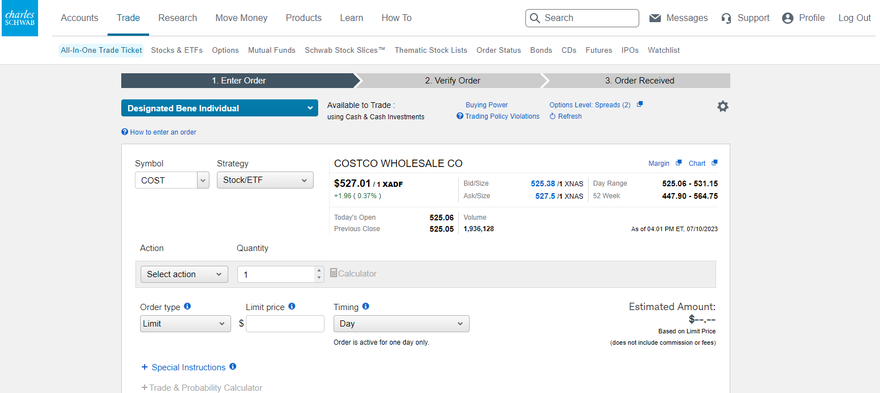

4. Current information about Costco stock will appear on the page.

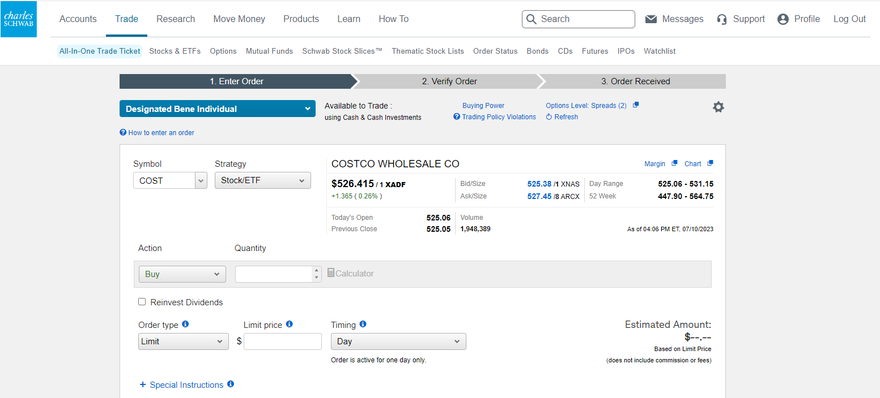

- Select "Buy" in the Action box.

- Type the number of shares you want to purchase into the Quantity box.

- Check "Reinvest Dividends" if you want to reinvest the dividends (i.e., use any dividends received to purchase additional shares going forward).

- Select your desired order type from the Order Type box. The main order types to consider are market orders and limit orders. Selecting "market order" will allow you to buy Costco stock at the current market price. If you select "limit order," you will also need to specify a limit price in the Limit Price box.

- Select the timing of the order from the Timing box. The default is "Day," which means the order will be active only on the current trading day.

5. If you made any mistakes and want to start over, you can scroll down and click the Clear button at the bottom right of the page. Otherwise, click the Review Order button, also at the bottom right of the page.

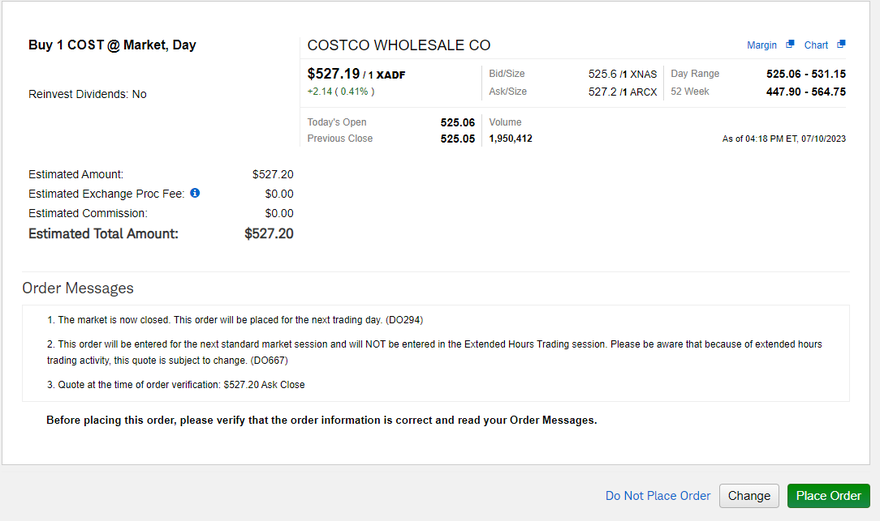

6. Clicking the Review Order button will open a page that allows you to review your order information before finalizing. If everything looks good, click the Place Order button at the bottom right.

If you want to change the order, click the Change button. If you want to cancel the order, click the “Do not place order” link.

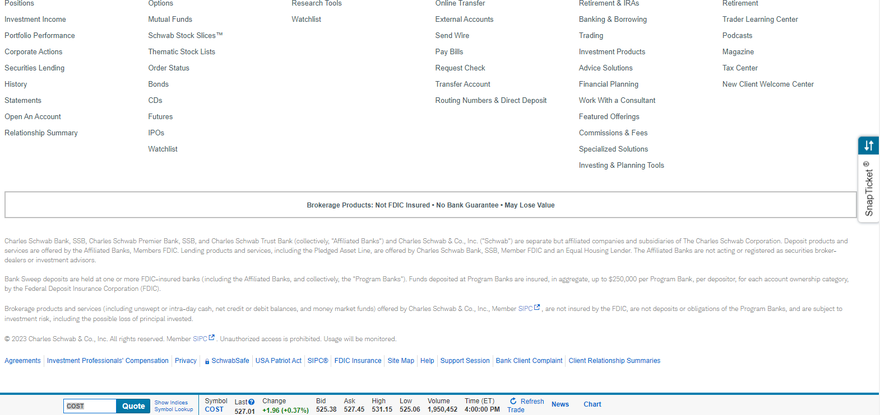

Note that there is also an alternate way to place an order to buy Costco stock. After logging in to your Schwab account, enter “COST” in the box on the bottom left of the page, then click the Quote button.

Next, click on the Trade link near the bottom right of the page. You can then follow steps four through six described above.

Should I invest in Costco?

Should I invest in Costco?

Whether or not you should invest in Costco is ultimately a personal decision only you can make. There are two especially important factors to consider before buying this retail stock.

One key consideration is your investing style. Costco isn't viewed as an aggressive growth stock, even though it has performed quite well in recent years.

Another thing to keep in mind is valuation. Costco stock trades at a relatively high forward price-to-earnings ratio. That's typical, though: Costco usually trades at a premium compared to the broader market. Still, investors seeking a bargain might prefer to look elsewhere.

There are several reasons to seriously consider buying shares of Costco. For example, the company has a strong business moat, as it uses a membership-based model. Customers must pay an annual fee to shop in its warehouse stores. These fees generate solid recurring revenue for Costco.

The membership model also has another big advantage. Customers have ample motivation to shop at Costco to get the best return on investment for their annual fees.

But customers don't seem to mind paying those fees, which are $60 for a Gold and $120 for an Executive membership. And they usually stick with Costco: The company's renewal rate is typically around 90%.

The big attraction for customers -- and one of the most important components of Costco's moat -- is its price structure. As the third-largest retailer in the world, Costco is able to negotiate low prices for the products it sells. The more members it gains, the more negotiating power it has.

To be sure, Costco has some challenges. In particular, the company faces strong competition. Walmart's (WMT -0.08%) Sam's Club uses a similar business model. BJ's Wholesale Club (BJ 0.35%) is another top rival. Costco also depends heavily on its supply chain. Any disruptions in the distribution of products to its warehouse stores can negatively affect sales.

Is Costco profitable?

Is Costco profitable?

One thing investors don't have to worry about is Costco's bottom line. The giant discount retailer remains highly profitable.

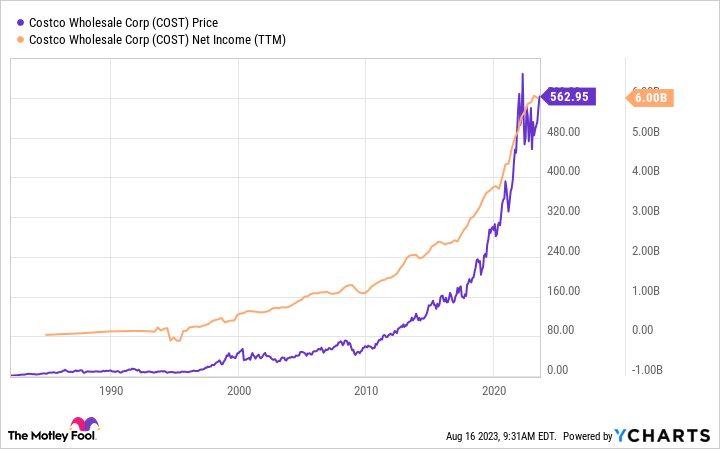

In 2022, Costco reported more than $5.8 billion in net income. Sure, the company's revenue was almost $227 billion, resulting in a net profit margin of only 2.6%. However, low profit margins aren't unusual in Costco's industry.

Revenue

Perhaps most impressive is how Costco's earnings have increased over time. And those higher profits have driven the stock higher, too.

Artificial intelligence (AI) could also help Costco continue improving its bottom line. AI is transforming the retail industry. Global consulting firm McKinsey & Company predicts that generative AI could deliver between $400 billion and $600 billion in additional value to the retail and consumer packaged goods industries.

Costco is already putting AI to work in its operation. For example, the company uses machine learning to track its fresh food and reduce waste.

Does Costco pay a dividend?

Does Costco pay a dividend?

Yes, Costco pays a dividend, though its dividend yield of less than 1% isn't very impressive. However, there are other things for investors to like about Costco's dividend program.

The company has increased its dividend for 19 consecutive years. Over the last 10 years, Costco's dividend has more than tripled. It has also rewarded investors periodically with special dividends.

Costco should be in good shape to keep its streak of dividend hikes going. The company's dividend payout ratio stands at less than 30%, indicating significant financial flexibility to raise dividends in the future.

Special Dividend

Will Costco's stock split?

Will Costco's stock split?

Costco's management team hasn't publicly stated that a stock split is being considered. However, it wouldn't be surprising if the company did split its stock in the not-too-distant future.

In January 2000, Costco conducted a 2-for-1 stock split. Its share price prior to the split was a little more than $91. Currently, Costco's share price is several times higher than its price back then. The company also had a 3-for-2 stock split in March 1992 and a 2-for-1 stock split in May 1991.

The bottom line on investing in Costco

The bottom line on investing in Costco

It's easy to invest in Costco stock using an online brokerage. The stock has been a big winner over the long run. The chances that Costco can keep up its winning ways appear to be good.

Investing in Costco FAQs

Investing in Costco FAQs

Is Costco a good stock to buy?

Different investors will have different views on what "good" means. However, Costco offers several key advantages. Its business model is exceptionally strong, the company is consistently profitable, and it has solid growth prospects.

The main negative for Costco is its lofty valuation, with shares trading at more than 30 times forward earnings. But there's a good case to be made that the stock deserves to trade at a premium because of its track record and resilience.

How much money would you have if you had invested $1,000 in Costco 10 years ago?

In July 2013, Costco stock traded at around $113 per share. An initial investment of $1,000 would have bought eight shares (with some money left over). As of July 10, 2023, those eight shares would be worth more than $4,200.

If you could have invested the full $1,000 (with one fractional share), your total return, including dividends, would be roughly 465%. That would make the initial investment worth around $4,650 as of July 10, 2023.

Will Costco stock hit $1,000?

It's certainly possible that Costco could hit $1,000. Just how long it will take to do so is a harder question to answer, though. There are too many variables at play, notably including the health of the overall economy.

The most likely reason Costco's share price might not reach $1,000 is the potential for a stock split. As mentioned, the company has conducted several stock splits over its history. Costco's management team could decide another stock split is in order well before the share price hits $1,000.