If you're interested in investing in the massive consumer health market, Kenvue (KVUE -0.84%) stock could be just what you're looking for. Spun off from Johnson & Johnson (JNJ -0.46%), Kenvue first started trading on public markets on May 4, 2023.

It's now the company behind many of the largest consumer health brands, taking over major brands that were previously part of Johnson & Johnson. In this guide, you'll learn how to invest in Kenvue, how the company is performing so far, and whether it's a good investment.

Stock

How to buy

How to buy Kenvue stock

Since Kenvue is a publicly traded company, investing in it is a straightforward process. Here's a step-by-step breakdown of how to buy Kenvue stock.

Step 1: Open a brokerage account

You invest in stocks -- and other types of investments, like bonds, mutual funds, and exchange-traded funds (ETFs) -- through a brokerage account. If you've invested before and already have one, you can proceed to the next step. If you don't have a brokerage account, check out our guide to the best online stock brokers for some quality options.

Exchange-Traded Fund (ETF)

When you've found a broker you like, choose the option to open an account. You'll need to fill out the broker's form with personal and financial information, including your name, date of birth, and Social Security number. Opening an account doesn't take long -- usually less than 15 minutes.

Step 2: Figure out your budget

It's always good to have a strategy when investing, and that includes a plan for how much you'd like to invest. Make sure you think about how much you want to put into all the individual investments you'll make, such as Kenvue stock, and into your portfolio as a whole. Putting all your money into a single company isn't recommended. You should have about 25 to 30 stocks for a well-balanced portfolio.

Once you know your budget, transfer the money you plan to invest to your brokerage account. If you send it via bank account transfer, it can take a few business days. Brokers also accept wire transfers, but there are usually extra fees. You can see your options on the transfers page in your online brokerage account.

Step 3: Do your research

Before you invest in any company, it's important to research it. We'll get into more detail on Kenvue stock as an investment further in this guide. Of course, it's also worth researching the company yourself and reading the latest news about it.

Many stock brokers provide research tools that can help with this step. On your broker's research page, you can plug in the ticker for the company you're interested in to get more information about it.

Step 4: Place an order

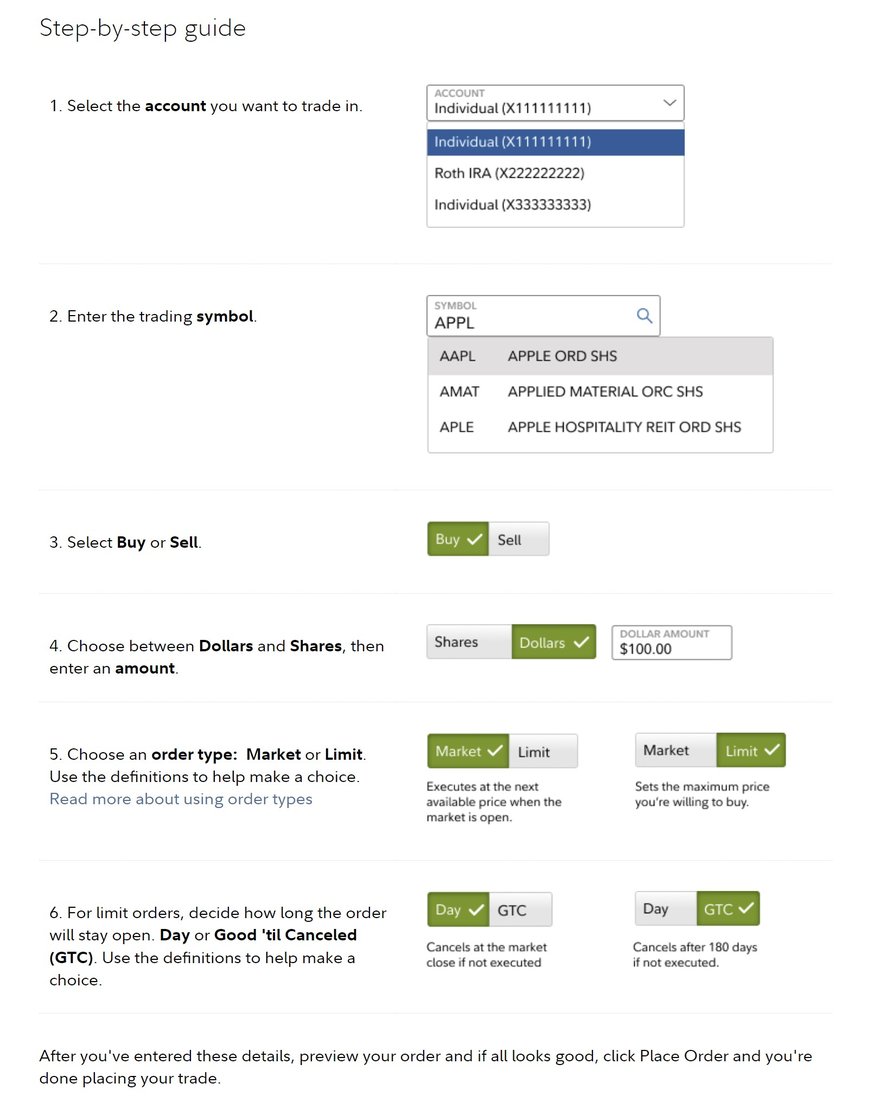

When you're ready to invest in Kenvue, it's time to place your order. Access your brokerage account through its online platform or mobile app. Open the trade tool and look up Kenvue stock using its ticker: KVUE. Select the buy option, the number of shares to buy, and the type of order you want to place.

There are multiple order types to choose from with any stock purchase. A market order places the order at the best available price and typically executes near the current ask price when placing a buy order. A limit order allows you to set a limit on how much you're willing to pay per share.

The screenshot below breaks down exactly how to invest in a stock using Fidelity.

Should I invest

Should I invest in Kenvue?

Kenvue will most likely be a quality performer as a long-term investment. It won't match the kinds of highs the best growth stocks reach, but it should provide stable growth and an ample dividend in the years to come.

While Kenvue hasn't been available long, it's not an unproven new company. After all, it was previously part of Johnson & Johnson, which has frequently ranked as one of the largest companies by market cap. Now that it's on its own, Kenvue is a major player among consumer goods companies and is the largest pure-play consumer health company.

What sets Kenvue apart as a company is its top-notch portfolio featuring a number of brands you're no doubt familiar with. It has a whopping seven No. 1 global brands:

- Band-Aid

- Johnson's

- Listerine

- Neutrogena

- Nicorette

- Tylenol

- Zyrtec

Because its brands are fairly diversified, Kenvue has a reliable business model that consistently churns out a profit. It's also not overly reliant on any one market. It generates about 50% of its sales in North America and 50% internationally.

Kenvue has been a great dividend stock so far, and that's certain to continue. Its dividend yield has exceeded 4%, so it pays its investors a sizable portion of its profits. If it follows the trend of Johnson & Johnson, which has increased its dividend for 61 straight years, shareholders can expect quite a bit of passive income from holding Kenvue stock.

There are a couple of drawbacks to know about before investing in Kenvue. It's currently dealing with a lawsuit alleging that Tylenol caused neurological disorders in children whose mothers used it while pregnant. The lawsuit is still in its early stages, but Tylenol is widely considered safe for pregnant women by most health organizations.

The consumer health industry is also on more of a slow and steady track than a fast one. Kenvue stock is worthwhile if you're looking for a low-risk investment. It's not the best choice if you're looking for potential home runs to add to your portfolio.

Profitability

Is Kenvue profitable?

Kenvue is a profitable company. In the third quarter of 2023, it had $3.92 billion in revenue, $2.25 billion in gross profits, and $438 million in net income.

Demand for Kenvue's products doesn't fluctuate much. People will always need products like Band-Aids and Listerine, so the company's sales and profits tend to be stable. Recent results have been positive, with year-over-year sales growth of 3.3% in its third-quarter results.

Dividends

Does Kenvue pay a dividend?

Yes, Kenvue pays a dividend and offers a high dividend yield. While Kenvue hasn't paid many quarterly dividends yet because of its recent creation, we can expect it to operate similarly to Johnson & Johnson in that regard. Johnson & Johnson has consistently ranked as one of the best dividend stocks, raising its dividend for over six decades.

ETF options

ETFs with exposure to Kenvue

If you want to build out your portfolio more quickly, ETFs that hold Kenvue stock are another option. Instead of owning Kenvue stock directly, you would get to invest in Kenvue as part of an ETF containing a number of stocks. Here are a few of the ETFs with significant exposure to Kenvue:

- The Invesco S&P 500 Equal Weight Consumer Staples ETF (NYSEMKT:RSPS) equally weighs stocks in the consumer staples sector of the S&P 500. Along with Kenvue, its other major holdings include Costco Wholesale (COST 1.01%), Colgate-Palmolive (CL 1.93%), and Walmart (WMT -0.08%).

- The Renaissance IPO ETF (IPO 2.16%) invests in newly listed companies. It's rebalanced each quarter to add new initial public offerings (IPOs), and stocks are cycled out three years after their IPOs, so Kenvue will be one of its holdings until 2026.

- The ProShares S&P 500 Dividend Aristocrats ETF (NOBL -0.35%) seeks to track the performance of the S&P 500 Dividend Aristocrats Index. It's built around companies that pay high dividends, so if that's what attracted you to Kenvue, this ETF could be a good choice for a more diverse portfolio of dividend stocks.

Stock splits

Will Kenvue stock split?

There’s no indication that Kenvue will announce a stock split. Considering the company had its IPO in May 2023, it's unlikely to have any upcoming stock splits in the near future. Johnson & Johnson has gone through six stock splits over the years, but its most recent happened in 2001.

Related investing topics

The bottom line on Kenvue

Now that Kenvue stock is available on public markets, you can buy shares through any brokerage account. If you'd prefer an all-in-one investment with more stocks, you could buy shares of an ETF with exposure to Kenvue, such as one of the many consumer staples ETFs.

As an investment, there's a lot to like about Kenvue stock. It's stable, profitable, and has a large roster of well-known brands. It's a great choice if you're looking for steady, long-term growth and a healthy quarterly dividend.

FAQs

Investing in Kenvue FAQs

Is Kenvue worth investing in?

Kenvue is worth investing in if you're looking for stable value stocks to add to your portfolio. It's also a good choice for dividend investors because it offers a high dividend yield.

What happens to Johnson & Johnson stock after the Kenvue split?

Johnson & Johnson is now solely a medical device and pharmaceutical company, and its stock provides investors with exposure to those markets. Kenvue handles the consumer health business. Shareholders of Johnson & Johnson were given the option to swap their shares for Kenvue stock. The offer expired on Aug. 18, 2023.

What is the outlook for Kenvue?

Analysts have a positive outlook for Kenvue stock, expecting it to grow over the next year and on a long-term basis. Based on Kenvue's fundamentals and performance so far, there's a reasonable chance it will outperform the S&P 500 over the next several years.