So, you think you might want to invest in Unity Software (U 3.47%)? You're not alone. The American tech expert is an innovator in the field of video game technology. In fact, its 3D modeling and world-building tools are so advanced and easy to use that Hollywood has embraced them. Unity's technology is also an industry-standard movie-making platform nowadays.

It's no wonder that this creative trailblazer caught your eye. But where do you go from here?

Understanding the ins and outs of Unity Software and its stock is crucial in today's fast-paced market. Read on for an overview of the company and its business and how you can buy shares of Unity Software stock today.

Stock

Is Unity profitable? Does the company pay a dividend? Is it a good investment? You're about to learn the answers to these questions and many more.

How to buy

How to buy Unity Software stock

First, let me show you how easy it is to buy shares of any publicly traded stock, such as Unity Software. Gone are the days when buying stock was a complex and costly endeavor, accessible only to a select few through a complicated system of stock brokers shouting orders on a crowded trading floor.

Today, the process is straightforward, democratized, and widely accessible to almost anyone. What's more, online trading platforms have essentially eliminated traditional trading fees. Anyone can invest in stocks, setting the stage for long-term financial independence.

Here's how to get started with your first trade. In this example, you'll be buying a few shares of Unity Software stock through the E*Trade brokerage managed by Morgan Stanley (MS 0.29%) since fall of 2020.

Step 1: Open a Brokerage Account

Choosing the right brokerage is a critical first step. You have many options, and most leading online stock brokers look similar at first glance. But there are still important differences between them. Some brokerages cater to experienced investors, others are better for beginners, and some specialize in unique services.

Factors like fees, platform usability, features, and customer support are vital to consider. For instance, E*Trade is known for its user-friendly interface, low fees, and robust customer service, making it a solid choice for both new and experienced investors.

Signing up for a new account with E*Trade (or any other respectable brokerage) won't take long. The brokerage needs to know who you are and how you want to log in. You must also fund your new account before making your first trade. This can be done with an instant online transfer or by sending a check in the mail.

Step 2: Figure out your budget

Determining your investment budget is crucial and should align with your financial goals and risk tolerance. Consider how much you can afford to invest without compromising your financial security. It's essential to invest only what you can afford to lose, especially in volatile tech stocks like Unity Software. You should pay the bills before setting money aside for investments.

Step 3: Do your research

Before investing, you should understand Unity Software's business model, market position, and financial health. Look into the company's revenue streams, profit margins, market competition, and growth prospects. The stock price doesn't always reflect the true long-term value of every investment.

Ideally, you want to buy stock in great businesses and at reasonable prices. Every potential investment comes with risks, and you want to weigh these possible downsides against the company's long-term business prospects and current business valuation.

You can find important information in many places. The Motley Fool provides lots of investment analysis for free, and you can find even deeper insights through our subscription-based newsletter services.

Every stock brokerage offers information on publicly traded stocks. Some also provide powerful tools, such as stock screeners and analyst write-ups. And, of course, you should become familiar with Unity Software's investor relations site, where you'll find company news, financial filings, and more.

Sometimes, you may find that the stock you want to buy comes with serious baggage. Maybe it has more competitors than you thought, it's overvalued, or you simply found an even better idea while digging into Unity Software's business.

That's alright.

You are not trying to justify the original idea here but rather making sure your chosen stock really is a good investment. If Unity doesn't cut the mustard for you, it's time to research a different stock instead.

Step 4: Place an order

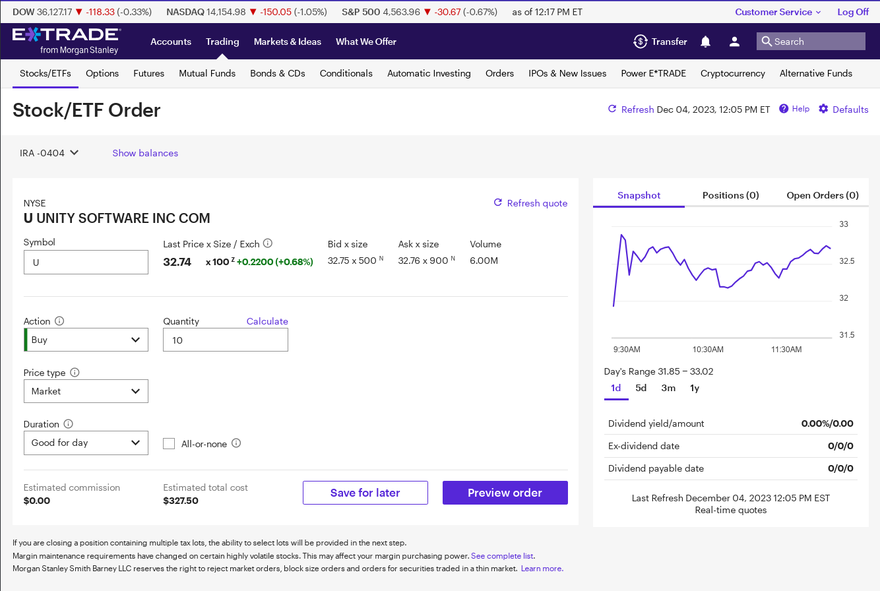

Once your account is set up and you've done your research, it's time to buy some Unity Software stock. Log on to your E*Trade account and search for Unity Software or its stock ticker, "U." You will be met by E*Trade's overview page for Unity, featuring a plethora of financial data and stock information. In the top-right corner of that page are two small buttons marked "Buy" and "Sell."

Clicking on the Buy button brings you to E*Trade's stock order interface with a few data points prefilled. The system already knows you are interested in Unity Software stock and want to buy it today.

You can choose from a few order types, but market or limit orders are enough in most situations. The market order option simply executes your order immediately at the lowest current price.

For a stock with high trading volume, such as Unity Software, that's usually good enough. Less-liquid stocks with large gaps between the lowest selling price and highest buyer bid may instead require a limit order, wherein you set the highest price you're willing to pay per share.

Divide your investing budget by the price you've chosen and enter the result in the Quantity box. E*Trade will round any decimal figure down to the nearest whole number since this brokerage doesn't support buying fractional shares yet.

You have chosen Unity Software, set up a Buy order with an acceptable price and the right number of shares, and are ready to go. Click on "Preview order," double-check the data you entered, and finalize the process by clicking on "Place order." And that's it. You are now the proud owner of Unity Software stock.

Should I invest?

Should I invest in Unity Software?

Unity Software plays a unique and crucial part in several interesting industries. This stock is a simple way to invest in the video game sector, movie and TV series producers, and the metaverse without picking a winner within these broad market categories.

Anywhere you might encounter digital video supported by realistic physics models and other world-building features, Unity's namesake game engine can get the job done. Of course, it isn't the only name in the game, though.

The business opportunity is much too large to allow a single provider unrivaled control of it all. The Unreal Engine from Epic Games is Unity's clearest head-to-head rival. Other alternatives include Autodesk's (ADSK 0.71%) Maya and 3ds Max, Adobe's (ADBE 0.87%) Substance 3d and After Effects, and the open-source Blender platform.

You should consider how the Unity Engine compares to its peers and how quickly each competitor is pursuing new opportunities in this dynamic market. Unity is a longtime leader in some submarkets.

Competitive Advantage

For instance, the company claims that Unity Engine powered over 70% of the top 1,000 mobile games in 2022. Unity-powered apps, games, and videos are found on billions of devices worldwide, and its developer community had more than 1.3 million active users in 2023.

So, Unity's target market and competitive environment are always changing. Unity's fortunes also often change in this eternal game of technology leapfrog. Unity Software stock is subject to unpredictable swings amid a constant onslaught of technology upgrades, contracts won or lost, and other potentially game-changing news.

As a Unity investor, you must keep an eye on Unity's business and how the stock market reacts to the news. It is a volatile stock, sometimes caught in an overvalued or undervalued limbo for no good reason. You need to be prepared for turbulence and potholes on this trip.

At the end of the day, Unity Software may be one investor's dream stock and another's nightmare. Ensure you understand the company and are comfortable with its risks before buying that first share.

Profitability

Is Unity Software profitable?

Unity Software runs a classic, high-growth business model. The company reinvests incoming revenues into growth-promoting expenses, such as research and development or sales and marketing, resulting in skimpy or negative bottom-line earnings.

As of December 2023, Unity's sales added up to $2 billion over the last four quarters, almost tripling the $772 million Unity collected in fiscal year 2020. Together, sales and research consumed $1.9 billion of the incoming cash, up from $620 million three years ago.

In other words, Unity is not interested in generating a profit yet. The company is laser-focused on maximizing its top-line growth at this point, aiming to expand its customer base and developer community as far as possible before shifting into a profit-oriented mode.

If you're reading this in 2025, or maybe even 2030, the story probably hasn't changed. Unity isn't likely to run out of potential growth in this decade.

Dividends

Does Unity Software pay a dividend?

Most growth-obsessed tech stocks don't pay dividends, funneling that cash into boosting the business instead. Unity Software follows that path and has not yet paid a dividend.

ETF options

ETFs with exposure to Unity Software

An exchange-traded fund (ETF) is a stock-like investment that tracks the performance of more than one stock (or bond or other type of asset). ETFs are similar to a classic mutual fund but with a few important differences.

Exchange-Traded Fund (ETF)

Mutual funds update their prices once per day, while ETF values change throughout the day. You can buy an ETF anytime during regular trading hours, but mutual fund units change hands only at the close of each day.

ETFs also come with a more tax-efficient structure and some unique tools that ensure the fund always matches the value of the underlying stock list. In short, an ETF is more flexible than an old-school mutual fund when investing in a group of stocks.

As a large company with a substantial market capitalization, Unity Software is a component of the Nasdaq Internet and NYSE Composite market-tracking indices. ETFs mirroring these stock lists must include Unity Software stock in their asset lists. Other ETFs, including some good technology ETFs, choose to own some Unity Software stock in a handpicked, actively managed portfolio.

Here are a few ETFs with substantial exposure to Unity's stock as of Dec. 4, 2023:

| Exchange-Traded Fund (ETF) | Number of Unity Software Shares Under Management | ETF's Net Asset Value | % Allocation of Unity Software Stock |

|---|---|---|---|

| ARK Innovation ETF (NYSEMKT:ARKK) | 8.7 million | 6.0 billion | 3.2% |

| Vanguard Mid-Cap Index Fund (NYSEMKT:VO) | 2.3 million | 132.6 billion | 0.1% |

| iShares Expanded Tech-Software Sector ETF (NYSEMKT:IGV) | 0.8 million | 5.9 billion | 0.3% |

| Roundhill Ball Metaverse ETF (NYSEMKT:METV) | 0.4 million | 0.4 billion | 2.2% |

Stock splits

Will Unity Software's stock split?

As of December 2023, Unity Software has not split its stock since entering the public market in September 2020. The stock price plunged amid the inflation crisis of 2022, and Unity doesn't seem likely to announce a split any time soon.

This may change if Unity's stock soars in the coming years, but it's not worth holding your breath and waiting for an upcoming stock split. These events are exercises in accounting mathematics that don't add any real value to the stock.

Related investing topics

The bottom line on Unity Software

Now you know how easy it is to invest in Unity Software stock. You're also familiar with some key questions to consider before taking the plunge and buying Unity shares with your hard-earned cash.

The company is an established leader in a few exciting markets, and you'll probably never get bored watching the 3D graphics and world-building sectors evolve. Unity may be the perfect stock for a growth-oriented portfolio, while value investors are less likely to take a serious interest in the stock.

Either way, you're ready to take the first steps to investing in the stock market or expanding your horizons where Wall Street crosses Silicon Valley.

FAQs

Investing in Unity Software FAQs

Is Unity a publicly traded company?

Yes, Unity Software has been a publicly traded company since September 2020. The stock trades on the New York Stock Exchange under the stock ticker U.

Will Unity Software stock go up?

There are no guarantees in the stock market. However, most financial analysts who follow the stock believe it will outperform the broader market over the next year or so.

Of 28 firms with a recommendation on Unity Software stock in December 2023, 16 see it as a "buy" or "strong buy" for their clients, while 10 recommendations amount to a "hold" instead. It's even harder to tell where a stock will go in the long run, but Unity Software looks ready to compete and win for years to come.

What type of investment is Unity Software?

Owning shares of Unity Software makes you part owner of the company's actual business. Owning stock goes beyond attempting to make money on Wall Street. Each share also gives you a vote in the company's board elections and other voting matters.

The stock is classified as a software company in the technology sector. With a $12.4 billion footprint on Dec. 4, 2023, Unity Software is a mid-cap stock in terms of market capitalization.