Many people want to know how to invest in Etsy (ETSY 0.34%), and it's easy to see why. The online retailer has built a strong brand as the leading marketplace for handmade products, and it saw its share price skyrocket early during the COVID-19 pandemic.

Like many stocks that were popular during the pandemic, Etsy lost a sizable chunk of those gains, but it's still in a solid financial situation with room to grow. In the guide below, we'll show you how to invest in Etsy, go over its pros and cons as an investment, and cover everything else you need to know before buying.

How to buy Etsy stock

How to buy Etsy stock

Since Etsy is a publicly traded company, you can invest in it through any brokerage account. Here's how to buy Etsy stock:

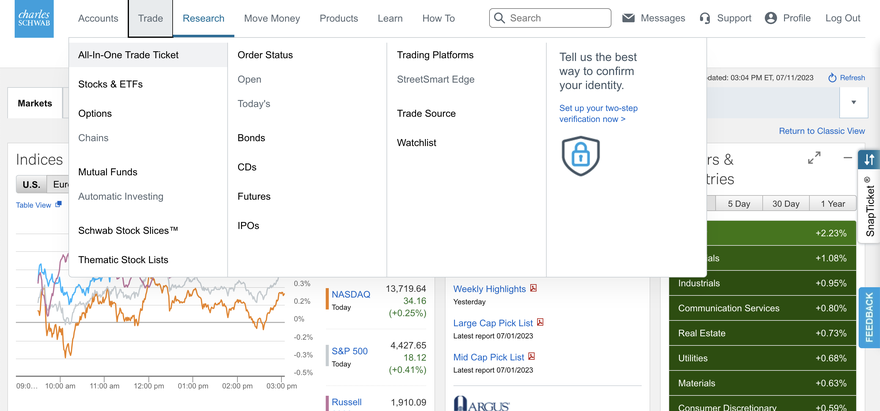

- Log in to your brokerage account, or sign up for an account if you don't have one yet.

- Select the option to place a trade.

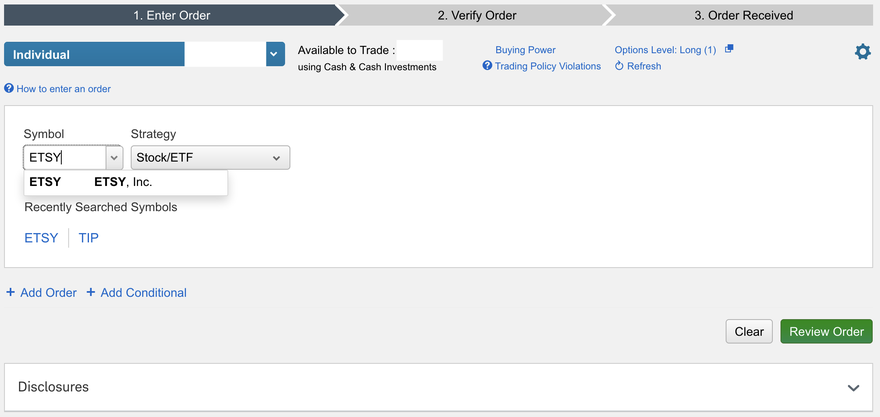

3. Enter the ticker symbol: ETSY.

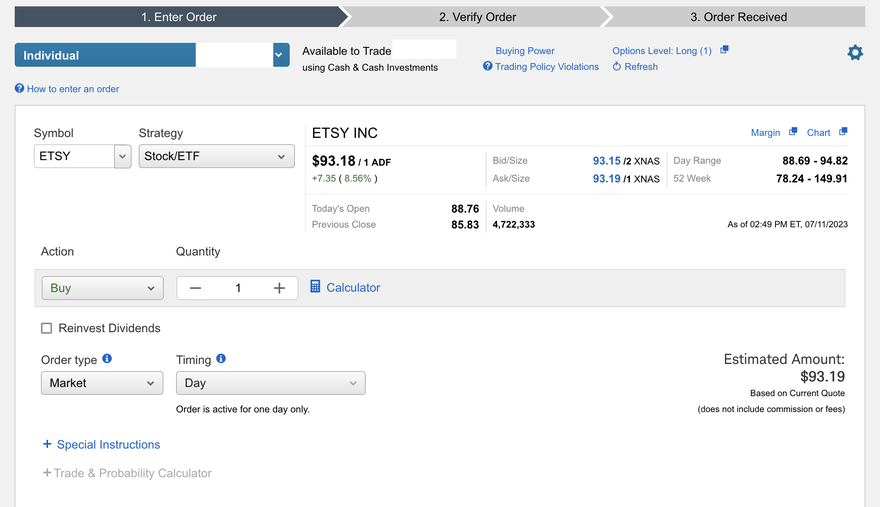

4. With the stock information pulled up, choose the option to place a buy order, enter how many shares to buy, and select the type of order (market, limit, etc.)

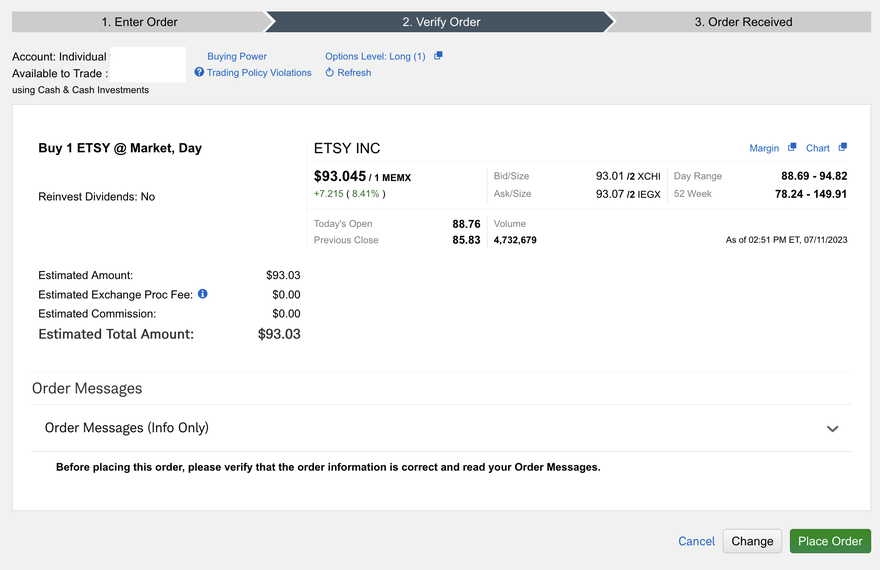

5. Review the order details. When you're ready, confirm your order.

The screenshots show how to buy Etsy stock with a Charles Schwab account. It will be the same general process using any broker, just with a different platform.

Should I invest in Etsy?

Should I invest in Etsy?

Etsy could be worth investing in if growth potential is your priority and you don't mind volatility. There are several indicators that it could do well in the years to come, with the biggest being how it has established itself as the place online to buy unique products, including handmade and vintage goods.

Its focus on unique items has helped it build a powerful brand and not become just another online retailer competing with Amazon.com (AMZN 3.43%). It also has a key advantage over most competitors with its business model: On Etsy, sellers handle order fulfillment. While other retailers need to deal with product storage and shipping, Etsy doesn't. That allows it to run a capital-light business and turn most of its earnings into free cash flow.

While Etsy is the company's most well-known brand, it has expanded with some interesting acquisitions. These include:

- Reverb: An online marketplace for new and used musical gear, acquired by Etsy in 2019.

- Depop: An online marketplace for used and vintage apparel that's popular with Generation Z, acquired by Etsy in 2021.

- Elo7: An online marketplace in Brazil with a similar focus on unique and handmade goods, acquired by Etsy in 2021.

The downside of Etsy's Depop and Elo7 acquisitions is that CEO Josh Silverman may have overpaid. Etsy took a goodwill impairment charge of $1 billion only one year after the purchases. That's certainly not what you like to see as an investor, but the acquisitions could still pay off in the long run.

Etsy's leadership has also done a good job of improving customer experience. It started investing in artificial intelligence (AI) earlier than most companies, with its 2016 acquisition of Blackbird Technologies, a startup that developed algorithms for natural language processing and other AI elements.

Through AI and machine learning technology, Etsy aims to improve not only its search function but the entire shopping experience. Silverman has said that the plan is to make shopping on Etsy like shopping in a real-world boutique, where you can talk to a digital salesperson and get carefully curated suggestions instead of a massive list of products.

Last but not least, Etsy's active buyers more than doubled from 2018 to 2022, and its active sellers almost tripled. Much of the growth was due to the pandemic, but even with consumers doing more in-store shopping, Etsy held on to most of its gains in 2022, and it was able to do that while increasing seller fees from 5.0% to 6.5%. Here's a look at how Etsy's active buyer and seller numbers have grown over the last five years:

| Year | Active buyers | Active sellers |

|---|---|---|

| 2018 | 39.45 million | 2.12 million |

| 2019 | 46.35 million | 2.70 million |

| 2020 | 81.90 million | 4.37 million |

| 2021 | 96.34 million | 7.52 million |

| 2022 | 95.01 million | 7.47 million |

Is Etsy profitable?

Is Etsy profitable?

Etsy is largely a profitable company. It posted a net income loss of $694.27 million in 2022, but that was due to a one-time goodwill impairment charge of $1 billion for its acquisitions of Depop and Elo7. The goodwill impairment charge suggests that it overpaid for those companies.

Before that, Etsy had been profitable for five straight years, starting in 2017. It also bounced back since that impairment charge, which it took in the third quarter of 2022, getting back to positive net income figures in the fourth quarter of the year and the beginning of 2023.

Here's a look at Etsy's net income over the last five years. While it was already on the way up, its income exploded during the pandemic as people at home started spending much more on online shopping.

Net Income

| Year | Net income |

|---|---|

| 2018 | $77.49 million |

| 2019 | $95.89 million |

| 2020 | $349.27 million |

| 2021 | $493.51 million |

| 2022 | ($694.29 million) |

Does Etsy pay a dividend?

Does Etsy pay a dividend?

Etsy doesn't pay a dividend. It hasn't paid a dividend before, and since it's a growth stock, it probably won't pay them in the future, either. If you're interested in receiving dividends, check out our list of top dividend stocks to find quality options.

ETFs with exposure to Etsy

ETFs with exposure to Etsy

There are hundreds of exchange-traded funds (ETFs) that hold Etsy. These are a good choice for those who prefer more passive investing over actively picking stocks and managing your portfolio.

Since there are so many ETFs with exposure to Etsy, a good way to start is by deciding on a type of ETF or market sector that you want to focus on first. For example, if you want one that will largely follow the performance of the U.S. stock market, you could go with a total stock market or S&P 500 ETF. Here are some of the best options:

- Vanguard Total Stock Market ETF (VTI 0.93%)

- Schwab S&P 500 Index Fund (NASDAQMUTUALFUND:SWPP.X)

- Fidelity 500 Index Fund (NASDAQMUTUALFUND:FXAI.X)

ETFs like these track the largest publicly traded U.S. companies, including Etsy, but it makes up a very small portion of their portfolio. If you want a fund with a different focus and more exposure to Etsy, here are more options:

- ProShares Online Retail ETF (ONLN 2.44%) invests in online retailers.

- First Trust Dow Jones Internet Index Fund (FDN 2.58%) focuses on stocks in the internet industry.

- SPDR S&P Retail ETF (XRT 1.4%) invests in U.S. retailers.

- Vanguard Consumer Discretionary ETF (VCR 1.2%) holds companies that sell products and services consumers purchase with their discretionary income.

Exchange-Traded Fund (ETF)

Will Etsy stock split?

Will Etsy stock split?

Etsy hasn't announced any plans for a stock split. It also hasn't split its stock before, even when its share price increased by almost 700% in 2020 and 2021.

There's no way of predicting if and when a company will split its stock. One of the most common reasons that companies do this is when the share price has increased significantly. By splitting its stock, a company can lower the share price, potentially attracting more retail investors.

So, we can't say with any certainty whether Etsy will split its stock. It could happen if its share price begins climbing rapidly.

Related investing topics

The bottom line on Etsy

There's plenty to like about Etsy as an investment. It has built a recognizable brand name in a popular niche. By placing order fulfillment in the hands of its sellers, Etsy is also able to avoid some of the most common costs that online stores have, including storage and shipping.

If you're interested in finding quality growth stocks to add to your portfolio, Etsy is worth checking out. Keep in mind that since it's a growth stock, it will generally be on the volatile side. That means bigger gains when things are going well but also bigger losses when they aren't.

Like other consumer discretionary stocks, Etsy is highly dependent on the economy. During periods of economic uncertainty and high inflation, it likely won't be as successful. It does best when people have plenty of disposable income and aren't afraid to use it.

The most exciting part about Etsy as an investment is its plan to build out its search function using AI and make it more like an in-store experience. One of the hardest parts about shopping online is sorting through a massive number of options with each search. If Etsy makes that easier, buyers and sellers -- as well as investors -- are likely to benefit.

Investing in Etsy FAQs

Can you invest in Etsy stock?

Yes, you can invest in Etsy stock. To invest, search for the stock using the name or ticker (ETSY) in your brokerage account.

Is Etsy a good company to invest in?

Etsy is a good company to invest in if you're looking for growth stocks to buy and hold. It's the leading e-commerce platform for handmade goods, and it has expanded its reach with acquisitions of other brands, including Reverb, Depop, and Elo7.

Is Etsy Profitable?

Yes, Etsy is largely a profitable company, despite posting a large loss of nearly $700 million in 2022 due to the acquisitions of Depop and Elo7. However, Etsy remained profitable for the prior 5 years, from 2017 to 2022, and has since returned to positive net income figures in 2023.