Novo Nordisk (NVO 0.08%) is a leading global healthcare company headquartered in Denmark. The company has spent the past century helping defeat serious chronic diseases, such as diabetes. In addition to the company's COVID-19 vaccine research leading to the first COVID-19 mRNA vaccine, it developed the breakthrough medication semaglutide to treat type 2 diabetes and weight loss, marketed under the brands Ozempic and Wegovy.

Sales of the products are soaring, driving healthy profit and cash flow growth for the pharmaceutical company. That growth potential has many people interested in learning how to invest in Novo Nordisk stock. Here's everything you need to know about investing in the pharmaceutical company.

Stock

How to buy

How to buy Novo Nordisk stock

Anyone can invest in Novo Nordisk. Here's a four-step guide to help you add the pharmaceutical stock to your portfolio.

Step 1: Open a brokerage account

You'll have to open and fund a brokerage account before buying shares of any company. If you need to open one, here are some of the best-rated brokers and trading platforms. Take your time researching the brokers to find the best one for you.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

You don't have to get there on the first day, though. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow from there.

Step 3: Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about its competitors, review its balance sheet, find out how it makes money, and consider other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term.

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (NVO for Novo Nordisk).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at market price.

Here's a screenshot of how to buy a stock with the five-star-rated platform Fidelity (which offers a video tutorial and a step-by-step guide):

Once you complete the order page, click to submit your trade and become a shareholder of the pharmaceutical giant.

Should I invest?

Should I invest in Novo Nordisk?

Deciding whether to invest in any company is a personal decision. Here are some reasons you might want to buy shares of the pharmaceutical stock:

- You take one or more medications sold by Novo Nordisk.

- You believe the company's semaglutide products for weight loss and type 2 diabetes have tremendous sales growth potential.

- You want to invest in a company that pays a growing dividend.

- You're comfortable with the risks of investing in a pharmaceutical stock.

- Adding Novo Nordisk would help diversify your portfolio by adding some international exposure.

- You believe the company can grow into its high valuation (almost 40 times forward earnings in early 2024).

On the other hand, here are some reasons you might not want to buy shares of Novo Nordisk:

- You're unsure whether weight loss drugs like Wegovy will live up to their hype.

- You're concerned about the company's high valuation.

- You prefer to take a more natural approach to health and wellness.

- You're in or approaching retirement and need more dividend income than Novo Nordisk currently supplies.

- You already own several other pharmaceutical and healthcare stocks.

- You'd prefer to only invest in companies headquartered in the U.S.

Profitability

Is Novo Nordisk profitable?

Researching a company's profitability is important because profits are crucial to its long-term success. Profit growth tends to drive a stock's performance over the long term. That's why investors will want to see that a company is growing its earnings or at least on track to making money.

Novo Nordisk is a very profitable company. It reported 83.7 billion Danish kroner (about $12.2 billion at the exchange rate in early 2024) of net profit in 2023 on DKK$232.3 billion ($33.8 billion) in net sales. The company's sales were up 31% from 2022, while its net profit surged 51%. Driving that strong growth was the blockbuster performance of its diabetes and obesity treatments.

The company expects those blockbuster drugs to continue driving strong sales growth in 2024 and beyond. It anticipates sales rising 18% to 26% in 2024, which should drive 21% to 29% operating profit growth.

Meanwhile, the company expects to deliver solid sales and operating income growth in 2025, driven by a target of capturing a third of the global diabetes market and delivering DKK$25 billion ($3.6 billion) in obesity sales.

Novo Nordisk's growing sales and profits position it to deliver strong free cash flow, which should enable it to return lots of money to shareholders in the coming years through dividends and share repurchases.

Dividends

Does Novo Nordisk pay a dividend?

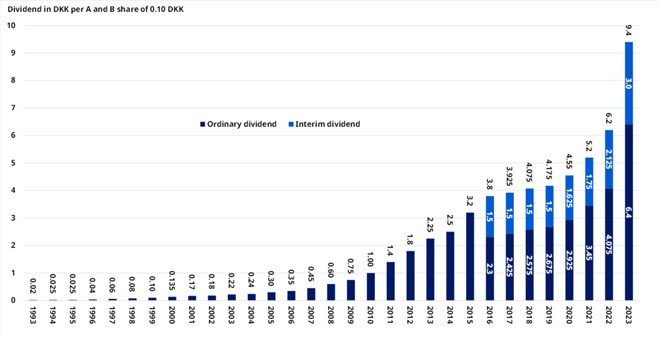

Novo Nordisk's guiding principle is to return any excess capital after funding its growth to investors via dividends and share repurchases. It has a long history of paying dividends to its shareholders. Payouts have steadily risen over time as the company's profits and excess cash flow have increased.

One thing worth pointing out about Novo Nordisk's dividend is that it pays on a different schedule than its counterparts in the U.S. pharmaceutical industry. Whereas most U.S. companies pay quarterly dividends, European companies tend to pay annual or biannual dividends. Novo Nordisk moved from paying annual to biannual dividends in 2016.

While Novo Nordisk pays a growing dividend, it offered a low dividend yield in early 2024. At 0.4%, its yield was much lower than the S&P 500's (roughly 1.4%).

ETF options

ETFs with exposure to Novo Nordisk

Many prefer to invest passively instead of actively picking a portfolio of stocks they must manage. Thanks to exchange-traded funds (ETFs), that's very easy nowadays. Many ETFs allow you to gain passive exposure to a company, theme, or broad market index.

Exchange-Traded Fund (ETF)

According to ETF.com, 37 ETFs held 2.2 million shares of Novo Nordisk in early 2024. The Avantis International Equity ETF (AVDE 0.73%) was the biggest holder in early 2024, with around 550,000 shares. However, this broader market ETF had a rather low allocation to the pharmaceutical company at 1.7% of its assets.

Investors seeking an ETF with a larger allocation to Novo Nordisk have several options, including:

- VanEck Pharmaceutical ETF (PPH 0.4%): This fund tracks the performance of pharmaceutical companies listed on U.S. exchanges. The fund had 26 holdings in early 2024, including Novo Nordisk (second-largest, at 9.4% of its assets). The fund had a 0.36% total ETF expense ratio.

- First Trust International Equity Opportunities ETF (NYSEMKT:FPXI): This international ETF focuses on the 50 largest companies outside the U.S. It held 50 stocks in early 2024, including Novo Nordisk (sixth-largest holding, at 4.1% of the fund's assets). The ETF had a 0.7% expense ratio.

Stock splits

Will Novo Nordisk stock split?

Novo Nordisk didn't have an upcoming stock split as of early 2024. However, the leading global healthcare company completed a 2-for-1 stock split in September 2023. That was one of several stock splits it has completed throughout its history.

Given how recently the company split its stock, it likely won't complete another soon. Its share price was around $125 in early 2024, a reasonably accessible level for most investors. However, if shares continue to rise, the company could split its stock again.

Related investing topics

The bottom line on Novo Nordisk

Novo Nordisk has developed several blockbuster drugs over the years. Its latest breakthroughs for Type 2 diabetes and weight loss are selling briskly, which could drive robust profit growth for the global pharmaceutical giant. That could send its share price higher in the coming years, making it a potentially lucrative investment.

FAQ

Investing in Novo Nordisk FAQ

Is Novo Nordisk a good stock to buy?

Novo Nordisk has been a good stock to buy over the years. The pharmaceutical company has produced a 21% total annualized return over the past 10 years, outperforming the S&P 500's average annual total return.

The company is in a strong position to continue growing value for its shareholders in the future. It expects sales of Ozempic and Wegovy to continue growing briskly, which should drive its earnings and cash flow higher. That will give the company more money to return to investors through dividends and share repurchases.

However, investors do have to pay a high premium for that growth (Novo Nordisk traded at almost 40 times forward earnings in early 2024). Given the company's growth potential, it could grow into its valuation while continuing to deliver strong returns for investors. That makes it look like a good stock to buy.

How can I buy shares in Novo Nordisk?

You can buy shares of Novo Nordisk in any brokerage account. You need to open a brokerage account (if you don't have one already). From there, you'll need to figure out your budget, thoroughly research the stock, and place an order when you're ready to buy shares. To place an order, you'd fill out the order page in your brokerage account, including:

- The number of shares you want to buy.

- The correct stock ticker (NVO for Novo Nordisk).

- The order type (limit order or a market order).

Once you fill out the order page, click to submit your trade to buy shares of Novo Nordisk.

Can I buy Novo Nordisk stock on Robinhood?

Yes, you can buy shares of Novo Nordisk on Robinhood (NASDAQ:HOOD). The global healthcare company trades under the stock ticker NVO.

What stock exchange is Novo Nordisk on?

Novo Nordisk's B shares trade on the Nasdaq Copenhagen exchange. In addition, the company's American depositary receipts (ADRs) trade on the New York Stock Exchange under the stock ticker NVO.