Diversifying your investment portfolio into the aerospace and defense industry? You could consider Northrop Grumman (NOC -1.56%), an experienced leader in this sector. Known for its pioneering work in defense and aerospace technologies, with a hand in the American space program and many other government contracts, Northrop Grumman has been a mainstay in investment circles for decades. As the industry faces new challenges and opportunities, from cybersecurity to expanded space exploration, Northrop Grumman's evolving strategy positions it as a resilient and forward-thinking choice for investors.

Basic information

Shares of Northrop Grumman stock

Purchasing a stock is an investment in a company's journey and success. It's not merely a financial instrument; it's a share of the company's value, both in assets and earnings, and a say in its governance. Shareholders wield their power through voting, shaping the company's strategic path and choosing its leaders. The market capitalization, a measure of the company's total value, is the product of the number of shares and the stock price. Investing in a company means becoming a part of its ongoing narrative and future prospects.

The basics of Northrop Grumman

Northrop Grumman Corporation, a titan in the defense and aerospace sectors, is best known for its sophisticated military hardware and space technology. Since its inception in 1939, Northrop Grumman has also become a technology giant, venturing into realms like cybersecurity, unmanned aerial vehicles, and space systems.

Northrop Grumman keeps proving its resilience and adaptability in an ever-changing global landscape. Despite intense competition and the complexities of a dynamic market, Northrop Grumman continued to innovate and maintain a significant presence in the global defense and aerospace sectors. This tenacious attitude makes Northrop Grumman a compelling choice for investors interested in the defense and space exploration sectors.

Investing in Northrop Grumman goes beyond just tapping into current market trends, like a sophisticated lottery ticket. A shareholder owns a small part of the company in a very real sense, with voting power in electing the board of directors and a claim to the stock's dividend payouts. Owning this stock is about defining the future of defense, cybersecurity, and space exploration. Northrop Grumman, with its deep-rooted history and progressive approach, stands as a symbol of both a storied past and a visionary future in the dynamic defense landscape. That's what you are buying in Northrop Grumman's stock.

How to buy

How to buy Northrop Grumman stock

Investing in Northrop Grumman is as straightforward as buying any other publicly traded stock. Whether you're an experienced investor or just starting out, acquiring shares of Northrop Grumman can be accomplished in a few easy steps. To illustrate, let's consider the trading process on a popular online brokerage platform like E*Trade as an example.

Step 1: Open a brokerage account

To begin investing in Northrop Grumman, the first step is to open a brokerage account if you don't already have one. Northrop Grumman trades on the New York Stock Exchange (NYSE), so you'll need an account with a brokerage that offers trading on that platform (Pretty much any well-known and respectable brokerage will do the job). You might consider brokers like Charles Schwab (SCHW 0.13%), Robinhood (HOOD 4.44%), or Interactive Brokers (IBKR -1.01%). Opening an account involves providing personal information and establishing how you will fund your trades.

Step 2: Conduct your research

Before putting your money into Northrop Grumman, it's crucial to analyze its business structure, financial status, and the risks involved. Examine Northrop Grumman's latest financial results, the views of market analysts, and current news influencing the company. It's also wise to compare Northrop Grumman with other key players in the defense industry, such as Lockheed Martin (LMT -0.75%), Raytheon Technologies (RTX -0.29%), and Boeing (BA 0.25%).

Keep an open mind during your research. Let the facts, not preconceptions, drive your investment decisions. The valuation of defense stocks can be influenced by a range of factors, including military spending trends and international relations. Determine where Northrop Grumman stands in this context, as its market value may vary with shifting industry dynamics. And if the company turns out to play second fiddle to rivals like Boeing or Lockheed Martin in important ways, you might end up owning one of those stocks instead -- and that's OK.

The aim is to confirm that Northrop Grumman is a viable investment, not merely to justify the opinion you had at the start of this research project. On that note, a deeper look at the company's suitability for investment will turn up in a minute. For now, let's finish checking out how to actually buy the stock.

Step 3: Place your order

Ready to go ahead and invest in Northrop Grumman's stock? It's time for the last couple of steps.

Log into your brokerage account and search for Northrop Grumman or its ticker, NOC. You'll find a detailed page with the stock's data and charts, plus a section for placing trades.

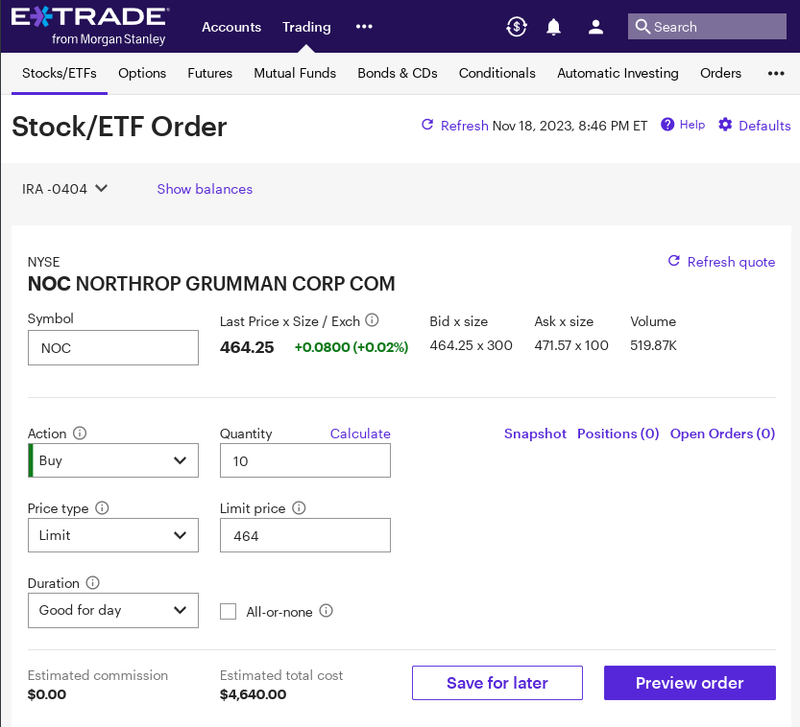

Next, decide how you want to buy Northrop Grumman shares. A "Buy Order" at E*Trade lets you input the number of shares you want to buy and specify the price you're willing to pay in a couple of different ways.

Given Northrop Grumman's active trading volume, a market order often suffices. That's an automated way to pay the going price for the stock in question without setting any specific targets. Alternatively, a limit order lets you set a maximum price per share, offering more price control. Market orders tend to execute right away since you're agreeing to a price established by the open market. Limit orders can take longer or may not be filled at all if the stock price doesn't dip down to your lowest acceptable level. You could change the price limit and try again, change to a market order, or simply accept that you're not buying Northrop Grumman at the desired price and move on to a different stock. The choice is up to you.

You also have the option to trade outside normal market hours and set an expiration time for orders that don't fill immediately. These are more advanced features, but for most, simple buy and limit orders are adequate.

So now you have chosen to buy Northrop Grumman shares, selected a market or limit order, and determined your investment amount. Now, divide your investment by the selected (or reported) price to figure out how many shares you're buying; if you have a fixed amount to invest and your brokerage offers the service, you can buy fractional shares of stock, as well.

Enter this data into your brokerage's buying interface. Here's an example of buying 10 Northrop Grumman shares on the E*Trade platform, managed by Morgan Stanley (MS 0.29%):

Follow through a couple of confirmations, and once your order is executed, you'll be a Northrop Grumman shareholder. Congratulations!

Should I invest in Northrop Grumman?

Before you decide to invest in Northrop Grumman, let's assess its investment merits.

Profitability

Is Northrop Grumman profitable?

Northrop Grumman's financial track record is a blend of stability and strategic growth. In fiscal year 2022, the company reported robust revenues of $36.6 billion, with net income of $4.9 billion. Its organic sales rose 3% year over year despite the ongoing inflation crisis.

These figures reflect Northrop Grumman's steady navigation through the complexities of the defense market in times of shifting geopolitical pressures, including variable government spending and international policy shifts.

The defense industry's profitability is often tied to long-term contracts and the cyclical nature of government spending. Northrop Grumman's operational cash flow stood at $2.9 billion in 2022, indicating solid operational efficiency. The company's significant investments in research and development (R&D) and technological advancements are essential for staying at the forefront of the defense and aerospace sectors.

Dividends

Does Northrop Grumman pay a dividend?

A key aspect of Northrop Grumman's appeal to investors is its consistent dividend payments. The company has a history of increasing its dividends, reflecting its financial health and commitment to shareholder value. The dividend yield has been competitive, ranging between 1.2% and 2% in the long run, appealing to people who prioritize steady income streams. Northrop Grumman's balance of dividend payouts and reinvestment into growth initiatives offers a compelling mix for investors seeking both income and capital growth potential.

ETFs

ETFs with exposure to Northrop Grumman

As an industry leader with solid American roots, Northrop Grumman is a longstanding component of many market indexes, such as the S&P 500 (SNPINDEX:^GSPC) and the Russell 1000. As such, many exchange-traded funds and mutual funds that track these indexes will automatically own a significant amount of Northrop Grumman stock.

Northrop Grumman's impact on the value and overall performance of these funds is proportionate to its weighting in the tracked stock portfolio, and the stock can make a larger difference to the prospects of smaller ETFs. Here are a few ETFs with prominent ownership of Northrup Grumman in November 2023, measured by dollar amounts or the proportion of the fund's assets being invested in this specific ticker:

| EXCHANGE-TRADED FUND | NUMBER OF NORTHROP GRUMMAN SHARES UNDER MANAGEMENT | ETF'S NET ASSET VALUE | % ALLOCATION OF NORTHROP GRUMMAN STOCK |

|---|---|---|---|

| SPDR S&P 500 ETF TRUST (NYSEMKT:SPY) | 1.6 million | $394 billion | 0.2% |

| iShares Core S&P 500 ETF (NYSEMKT:IVV) | 1.4 million | $341 billion | 0.2% |

| iShares US Aerospace and Defense ETF (NYSEMKT:ITA) | 568,000 | $5.2 billion | 5.2% |

| Invesco Aerospace & Defense ETF (NYSEMKT:PPA) | 309,000 | $2.1 billion | 6.8% |

Stock splits

Will Northrop Grumman's stock split?

Northrop Grumman has a long history of stock splits but only a couple of actual splits executed across that lengthy period. The defense contractor's shares split at a 3-for-1 ratio in 1984, followed by a 2-for-1 split in 2004. In March 2011, you may see an unusual split of 10,000-for-9,035 as part of the Huntington Ingalls Industries (HII 0.36%) spinoff when Northrop Grumman cut loose its shipbuilding operations as a separate company, creating the robust Huntington Ingalls company with an HII stock ticker. Northrop Grumman shareholders at the time received one share of the smaller shipbuilding company for each six shares they owned in the parent company.

Many companies start considering stock splits when their stock prices run into triple-digit territory. Northrop Grumman's stock crossed the $100 threshold in 2013 and hasn't looked back, so another split might be in the cards. That said, stock splits don't add any value to the underlying business. It's just a way to cut the ownership of the company into a larger number of smaller slices. So, it's not a game-changing idea, but a stock split can still make the stock more approachable, especially for those without easy access to fractional shares. Keep an eye on Northrop Grumman for any split announcements since this could widen its investor appeal.

Related investing topics

Is Northrop Grumman a good investment?

Northrop Grumman's investment potential is shaped by its prominent position in the defense and aerospace sectors, its innovative edge, and its financial resilience. Despite facing stiff competition from robust industry peers like Lockheed Martin and Raytheon, Northrop Grumman's consistent involvement in key defense contracts and advancements in areas such as space exploration and cybersecurity make it a potentially strong long-term investment.

Near the end of 2023, Northrop Grumman continued to hold its ground in a highly competitive industry, adapting to global defense dynamics and technological advancements. The company's strategic initiatives, including expanding into new defense technologies and maintaining a strong contract pipeline, suggest a positive outlook. While the volatility and sharply competitive nature of the defense sector might deter some investors, others may see Northrop Grumman's adaptability and consistent performance as a testament to its enduring strength.

The decision to invest in Northrop Grumman should be in line with your investment objectives and risk tolerance. The company may not fit every portfolio, but for those looking for long-term growth in a competitive yet lucrative defense and aerospace market, Northrop Grumman stands out as a compelling option. At the very least, any investor in the defense sector needs to keep an eye on this sector giant.

Investing in Northrop Grumman FAQs

Is Northrop Grumman publicly traded?

Yes, Northrop Grumman trades on the New York Stock exchange under the ticker symbol NOC.

What is the minimum investment in Northrop Grumman?

The smallest investment in Northrop Grumman is determined by your broker's rules. If they offer fractional shares, you can invest just a couple of dollars if you want. Most traders have canceled their commission fees for simple stock orders, so there's no real downside to making small investments anymore -- though some may still charge a fee for fractional shares. Keep an eye on those policies before hitting the "Buy" button.

And without the option of fractional shares, the minimum would be the price of one share. That price rose from the low $200s to the high $400s in the five-year period from 2019 to 2023. Only time will truly tell where it goes from there, though Northrop Grumman has traded at triple-digit share prices for more than a decade.

Is Northrop Grumman a good investment?

Whether Northrop Grumman is a suitable addition to your portfolio depends on various factors, including your financial objectives and risk tolerance. The company's established reputation in defense and aerospace and its commitment to innovation are compelling, but it's important to assess how it fits within your broader investment strategy, especially given the sector's competitive landscape.

Is Northrop Grumman a safe investment?

All stock investments, including Northrop Grumman, carry inherent risks. That said, we are talking about an industry leader in a stable sector with muscular staying power. You shouldn't bet the farm on Northrop Grumman, but the stock could add some effective defense and industrial exposure to a diversified stock portfolio.