If you're expanding your investment horizons into the world of semiconductor giants, Intel (INTC -9.2%) stock could be a compelling choice. Renowned for its pivotal role in the history of computer chips, Intel has been a cornerstone of technological innovation and a staple in many investment portfolios for decades.

The company's business strategy is shifting as the semiconductor space goes through some dramatic changes. However, the new Intel looks just as solid as its old-school incarnation.

Shares of Intel stock

Shares of Intel stock

A share of stock is much more than a casino chip. It represents ownership in a company, entitling holders to a portion of its assets, profits, and voting rights. Shareholders use their votes to elect the board of directors and settle other matters of strategy and management.

The total market value of a publicly traded company is known as the market capitalization or market cap. You get it by multiplying the number of shares by the current stock price.

Stock

Intel isn't just about chips; it's a symbol of enduring strength in the tech sector. By investing in Intel, you're not just buying a piece of a company; you're becoming part of a legacy that has shaped the digital age.

Getting to know Intel

Getting to know Intel

Intel Corporation stands as a titan in the semiconductor industry, known primarily for microprocessors that power a vast majority of the world's personal computers and many big-iron server systems. Intel's journey began in 1968; since then, it has evolved into a multifaceted tech giant, delving into areas like data centers, the Internet of Things (IoT), and artificial intelligence (AI).

By the end of 2022, Intel had demonstrated its resilience and adaptability in a rapidly changing tech landscape. Despite facing stiff competition and the challenges of a dynamic market, Intel continued to innovate and maintain a significant presence in the global semiconductor industry. This adaptability and persistence make Intel an intriguing option for investors looking to tap into the tech sector.

Remember, investing in a company like Intel is not just about riding the current wave of technology; it's about being part of a journey that shapes the future of computing and digital innovation. With its rich history and forward-looking approach, Intel represents both a legacy and a promise in the ever-evolving world of cutting-edge technology.

How to buy

How to buy Intel stock

Investing in Intel is a straightforward process, similar to purchasing other publicly traded stocks. Whether you're a seasoned investor or new to the stock market, buying Intel shares can be done in a few simple steps. Let's use the trading process of a popular online brokerage, such as E*Trade, as an example to illustrate these steps from scratch.

Step 1: Open a brokerage account

To start buying shares in Intel, you first need a brokerage account. If you don't already have one, it's time to choose a broker.

Look for a reputable brokerage firm that offers trading on the Nasdaq stock exchange, where Intel shares are listed. Options include well-known brokers like Charles Schwab (SCHW 0.13%), Morgan Stanley (MS 0.29%) and its E*Trade subsidiary, and Robinhood (HOOD 4.44%). Opening an account usually involves providing some personal information and setting up funding options.

Step 2: Conduct your research

Before investing in Intel, it's crucial to understand its business model, financials, and the risks involved. Dig into Intel's latest earnings reports, analyst ratings, and news affecting the company.

Compare Intel with its competitors and other investments in the semiconductor industry, such as Advanced Micro Devices (AMD 2.37%), Nvidia (NVDA 6.18%), and Qualcomm (QCOM 1.45%), to get a comprehensive view of its market position.

Approach this research with an open mind. Let the facts guide your investment decision, ensuring it's based on solid analysis rather than preconceived notions. Sometimes, a tech stock may be cheap for a good reason; other times, it may deserve a high share price. Where Intel falls on that scale will vary over time and with different market developments.

Your goal is to confirm that Intel is a sound investment, not just to validate an initial impression. We'll get back to Intel's suitability as an investment after this review of the actual buying process.

Step 3: Place your order

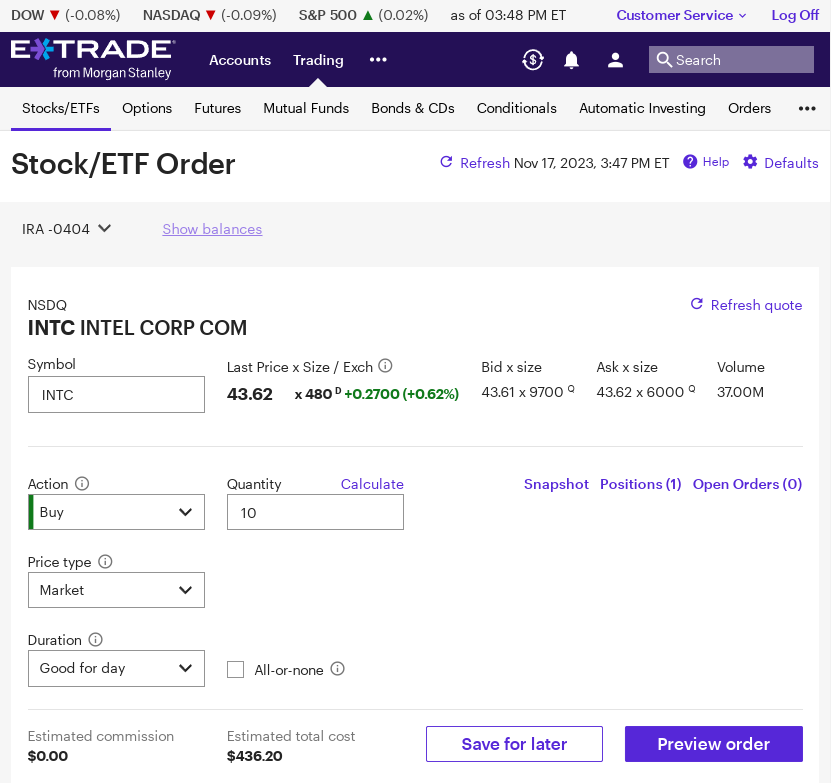

When you're ready to buy Intel stock, log in to your brokerage account and search for Intel or its ticker symbol, INTC. You'll find a page filled with stock data and charts, along with a trading window for your transaction.

Now, it's time to execute your purchase of Intel shares. First, decide on your order type. A standard "buy order" allows you to specify the dollar amount you want to invest in Intel. The brokerage will calculate the number of shares you can buy at the current market price, including fractional shares, if applicable.

A market order is usually sufficient for a stock with significant trading volume like Intel. However, you could also consider a limit order, where you set the maximum price you're willing to pay per share. It's a little bit more work, but on the upside, you have full control over the pricing.

You also can choose to execute trades outside standard market hours and set how the order system handles the expiration of unfilled orders. We're not talking about Stockbuying 101 anymore, though. Although advanced order types are available, the basic buy and limit orders typically meet most investors' needs.

Now you know you want to buy Intel shares. You have either decided to use a basic market order or settled on a fair limit price. You know how much you want to invest in this stock today, and you have divided the cash you're investing by the appropriate price, arriving at the number of Intel shares you're going to buy.

All you have left to do is enter this data into your brokerage's buying tool. Here's what a modest market order for Intel stock might look like, using E*Trade's interface as an example:

Click through a couple of confirmations and wait for the order to execute. Congratulations -- you are now the proud owner of Intel stock.

Should I invest?

Should I invest in Intel?

Now that you know how to buy Intel shares, let's consider its potential value as a long-term investment.

Profitability

Is Intel profitable?

Intel's financial health has shown resilience over time. For instance, in the fiscal year 2022, Intel reported revenues of $63.1 billion and $8.0 billion in bottom-line net income. It faced challenges like global supply chain disruptions and intense competition that year, resulting in softer year-over-year comparisons.

There are other ways to look at profits, and Intel's profitability on a cash-generating basis can vary greatly amid heavy or light infrastructure investments. The company generated $15.4 billion of operating cash flow that year but spent $24.8 billion on maintenance and additions to its chipmaking infrastructure. So, Intel reported negative free cash flow in 2022 due to a massive expansion of its manufacturing capacity.

Dividends

Does Intel pay a dividend?

Intel has a history of paying dividends, reflecting its commitment to returning value to shareholders. The company's dividend history and yield are important factors for investors seeking income alongside capital appreciation.

Its quarterly payouts increased every year for several decades until a strategy shift resulted in a dividend cut in 2023. The company needed more cash for its manufacturing infrastructure expansion and decided the project was a more important use of cash than the generous dividend policy. The dividend yield peaked at 5.9% before the cut, dropping to less than 2%.

ETF options

ETFs with Intel Inside(R)

Intel is a component of myriad exchange-traded funds (ETFs) offering diversified exposure to the stock. As a member of many market indices, such as the S&P 500 (SNPINDEX:^GSPC) and Dow Jones Industrial Average (DJINDICES:^DJI), the stock is automatically included in index funds and ETFs that track these popular index lists. Intel's impact on these funds' overall performances is proportionate to its weighting in the ETF, and the stock can be more influential in smaller ETFs.

Exchange-Traded Fund (ETF)

| Exchange-Traded Fund | Number of Intel Shares Under Management | ETF's Net Asset Value | % Allocation of Intel Stock |

|---|---|---|---|

| Invesco QQQ Trust (NYSEMKT:QQQ) | 72.1 million | $195 billion | 1.4% |

| SPDR S&P 500 ETF Trust (NYSEMKT:SPY) | 46.9 million | $394 billion | 0.4% |

| Vanguard Value ETF (NYSEMKT:VTV) | 24.6 million | $139 billion | 0.9% |

| First Trust Nasdaq Semiconductor ETF (NYSEMKT:FTXL) | 2.6 million | $986 million | 9.5% |

Stock splits

Will Intel's stock split?

Intel has a long history of stock splits, with eight splits executed between the fall of 1980 and the summer of 2000. Over that period, one Intel share turned into 192 stubs without affecting the stock's overall market value.

Future splits will depend on various factors, including Intel's stock price and corporate strategy. The company doesn't look likely to invoke another split any time soon, but you never know. Keep an eye on Intel's stock performance and company announcements for potential split information.

Related investing topics

Is Intel a good investment?

Intel's investment potential hinges on several factors, including its market position, innovation pipeline, and financial performance. While the stock has experienced fluctuations, Intel's role as a leading semiconductor company and its efforts in areas like AI and IoT position it as a potentially strong long-term investment.

As the end of 2023 approached, Intel was shifting its focus away from in-house chip designs to serve the semiconductor at large with third-party manufacturing services. The change was a response to the chip manufacturing shortage that began in the early coronavirus era and also served to move chipmaking capacity away from China.

So, Intel is undergoing some radical changes at this time and may look quite different in a few years. Bears will argue that this is a bad situation, while bullish investors see a new realm of opportunity instead.

So, it depends. Intel isn't the dominant leader in computing hardware it once was, but the so-called chip foundry strategy could be just as effective in the long run. Intel's stock doesn't fit every investing philosophy, but it may be a great fit for your personal strategy.

FAQs

Investing in Intel FAQs

Is Intel publicly traded?

Yes, Intel trades on the Nasdaq stock exchange under the ticker symbol INTC.

What is the minimum investment in Intel?

This depends on your broker's policies. Many allow trading of fractional shares, effectively making the minimum investment very low. Otherwise, the minimum Intel investment will be a single share, with a cost that ranges between $25 and $70 from 2019 to 2023.

Is Intel a good investment?

Intel's long-term potential is influenced by its market leadership, innovation, and financial health. However, like any investment, it carries risks and requires thorough research.

It may be the best choice for my portfolio but a poor choice for yours -- or the other way around. Every investor's situation is different, and the market conditions are always in flux. You need to weigh Intel's pros and cons against your own conclusions, preferences, and needs -- as you do with any investment.

That said, Intel is a popular stock, offering robust long-term stability in the highly cyclical semiconductor industry. That profile may (or may not) be just what you need.

Is Intel a safe investment?

Intel is a well-established company with a strong market presence, but stock investments always carry inherent risks. Diversification and careful analysis are key to managing these risks.