Plug Power (PLUG 1.26%) has grand ambitions. It's building an end-to-end hydrogen ecosystem to produce, store, and deliver lower-carbon emissions energy to customers across the U.S. and Europe. The company's strategy could fuel significant revenue and earnings growth in the coming years.

Plug Power was a first mover in the hydrogen sector. The company developed the first commercially viable hydrogen fuel cell technology market. It has since deployed an industry-leading 60,000+ fuel cell systems into the electric mobility market.

The company is leveraging its first-mover advantage and hydrogen experience to become a leader in producing the low-carbon fuel. It's building and developing several hydrogen production facilities across the U.S. and Europe. Plug Power set an ambitious goal of producing more than 2,000 tons of hydrogen per day by 2030.

Plug Power's ambitious growth plan should fuel significant revenue and earnings growth. The company sees its annual sales topping $5 billion in 2026 while delivering a more than 30% gross margin and an operating margin topping 17%. That's up from expectations of $1.4 billion in revenue and a 10% gross margin at the high end in 2023. Meanwhile, the company forecasts sales to pass $20 billion by 2030, with margins exceeding 35% (gross) and 20% (operating). It's investing heavily to build its hydrogen network to achieve these bold financial goals.

Plug Power's enormous growth potential has many investors interested in buying the leading hydrogen stock. Here's a step-by-step guide on how to invest in its shares and some things to consider before buying the stock.

How to invest

How to buy Plug Power stock

You'll need to take a few steps before buying shares in Plug Power (or any other stock). Here's a step-by-step guide to adding the hydrogen-focused company to your portfolio.

- Step 1: Open a brokerage account: You need to open and fund a brokerage account before buying shares of any stock; here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one for you.

- Step 2: Figure out your budget: Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years. You don't have to get there on the first day. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow from there.

- Step 3: Do your research: It's essential to thoroughly research a company before buying its shares. You should learn about how it makes money, its competitors, its balance sheet, and other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term. Continue reading to learn more about some crucial factors to consider before investing in Plug Power's stock.

- Step 4: Place an order: Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively simple. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (PLUG for Plug Power).

- Whether you want to place a limit order or a market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price.

Once you complete the order page, click to submit your trade and become a Plug Power shareholder.

Stock Ticker

Should I invest?

Should I invest in Plug Power?

Doing research is essential before buying a stock. It could lead you away from buying shares or further confirm your thesis. Here are some reasons why you might want to buy shares of Plug Power:

- You believe that green hydrogen powered by renewable energy could be a crucial solution in helping decarbonize the global economy.

- You think Plug Power's heavy investment in building an end-to-end hydrogen solution will pay off down the road.

- You believe the stock will significantly outperform the S&P 500 over the next five years.

- You don't need dividend income from your investment.

- You understand that Plug Power isn't profitable and could continue losing money.

- You're comfortable with owning a stock that could be very volatile.

- You understand the risks, including the possibility that shares of Plug Power could continue to lose value.

On the other hand, here are some factors that might cause you to opt against buying shares of Plug Power:

- You're unsure if hydrogen will be a commercially viable alternative energy solution.

- You're worried about Plug Power's ability to finance its ambitious growth strategy.

- You're concerned that the company will continue to lose money.

- You're retired or nearing retirement and need investments that generate income.

- You're seeking investments with less volatility and a higher probability of generating attractive total returns.

Profitability

Is Plug Power profitable?

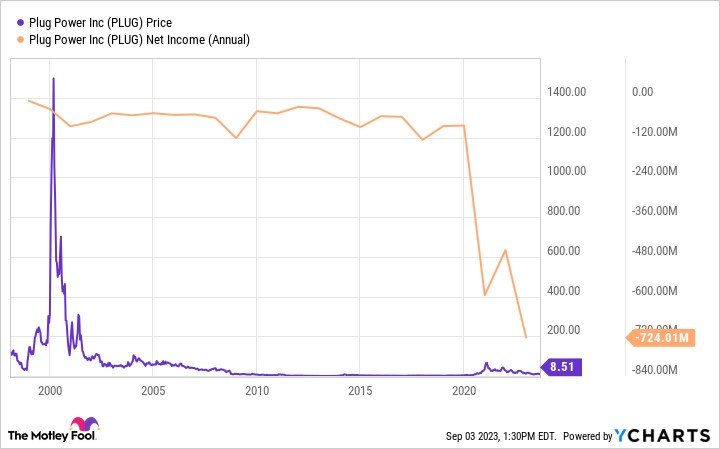

Profitability is a big driver of share price growth over the long term. Unfortunately, profitability has proven elusive for Plug Power. That has weighed on its share price over the years:

Shares of the money-losing company have lost more than 90% of their value since its initial public offering (IPO) more than 20 years ago.

Plug Power was still a long way from profitability as of mid-2023. Despite reporting the highest quarterly revenue in its history at $260.2 million in the second quarter of 2023 (up 72% year-over-year), Plug Power posted a net loss of $236.4 million.

Through the first six months of 2023, Plug Power reported a $443 million loss on only $470.5 million in revenue. On a more positive note, that's an improvement from the same period in 2022, when it reported a higher net loss ($329.8 million) than its net revenue ($292.1 million).

The company is on a path to profitability. It's investing heavily to increase its manufacturing scale and build green hydrogen production facilities, which should continue powering robust revenue growth while improving its margins. The company believes that as it continues to scale, it will eventually turn the corner and reach profitability in the coming years.

Dividends

Does Plug Power pay a dividend?

Plug Power didn't make dividend payments to its shareholders as of mid-2023. The company hasn't declared a dividend since its 1999 initial public offering. Since the company isn't yet consistently profitable, it likely won't initiate a dividend in the foreseeable future.

ETFs with exposure

ETFs with exposure to Plug Power

An alternative to investing directly in Plug Power stock is to consider a passive investment through a fund that holds its shares. One of the most common passive investment vehicles is an exchange-traded fund (ETF).

Exchange-Traded Fund (ETF)

In mid-2023, 103 ETFs held 50.5 million shares of Plug Power, according to ETF.Com. The iShares Global Clean Energy ETF (NYSEMKT:ICLN) was the largest holder at 10.2 million shares. Plug Power was the fund's 11th-largest holding with a 2.5% allocation. That makes it a decent way to gain some passive exposure to Plug Power and other top clean energy stocks.

Meanwhile, the Global X Hydrogen ETF (NYSEMKT:HYDR) has an even larger allocation to Plug Power. It was the fund's second-largest holding at 13.2% of its total. That makes it a potentially appealing option for those seeking greater passive exposure to Plug Power and other leading hydrogen stocks.

Stock splits

Will Plug Power stock split?

Plug Power hadn't announced an upcoming stock split as of mid-2023. The company had never completed a regular stock split in its history.

However, Plug Power did complete a reverse stock split in 2011. It completed a 1-for-10 reverse stock split to maintain its listing on the Nasdaq Stock Exchange and make its share price more appealing to institutional investors like mutual funds and hedge funds.

Related investing topics

The bottom line on Plug Power

Plug Power has an ambitious plan to become a powerhouse in the hydrogen industry. The company is investing heavily to build additional hydrogen production sites and other infrastructure to become a leading provider of this lower-emissions fuel. The company's strategy could enable it to generate robust revenue and earnings growth in the coming years.

However, Plug Power has struggled to produce profits in the past. There's no guarantee it will achieve its bold plans and make money in the future. It's a very risky investment that could either pay off spectacularly or continue eroding shareholder value.

FAQs

Investing in Plug Power FAQs

Is PLUG a good stock to buy now?

Plug Power holds tremendous promise. The company is building an integrated hydrogen network. Those investments could fuel significant earnings and profit growth over the coming years.

However, Plug Power's potential comes with many risks. While hydrogen holds substantial promise as a low-emissions fuel source, its commercial viability remains a big question. Meanwhile, Plug Power has yet to prove it can make money from the technology. Investors should view Plug Power as a very speculative and high-risk stock that also offers high reward potential.

What will PLUG stock be worth in five years?

It's impossible to accurately predict a stock's price several years into the future. However, foreseeing Plug Power's upside potential is a bit easier because it has provided investors with a road map that hints at its future value upside.

The company believes it will produce more than $5 billion in annual revenue by 2026 (up from around $1.4 billion in 2023) and more than $20 billion in sales by 2030 while improving profitability along the way. If it delivers on that ambitious growth, the stock could easily be worth more than double its price from mid-2023 in five years. On the other hand, if it underachieves its ambitious plan and runs into financial trouble because it still hasn't turned a profit, the stock value could continue heading lower.

Is Plug Power a publicly traded company?

Plug Power has been a publicly traded company since it completed its initial public offering in 1999. The hydrogen company trades under the stock ticker PLUG on the Nasdaq Stock Exchange.