Like the rest of the cannabis sector, Canopy Growth (CGC 2.41%) stock boomed in 2018 in anticipation of legalization in Canada. But since then, Canopy Growth and the rest of the sector have largely gone up in smoke. The stock boomed again in 2020 and 2021 during the early part of the pandemic before collapsing.

While a number of states have legalized pot in the U.S., legalization at the federal level hasn't shown any significant signs of progress. Cannabis growers have struggled with high levels of competition and falling commodity prices. Most have found little opportunity for competitive advantage.

In this deep dive, we'll discuss how to buy Canopy Growth stock, whether you should invest in the company, whether it's profitable, other ways to get exposure to it, and its future prospects.

How to buy

How to Buy Canopy Growth Stock

Step 1: Open a brokerage account

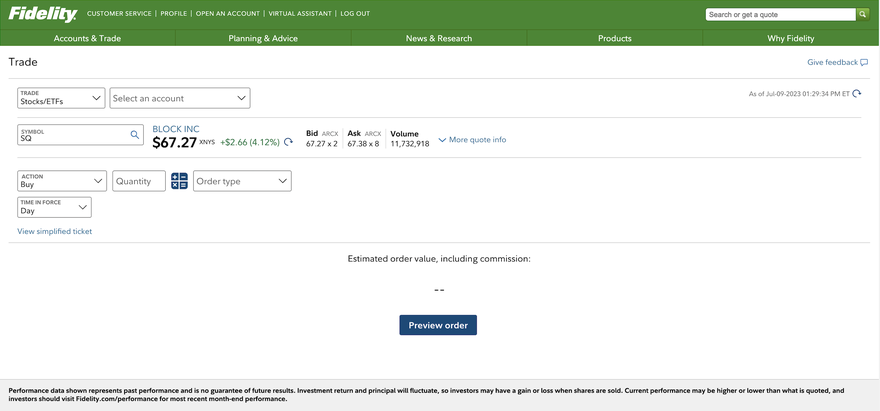

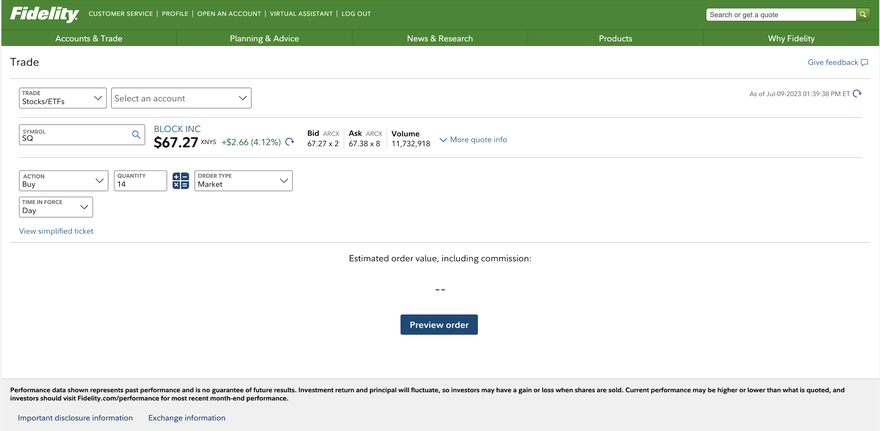

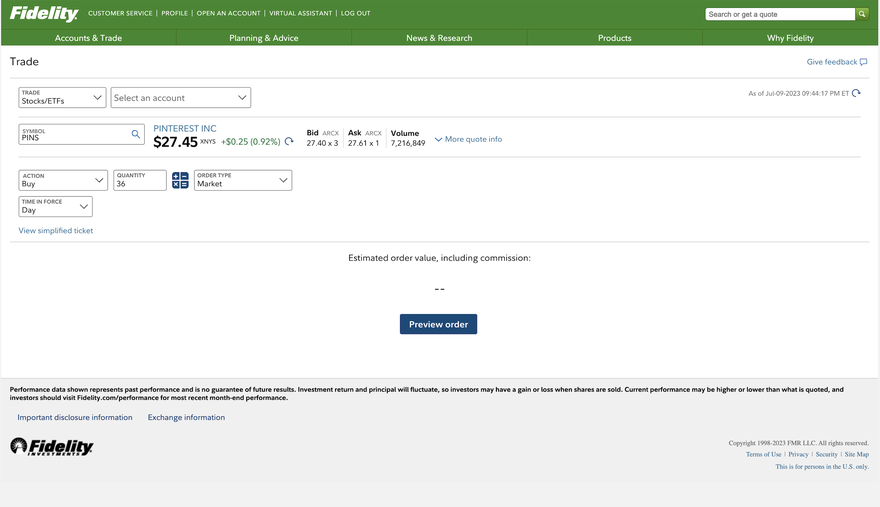

To buy Canopy Growth stock, the first thing you need is a brokerage account. If you don't already have a brokerage with a company like Robinhood, E-Trade, Fidelity, or TD Ameritrade, you'll have to open an account before you can buy the stock.

Once you open the account, you'll have to fund it and then find the the CGC stock page and buy the stock.

Step 2: Figure out your budget

One of the most important decisions any investor makes is how much to invest in a particular stock. Your budget could depend on how much you have to invest, or it could be a matter of position sizing.

Generally, you'll want to have a smaller position in a riskier stock like Canopy Growth.

Step 3: Do your research

More important than position sizing is choosing the right stocks and doing your research to give yourself the greatest chance of picking winning stocks.

Understand the business model of the company you're planning to invest in. Review the recent financials, and seek out other opinions.

Doing your research is the best way to improve your success rate as an investor.

Step 4: Place an order

Now that you've opened a brokerage account, funded it, and chosen what stock to buy, you have to place an order, which may not be as simple as it sounds, as there are two main types: limit orders and market orders. Once you decide which one is better for you, find the stock and hit the buy button.

Should I invest?

Should I invest in Canopy Growth?

A recent review of Canopy Growth's quarterly report shows that the business is struggling. Revenue in the quarter fell 21% to $69.6 million, and the company remains unprofitable with an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss of $11.9 million and a generally accepted accounting principles (GAAP) loss of $148.2 million.

The company did report a significant improvement in its gross margin, up 4,900 basis points from the second quarter a year ago. Canopy closed its Canadian retail business last September, selling 28 company-owned stores under the Tweed and Tokyo Smoke brands, closing five other stores, and ending franchising and licensing agreements.

The news shows how competitive the Canadian retail market has become; the company brought in only $12.8 million in revenue last quarter.

In its current form, Canopy consists of several different segments, including Canadian business-to-business, Canadian medical, rest-of-world cannabis, Storz & Bickel (a maker of high-grade, medically certified cannabis vaporizers), and This Works, a maker of skin-care products.

The diversified business model gives Canopy Growth exposure to a number of potential growth opportunities in the broader cannabis sector. Profitability remains elusive for Canopy, but the silver lining here is that the stock price reflects the company's struggles, with its market cap falling to $500 million.

Investors should look for clearer signs that profitability is achievable for Canopy before buying the stock.

Is it profitable?

Is Canopy Growth profitable?

Canopy Growth has never been profitable on the basis of GAAP operating income, and it remains unprofitable despite efforts to cut costs and drive profitability, including the sale of its retail business for an undisclosed amount.

In its fiscal second quarter of 2024, the company posted a net loss of $148.2 million, which was a 25% improvement from the quarter a year ago; an adjusted EBITDA loss of $11.9 million, which was a 79% improvement from the quarter a year ago; and a free cash flow loss of $67.1 million, which was 32% better than the quarter a year ago. Adjusted gross margin in the quarter improved by 49 percentage points due largely to the divestiture of the retail business.

Operationally, Canopy continues to lose money. It also has a large interest expense from almost $700 million in high-interest debt, and its GAAP results swing wildly due to its minority stakes in other companies and a history of asset impairments and restructuring expenses.

The debt burden itself may make it difficult for the company to ever reach a profit, at least without being able to refinance at a lower rate. Additionally, only two of its five continuing business segments reported an increase in revenue in the most recent quarter; both increases were in the single digits. At this point, the company doesn't seem to have any major growth drivers that would help it achieve profitability.

In fiscal 2023, which ended on March 31, the company reported a GAAP net loss of $3.28 billion, which included a $2.26 billion in asset impairment and restructuring expenses.

It also reported an adjusted EBITDA loss of $350 million and a $558 million operating cash flow loss.

Does it pay a dividend?

Does Canopy Growth pay a dividend?

Canopy Growth pays a dividend. According to the company's annual report, it has no intention of declaring dividends on Canopy shares in the foreseeable future.

Unprofitable companies generally do not pay dividends since they are unable to fund dividend payments out of the business. Additionally, companies that pay dividends tend to be more mature, slower-growth businesses.

For those reasons, it's unlikely that Canopy Growth will pay a dividend soon, if ever.

ETFs with exposure

ETFs with exposure to Canopy Growth

Investing in exchange-traded funds (ETFs) is another way to gain exposure to a stock like Canopy Growth. By owning an ETF you can outsource the work of diversifying the portfolio. If the ETF is actively managed, it will adjust your holdings according to the fund's determination of the best stocks to own in that category.

A number of ETFs in the cannabis sector have exposure to Canopy Growth. Among them is the ETFMG Alternative Harvest ETF (MJ 3.22%). Canopy Growth's Canadian ticker (WEED.TO) is the fund's fourth-biggest holding, currently making up 6.6% of the fund's net assets of $196.8 million.

Global X Cannabis ETF (NASDAQ:POTX) is a smaller ETF that counts Canopy Growth as one of its biggest holdings. Canopy Growth is its fourth-largest holding, making up 7.1% of its $28.3 million in net assets.

The Cambria Cannabis ETF (TOKE -0.25%) holds 304,000 shares of Canopy, making up just 0.28% of its fund.

Will its stock split?

Will Canopy Growth's stock split?

Stock splits tend to happen after a stock has made significant gains and its share price is much higher than it was earlier.

That might have been the case for Canopy Growth when the stock skyrocketed twice before. But at this stage, a reverse stock split seems more likely than a regular stock split since the share price has fallen to below $1 a share.

Stock splits typically happen when a share price is more than $100, if not significantly higher. Without measurable gains, there's no reason to expect a stock split from Canopy Growth, although a reverse stock split is possible.

The bottom line

The bottom line on Canopy Growth

At this point, there's little doubt that Canopy Growth has had a challenging history and that its earlier growth potential has gone unfulfilled.

Based on the company's current financial performance, its trajectory, and its history of poor acquisitions and strategic errors, it seems hard to bet on a comeback for Canopy Growth.

However, the cannabis sector can change rapidly when regulations are lifted, and Canopy stock could be invigorated if cannabis is legalized at the federal level. The industry remains highly competitive so Canopy would face similar challenges in the U.S. to those it experienced in the Canadian market. It's worth watching any developments at the U.S. federal level for Canopy Growth shareholders or people considering buying the stock.

Investing in Canopy Growth FAQs

Is Canopy Growth a good investment?

Canopy Growth has historically been a bad investment. As of Nov. 24, 2023, the stock is down 98% from its all-time high. The stock surged in 2018 on excitement over Canadian legalization and in 2020-21 during the COVID-19 pandemic, but it has since plunged, as growth has been challenging and it's lost a lot of money.

Where can I buy Canopy Growth stock?

Canopy Growth is traded on both U.S. and Canadian exchanges. You should be able to buy it using any reputable brokerage.

Is Canopy Growth publicly traded?

Yes, Canopy Growth is publicly traded. It's been a publicly traded company since 2014 when it went public through a reverse takeover of a capital pool company. Canopy had its initial public offering (IPO) in the U.S. in 2018.