The marijuana industry is expected to expand at a minimum compound annual growth rate of 25% through 2030, and many investors are seeking to profit. As states and entire countries decriminalize or legalize cannabis and/or its components, there are growing opportunities for entrepreneurs and existing companies. This is especially true with the Biden administration moving to reclassify marijuana from a Schedule 1 controlled substance (no accepted medical use and a high potential for abuse) to Schedule 3 (drugs that have moderate to low potential for physical and psychological dependence).

As with any nascent industry, there are also plenty of investment risks. Whether you're a first-time investor or a seasoned veteran, it pays to understand how this industry works. This guide will get you up to speed quickly and includes our picks for the top marijuana stocks.

Best marijuana stocks in 2024

Best marijuana stocks for 2024

| Company | Description |

|---|---|

| Green Thumb Industries (OTC:GTBIF) | Marijuana grower and retailer |

| Cresco Labs (OTC:CRLBF) | Marijuana grower and retailer |

| Innovative Industrial Properties (NYSE:IIPR) | Ancillary provider |

| GrowGeneration (NASDAQ:GRWG) | Ancillary provider |

| Scotts Miracle-Gro (NYSE:SMG) | Ancillary provider |

| Jazz Pharmaceuticals (NASDAQ:JAZZ) | Biotech company |

1. Green Thumb Industries

1. Green Thumb Industries

Green Thumb Industries ranks as one of the largest U.S. multi-state cannabis operators. It owns more than 80 retail cannabis stores in 15 states across the U.S. and operates 18 manufacturing facilities. Green Thumb also holds enough additional licenses to roughly double the number of its retail locations.

The company has been profitable on an annual basis since 2020. It continues to deliver revenue growth and maintains a strong balance sheet even with macroeconomic and cannabis industry headwinds. Green Thumb should have plenty of growth potential over the long term as the U.S. cannabis market expands.

For now, Green Thumb's shares can only be bought and sold on over-the-counter (OTC) markets in the U.S. But if federal cannabis restrictions are lifted, the stock could be listed on major U.S. stock exchanges. This would almost certainly be a huge catalyst for Green Thumb.

Over-the-Counter (OTC)

2. Cresco Labs

2. Cresco Labs

Cresco Labs, like Green Thumb, is based in Illinois. It operates retail cannabis stores in nine states, including six of the most populated states in the U.S.

The company ranks as the top wholesaler of branded cannabis products in the U.S. It also markets the No. 1 cannabis flower and concentrates portfolios, along with the No. 3 vapes portfolio and the No. 4 edibles portfolio.

Like Green Thumb, Cresco Labs' shares can currently only be traded on OTC markets in the U.S. The stock will likely be a big winner if the Biden administration moves forward with federal marijuana reforms that allow U.S. stock exchanges to list the shares of cannabis companies that operate in the U.S.

3. Innovative Industrial Properties

3. Innovative Industrial Properties

U.S. cannabis companies can't easily secure capital from banks or financial institutions since marijuana remains illegal at the federal level. Innovative Industrial Properties (IIP) helps to solve the cash shortage for growing marijuana companies. It buys properties owned by U.S. medical cannabis operators and leases the properties back to them. The sale to IIP provides the cannabis operator with much-needed cash, and the lease agreements create a steady revenue stream for IIP.

Innovative Industrial Properties has grown significantly in recent years and now owns properties in 19 states. The company continues to generate strong revenue and earnings growth powered by its sale-leaseback business model, even with some of its tenants facing financial challenges. Because IIP is organized as a real estate investment trust (REIT), it returns at least 90% of its taxable income to shareholders.

In some ways, IIP wouldn't be helped as much by federal cannabis reform as other companies. Its shares already trade on the New York Stock Exchange (NYSE). If traditional banking services were available to U.S. cannabis operators, IIP could face increased competition. However, federal reforms would likely cause the U.S. cannabis market to expand -- which should work in IIP's favor.

Revenue

4. GrowGeneration

4. GrowGeneration

GrowGeneration is another ancillary provider and the largest specialty retail chain focused on the cannabis market. It operates more than 60 stores in 18 states. Because the company's business doesn't violate any existing federal marijuana laws, its stock can trade on the Nasdaq stock exchange without any issues.

Demand for the company's hydroponics products has fallen due to an oversupply of cannabis in the U.S. This has caused short-term headwinds for GrowGeneration that are likely to continue in 2024. However, the company's long-term prospects remain bright, and GrowGeneration should be in a position to significantly rebound when market conditions improve.

5. ScottsMiracle-Gro

5. ScottsMiracle-Gro

ScottsMiracle-Gro is facing the same supply-and-demand market dynamics as GrowGeneration. Like GrowGeneration, its shares can be traded on a major stock exchange (in this case, the NYSE) since Scotts doesn't violate any federal marijuana laws.

The company's Hawthorne Gardening subsidiary ranks as a leading supplier of hydroponic gardening products to the cannabis industry. Hawthorne should have a significant growth runway over the long term despite some near-term challenges.

Although Hawthorne Gardening has been a primary growth driver for Scotts, the company still generates the majority of its total revenue from consumer lawn and garden products. Higher commodity prices are currently squeezing margins for the business. However, the company's consumer lawn and garden products provide a relatively steady counterbalance to its cannabis supply unit.

6. Jazz Pharmaceuticals

6. Jazz Pharmaceuticals

Ireland-based Jazz Pharmaceuticals acquired the cannabis-focused biotech company GW Pharmaceuticals in May 2021. GW's drug Epidiolex is the first cannabis-based medicine to be approved by the U.S. Food and Drug Administration (FDA). Epidiolex, which treats two forms of childhood epilepsy and tuberous sclerosis complex (a rare disease where benign tumors grow on organs), has been a big commercial success, with sales of $736.4 million in 2022.

Jazz's pipeline also features other cannabis drugs in phase 2 testing, targeting autism spectrum disorders and related issues. In addition to its cannabis products, Jazz markets sleep-disorder and cancer drugs.

Overview

Marijuana stocks overview

Let’s cover some of the basics you need to know before investing in marijuana stocks.

- The marijuana industry is divided into three broad categories. Marijuana growers and retailers cultivate and package cannabis products and sell them to consumers. Biotechnology companies develop and market cannabis-based pharmaceutical drugs. Ancillary marijuana businesses provide products and services to cannabis companies without touching the plant.

- Cannabis can be medical or recreational. Medical cannabis patients use cannabis or cannabis extracts to treat health conditions and have recommendations or cannabis prescriptions from physicians. Recreational cannabis users purchase marijuana or cannabis extracts purely for enjoyment and must be 18 or older and living in a jurisdiction where recreational use of the plant is legal.

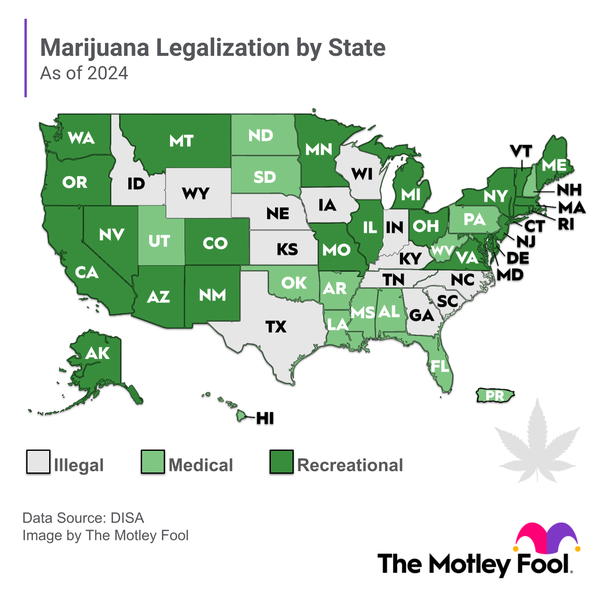

- Geography matters. Medical cannabis is legal in many more countries than recreational cannabis. In the U.S., cannabis remains illegal at the federal level. However, a growing number of states have legalized medical and/or recreational cannabis. And -- as mentioned earlier -- the Biden administration is taking some steps that could lead to federal decriminalization of marijuana. The rapid growth of the U.S. cannabis market is translating into impressive growth by U.S.-based cannabis companies, while marijuana companies in Canada -- where the plant is already fully legal nationwide -- are expanding more slowly. Canada is one of the global legal markets where supply is outpacing demand and leading to falling cannabis prices.

The COVID-19 pandemic affected nearly every part of the global economy, including the cannabis industry. In many U.S. states, cannabis dispensaries were designated as essential businesses. Cannabis sales boomed in some states during the first few months of the coronavirus outbreak, driven in part by more time spent at home and increased anxiety. Marijuana growers and retailers benefited, as did ancillary providers selling gardening supplies and other products to these companies.

However, not all cannabis companies fared well in the pandemic. Recreational cannabis retailers in tourist destinations such as Las Vegas saw their customer traffic dwindle, causing some dispensaries to start focusing on home delivery. In the medical segment, people delayed doctor visits, causing new patient starts to drop. Biotech companies experienced logistical challenges that affected sales and research progress.

To a large extent, the worst appears to be over for the cannabis market with respect to COVID-19, but some effects are still being felt.

Related investing topics

Should you buy marijuana stocks?

Just because there's a trendy new sector with lots of press and potential growth doesn't mean you need to invest in it. If you buy broad-based index funds, you're covered no matter which sectors of the stock market do well. Conservative investors who prefer lower risk are likely better off avoiding investing in marijuana stocks.

Several of the marijuana stocks mentioned above have fallen significantly over the past 12 months. This pattern underscores the risks that investors face and highlights why using margin to buy these stocks should be avoided. However, the factors causing poor performance (especially a supply-demand imbalance) should be resolved over time.

Aggressive investors with high risk tolerances, though, will probably find a lot to like about marijuana stocks. The cannabis industry is still in its early stages. The market opportunities are enormous, especially as more U.S. states legalize cannabis. Investing in these stocks is a high-risk but potentially high-reward proposition.