Have you ever considered investing in a company that shapes how we watch television, go online, and enjoy content on both the small and big screen?

Comcast (CMCSA 1.85%) is a longtime provider of cable TV and internet connectivity services. It has also managed a media empire since the NBCUniversal buyout in 2011. This company belongs on your shortlist for further research if you want to add an investment in either one of these sprawling industries -- or both. And since Comcast is a firmly established household name, this might be one of the first names that come to mind when building your first stock portfolio. So, let's take a look at Comcast's business model, history, and investment value, along with a quick overview of how to buy some Comcast stock.

Comcast's shares

Shares of Comcast stock

Buying stock in a company is an investment in that company's business and success. It's more than a financial agreement; shareholders actually own a part of the underlying business, taking part in the value of its assets and earnings. In most cases, they also have a say in its governance since each share represents one vote in any matter that requires shareholder voting.

In this case, Comcast's publicly traded stock is from the Class A cohort of common stock, with the expected single vote per share. Its ticker symbol is CMCSA, trading on the Nasdaq stock exchange. There is also a special Class B stock, which always controls one-third of Comcast's voting stock and is under the direct control of CEO Brian Roberts. This unique type of Comcast stock does not trade on the public market and doesn't have a stock ticker.

There used to be a third class of Comcast stock, known as the Class A Special common stock, without voting power but otherwise comparable to the regular Class A stock. Comcast simplified that structure in 2015 by converting all Class A Special shares (CMCSK) into regular Class A stubs (CMCSA).

The commonly cited market cap is calculated by multiplying the number of shares by the stock price. Comcast's market cap ranged between $114 billion and $283 billion in the 10-year period starting in January 2014.

About Comcast

A quick overview of Comcast

Starting in 1963 as a local cable TV system in Mississippi, Comcast quickly grew into a leading provider of cable TV services in the United States. The stock entered the public market with an initial public offering in 1972, expanding across America with a combination of cable system buyouts and original installations.

The Comcast@Home cable modem service made its debut in 1996, sowing the seeds of a long-term business focus. By fiscal year 2022, Comcast's connectivity and platforms division collected equal revenue from its residential connectivity (broadband and cell phone services) and video service subscriptions.

The smaller content and experiences segment offers original content in the form of feature films and TV series, presented across traditional TV systems and movie theaters, as well as various media-streaming services. Peacock, Comcast's in-house streaming service, sported 21 million subscribers at the end of 2022 and 28 million accounts three quarters later. The section also includes Comcast's theme parks, hosting Universal Studios destinations in Orlando, Los Angeles, Beijing, and Osaka. In November 2023, Comcast planned a horror-themed park in Las Vegas and a smaller park themed for younger children in Frisco, Texas.

Comcast is a naturally diversified business thanks to its two segments, with widely separated operations. You can invest in this company because you want exposure to high-speed data connection services or to the legendary media productions of NBCUniversal. Either way, buying stock in Comcast makes you a shareholder in both of these robust industries.

How to buy

How to buy Comcast stock

Investing in Comcast stock is as simple as buying any other stock on the public market. In this era of online stock trading without trading fees, it only takes a few clicks to collect a few Comcast shares once you have set up a brokerage account.

Step 1: Open a brokerage account

To begin investing in Comcast, you must first open a brokerage account. If you already have one, you can skip to the next step.

Comcast trades on the popular Nasdaq stock exchange, so you'll need your brokerage to support trading on that platform. You can do that with nearly any well-known and respectable stock brokerage. For example, you could consider firms such as Robinhood (HOOD 4.44%), Charles Schwab (SCHW 0.13%), or Interactive Brokers (IBKR -1.01%). Each one has its own quirks, advantages, and supporting services, but all will do the job of letting you buy Comcast stock.

The signup involves entering some personal information, linking the platform to your bank account, and funding your new brokerage account through that link. You can't buy stock until there's some money in your stock-trading account.

Step 2: Conduct your research

Before putting your money at work in Comcast stock, you need to analyze its business structure, financial status, and the risks involved. Check out Comcast's latest financial results, how market analysts and Motley Fool writers currently view the stock, and recent news about this company.

You should also compare and contrast with its leading rivals, and that's a rather large group thanks to its wide-ranging services. The NBCUniversal media business is considered one of the "Big Six" media conglomerates, alongside Walt Disney (DIS -0.04%), Paramount Global (PARA -2.22%), Warner Bros. Discovery (WBD -2.17%), Sony (SONY -0.13%), and Fox (FOX -1.5%). The connection business competes with a completely different set of heavyweights, led by AT&T (T 1.02%), Charter Communications (CHTR -1.73%), Verizon (VZ 1.17%), and Frontier Communications (FYBR 1.37%). So, a Comcast investor should keep an eye on a large herd of head-to-head rivals.

Keep an open mind when researching Comcast and its competitors, by the way. Let the facts, not your preconceived notions, inspire your investment decisions. The valuation of media and connectivity stocks can rely on many different factors, from the prevailing consumer tastes and spending habits to regulatory and economic considerations. Work out where Comcast stands in this sprawling context; its market value may vary along with these complex and ever-changing industry dynamics.

If Comcast turns out to look less robust than a rival like Disney or Verizon, you might end up buying one of those stocks instead -- and there's nothing wrong with that.

After all, you weren't trying to prove Comcast's superior status, just weighing its qualities and challenges against those of its main rivals. You never know where that journey might take you, and your list of interesting stock ideas could grow longer as the research project goes along.

On that note, you will get a deeper look at the company's suitability for investment further down. First, let's finish up the actual stock-buying process.

Step 3: Place your order

If your research suggests that Comcast is the right stock for you, it's time to take the plunge. Here's how you buy some Comcast stock, using the Robinhood trading platform as an example.

Log into your Robinhood and search for Comcast or its ticker, CMCSA. You'll land on a detailed page with the stock's basic data and long-term charts, with a stock-trading section to the right.

Exactly how do you want to buy your Comcast stock? A "Buy Order" is the simplest option. Input either a dollar amount or the number of shares to buy, click "Review Order," and confirm your purchase of Comcast shares. The Robinhood service does all the math for you, splitting the investment amount into the right number of Comcast shares or multiplying the number of shares you're buying by the latest stock price.

You could specify both the number of shares and the highest price you're willing to pay with a limit order, and your broker will probably have more advanced order types available as well. For a large and popular stock such as Comcast, with robust trading volumes and liquidity, you don't need to look beyond the simple Buy or Limit orders.

Here's what it might look like when you're investing $100 in Comcast stock from a Robinhood account using a simple Buy order:

Should I invest in Comcast?

Before you invest your hard-earned dollars in Comcast, let's evaluate investment value.

Profitability

Is Comcast profitable?

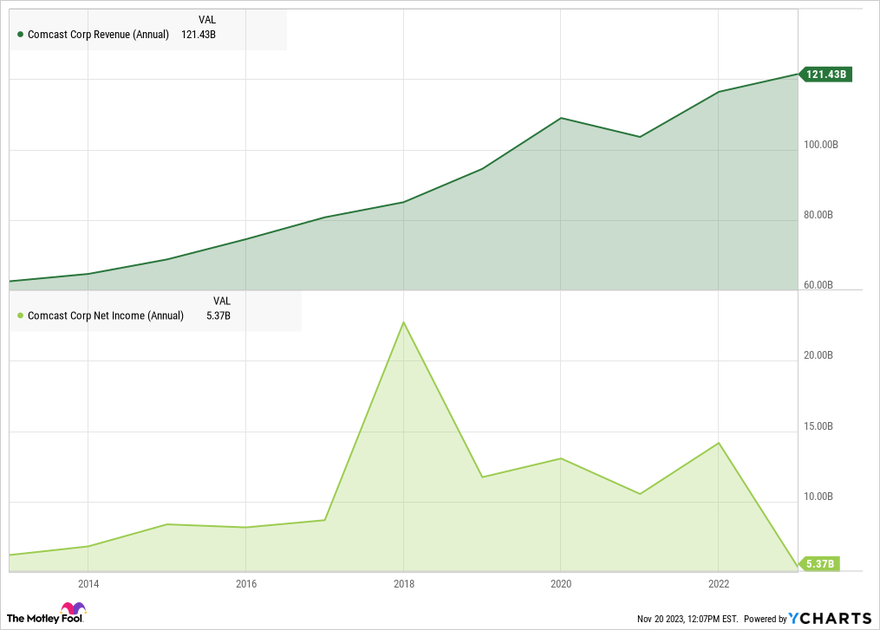

Comcast's financial track record has been robust over time, and the company is an effective cash machine. In fiscal year 2022, the company reported revenue of $121.4.7 billion, generating $5.4 billion of net income and $12.7 billion in free cash flow.

Dividends

Does Comcast pay a dividend?

The company returned $4.7 billion to shareholders in the form of dividend payouts in 2022. Its dividend yield tends to hover between 2% and 3%, depending on the current stock price. Comcast also sponsors a generous stock buyback program, investing an annual average of $5 billion in share repurchases between 2018 and 2022. The board of directors has increased Comcast's annual dividend payouts every year since 2009.

ETFs

ETFs with exposure to Comcast

As a market-leading U.S. company, Comcast is an active component of many stock market indexes. The list includes the broad market-tracking S&P 500 (SNPINDEX:^GSPC) index, so exchange-traded funds and mutual funds that track these indexes must own a large number of Comcast shares, not to mention the dozens of funds with industry-specific or hand-picked management systems that choose to include Comcast.

This stock's impact on the value and overall performance of these funds varies with its weighting in each fund, and Comcast's performance makes a larger difference to the returns of smaller ETFs with an outsized Comcast investment. Here are a few ETFs where Comcast stock accounted for a significant ownership stake in November 2023, either by dollar amounts or in terms of Comcast's weighting of the fund's total assets:

| EXCHANGE-TRADED FUND | NUMBER OF COMCAST SHARES UNDER MANAGEMENT | ETF'S NET ASSET VALUE | % ALLOCATION OF COMCAST STOCK |

|---|---|---|---|

| Invesco QQQ TRUST (NYSEMKT:QQQ) | 70.9 million | $195 billion | 1.5% |

| SPDR S&P 500 ETF TRUST (NYSEMKT:SPY) | 46.1 million | $394 billion | 0.5% |

| Communication Services Select Sector SPDR Fund (NYSEMKT:XLC) | 14.3 million | $13 billion | 4.5% |

| iShares U.S. Telecommunications ETF (NYSEMKT:IYZ) | 0.9 million | $0.2 billion | 14.7% |

Stock splits

Will Comcast's stock split?

Comcast has a long history of stock splits, stretching back to the early 1980s. One Comcast share bought at the 1972 IPO has become 230.67 shares today. However, the latest stock split took place all the way back in 2017. The company doesn't seem likely to announce another stock split anytime soon, given the long pause marked by big swings that eventually returned to the post-split price range of roughly $40 per share.

However, you never know when Comcast's board might have a change of heart, especially if the stock skyrockets as it did in the early 2010s. Keep an eye on the split calendar for potential Comcast announcements.

Related investing topics

The bottom line on Comcast

This stock's investment potential depends on its leading role in the media and communications markets.

The Peacock service needs a steady flow of high-quality exclusive content, and these stories also provide fodder for future theme park additions. So, great content forms the foundation of Comcast's NBCUniversal operations. On the connectivity side, Comcast seeks a perfect balance between consumer-pleasing products and services, affordable network upgrades, and appropriate pricing levels.

Both divisions face fierce competition and regulatory challenges. A reasonable hurdle for Comcast may be more than smaller and younger companies can handle. A harsh market presents both problems and opportunities for a sector leader like Comcast.

The theme parks under development and the burgeoning Peacock service are key to Comcast's near-term growth. The old-school cable network is transitioning to a fiber-optic infrastructure, which adds heavy capital expenses but also sets Comcast up for next-generation internet services.

The volatility and rough-and-tumble competition of Comcast's target markets may be too uncertain and complicated for some investors. At the same time, others see nothing but long-term growth opportunities in Comcast's sophisticated business structure. In particular, success in the media segment should translate into stronger internet service sales, given the unstoppable cord-cutting trend.

The decision to buy stock in Comcast should match your risk tolerance and long-term investment objectives. It may not be a perfect fit for every portfolio, but Comcast could be a solid pick if you're willing to manage the complexity of its evolving business model. If nothing else, every investor in the media and communications industries should keep a close eye on this gigantic competitor.

Investing in Comcast FAQs

Is Comcast publicly traded?

Yes, Comcast trades on the Nasdaq stock exchange under the ticker symbol CMCSA.

What is the minimum investment in Comcast?

The smallest investment in Comcast depends on your broker's policies. With fractional shares, you can invest just a couple of dollars. Without that option, the minimum Comcast investment would be the price of one share. Roughly speaking, Comcast's stock price has hovered between $30 and $60 per share over the last decade, so the smallest possible investment would normally be found in that range for single-stub buyers.

Is Comcast a good investment?

Whether Comcast fits your investment portfolio depends on your financial goals and risk tolerance. With its significant role in media and telecommunications, Comcast is a notable player. However, consider its alignment with your investment strategy and the competitive landscape of its target industries.

Is Comcast a safe investment?

All stock investments, including Comcast, come with inherent risks. However, Comcast is an industry leader across several robust sectors. You shouldn't go all-in on Comcast stock, but it could add some exposure to the media and communications industries as part of a diversified stock portfolio.

Is Comcast a good dividend stock?

Comcast has a history of consistent dividend payments, with a tendency to increase its dividend annually since 2009. This track record, combined with a stable yield, can make it a reasonable choice for dividend-focused investors.