Instacart (CART 0.43%) has been one of the hottest initial public offerings (IPOs) in 2023. The company, which is officially Maplebear but does business as Instacart, delivered a lot of buzz on its first day of trading after its stock jumped 40% at the open. Although it cooled off in the weeks after its IPO, it remains a very exciting company.

Its growth potential is fueling the Instacart excitement. The grocery technology company helps brick-and-mortar grocery stores enter the digital age primarily by providing the technology backbone so customers can shop for groceries online. A personal shopper will prepare their order and deliver it to their door, or they can pick it up curbside.

Only 12% of grocery sales are currently online. Instacart believes the number could more than double in the future, representing tremendous growth potential, given the U.S. grocery industry's massive $1.1 trillion size.

Instacart believes it can capture this opportunity by working closely with grocery stores and delivering excellent customer service, positioning it to deliver robust revenue and earnings growth, which could send its shares a lot higher in the future.

Instacart's big-time growth prospects might have you interested in buying its stock. You could be contributing to its growth by being an avid user of its services. Here's a step-by-step guide on how to add the food delivery stock to your cart and become a shareholder.

Stock

How to buy

How to buy Instacart stock

People interested in buying Instacart stock must do a few things before becoming a shareholder. Here are four steps to investing in the grocery technology company.

Step 1: Open a brokerage account

You'll have to open and fund a brokerage account before buying shares of any company. If you still need to open one, here are some of the best-rated brokers and trading platforms. Take your time to research the brokers to find the best one.

Step 2: Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to decide how to allocate that money.

The Motley Fool's investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years. You don't have to get there on the first day. For example, if you have $1,000 available to start investing, you might want to begin by allocating that money equally across at least 10 stocks and then grow from there.

Step 3: Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about how it makes money, its competitors, its balance sheet, and other factors to make sure you have a solid grasp on whether the company can grow value for its shareholders over the long term. Continue reading to learn more about some crucial factors to consider before investing in Instacart stock.

Step 4: Place an order

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares

- The stock ticker (CART for Instacart)

- Whether you want to place a limit order or a market order (The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the market price.)

Once you complete the order page, click to submit your trade and become an Instacart shareholder.

Should I invest?

Should I invest in Instacart?

Doing your research is vital to see whether a stock is right for you. This process could make you even more excited about buying shares in the company because it increases your confidence that they could be a big winner. However, you might also learn something in this process that changes your mind about buying shares.

Here are some factors to consider about Instacart that might help you decide to buy shares:

- You're a fan of Instacart and use its services regularly.

- You believe it can fend off the competition and be a leader in grocery delivery.

- You think the company can grow its sales and revenue rapidly as more customers buy groceries online.

- You believe Instacart's stock can outperform the S&P 500 over the next three to five years.

- You want to invest in a recent IPO.

- Adding a technology company focused on the consumer staples industry would help diversify your portfolio.

- You think Instacart's valuation is attractive.

- You understand that shares of Instacart could be volatile and may lose money.

- You don't need dividend income right now.

Dividend Income

On the other hand, here are some factors that could cause you to avoid the stock:

- You prefer the services of technology-based rivals like DoorDash (DASH 3.12%) or Uber (UBER -0.38%).

- You're worried Instacart has too much competition, including retailers with their own online delivery platforms, like Walmart (WMT -0.08%), Target's (TGT 0.18%) Shipt, or Amazon's (AMZN 3.43%) AmazonFresh.

- You're not sure Instacart can beat the S&P 500 over the next five years.

- You're not sure online grocery shopping will grow that much in the future.

- You don't like to chase hot IPOs.

- You already own a lot of technology and food stocks in your portfolio.

- You're looking to invest in stocks with less volatility than a recent IPO like Instacart.

- You're concerned that insiders still controlled more than 90% of the company's outstanding shares after its IPO.

- You're in or nearing retirement and seeking income-producing investments.

Profitability

Is Instacart profitable?

An essential part of an investor's research process is to check out a company's profitability. Profit growth has historically been the biggest factor driving the performance of a company's stock price over the long term. To help get this part of your research started, here's a look at Instacart's profitability.

Given its recent IPO, Instacart has yet to report quarterly earnings as a publicly traded company. However, the grocery technology company did include its most recent financial results in its IPO prospectus. They showed that it's solidly profitable, which is unusual for a venture capital-backed technology company.

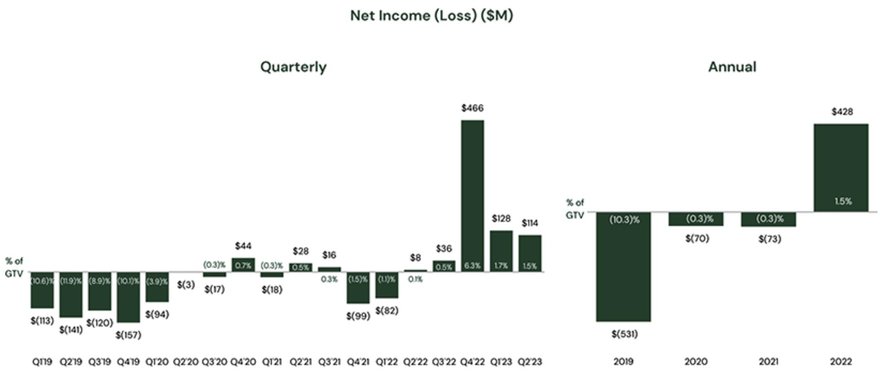

As this graphic shows, Instacart was profitable for 2022 and has generated positive net income for five straight quarters.

Profitability has been an area of focus for the company. It has sacrificed some growth to boost its profitability in hopes of attracting investors to its stock. The company reduced its headcount and cut other costs before its IPO to enhance its profitability since investors favor that metric over revenue growth these days.

Hopefully, Instacart will remain focused on profitable growth. That should enable the company to grow shareholder value over the long term.

Dividends

Does Instacart pay a dividend?

Instacart doesn't currently make dividend payments. As a recent IPO, the company has yet to initiate a dividend. It likely won't start paying dividends anytime soon. The fast-growing company will likely retain earnings to fund its continued expansion.

ETF options

ETFs with exposure to Instacart

Many investors prefer the ease of passively investing in stocks as opposed to actively investing by directly buying shares of specific companies. Exchange-traded funds (ETFs) are one of the most common passive investments.

However, as a relatively recent IPO, Instacart had yet to make its way into most ETFs as of late 2023. That's because many ETFs track stock market indexes with eligibility requirements.

Exchange-Traded Fund (ETF)

A common prerequisite is that a company must have traded publicly for three calendar months after the month of its IPO. Since Instacart completed its IPO in September 2023, it won't be eligible for these indexes (and the ETFs tracking them) until January 2024.

Another eligibility requirement for some indexes is that at least 10% of a company's outstanding shares trade freely (i.e., float) on an exchange. However, Instacart only floated 8% of its shares in its public offering. It would have to increase the percentage to be eligible for certain indexes and the ETFs tracking them. Investors must wait a bit longer to passively invest in Instacart through ETFs.

Stock splits

Will Instacart stock split?

Instacart doesn't have an upcoming stock split scheduled. The company only recently completed its IPO. While shares of the grocery delivery company popped 40% at the open of its IPO, they quickly gave back those gains. Instacart stock would need to stage a significant surge before it would consider splitting its stock.

Related investing topics

The bottom line on Instacart

Instacart sees a tremendous opportunity in bringing the grocery industry online. It believes its tools could help shift more sales online, which would increase its revenue and profits. That makes its upside potential interesting for investors comfortable with the volatility of a recent IPO.

Investors who add Instacart to their carts could do very well over the coming years if the company can deliver on its promise and capture the massive opportunity of bringing grocery stores into the digital age.

FAQs

Investing in Instacart FAQs

Is Instacart a good stock to buy?

Instacart sees a massive market opportunity. Grocery is the largest retail sector category, with $1.1 trillion in annual sales. However, only 12% of those sales currently come online. Instacart believes the number could double (or more), giving it a tremendous growth runway.

The grocery technology company is already quite profitable after cutting costs before its IPO in 2022 to improve its earnings. Meanwhile, Instacart trades at a relatively reasonable valuation, especially given its growth prospects. So, it looks like a good stock to buy, particularly for investors seeking a company with outsize growth potential.

Can I buy shares in Instacart?

Instacart is a publicly traded company. You can buy shares of it through any stock-trading platform or broker. It trades under the stock ticker symbol CART.

Is Instacart a publicly traded company?

Instacart is a publicly traded company. It completed an initial public offering on Sept. 19, 2023. It trades on the Nasdaq Stock Exchange under the stock ticker CART.

What happened to the Instacart IPO?

Instacart completed its long-awaited IPO on Sept. 19, 2023. The company priced its offering at $30 per share, valuing it at around $10 billion. Shares initially popped 40% at the open, hitting $42 per share. However, they closed the first day at $33.70, a 12% gain.