Nikola Corporation (NKLA 7.23%) is on a bold mission to pioneer solutions for a world free of carbon emissions. The company has created trucks powered by batteries and hydrogen fuel cells and is developing hydrogen refueling solutions to ensure its customers can use that emission-free fuel.

Nikola burst onto the scene in 2020 when it went public via a merger with a special purpose acquisition company (SPAC) in a $3.3 billion deal. The stock's value quickly accelerated to more than $30 billion, eclipsing the value of several traditional automakers. Investors bought into the hype that it would become the Tesla (TSLA -1.11%) of the trucking industry, even though it wasn't generating revenue.

Stock

Shares have since come crashing back down to Earth as investors started to realize the company has a long and challenging road ahead. However, it still has a lot of promise.

That promise has many people interested in learning how to invest in its stock. Here's a step-by-step guide on investing in the emissions-free truck maker and some factors to consider before adding it to your portfolio.

How to buy

How to buy Nikola stock

Anyone can buy shares of Nikola. These four steps will show you how to add the emission-free truck maker to your portfolio.

1. Open a brokerage account

You'll need to open and fund a brokerage account before buying shares of any company. If you don't have one yet, here are some of the best-rated brokers and trading platforms. Take your time to research brokers to find the best one for you.

2. Figure out your budget

Before making your first trade, you'll need to determine a budget for how much money you want to invest. You'll then want to figure out how to allocate that money. The Motley Fool investing philosophy recommends building a diversified portfolio of 25 or more stocks you plan to hold for at least five years.

You don't have to get there all at once. For example, if you have $1,000 to invest, you might want to begin by allocating that money equally across at least 10 stocks and grow from there.

3. Do your research

It's essential to thoroughly research a company before buying its shares. You should learn about its balance sheet, its competitors, how it makes money, and other factors to ensure you have a solid grasp on whether the company can grow value for its shareholders over the long term.

4. Place an order

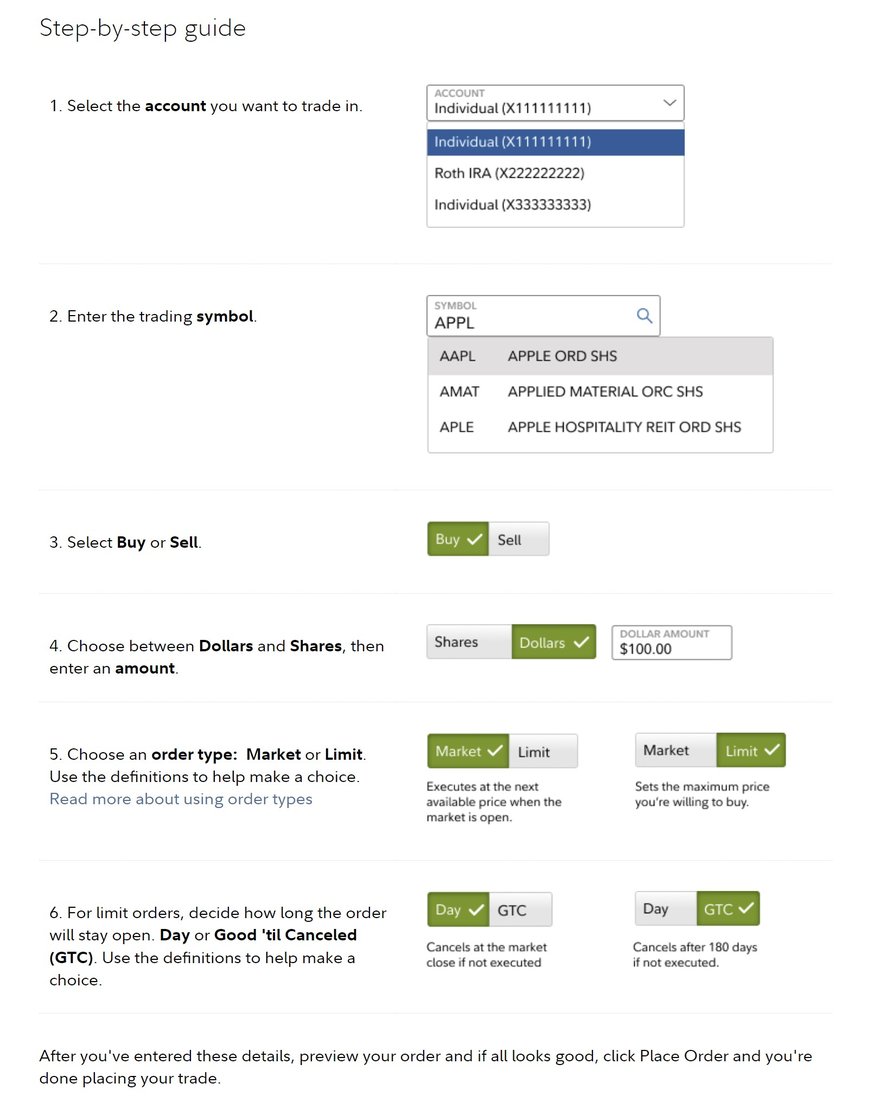

Once you've opened and funded a brokerage account, set your investing budget, and researched the stock, it's time to buy shares. The process is relatively straightforward. Go to your brokerage account's order page and fill out all the relevant information, including:

- The number of shares you want to buy or the amount you want to invest to purchase fractional shares.

- The stock ticker (NKLA for Nikola Corporation).

- Whether you want to place a limit order or market order. The Motley Fool recommends using a market order since it guarantees you buy shares immediately at the current market price.

Here's a screenshot of an order page from the five-star-rated Fidelity Investment's trading platform.

Once you complete the order page, click to submit your trade and become a Nikola shareholder. Continue reading to learn more about some crucial factors to consider before investing in Nikola stock.

Should I invest?

Should I invest in Nikola?

An important step in the investment process is to thoroughly research a company before buying shares. This exercise should give you a better understanding of the company and whether it can deliver a strong return for its investors over the long haul. You also might see something in your research that you don't like about the company, causing you to pass on the stock.

To help you get started with your Nikola research, here are some reasons you might want to invest in its stock:

- You believe the company's battery-powered and hydrogen fuel cell trucks could play a big role in helping reduce emissions.

- You think the company can eventually start living up to its promise and deliver accelerated sales growth.

- You believe the company will eventually turn the corner on profitability.

- You're confident that Nikola can continue to raise outside capital from shareholders until it can internally fund its operations with retained cash.

- You firmly believe the stock can deliver market-trouncing returns in coming years.

- You're fully aware of the risks, including the possibility that Nikola stock could lose all its value if the company files for bankruptcy.

- You don't need to invest in stocks that produce dividend income.

On the other hand, here are some reasons you might decide against buying Nikola stock:

- You're concerned about the company's cash burn and that it could run out of money and declare bankruptcy.

- Given its low stock price, you're worried future cash infusions will significantly dilute existing shareholders.

- You already own one or more electric car stocks in your portfolio.

- You don't think Nikola will ever turn the corner and get on the road to profitability.

- You think the company is more hype than substance.

- You're retired or nearing retirement and need investments that produce income.

- You're concerned Nikola isn't growing its sales or revenue despite reaching the production stage.

- You believe the revolving door in the C-suite is a big red flag—Nikola has had three CEOs in the past year.

Profitability

Is Nikola profitable?

Looking under the hood at a company's profitability is crucial to investment research. Investors typically want to see that a company is solidly profitable or on the road to profitability. They'd also like to see it on track to grow its earnings in the future. Profit growth tends to be the biggest driver of a stock's price over the long haul.

Nikola was miles away from profitability in late 2023. Through the first nine months, the company produced only 96 trucks (and it didn't make any of those in the third quarter). That was a decline from the 125 produced during the previous year.

Profitability Ratios

Driving this decline was the company's decision to pause production to streamline its assembly line amid weak demand for its trucks. As a result, the company generated only $24.3 million in revenue through the third quarter, a steep decline from the $44.3 million it produced in the year-ago period.

Meanwhile, Nikola is piling up steep losses. Its net loss was a whopping $812.7 million through the first nine months of 2023, widening from $562.2 million during the same time frame in 2022.

Nikola is also hemorrhaging cash. It burned through $240 million in cash per quarter during 2023, up from $200 million in 2022. "This level of cash burn is not sustainable for our business, and we are looking at every option for reductions in spending," said CFO Stasy Pasterick on the company's third-quarter conference call.

The company also sought to raise more capital from investors to replenish its cash pile, which stood at $362.9 million at the end of the third quarter. If the company isn't successful in reducing its cash burn rate and raising additional cash, it might not survive.

Dividends

Does Nikola pay a dividend?

Nikola doesn't make dividend payments to its shareholders and likely won't initiate one anytime soon. As of late 2023, the company was losing money and burning through cash.

ETF options

ETFs with exposure to Nikola

Not everyone has the time to invest in stocks that they must manage actively. Instead, they'd rather be passive investors. Exchange-traded funds (ETFs) make it easy to be a passive investor in a company like Nikola.

Exchange-Traded Fund (ETF)

Many ETFs hold shares of Nikola. According to ETF.com, 41 ETFs held 57.8 million shares of the truck maker in late 2023. The iShares Russell 2000 ETF (IWM 0.96%) was the biggest holder, at 14.8 million shares. However, the ETF had a minuscule allocation at 0.03% to Nikola.

Investors looking for ETFs with a higher allocation to Nikola could consider the following alternative options:

- Direxion Moonshot Innovators ETF (MOON 3.44%): This ETF invests in the 50 most innovative companies in the U.S. Nikola was its top holding as of late 2023 at 6.4%. The fund had a 0.65% ETF expense ratio.

- SPDR S&P Kensho Smart Mobility ETF (HAIL 1.76%): This fund seeks to invest in companies driving innovation in the transportation sector. Nikola was its third-largest holding in late 2023 at 2.7%. The ETF had a 0.45% expense ratio.

Stock splits

Will Nikola stock split?

Nikola hadn't announced an upcoming stock split as of late 2023. The company has not split its stock since going public through a SPAC merger in 2020. It likely won't complete a regular stock split anytime soon. Shares have lost nearly 90% of their value since the company's initial public offering (IPO).

In 2023, the company received a notice from the Nasdaq Stock Exchange stating that its stock didn't comply with its minimum bid price requirement. Failure to address that problem could result in its delisting from that exchange. One solution to comply with that requirement is to complete a reverse stock split, which the company was considering in 2023.

The bottom line on Nikola

Nikola is helping put the world on the road to an emission-free future. The stock could be a big winner if it can deliver on its promise and turn the corner on profitability. However, given its financial situation, the company has a long, challenging road ahead. There's a real risk that the stock could go to zero. Investors must carefully consider the risks before buying shares of the truck maker.

FAQs

Investing in Nikola FAQs

Can you buy stock in Nikola?

You can buy stock in Nikola through any brokerage account. The truck maker trades on the Nasdaq exchange under the stock ticker NKLA.

Is Nikola still a good investment?

Nikola's stock got off to a fast start, accelerating in value as investors bought into the company's initial hype of helping decarbonize the trucking sector. However, shares have crashed spectacularly, losing over 90% of their initial value and falling even further from their peak.

The company faces a challenging road ahead as it works to continue building its truck businesses at a time when funding is getting harder to find. There's a real possibility the company could run out of money before it turns the corner on profitability, so Nikola isn't a good investment for most people.

It's a very high-risk stock with a low probability of paying off. However, if it can get through this rough patch and deliver on its promise, the stock has the potential to be a big winner. Given its high-risk/high-reward potential, investors who buy shares of Nikola should keep their allocation small enough that they'd be comfortable losing their entire investment, which is a real possibility.

Does Nikola pay a dividend?

Nikola doesn't pay a dividend. The company can't afford to make dividend payments to shareholders. It's burning through cash and needs to routinely receive cash infusions from investors to continue operating.